Comments on the Department of Energy’s (DOE’s) proposed grid resiliency rule from an assortment of state agencies, trade groups, environmental organizations, and organized market entities flooded the Federal Energy Regulatory Commission’s (FERC’s) docket before the tight three-week timeframe expired Oct. 23.

The DOE’s “Grid Resiliency Pricing Rule” proposed on Sept. 29 directs FERC—an independent regulatory government agency that is officially organized as part of the DOE—to exercise its authority under sections 205 and 206 of the Federal Power Act (FPA) and require that independent system operators (ISOs) and regional transmission organizations (RTOs) “establish just and reasonable rates for wholesale electricity sales” for power plants that show “reliability and resiliency attributes.”

The DOE directed FERC to take action on the rule within 60 days, or impose an interim final rule immediately—with a provision for “later modifications” after a 45-day public comment period. The rule also requires that ISOs and RTOs submit a compliance filing within 15 days after the DOE finalizes the rule.

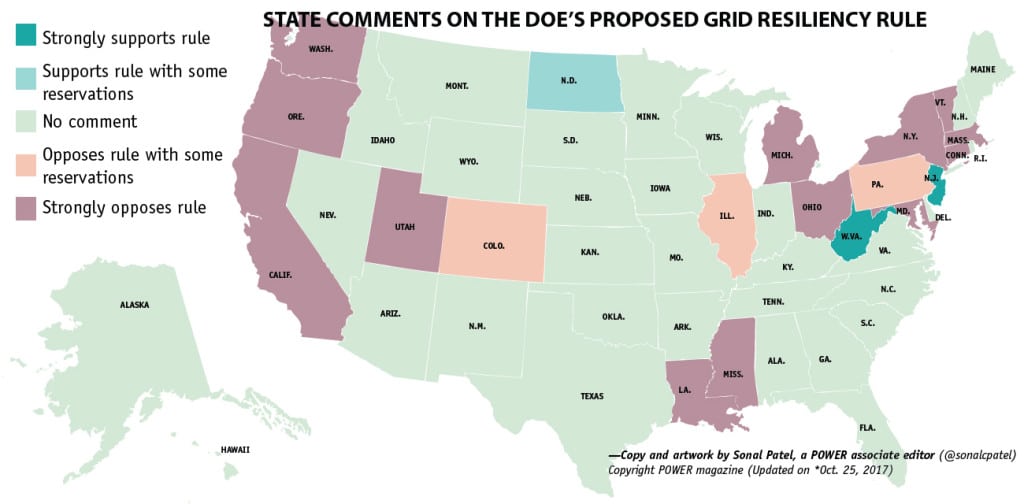

While a majority of states remained silent on the controversial issue, others had a lot to say. This infographic below shows how the states that submitted comments in FERC’s Docket RM18-1 saw the issue.

California*: Opposes

While the Public Utilities Commission (PUC) of California filed a notice of intervention on Oct. 13, the California attorney general also filed a motion to intervene on Oct. 20, citing the authority given to it by the legislature to step into administrative proceedings that may have the effect of “impairing, polluting, or destroying natural resources” of California. On Oct. 23, the PUC filed comments calling on FERC to reject the rule “because it amounts to poorly reasoned decision making” and suffers from “fatal legal deficiencies.”

Among those deficiencies, it said, are that the rule is arbitrary and capricious, it encroaches on state authority, it fails to meet FERC’s burden of proof under Section 206 of the FPA, and it is “unjust, unreasonable, and unduly discriminatory” because it specifies that merchant coal-fired and nuclear plants must be added to ISO and RTO system needs. California’s Gov. Jerry Brown also opposed the rule in comments filed on Oct. 23. “If the energy crisis has taught us anything, it is that diversification of resources is critical for resiliency and reliability planning,” he said.

Colorado: No statewide comment

Colorado’s state agencies don’t seem to have submitted a comment, but the city of Aspen, which owns the Aspen Electric Utility, urged FERC not to adopt the rule, saying it does not address the needs of the comprehensive energy needs of the future. Coal, it said, is in a period of transition, facing a “perfect storm” of aging infrastructure, environmental concerns, and cheaper energy alternatives.

Connecticut*: Opposes

While part of a multi-state filing opposing the rule (*see below), Connecticut Attorney General George Jepsen separately said the rule could require new tariffs requiring operators of organized markets to ensure that certain reliability and resiliency attributes are fully valued, and could have a dramatic effect on power prices in New England. The state’s Public Utilities Regulatory Authority and other agencies also opposed the rule in their own filing, saying it doesn’t give anyone the meaningful opportunity to comment, and that it infringes upon state jurisdiction over generation facilities.

