The Expanding Wood Pellet Market

Last year, the U.S. exported nearly twice the amount of wood pellets it sent overseas in 2012—and almost all of it went to Europe for heat and power needs. This trend has gained momentum since 2009, when the European Commission (EC) enacted its 2020 climate and energy package, and will possibly continue in the long term, says the U.S. Energy Information Administration (EIA) in a new report.

As recently as 2008, about 80% of U.S.–made wood pellets, typically from wood waste (such as sawdust, shavings, and wood chips), but also from unprocessed harvested wood, were consumed domestically for residential heating fuel. But the EC’s binding 2009 legislation, which calls on the European Union (EU) to reduce greenhouse gas emissions by 20% from 1990 levels and to produce 20% of its power from renewables, has sent demand for U.S. wood pellets soaring, the EIA says.

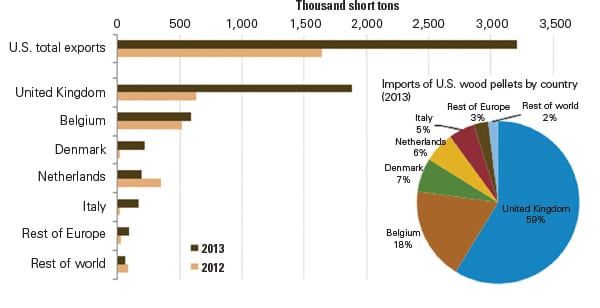

At least 98% of wood pellet exports (and 99% sourced from ports in the southeastern and lower Mid-Atlantic regions of the U.S.) went to Europe in 2013, mostly to the UK, Belgium, Denmark, the Netherlands, Italy, and other countries that are using wood pellets to replace coal for power generation and space heating (Figure 2). The UK, specifically, consumed 59% of U.S. wood pellet exports to meet demand that has grown from near zero in 2009 to more than 3.5 million short tons in 2013. It also imported from Canada and other European sources.

|

| 2. From trash to treasure. Wood pellet exports from the U.S. nearly doubled last year, from 1.6 million short tons in 2012 to 3.2 million short tons in 2013. Source: EIA |

One reason for the soaring growth is the UK’s Renewables Obligation program, through which operators of several large coal-fired power plants have either retrofitted existing units to cofire biomass wood pellets with coal or have converted to 100% biomass. Last December, for example, Drax completed the $1.14 billion conversion of three of its six coal-fired units at the Drax Power Station to biomass. The facility reportedly needs at least seven million metric tons of wood pellets a year. At the same time, Drax is considering converting a fourth unit, meaning pellet demand could exceed nine million metric tons. The company is building two of its own pellet plants in Louisiana and Mississippi.

According to one of the largest U.S. wood pellet manufacturers, Enviva, the primary reason that European utilities are banking on imports—rather than using wood from European forests—is because “North America has significantly more forestland than Europe as well as a long history of sustainable forest management and productive commercial forest product industries.” And, biomass isn’t being adopted on the same scale in the U.S. because it just doesn’t have a “cohesive” national renewable policy as the EU does. Meanwhile, ocean freight is “substantially more carbon and energy efficient in a per ton basis than trucking,” says the company. “This means that shipping a ton of pellets from the Southeast U.S. to England results in less carbon emissions than trucking that same ton from northern Scotland to England.”

For Enviva, the growth of the wood pellet export market is sound. Though the UK recently placed a 400-MW limit on new-build biomass-fired power plants, “there’s no limit on the conversion of existing coal plants to biomass or on the construction of biomass-fueled combined heat and power (CHP) facilities,” it says. “Demand for sustainably produced biomass fuels is still expected to grow substantially through 2020 as coal-fired power facilities attempt to meet regulatory targets and improve the environmental profile of energy generation.”

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)