The Clean and Dirty of Landfill Gas Power

Despite its apparent environmental benefits and strong government backing, generating power from landfill gas hasn’t gained traction for a variety of reasons in the U.S. Will the Clean Power Plan bolster this “dirty” renewable power source?

For the U.S. Environmental Protection Agency (EPA), the only clean thing about landfills—those engineered dumps that entomb America’s infinite supply of trash—is the power generated from the methane that municipal solid waste (MSW) emits.

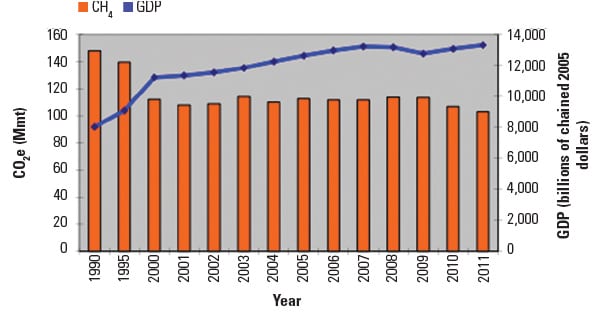

The agency that is due to release final rules to curb existing power plant carbon dioxide emissions this summer claims that MSW landfills are the third-largest source of human-related methane emissions in the U.S.—and methane, it points out, is an insidious greenhouse gas (GHG) that has 23 times the global warming potential of carbon dioxide.

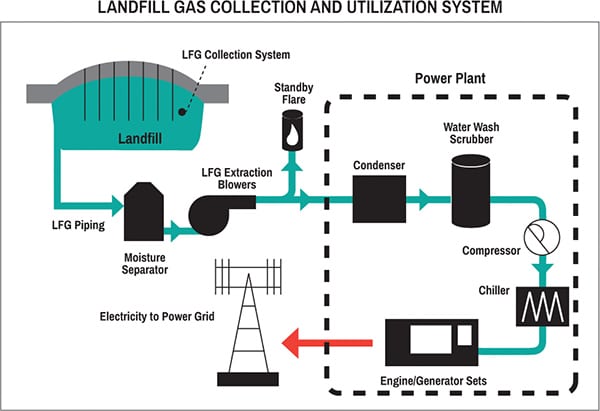

But methane emissions from landfills also represent a “lost opportunity to capture and use a significant energy resource,” it says. Instead of escaping into the air, the gas created when MSW decomposes in a landfill—otherwise known as landfill gas (LFG)—can be captured and converted, and used as an energy source as a “win/win opportunity,” says the agency.

Not only does it reduce odors and improve safety by reducing explosion hazards from gas accumulation in a landfill, it is a potential moneymaker (see sidebar). It does all that while reducing compliance costs associated with current EPA regulations under the Clean Air Act that require many larger landfills to collect and control LFG by flaring it or using it for energy, the agency notes.

At the same time, it’s a renewable fuel: As long as there’s landfill—and even after the closure of a landfill—there will be landfill gas (Figure 1). And, bonus: Unlike wind and solar, those less “sexy” landfill gas power projects can be used to produce both baseload and peak power, as well as work as a distributed energy source.

Then, there’s the air emissions factor. The EPA notes that the carbon dioxide emissions from MSW landfills are not counted as contributing to climate change because the carbon was contained in recently living biomass, and that the same carbon dioxide would be emitted as a result of the natural decomposition of the organic waste materials outside the landfill environment. It also says that, like all combustion devices, LFG electricity generation devices emit some nitrogen oxides that can contribute to local ozone and smog formation. “Overall, however, LFG electricity generation projects significantly improve the environment, because of the large methane reductions, hazardous air pollutant reductions, and avoidance of the use of limited non-renewable resources such as coal and oil that are more polluting than LFG.” it says.

Good Riddance to Bad Rubbish

To that end, in December 1994, the EPA launched a voluntary assistance program that encourages the recovery of landfill gas as a renewable energy source, and which creates partnerships among states, energy users/providers, the LFG industry, and communities that seeks to lower barriers and promote the development of cost-effective and environmentally beneficial LFG-to-energy (LFGTE) projects. The Landfill Methane Outreach Program (LMOP) has been wildly successful, it says (Figure 2).

In 2013, the nation’s LFGTE facilities produced 10.7 TWh—more than the nation’s total solar output for that year, which was 8.1 TWh for photovoltaic power and 0.92 TWh for solar thermal (in 2014, solar generation grew to 18.3 TWh, while landfill generation saw a small spurt to 11 TWh).

