Ten Smart Grid Trends to Watch in 2012 and Beyond

The year 2012 represents a turning point for the smart grid. Many foundational elements have been tested; several have been successfully deployed. Now the serious work of integration and value-generation begins, even though the challenges remain substantial.

Smart grid technologies—particularly in the U.S. and Europe—are at a pivotal point. Sufficient initial steps have been made on the part of both technology suppliers and utility implementers that we are starting to see some payoffs—small, to be sure, in some cases, but significant in terms of proving technical and economic value.

Given that most elements of the smart grid sit “downstream” from power generators, one might ask why those on the generation end of the industry should care (other than because we are all electricity consumers). One reason is that smart grid technologies will both challenge the operation of utility-scale generation and become valued partners with traditional generation. For example, sophisticated peak-leveling programs can reduce the need for fast-responding peaker plants with low capacity factors. Advanced forecasting, automated load-shifting capabilities, and other communication and information technology tools all along the transmission and distribution grid can make it easier for fossil-fueled generators to integrate renewable generation to maximize efficiency, lower overall emissions, and balance portfolios.

In the medium to long term, smart grid technologies—which include myriad devices and tools to strengthen and secure power delivery systems—will inevitably affect the business models and operating practices of both utilities and independent power producers.

This article, based on the recent Pike Research white paper “Smart Grid: Ten Trends to Watch in 2012 and Beyond,” sums up the current status of the smart grid industry and identifies the top trends.

1. Smart Meters Will Shift from Deployment to Applications

For the past few years, utilities have been laser-focused on getting smart meters into the field. Federal stimulus money has fueled this effort to a great extent in the U.S. But that money is drying up, and a shift to making use of all that data is under way.

Smart meters have reached (or are near) critical mass. By Pike Research’s estimates, some 200 million smart meters have been deployed worldwide, and 40 million of those are now installed at premises in North America. Utilities have begun to realize internal cost savings from these new meters thanks to features such as remote disconnect capabilities and more efficient meter reading. However, new challenges will surface in the near term as utility managers build out consumer-facing services, such as web portals and useful apps that flow from smart meter data.

It is time for the new meters to start delivering on some of the promises to help consumers reduce consumption, lower their spending on energy, and deepen their engagement with utilities. Our expectation is that this shift from deployment to applications will take longer than anticipated because utilities have never seen this volume of data from meters, and no one has fully mined the complexities. Eventually, some clever applications will surface from forward-thinking companies that can see beyond the obvious use of the data. However, that is likely to occur in the years beyond 2012.

2. Dynamic Pricing Debates Will Escalate

Multiple studies show that dynamic pricing does indeed reduce peak loads and that its effects are enhanced with the application of smart grid technology. However, variable rates have some legitimate strikes against them and, interestingly, opposition to dynamic pricing can be found on both ends of a politically polarized spectrum. Those toward the right fear Big Brother taking control of their thermostats and appliances (here, utilities = government). Those bent leftward see the social good of universal electricity being corrupted, leaving the vulnerable unprotected (here, utilities = big business).

What has been missing from the broader debate is this question: Who wins/loses in the status quo of average rates? Heavy peak users are effectively being subsidized by everyone else. Efficient users are subsidizing inefficient users. In this context, consumer advocates should be clamoring for the energy hog consumer “peakers” to “pay their fair share.” More capitalistic types should welcome systems that make energy a free market with more consumer choice and effective pricing mechanisms.

Programs are likely needed for disadvantaged groups, but this is not a new challenge for policy makers. Regardless, there is growing evidence that even low-income consumers are often able to respond to dynamic pricing incentives and therefore share in the economic benefits. Ultimately, regulators and legislators armed with better data from pilot programs and carefully considered consumer protections integrated into service offerings will need the courage to drive dynamic pricing implementation forward.

3. “Architecture” Will Be the New Buzzword

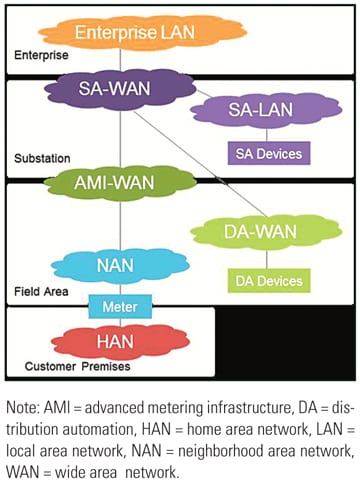

“Silo-busting”—integrating previously independent functions, technologies, and people—has been a widely recognized attribute of smart grid deployment. The better integration of substations, the distribution network, and metering systems is key to the improved grid management assumed to be required for the future growth of electric vehicles and distributed renewable energy generation. Silo-busting is easier defined than done.