Delaware: Opposes

The Delaware Public Service Commission and other state agencies said the rule is “deficient in so many ways that we fear it will have the significant unintended consequences that will adversely affect existing competitive energy markets.”

Illinois*: Opposes with reservations

Though part of a multi-state filing* opposing the rule, Illinois is one of two states (along with New York) that has created a zero-emission standard to compensate nuclear power plants for their carbon-free power. The state public policy action was implemented precisely because FERC’s RTO/ISO market design does not compensate zero-carbon generators any differently from carbon-emitting generators, said the Illinois Commerce Commission (ICC) in a separate filing.

“As stated before, the ICC recognizes the complexities of balancing appropriate market design rules with ‘the need to recognize valid state action to promote selected social, political and environmental policy objectives’,” it said. It urged FERC not to undermine the state’s zero-emissions standard, but also said it doesn’t support the rule’s position regarding fuel security. The ICC said it specifically backs statements that recognize FERC’s initiatives to improve the mechanics of price formation in RTO-operated markets. “The ICC believes that the Commission’s organized electricity markets would benefit from greater focus and prompt action on improved electricity and ancillary price formation,” it said. The ICC also urged FERC to undertake a proceeding to determine whether there is a resiliency issue to address.

Louisiana: Opposes

The Louisiana Public Service Commission, which filed joint comments with the Mississippi Public Service Commission, said the rule “harms ratepayers, intrudes upon rights traditionally and properly reserved to states, is based on false conclusions unsupported by sufficient evidence, conflicts with the Commission’s fuel and technology neutral policy, and is contrary to the Commission’s policies favoring competition.” Also, most resources that fit into FERC’s 90-day fuel supply criterion are coal and nuclear resources, the filing notes, but they don’t include natural gas. The DOE’s claims that the 2014 Polar Vortex showed too much reliance on natural gas “do not fit the facts,” it also argues.

Maryland*: Opposes

While part of a multi-state filing* opposing the rule, the state’s Public Service Commission (PSC) concurred that issues concerning the preservation of important generation assets “are vitally important.” However, it said that any rulemaking would erode the state’s jurisdiction in designating and incentivizing a specific fuel mix within its borders, and it could “frustrate” state statutes, regulations, and policies. Specifically, the PSC said that as proposed, the rule could impair the Regional Greenhouse Gas Initiative (RGGI), which has realized a 45% reduction in power sector carbon pollution since 2005 while boosting the economy of participating states. It also bemoaned possible rate increases. “A very real concern for us is that Marylanders would bear the cost of reducing fossil fuel-fired electric generation through Maryland’s participation in RGGI, while simultaneously bearing the costs associated with subsidizing this same generation through the proposed rule,” it said.

Massachusetts*: Opposes

Massachusetts led a coalition of states that opposed the rule in a joint filing*.

Michigan: Opposes with reservations.

Michigan’s Public Service Commission noted that the Organization of MISO States and the Michigan Agency for Energy (MAE) both filed comments acknowledging, among other things, the strides that Michigan has taken to promote clean, reliable, adaptable, and affordable energy. The state has both an integrated resource planning process to identify and approve new supply and demand options as well as a new statutory “reliability mechanism” ensuring all power generators—electric cooperatives, municipal utilities, investor-owned utilities, and alternative electric suppliers—secure enough electric generation capacity to meet customers’ future needs. The agency called on FERC to consider several factors if it were to adopt the rule, including cost allocation for independent power producers, whether competitive market organizations have the expertise and capacity to implement the rule, whether resources already recovering their costs of service should be excluded from the rule, and how the rule would play out in future system support resource (SSR) agreements in the MISO footprint.

In its filing, however, MAE voiced support for some of the rule’s attributes. “We believe a rule premised on cooperative federalism to achieve these important goals is appropriate under the law and appreciate several aspects of the proposed rule that recognize both the legal responsibility and vital role of states in finding that balance,” it said.

Mississippi: Opposes

In a joint comment with the Louisiana Public Service Commission, the Mississippi Public Service Commission said the rule “harms ratepayers, intrudes upon rights traditionally and properly reserved to states, is based on false conclusions unsupported by sufficient evidence, conflicts with the Commission’s fuel and technology neutral policy, and is contrary to the Commission’s policies favoring competition.”

New Hampshire*: Opposes

The state’s Office of the Consumer Advocate was part of a multi-state filing* opposing the rule.

