Utility Perspectives on Using Renewable Power

ELECTRIC POWER 2010

As U.S. utilities increase the percentage of renewable energy in their generation portfolio, they must deal with a number of key issues related to selecting specific technologies. Additionally, they must figure out what it will take to make renewables emerge as a mainstream generating option in the future.

U.S. utilities are increasingly selecting renewable energy technologies for power generation, prompted by state renewable energy portfolio standards (RPS) requirements and several other criteria unique to their generation mix. Reflecting the growing impact that renewable energy sources are having on the industry, this year’s ELECTRIC POWER Conference offered a session titled “Utility Perspectives on Renewable Power—Panel Discussion,” which featured a lively exchange about this complex topic.

The speakers included Mike Smith, senior vice-president of Green Initiatives at Constellation Energy; Mike Turner, process supervisor at American Electric Power’s (AEP) Rockport Power Plant; Dr. Sarah Kurtz, principal scientist with the U.S. Department of Energy’s (DOE) National Renewable Energy Laboratory (NREL); and Dr. Allen Hoffman, senior analyst with the DOE’s Office of Energy Efficiency and Renewable Energy. In addition, Mark Kapner, PE, senior strategy engineer with Austin Energy in Austin, Texas, shared his utility’s efforts to integrate renewable energy into its portfolio mix. I cochaired the session with Vas Choudhry, strategic marketing program manager, GE Energy, Global Marketing.

Efforts to Integrate Renewables

“Austin Energy currently has five power purchase agreements for wind (projects in operation) and one for solar (project in development),” Kapner said. “The five wind projects contribute 10.6% of our total megawatt-hours.”

When asked how much renewable power can be accommodated by the existing system for a given state, region, or utility, Kapner responded that the answer depends on how much flexible generating capacity the balancing area currently has. For example, flexible generation can be ramped up or down at a rate equal to the maximum ramping rate of the wind or solar generating units.

In contrast to Austin Energy, AEP has tried cofiring coal and sawdust but still had some emission issues to deal with. AEP also has tried different biomass ventures, according to Turner.

“At AEP, we’re also trying carbon sequestration,” Turner said. “However, the issue is whether the PUC [Public Utility Commission] will let you put [it] in your rate base. We found that you have to get the PUC to let you put it in your rate base.”

Hoffman, the DOE analyst, focused on current challenges that are slowing the adoption of renewable energy by utilities: “At the present time, the two biggest barriers for renewables in the U.S. are that we haven’t yet developed successful energy storage technology and we don’t have a national grid.”

Financial Issues Related to Renewables

Utility customers want to be “green,” but they also do not want to incur significant additional costs for their electricity, Smith noted. “At Constellation Energy, we don’t talk to our customers about saving polar bears,” he said. “Electricity must be cost-efficient for our customers. Technologies like microwind and fuel cells can bring benefits to customers’ backyards. Customers will be able to save money through distributed energy sources.”

He emphasized that the Constellation Energy management spends a large amount of time analyzing political developments in order to review risks. The company won’t build new facilities unless management thinks the company will get a good return on investment. “It’s best if the renewable technologies have a glide path with upfront subsidies, but ultimately, they have to stand on their own,” Smith explained.

Along the same lines, Kapner explained the financial issues that the Austin Energy management focuses on. “Capital cost and capacity factor act together along with operations and maintenance costs and the cost of capital (i.e., financing) to create the levelized cost of energy—the single most important factor,” he said. “Intermittency—which we prefer to call variability—is a lesser factor. Long term (i.e., 20-year) fuel supply certainty is, of course, a major factor for biomass.”

AEP’s Turner emphasized the impact of incentives on the integration of renewables into utilities’ generation mix. “Incentive programs for renewable energy promote the greenest power at the cheapest price for both utilities and individuals,” he said.

Turning to another financial issue, Hoffman focused on the relative costs of different fuel sources used in generating electricity. “Our country pays for our energy one way or another. We’re already paying a price to burn coal,” he said. “In the future, if we put a price on carbon (such as imposing a tax), we’ll see lots of innovation in the development of renewables.”

He also had strong views about utilities’ role in educating their customers. “I feel that we have not had enough public education about the real costs of energy,” he said. “We need to educate people about why it’s important to use energy efficiently.”

Dealing with State Renewable Portfolio Standards

“One of Constellation’s biggest questions is, how do we comply with state renewable energy portfolio standards [RPS] in the most cost-effective manner?” Smith said. “We’ve determined that fuel mix diversity will help us get to a sustainable future.”

“State RPSs allow a market approach that can drive down technology costs. My mantra is that markets work,” he said. “In contrast, feed-in tariffs provide no incentives to bring down costs.”

Smith also emphasized that regulators need to set rules and keep them stable. Then utilities can start to take more decisive actions to incorporate renewable energy into their operations.

On the other hand, Austin Energy is not guided by a state RPS, according to Kapner. “We have our own renewable goals: 35% by 2020 and 200 MW of solar by 2020,” he said. “We’re not sure that a national RPS is a good idea or a bad idea. Some regions of the country are clearly far more blessed with renewable resources than others; why should the areas that are deficient in the resources be penalized?”

The PV Technology Market

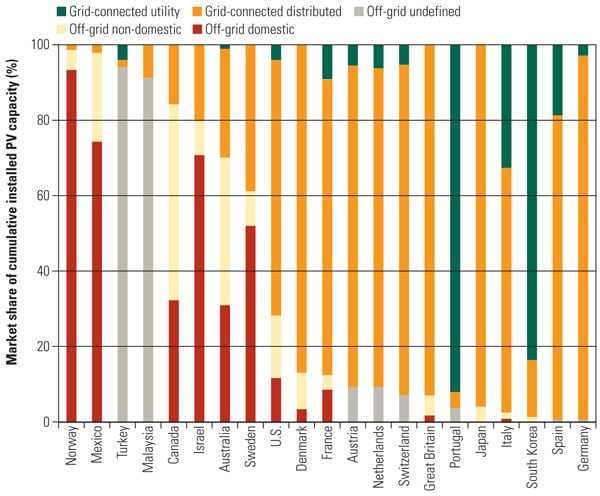

In her presentation, Kurtz primarily focused on the developing solar photovoltaic (PV) market. She pointed out that in the past the U.S. has mainly had a distributed market with little utility involvement. In contrast, Portuguese and South Korean utilities are very involved in using PV for electrical generation (Figure 1). Nonetheless, she emphasized that many predict that U.S. utilities are poised for large PV growth in the future.

|

| 1. Worldwide use of PV. The Jan. 2010 Solar Technologies Market Report shows that the countries on the right side of this graph have the highest percentages of grid-connected solar PV power. Source: U.S. Department of Energy’s Energy Efficiency and Renewable Energy Office |

Recently, solar PV systems have undergone important increases in the following areas, according to Kurtz:

- Maximum system size.

- Average system size.

- Ground mount (instead of roof mount).

- Connection at transmission voltages instead of at distribution voltages.

- Utility ownership.

Selection Criteria for Renewables

In general, utilities use some basic metrics when choosing a renewable energy technology, according to Kurtz:

- Acceptable cost, which depends on local resources.

- Energy payback, which also depends on local resources.

- The match between generation and load profile (peak shaving).

- Demonstration of the product.

- The future potential for the product (PV technology is still maturing).

- Installation details, such as the size of the installation, site preparation, and dual use of land.

- Maintenance requirements (for example, trackers require regular maintenance, but inverters are typically the most problematic).

- Water use.

- Other environmental concerns, such as permitting challenges.

Kapner gave a specific example of the renewable technology selection criteria that Austin Energy uses: “We consider wind, solar, hydro, biomass (landfill methane, anaerobic digestion of organic waste, and combustion of wood and crop residue), and geothermal as qualified renewable energy sources.”

What the Future May Hold for Renewables

Session participants provided valuable insights into the variety of challenges that lie ahead related to adding more renewables to utilities’ generation portfolios.

“Renewable energy is gaining in market share as the prices drop. Within a few years, renewables may be a substantial fraction of new electricity generating capacity,” Kurtz said. “Any utility out there needs to be diversified and able to move quickly in new directions.”

In a different vein, Turner emphasized the impact that utilities’ increased use of renewables will have on their personnel. “There will be a huge transition for the U.S. utility workforce as utilities move from coal-fired power plants to facilities based on renewable energy like wind and solar. The workforce will need to retrain for more maintenance-type jobs,” Turner said.

Kapner chose to focus on plans that Austin Energy has related to using more renewable energy sources such as wind or solar. The utility’s generation expansion plan calls for 1,000 MW of wind, 200 MW of biomass, and 200 MW of solar by 2020.

He also addressed the question of how critical the role of energy storage is for his utility. “Energy storage should not be viewed as a show-stopper for the addition of renewables until Austin Energy runs out of flexible generating capacity,” he said. “In addition, when storage is considered, it should be viewed and analyzed as a system resource, not a cost to be assigned just to the renewable sources.”

Hoffman had a different view of how the U.S. should handle the expected growth in demand from both business and residential consumers. “Going into the future, we’re going to need it all: renewables and traditional energy sources,” he said. “In addition, looking ahead, the electrification of the U.S. transportation fleet is critical.”

—Angela Neville, JD, is POWER’s senior editor.