U.S. Coal-Fired Generation at Lowest Level Since 1976

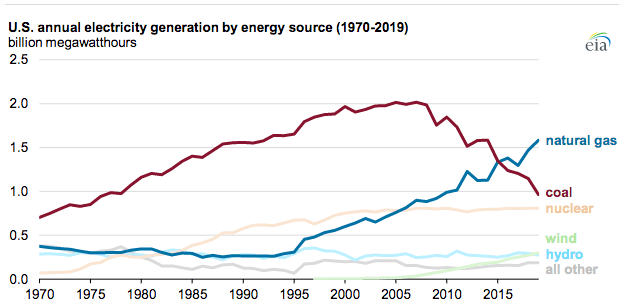

U.S. coal-fired power generation last year was at its lowest level since 1976, according to data released May 11 by the U.S. Energy Information Administration (EIA). The EIA in its latest Short-Term Energy Outlook report said energy from renewable resources could this year for the first time surpass coal-fired generation in the U.S.

The

agency said output from U.S. coal-fired units fell to 966,000 GWh in 2019, the

lowest level in more than 40 years. The EIA said the 16%, year-over-year drop from

2018 levels was the largest percentage decline ever, “and the second-largest in

absolute terms (240,000 GWh).”

That decline is expected to continue this year; IHS Markit recently projected that utilities will burn nearly 130 million fewer tons of coal this year than in 2019.

The EIA said increased power generation from natural gas-fired plants, along with wind power and overall lower demand for electricity, has driven the decline in coal-fired generation. The agency said natural gas-fired generation reached an all-time record of almost 1.6 million GWh in 2019, a year-over-year increase of 8%. Wind power generation topped 300,000 GWh, up 10% from 2018.

EIA has forecast generation from renewable resources will increase 11% this year from 2019 levels. The agency said renewable energy is more likely to be dispatched by grid operators when it’s available because of its lower operating cost. According to EIA, in the first four-and-a-half months of this year, power generation from wind, solar, and hydropower produced more electricity than coal on 90 separate days, something that occurred on just 38 days in 2019.

The EIA in its report did say that while it “expects renewable energy to be the fastest-growing source of electricity generation in 2020, the effects of the economic slowdown related to COVID19 are likely to affect new generating capacity builds during the next few months.” The agency said it expects 20.4 GW of new wind power capacity will be added this year, along with 12.7 GW of utility-scale solar capacity. The agency also said that due to the coronavirus pandemic, “these forecasts are subject to a high degree of uncertainty, and EIA will continue to monitor reported planned capacity builds.”

Coal Reached Its High in 2011

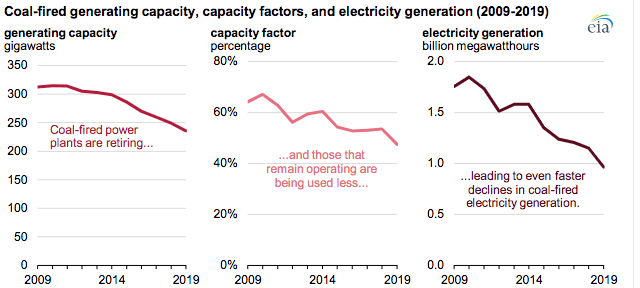

U.S. coal-fired generation capacity hit a high of 318 GW in 2011, and has fallen ever since as coal units have retired, or switched to natural gas and other fuels. The EIA said U.S. coal-fired generation capacity was at 229 GW in 2019, a 28% drop during the decade.

Utilization rates for coal plants also have fallen, to 48% in 2019, down from 67% in 2010, based on the operating capacity at those times. Meanwhile, combined cycle gas turbine (CCGT) power plants ran at an average capacity factor of 57% last year, nine percentage points higher than coal-fired plants.

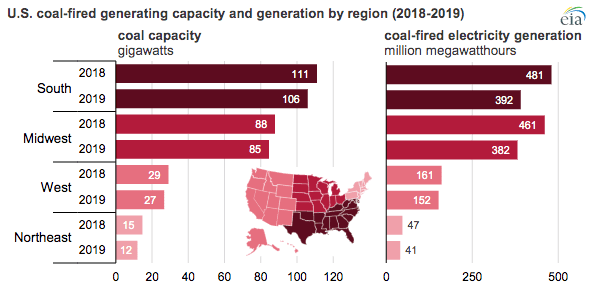

EIA’s report released Monday showed coal-fired generation dropped in every U.S. region, by more than 18% in some areas, including the U.S. Southeast. The agency also noted that “Average delivered prices for coal at power plants have been declining. Through 2015, the cost of coal averaged $2.25 per million British thermal units (MMBtu) before falling to less than $2.00/MMBtu in late 2019.”

An EIA analysis said that for coal to be cost-competitive with natural gas, coal’s “delivered cost must be at least 30% lower to make up for the differences in efficiency between a typical coal-fired plant and a typical natural gas-fired plant.” The agency said those “differences are even larger for more efficient natural gas-fired combined-cycle plants,” and noted that “coal plants must also offset higher costs for emission control equipment and other operations.”

The economic struggles for operators of coal-fired power plants were in large part responsible for the retirement of almost 13.9 GW of coal-fired generation in 2019. That was the highest amount of closures since 2015, when new pollution regulations led to the retirement of more than 15.1 GW of generation capacity.

A POWER analysis of publicly announced coal plant retirements shows that about 9 GW of coal-fired generation capacity is earmarked to shut down this year, with about another 23 GW of capacity in line to be retired from 2021-2025.

—Darrell Proctor is associate editor for POWER (@DarrellProctor1, @POWERmagazine).