Recent smart grid standards initiatives around the world have accelerated the movement toward a common architectural vision (Figure 1). The fruit of these efforts will emerge throughout 2012 with a tangible vendor solution offering. Cisco’s formal articulation of its GridBlocks architecture this past January provides perhaps the most comprehensive framework for considering specific system implementations. Although focused on the communications network, it offers a considered approach for broader systems interactions. At a subsystem level, most of the major smart meter manufacturers have just launched more open and flexible metering platforms.

|

| 1. Layers of smart grid architecture. In a fully integrated smart grid, individual technologies are able to interact with each other seamlessly. Source: Pike Research |

The adoption of an architectural filter for smart grid systems evaluation similarly applies to smart grid software (both information and operational technology) systems and is especially important for smaller utilities.

4. Cyber Security Failure Risks Will Near Inevitability

Smart grid cyber security at the end of 2012 is likely to look much as it did at the beginning of 2012. This “non-development” owes its existence to the continued non-existence of enforceable cyber security standards. The situation is dire enough that a recent Pike Research blog post on cyber security standards used Waiting for Godot as its graphic.

The details of the conundrum are too many for full consideration here, but one thing is clear: While some deride cyber security standards as irrelevant, that is far from reality. Utilities hesitate to invest in cyber security that is not required for compliance with something. That may sound cynical, but it is pragmatic. Utilities do not know what cyber security to buy, as they have no idea what some as-yet-unwritten regulation will require of them. An industry plagued by stranded assets will be loath to voluntarily sign up for more.

The lack of standards hinders vendors, as well. In order to decide which technologies to develop and which to leave untapped, vendors must predict what regulations will be enacted around the globe. That is nearly impossible, but vendors cannot be seen as inactive in their market, so they have to build something. Therefore, 2012 will most likely see new cyber security products targeted at smart grids. Unfortunately, not all vendors see the same market. Cyber security products from different vendors thus often do not integrate well. This adds further obstacles to smart grid interoperability—a feat that is challenging in the best of cases.

A recent Pike Research report forecasts that cumulative investment in smart grid cyber security through the end of 2018 will total nearly $14 billion. But without any standards, all that investment may not yield any meaningful improvements in smart grid protection. The continued lack of standards could also dictate a continued lack of protection.

5. Consumer Backlash Will Not Go Away

Health concerns, fears of privacy invasion and hacking potential, and general conspiracy theories continue to slow down smart meter deployments. Despite strong evidence to the contrary, vocal minorities will continue to push against these deployments. No matter how much utilities try to blunt the protests, they can expect to have to deal with this issue for the near term at least.

In California, to deal with the pushback problem, PG&E asked for and was granted permission by state regulators to let customers opt out of having a smart meter installed; instead, customers can keep their old analog meters if they agree to pay a monthly fee. A similar opt-out option is available in Maine. In Michigan, Consumers Energy is taking a proactive approach. While it has not yet deployed smart meters, the utility has decided to offer an opt-out program in advance of its planned rollout.

Though opt-out offers look necessary, savvy utility managers will acknowledge customer fears and work to directly engage them on this and other smart grid–related issues. Pecan Street, for example, is a public-private initiative in Texas that is looking at smart meters and the smart grid from the consumers’ perspective.

6. DA and AMI Will Intersect

The past year has seen distribution automaton (DA) projects and technologies emerge to the forefront of smart grid applications. Compared to the higher-profile smart meter and advanced metering infrastructure (AMI) deployments, DA investments often have clearer paybacks, can be deployed gradually with a tighter focus on problem areas, and (perhaps most attractively) do not require any consumer involvement (that is, behavior changes).

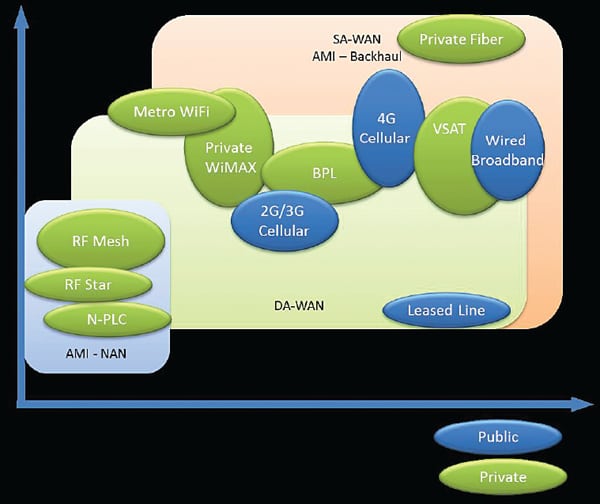

Consequently, AMI networking technology suppliers seem to be thinking that it should be easy to piggyback DA device communications on the same network. This may or may not be as easy as it seems, and there are plenty of competing technologies for the DA network (Figure 2).

|

| 2. Competing communication options. Distribution automation communications options include both private and public systems and come in a range of bandwidths and prices. Source: Pike Research |

DA applications are now becoming increasingly complex, including recent efforts at advanced, dynamic optimization of the distribution grid. This is especially important as distributed generation and plug-in electric vehicles (EVs) edge toward widespread deployment. (See POWER’ s March 2012 issue for more on EV integration issues.)