New Jersey: Supports

The New Jersey Board of Public Utilities (BPU) agreed with the DOE that a diverse mix of resources contributes to the reliability and resilience of the grid, and that FERC and the RTOs have a vital role in that process. It explained that because New Jersey is a restructured state, the board no longer has authority over companies owning power plants. It also said the board doesn’t engage in integrated resource planning “but largely depends upon properly functioning competitive markets to provide the quantity and composition of resources needed to cost-effectively meet the future reliability, resiliency, and operational needs of the State,” even though state law requires a “diversity in the supply of electric power.” The board said it had once already petitioned FERC—but the petition was rejected—to establish a strategy to address concerns that the market would shift toward overreliance on certain resources. That’s why it said it was “encouraged by the current federal and regional efforts in this direction.”

New York: Opposes.

Though New York in August 2016 approved a controversial measure to incentivize some nuclear plants, New York Attorney General Eric Schneiderman said in filed comments that the rule would be unlawful because “it lacks any legitimate purpose and fails to consider or analyze the possible impacts it might have, which include, among other things, increased emissions of carbon dioxide and other pollutants from coal-fired power plants that cause illness and other harm in New York.” He added: “As the saying goes, ‘if it ain’t broke, don’t fix it.’ Nothing in the Notice demonstrates that the Proposed Rule will solve any existing problem in our Nation’s electricity supply or in the wholesale electricity markets.”

Schneiderman, notably, raised concerns that the rule would increase the emission of pollutants, including carbon dioxide, fine particulate matter, and nitrogen oxides. “Indeed, because the Proposed Rule would worsen climate change, it would contribute to making storms more intense and thus create more occasions for storm resiliency problems on the electric grid—directly contrary to its purported goal of reducing such problems,” he said. Separately, the New York Public Service Commission and other state agencies expressed significant concerns with “the manner in which the Secretary proposes to meet those goals.”

North Carolina*: Opposes

North Carolina was part of a multi-state filing* opposing the rule.

North Dakota: Supports with reservations

In comments, the North Dakota Public Service Commission, an entity that regulates public utilities in the state, noted that the state is a long-standing net energy exporter. It agreed that many factors, internal and external to the FERC-regulated marketplace, have “encumbered coal-fired baseload generation” from competing fairly in regional electric markets. These include regulatory burdens, lack of full valuation, subsidies resulting in negative market pricing, and low gas prices. However, it said the proposal needed further refinement to appropriately compensate baseload generators and prevent early retirement.

It called for a “thorough analysis,” and the commission called on FERC to investigate the extent to which baseload provides value to adequately compensate for its benefits. “Attributes such as inertia to maintain frequency, supplemental and operative reserves, voltage support, reactive power compensation, and other baseload benefits should be considered to fully provide recovery for valued attributes to grid operations,” it said. The commission also had reservations about the exclusion of cost-of-service regulated entities from cost recovery.

Ohio: Opposes

The Public Utilities Commission of Ohio (PUCO) said it was “deeply concerned about the additional costs that will be borne by Ohio’s consumers.” The DOE had made no attempt to quantify the costs of its proposed rule, it added, and it noted that PJM Interconnection and its stakeholders and state commissions were already engaged in constructive dialogue about resiliency and reliability. Ohio’s coal share of its generating capacity plunged from 72.5% in 2010 to 59.5% in 2016, owing mainly to 6.5 GW of unit retirements. However, that capacity has been replaced by 4.4 GW of new investor-supported natural gas combined cycle generation (and 6 GW more are pending review or have recently been certificated).

“The PUCO notes that during this period of substantial change, Ohio’s fuel resource mix has actually become more diverse and resource adequacy has been maintained without exception.”

Oregon*: Opposes

In joint comments, Oregon’s Gov. Kate Brown and Washington’s Gov. Jay Inslee told FERC Chair Neil Chatterjee that their states aren’t immune to “exigent threats of catastrophic damage from earthquakes, tsunamis, and wildfires.” However, they said pointedly: “this doesn’t necessitate keeping coal and nuclear power plants in service when doing so is uneconomic, and does not provide demonstrable resilience benefits to the grid over other electricity generation technologies.”

More efficient, sustainable, and resilient options exist, and the “Department of Energy’s proposal is clearly motivated by the administration’s preference for coal generation above cleaner technologies,” they added. Oregon is on track to cease coal generation at its last coal plant by 2020, the filing notes. Separately, the Oregon Public Utility Commission said the state and its neighbors in the West have been actively discussing the expansion of organized markets “for some time,” and that the rule’s “singular focus on fuel security is inconsistent with our state’s policy priorities and focuses on arbitrarily limited parameters for how to achieve resilience and reliability in a modern electric grid.”

Pennsylvania: Opposes with reservations

The Pennsylvania Public Utility Commission (PAPUC) strongly opposed the rule, saying it “threatens the efficient functioning of organized competitive wholesale electricity markets by providing de facto cost of service treatment to coal and nuclear generation without adequate justification.” It also decried the DOE’s justification of the resiliency measures citing the Polar Vortex, saying it was “inadequate and inappropriate.”

