THE BIG PICTURE: Critical Mineral Concerns

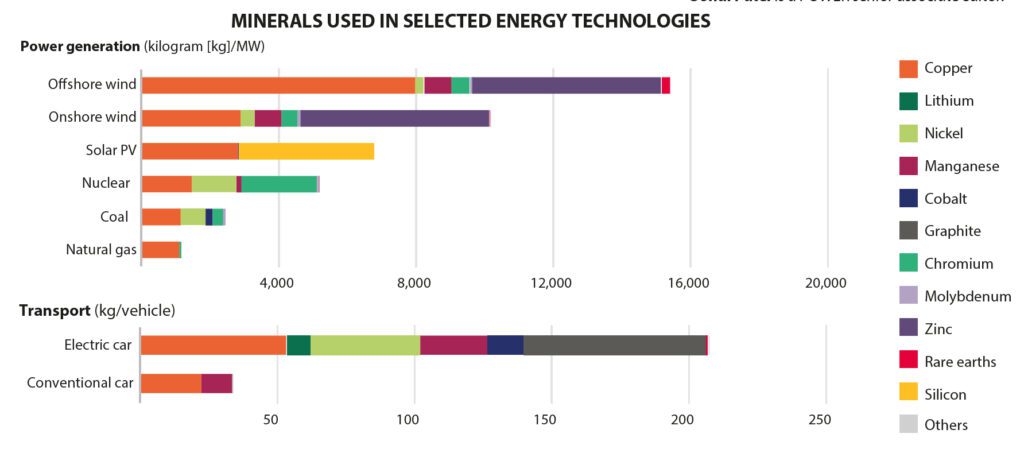

The shift to a clean energy system is set to drive a significant increase in requirements for critical minerals. Under an International Energy Agency (IEA) scenario that meets the Paris Agreement goals, clean energy technologies’ share of total critical mineral demand will likely soar over the next two decades to over 40% for copper and rare earth elements, 60% to 70% for nickel and cobalt, and almost 90% for lithium. Lithium, nickel, cobalt, manganese, and graphite will be crucial to battery performance, longevity, and energy density. At the same time, rare earth elements will be vital for permanent magnets in wind turbines and electric vehicle motors. Electricity networks will also need a huge amount of copper and aluminum. However, how and where suppliers will secure these necessary resources remains uncertain.

Read the related feature from POWER’s September 2021 issue: “Energy Transition Facing Potentially Debilitating Critical Mineral Supply Gap.”

Notes: A PDF version of POWER’s September 2021 print infographic can be accessed here. Sources: IEA, U.S. Geological Survey

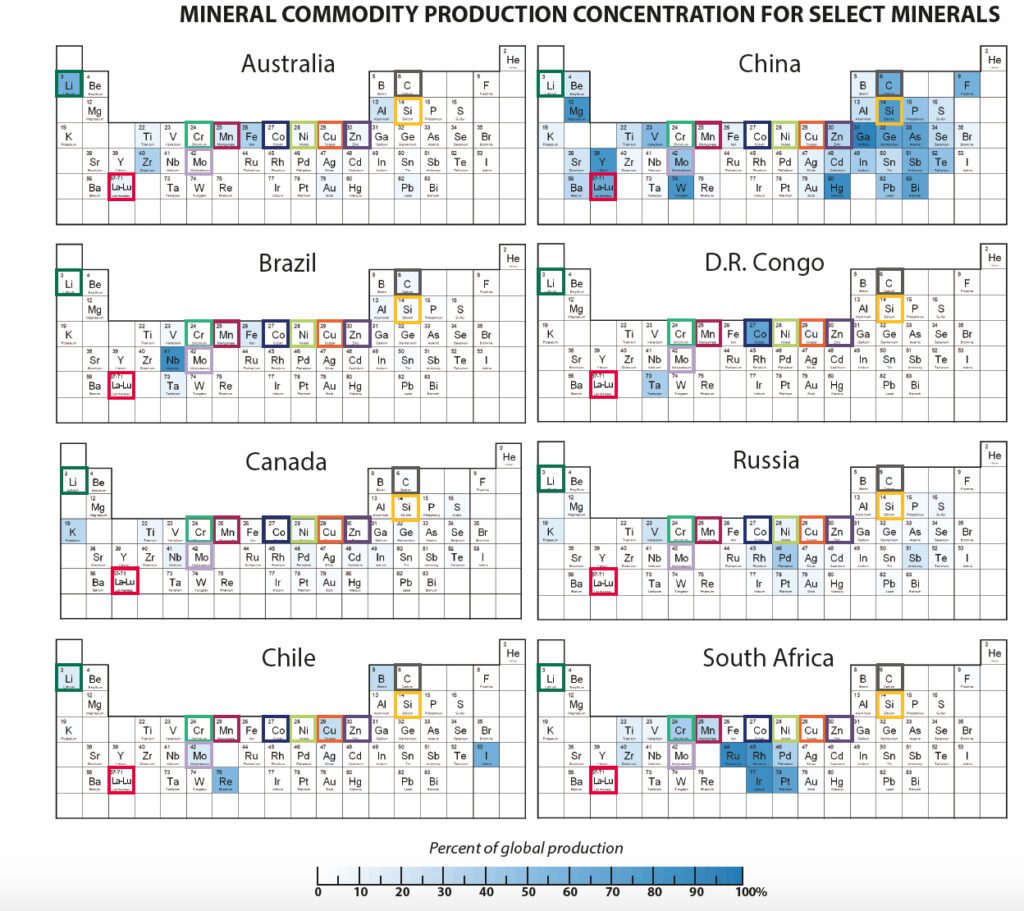

Mining and processing of several critical minerals are concentrated within a few countries—and that has prompted concerns about supply reliability. This figure leverages a U.S. Geological Survey assessment of 2018 data to illustrate the geopolitical concentration of production of several critical minerals. The darker blue shades indicate a higher percentage of global mine production. The colorful outlines within each periodic table correspond with the graph above to highlight critical minerals that are commonly used in selected clean energy technologies.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).