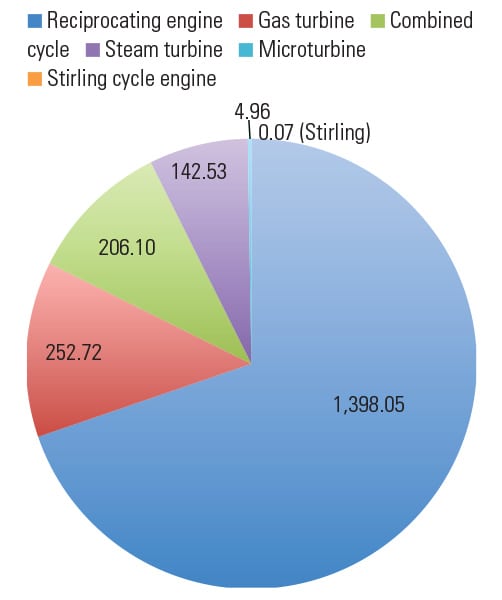

Between 1995 and 2015, the number of LFGTE projects increased by a dramatic 300%, 75% of which produce power (the rest is typically directly used for various purposes, such as for boiler applications, direct thermal, and vehicle fuel). LMOP’s frequently updated database (based on voluntary reporting) suggests that at least 2 GW of LFG power generation facilities are operational in the U.S. today. Another 12.8 MW is under construction, 9.6 MW is planned, and 250 MW has been shut down (Figure 3).

For the EPA, however, this growth has been tepid, at most. It says at least 440 candidate landfills, worth 855 MW, can be developed nationwide.

The Evolution from Waste to Gas to Power

Considering all its environmental benefits, its designation as a renewable fuel, and its government backing, why hasn’t the LFGTE sector become larger?

According to Kerry Kelly, senior director of federal affairs at Waste Management Inc.—the nation’s largest landfill gas power generator—the sector is suffering a temporary lull. The number of LFGTE projects grew aggressively from 2006 through 2013, supported by high wholesale energy prices, utility and local government interest in voluntary sustainability projects, Federal Section 45 tax credits for production of renewable electricity, and expansion in-state renewable portfolio standard (RPS) programs that promoted or mandated production of renewable energy including power from landfill gas, she told POWER in May.

“Since that time, there has been a marked slow-down in development of new LFGTE projects with lower natural gas and wholesale electricity prices and the expiration of federal tax credits last year,” she said. “We think it is possible that implementation of the Clean Power Plan and potential renewal of the Section 45 tax credits will spur development of new projects.”

Kelly remarked that the industry has always been in a state of flux; changing regulations have continually sculpted it. Before 1996—when the EPA finalized sweeping New Source Performance Standards (NSPS) that, for the first time ever, required the collection and combustion of LFG—LFG recovery and control systems were typically designed and installed to prevent subsurface LFG migration and address explosive gas concerns under Resource Conservation and Recovery Act Subtitle D, odor, groundwater protection.

But some major players also saw financial incentives. Energy production at Houston-based Waste Management, for example, evolved from its focus on environmental compliance and a drive to develop new and higher-value revenue streams. The company began by installing methane capture systems at landfills, flaring off gas. Soon it was capturing the methane at larger volumes and sending it via pipeline to generate power.

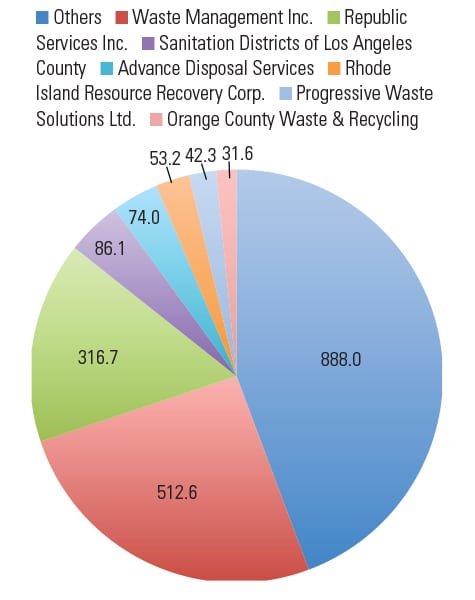

Today, Waste Management and Arizona-headquartered waste disposal firm Republic Services own the bulk of the nation’s LFGTE facilities (Figure 4).

|

| 4. The big players. “Other” includes 228 entities, each with under 1 MW. Private companies own 1,250 MW of operational capacity; public companies own 755 MW. All numbers are MW. Source: EPA LMOP |

Waste Management’s LFG activities have evolved even further: Under a partnership with Linde, the company has been exploring converting LFG to liquefied natural gas and plans to refuel its entire waste management vehicle fleet with compressed natural gas. It is also looking at converting LFG into synthetic diesel.

A Risky Business

Like most power projects, LFGTE projects do sometimes fail, said industry expert Jeffrey Pierce, project director at environmental engineering firm SCS Engineers.

