The U.S. House of Representatives on November 2 proposed a tax bill that would phase out the wind energy production tax credit (PTC), extend a tax credit for the nuclear power industry, add credits for geothermal and fuel cell programs, and end a tax credit for the purchase of electric vehicles.

Wind energy proponents decried the proposal, noting it was just less than two years ago that Congress renewed the wind tax credit, which spurred investment in wind energy projects.

“Despite comments to the contrary, this proposal reneges on the tax reform deal that was already agreed to, and would impose a retroactive tax hike on an entire industry,” said Tom Kiernan, CEO of the American Wind Energy Association (AWEA), in a statement Thursday. “The House proposal would pull the rug out from under 100,000 U.S. wind workers and 500 American factories, including some of the fastest growing jobs in the country. We expect members of the House and Senate to oppose any proposal that fails to honor that commitment, and we will fight hard to see that wind energy continues to work for America.”

Bill Could Quickly Change

While proponents and opponents of the proposal were vocal in their positions Thursday, the bill could quickly be changed. Kevin Brady, a Texas Republican and chairman of the House Ways and Means Committee, said he may rewrite the bill prior to a committee vote on November 6. And the Senate is expected to draft its own tax legislation.

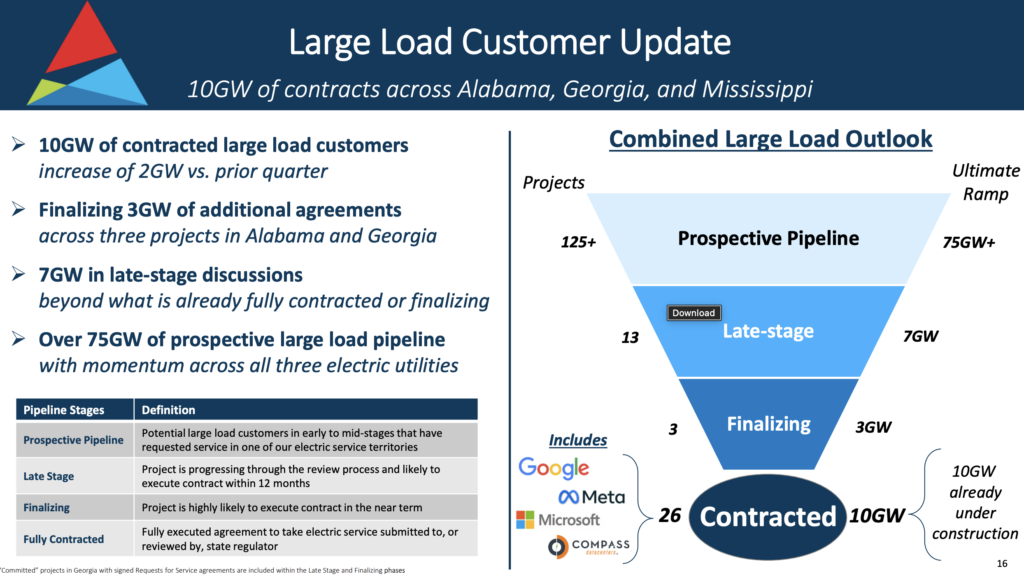

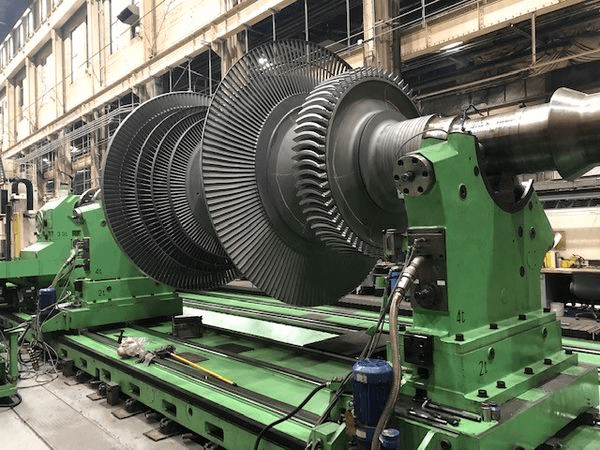

Tax credits for some wind and solar programs remain in the new bill, but the draft legislation would cut the current wind PTC by more than a third. However, the bill extends an estimated $6 billion tax credit for the nuclear power industry, a key provision cited by Southern Co. subsidiary Georgia Power earlier this year when it decided to continue construction of the Vogtle nuclear project in Georgia. The tax credit had a 2021 deadline, and the oft-delayed and much-troubled construction of two new AP1000 reactors at Vogtle likely would not make that deadline.

The bill’s tax credits for geothermal, small-scale wind projects, and development of fuel cells were resurrected after being left out of a 2015 budget and spending deal.

Congressional analysts estimated the phase-out plan for the wind PTC, which also cuts the industry’s 2.3-cent-per-kWh tax credit to 1.5 cents, would eliminate more than $11 billion in benefits to the industry over the next 10 years.

Congress in 2015 passed a law that said the wind PTC would begin phasing out in 2017, and expire in 2020. “The wind energy production tax credit is already being phased out under a compromise brokered in 2015,” Iowa GOP Sen. Chuck Grassley said in a statement. “It shouldn’t be re-opened. I’m working within the Senate Finance Committee to see that the commitment made to a multi-year phase-out remains intact.”

The wind energy PTC allows for a tax credit for each kilowatt hour generated. It was created by Congress to allow wind developers access to funds to invest in U.S. wind projects. In 2015, Congress passed a bipartisan five-year extension for the credit.

The bill introduced today changes the terms of PTC qualification defining start of construction, eliminating access to capital for some project developers. It also ends an inflation adjustment, which AWEA says cuts the PTC value by more than half.

“The House language would have a chilling effect on private investment in U.S. infrastructure,” said AWEA’s Kiernan. “Private capital commitments supporting over $50 billion in manufacturing and construction activity are at serious risk under this plan. These investments were made based on the rules of the 2015 phase-out. Changing the rules in the middle of the game would be disastrous for American workers building wind turbines and farmers and ranchers harvesting the wind.”

Solar Credit Also Impacted

A separate solar industry 30% tax credit phase-out agreed to in 2015 will continue, with the credit set to expire in 2022. However, the bill would end a 10% tax credit for utility-scale and commercial solar projects—called “permanent” in earlier legislation—after 2027.

The bill introduced Thursday would also end a $7,500 federal tax credit for purchasers of electric vehicles (EVs). Scott Mercer, founder and CEO of Volta Charging, told online technology magazine The Verge: “[Ending] the federal tax credit will definitely have an impact on U.S. adoption. It’s a bit unfortunate because it slows our ability to become competitive in what has become a global level of EV adoption.”

According to the National Conference of State Legislatures (NCSL), at least 34 states and the District of Columbia offer some type of incentive to owners of hybrid and plug-in electric vehicles (PEVs). The $7,500 federal tax credit has been available in addition to any state incentives; however, the federal credit would expire after 200,000 qualified PEVs were sold by an individual manufacturer. The NCSL says that as of August 2017, Tesla had sold the most PEVs in the U.S., but still needed to sell another 80,000 for the credit to phase out for its models.

—Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine).