U.S. Company Has Deal with Jordan for Nuclear Technology

There have long been grand plans for developing nuclear power in the Middle East. After Iran brought the Bushehr plant online in 2011, the country talked of building another dozen or so reactors. Saudi Arabia in 2011 announced plans to build as many as 16 reactors over the next two decades; it now says it will issue a tender this year to build its first two units. Egypt, Turkey, and Jordan have discussed nuclear power for years, along with Israel, which to date has one reactor, a small unit at the Shimon Peres Negev Nuclear Research Center outside Dimona.

The region’s plans for nuclear power have moved in fits and starts, but change is underway. Egypt is building a $29 billion plant with the help of Russia’s state-owned Rosatom (see “Russia Offers to Expand Nuclear Power in Africa” in the December 2019 issue of POWER). Construction on Unit 1 of a four-unit, 5,600-MW nuclear plant at Barakah in the United Arab Emirates is complete, with the other three units also well along. Unit 1 is expected online this year.

Concrete was poured in November 2019 for a second unit at Bushehr in Iran, expected to produce 1,000 MW, and a third unit at the site is planned. The Akkuyu Nuclear Power Plant in Turkey, a planned 4,456-MW facility where construction began in April 2018, is moving forward and could come online as early as 2023. The country has announced plans to build three more nuclear plants, each with four reactors, by 2030.

Sinamees Hajarat of Jordan’s Atomic Energy Commission (JAEC), in a July 2019 presentation at the International Atomic Energy Agency’s 17th INPRO Dialogue Forum on Opportunities and Challenges in Small Modular Reactors in Ulsan, South Korea, said Jordan wants nuclear power due to its “growing demand for energy” and its “need for reliable and affordable baseload power,” in part to support industries including desalination. Jordan’s path to nuclear power recently became clearer when X-energy, a company based in Rockville, Maryland, signed a letter of intent (LOI) with JAEC as part of that country’s plan to develop a civilian nuclear power program.

|

|

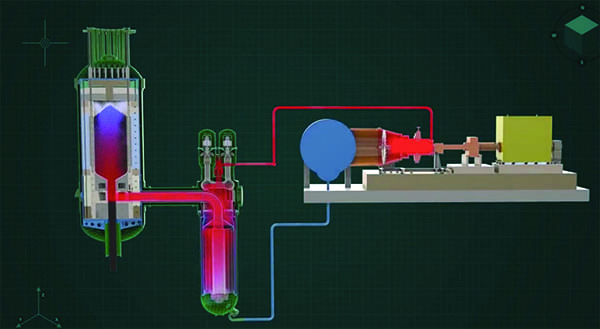

1. X-energy’s technology—a high-temperature gas-cooled reactor (HTGR)—works by passing helium over the fuel pebbles to extract heat. The heat then goes into a generator to produce steam for electricity. The X-energy reactor has a low power density (about 30 times lower than traditional reactors), which means heat generated during a loss of coolant event can be removed passively through conduction, thermal radiation, and natural convection. These natural mechanisms are always present, so the X-energy reactor does not have to rely on electricity to drive pumps or safety systems to prevent a core melt. Courtesy: X-energy |

X-energy is an advanced nuclear reactor design and TRi-structural ISOtropic (TRISO)-based fuel fabrication company, whose reactor designs (Figure 1) utilize high-temperature gas-cooled pebble bed reactors, are “walk-away” safe without operator intervention, and reduce costs by utilizing factory-produced components that significantly reduce construction time. X-energy also manufactures uranium oxide/carbide-based kernels, TRISO particles, and fuel pebbles at a fuel facility located at the Oak Ridge National Laboratory in Tennessee as a prototype for its commercial fuel manufacturing facility. The company in early December was awarded nearly $3.5 million from the U.S. Department of Energy (DOE) to further the development of its advanced Xe-100 nuclear reactor.

The signing of the LOI with Jordan in mid-November 2019 came at a ceremony at the Jordanian embassy attended by company and nuclear industry representatives, including staff from the DOE and U.S. Department of Commerce. JAEC in recent years has been evaluating different nuclear design technologies and has been in discussions with X-energy since 2017. The LOI is part of the process to accelerate construction of a nuclear power plant in Jordan by 2030, a facility that could feature X-energy’s 300-MWe Xe-100 reactor plant, utilizing four 200-MWth (75-MWe) helium-cooled reactors, and supplied by X-energy’s patented TRISO fuel.

“Jordan has been interested in nuclear power from an energy security, energy diversity standpoint for a long time,” X-energy CEO Clay Sell told POWER. “From a power generation standpoint, in many ways they’re dependent on gas from Egypt and Israel.”

Sell said Jordan first signed a nuclear power cooperation agreement with the U.S. more than a decade ago, and also agreed to work with Russia on developing a reactor project a few years ago. “That ultimately did not go forward,” Sell said. “They went back to a technology selection process, that a number of different vendors have been involved in. That materialized in the agreement announced Nov. 15 [with X-energy]. We’re committed to them, and they’re committed to us.”

Sell said X-energy’s technology fits neatly in the current trend toward small modular reactors (SMRs), which provide more generation flexibility at a lower cost. “It’s one of the benefits of advanced reactors that are also small modular reactors,” he said, also noting that the reason some foreign countries are signing development deals with the likes of Russia and China is that those countries have state-backed nuclear technology export programs—and the U.S. does not. “The process of financing a gigawatt-level plant, we don’t have the [government] capacity in the U.S. to do that,” Sell said. “Our government hasn’t been able to do that. But that question changes on a billion-dollar-class [project], say a 300-MW plant, where the size is smaller, the risk is more manageable. So, the prospect of U.S. investors, Jordanian investors, you can see a compelling package that the Jordanians could say yes to. They’ve always preferred our technology, it’s just been, ‘Give us some terms we can say yes to.’ They love the technology.” Sell said the target date for deployment of an operating plant is 2028 to 2030.

“We are unique among reactor companies because we have built our own fuel, a ceramic,” Sell said. Oxide ceramics, based on fissionable uranium and plutonium, have been made into highly reliable fuel pellets for both water-cooled and liquid-metal-cooled reactors. “Our TRISO fuel is so central to our process. We joined [in early November] with GE’s Global Nuclear Fuel [GNF] to build our first commercial facility at their Wilmington, N.C., fuel plant, and we’re moving aggressively on the fuel side.” The deal with GNF is a collaboration to produce TRISO fuel, and the companies have signed a teaming agreement for the purpose of developing high-assay low-enriched uranium (HALEU) TRISO fuel to potentially supply the U.S. Department of Defense (DOD) for micro-reactors and NASA for its nuclear thermal propulsion requirements.

“We have two reactor products,” said Sell. “TRISO fuel forms to support a multiplicity of advanced reactor designs. Our Xe-100 is a 300-MW permanently installed plant, with a small modular advanced reactor. It’s modular and small because the main components are built in a factory and sized to be road-transportable, and then assembled on-site,” making it a generation option for commercial and industrial sites.

“We have a second design that we have under development,” Sell said. “It is much, much smaller, I think between 1 MW and 5 MW of electricity output. It is fueled once and runs for the life of the core. The initial demand pool is the DOD. I believe intensely that that pool will result in commercial systems.” Sell said the SMR systems could be part of the growth of distributed, decentralized power generation. “Think about it. High-altitude mining sites, island nations, how much would they be willing to pay to get them away from that diesel supply chain?” he asked.

—Darrell Proctor is a POWER associate editor.