On Oct. 20, however, the Pennsylvania General Assembly introduced a concurrent resolution encouraging FERC to strongly consider the DOE’s rule (which was amended and adopted in the state Senate on Oct. 25). The state has the nation’s only caucus devoted to nuclear energy, and while Pennsylvania officials have told POWER that it serves only as a measure to educate residents about the economic and reliability benefits of nuclear generation, some experts see it as coalescing support for a state policy to prop up Exelon Corp.’s Three Mile Island nuclear facility, which the company wants to shut down in 2019 because it is unprofitable.

In comments to POWER on Oct. 20, Exelon spokeswoman Robin Levy said the company is in regular discussions with lawmakers in all states in which it does business. Nuclear power provides 93% of Pennsylvania’s clean energy, she noted. “As such, policy makers are naturally incented to keep nuclear power at the forefront for Pennsylvanians, and we support swift adoption of the resolution that has been introduced. Absent action at the federal level, other measures at the state level such as zero-emissions credit programs that promote zero-carbon energy and create and preserve clean-energy jobs will be necessary for Three Mile Island to remain operational.”

According to PAPUC, the rule probably wouldn’t even apply to nuclear generators. “There is an issue as to whether nuclear generation should qualify for cost of service treatment given that nuclear generation facilities do not have operating reserves,” it said.

Rhode Island*: Opposes

Rhode Island was part of a multi-state filing* opposing the rule.

Utah: Opposes

Utah Governor’s Office of Energy Development (OED) noted that while it isn’t a member of an organized market, it is monitoring the potential formation of a Western Regional Transmission Operator. “Though in its current form, the proposed rule would only apply to RTOs with a capacity market in place, OED wishes to make its position known in the event the scope of rule were to be expanded or to in some way affect resource planning and procurement in the EIM or a future Western RTO,” it said. The OED said that individual states should continue to play a key role in forming energy policies, and it urged FERC to give states “sufficient” opportunity to shape the laws and rules to meet their unique needs and goals.

Vermont*: Opposes

Vermont was part of a multi-state filing* opposing the rule.

Washington*: Opposes

In comments filed with Oregon’s governor, Washington Gov. Kate Brown lambasted the DOE’s motives to prop up coal power. “The Department erroneously equates reliability and resilience with the ability for generators to store fuel on-site. This is a simplistic and obvious effort to manipulate energy markets to support coal-fired power generation. Not only would this undermine states’ own resource preferences, but it will also fail to achieve the stated goals of ensuring access to reliable, resilient, and affordable electricity,” the filing says.

Washington is on track to close its only coal plant by 2025. Both Oregon and Washington are also working to eliminate the use of coal-fired electricity imported from other states. “We view this not as an obstacle to grid reliability and resilience, but as an opportunity to modernize our infrastructure while meeting our states’ clean energy and carbon reduction goals,” the filing says.

West Virginia: Supports

The Public Service Commission of West Virginia (PSCWV) noted it is one of several states that is wholly contained within PJM. “The PSCWV is not opposed to competitive markets,” it said. “We are opposed, however, [of the] failure to recognize that the markets are young and evolving. During this evolutionary process, our paramount goal is to maintain reliability, resilience, security, and adequate supply. The siren call of low bidders should not be allowed to interfere with those goals.”

The PSCWV additionally argued that the proposed rule does “not destroy, or even seem inconsistent with, the competitive market-approach for electricity supply.” Competitive markets, it said, can exist with specific rules that identify and encourage facilities that demonstrate adequacy and reliability of supply as well as resilience gained from onsite supply. In its comments, interestingly, the PSCWV outright said that it wasn’t supporting the rule because it is a “well-known coal rich state” or out of a “misplaced loyalty toward the coal industry or coal-fired plants” in the state.

“We believe that security of having onsite fuel supply is an important factor that has been too long overlooked as the market and the latest preferences for a new energy paradigm have been leading us toward the light without recognizing that there may be some unexpected pitfalls between us and the shiny new energy future,” it said.

| *. Part of a multi-state filing. The attorneys general of Massachusetts, California, Illinois, Maryland, North Carolina, Oregon, Rhode Island, Vermont, and Washington, the Connecticut Department of Energy and Environmental Protection, Rhode Island Division of Public Utilities and Carriers, and the New Hampshire Office of the Consumer Advocate said the rule would violate the FPA, it violates FERC’s legal rulemaking obligations, it is unnecessary to support system reliability, and it is contrary to the findings of the DOE’s staff report and “other credible analyses.” The states also said the proposal would pose a serious threat or harm them, and bring excessive costs to ratepayers. |

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)