One problem involves the over-projection of recoverable LFG. “When landfill gas recovery is over-projected, the LFGTE facility does not operate at its full capacity, and project revenues are not adequate to fully cover debt service and operating costs,” he said. While advances in LFG recovery modeling have been made, only a few consultants have the depth and breadth of experience required to select site-specific LFG modeling coefficients.

Waste Management’s Kelly also underscored the importance of good siting. An energy-producing landfill project that is too far away from a grid connection or an end user tends to be uneconomical, she said.

Then there are challenges that involve interconnecting with the local electric power company. “While some measure of standardization of interconnection requirements has been accomplished, interconnections are still approved on a case-by-case basis,” Pierce explained. “It is generally not difficult, nor extremely costly, to satisfy a utility’s technical requirements on the power plant side of the utility meter. It is, however, sometimes difficult to determine exactly what will satisfy the reviewer of the interconnection application.”

Pierce also noted that while interconnection costs on the power plant side of the utility meter are generally not great, the amount of time required to secure an interconnection agreement can present a problem in project development. “Utility interconnections can introduce schedule delays and added project costs. Interconnection applications should be filed early. Fortunately and surprisingly, interconnection applications can generally be filed without a great deal of the detailed design being completed,” he said.

A Small Player in a Big Field

On a larger level, the LFGTE industry’s success has historically been linked closely to the price of natural gas. More recently, the sector is reeling from the plunge in natural gas prices and the conversion of utility plants from coal to natural gas, which have contributed to the drop in wholesale power prices.

“About half of our LFGTE plants have long-term, fixed-rate contracts that are not affected by market volatility. In some markets (NEPOOL, PJM), the sale of renewable energy credits (REC) within state renewable portfolio standard programs helps to offset the drop in energy prices,” said Kelly. “There are a few markets (Florida, Wisconsin, Texas) with lower energy prices and low or zero REC prices. In these markets, we look for short-term contracts with buyers looking for renewable energy in support of sustainability programs who are willing to pay a slight premium to market prices.”

Cheap natural gas has also stalled construction of new landfill gas projects. “[New projects] are expensive to put in place,” explained Kelly. “You need an economic payback that will carry the project forward for decades and of course the lower price of natural gas poses a big barrier.”

Regulatory and Environmental Hurdles

Meanwhile, although LFG power generation is promoted by the EPA, LFGTE projects don’t have regulatory immunity. Kelly noted that some growing constraints faced by the sector include complying with ambient air quality standards for engines—which are the most efficient means of producing power from landfill gas, she noted. Installing pollution controls can become so expensive that they outweigh the benefits of the project, forcing a landfill to forfeit power production revenues and continue flaring the landfill gas.

Curiously, despite its widely lauded environmental benefits, LFGTE doesn’t have the backing of at least one environmental group: The Sierra Club. The national group with political clout has vowed to resist legislative and policy initiatives that encourage LFGTE projects and allow the generation method to receive credit for GHG reduction programs.

In a 2010 report analyzing the environmental impacts of LFGTE, the Sierra Club argues that only a relatively small carbon reduction benefit might be achieved by replacing fossil fuel power with landfill gas power, owing to the increase in fugitive methane emissions resulting from altered landfill management practices. Disposal of decomposable organic wastes in landfills, including those with associated LFGTE facilities, “clearly results in the release of substantially more greenhouse gases (and other environmental pollutants) than diversion of these wastes from land filling to other treatments,” the report says.

In particular, raising the moisture content of the landfill via the so-called “wet cell” method accelerates the decomposition of wastes (versus the dry-tomb method, which minimizes water filtering through the landfill) and makes room for more wastes, thereby increasing the volume and concentration of methane produced, Sierra Club said. That’s counterproductive to achieving the near-term reductions in GHG emissions needed to control climate change, it argues.

Waste Management, which disagrees with the Sierra Club’s position from both a scientific and policy perspective, noted that the Sierra Club’s views are starkly different from other environmental groups such as the Environmental Defense Fund and the Natural Resources Defense Council—groups that actively seek federal and state policies to promote LFGTE projects.

Industry experts also point out that landfills are extensively regulated under the federal Clean Air Act and are required to install gas collection and control systems to control odors, surface emissions, and prevent migration of gas to groundwater. Under the EPA’s 1996-promulgated NSPS, collected gas must be flared, or it can be treated and used as a fuel to produce electricity, power, or transportation fuel.

Observers note that a revision of the 1996 EPA rule that will finalize stricter requirements for new landfills was due earlier this year. Also awaited is an EPA proposal that will govern emissions at existing landfills, which will be released in August 2016.

“We believe that not using landfill gas where it is feasible to do so would be a terrible waste of a valuable resource,” said Kelly. ■

—Sonal Patel is a POWER associate editor