Beyond the sharing of network infrastructure, the more important intersection between AMI and DA is occurring at the IT and operational technology (OT) application level. Smart meters, the endpoints of every distribution network, can be very effective sensors for dynamic voltage monitoring. Capturing the smart meter data in a timely way may be a challenge for the AMI network. Often, however, the greater challenge is making that information available to distribution management systems and other OT systems in a complete, accurate, and timely way. Also required are the analytics to identify the required “information” within the pile of “data.”

Dominion Virginia Power is doing very interesting pilots that use basic analytics to identify “sentinel meters” to act as voltage sensors for a simple but robust conservation voltage reduction implementation. This novel approach is delivering significant distribution network optimization with relatively little additional field equipment deployment.

It may not be obvious at first, but this line blurring between different smart grid applications represents one of the key promises of developing a smart grid. By breaking through the traditional application silos, a more generalized smart grid infrastructure can be leveraged to deliver new applications and value beyond the original, more narrowly focused business cases. Pike Research believes 2012 will be the year utilities—especially those completing AMI rollouts—will take a long, hard look at these wider application possibilities.

7. Microgrids Will Move from Curiosity to a Reality

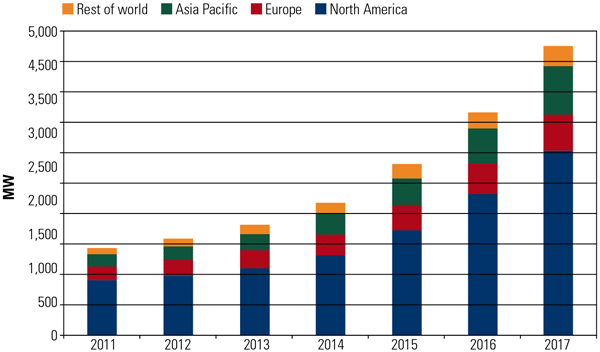

Pike Research has been monitoring and analyzing the world’s microgrid market since 2009, developing the world’s only database on microgrid projects segmented into five applications and four major geographies. Based in part on this data, Pike Research’s 2012 global microgrid market forecast shows that North America will continue to lead in terms of overall capacity (Figure 3). However, by 2017, the Asia Pacific region will lead in terms of revenue.

|

| 3. Major microgrid capacity growth. Pike Research anticipates total microgrid capacity (under its average scenario) to more than double in the next five years. Source: Pike Research |

There are two reasons why Pike Research sees microgrids moving from a curiosity into reality in 2012 and beyond, especially in the U.S. The first is the adoption of the Institute of Electrical and Electronics Engineers (IEEE) P1547.4 safe islanding standards in July 2011. These standards should accelerate the shift from pilot validation projects to fully commercial microgrid ventures. The second is a series of recent Federal Energy Regulatory Commission orders (719, 745, and 1000), which all take steps toward harmonizing innovation occurring independently at the wholesale and retail market levels.

Demand response (DR) is seen as a stop-gap resource whose role will expand in markets characterized by volatility, high demand peaks, and lack of new transmission-level generation capacity. Microgrids are now being viewed as the ultimate reliable DR resource, since islanding securely takes load off of the utility grid. (Also see POWER’ s January 2011 article on the U.S. military’s use of microgrids to ensure supply reliability.)

There are other drivers in other global markets. Interestingly enough, the entire European Union is reportedly abolishing the standard utility protocol of requiring inverters of solar photovoltaic installations and wind turbines to disconnect from the grid during a disturbance. This action removes one of the largest stumbling blocks to microgrid implementations, maximizing the value of these distributed resources.

The Asia Pacific market may become more robust in 2012 if the commercial/industrial segment—currently the smallest microgrid segment globally—takes off due to recent interest in data center microgrids, many operating on direct current. Rumors are swirling about projects as large as 500 MW in one Asia Pacific country.

8. The Freeze on HANs Will Thaw—Just a Little

The freeze on smart meters connected to home area network (HAN) interfaces will thaw—just a little bit. While the original notion of a thriving market for AMI-driven HANs has never materialized, there is evidence that some utilities are keeping the idea alive.

In the United Kingdom, for example, British Gas is in the midst of a huge rollout of smart meters, with plans to install 2 million of them in homes by the end of 2012. The company is also providing a Landis+Gyr in-home display and a communications link to go along with the meters. The ZigBee-based system transmits data among the various devices and back to British Gas.

In the U.S., HAN deployments and trials continue among several utilities. NV Energy in Nevada has rolled out a DR program using HAN technology that has more than 60,000 customers enrolled. The utility plans to double that number over the next several years. In Texas, AEP Energy has installed 450,000 smart meters and offers those customers the choice of buying a companion HAN device to manage electricity usage and control appliances. Similarly, Texas utility Oncor makes in-home monitors and HAN devices available to its residential customers who have smart meters installed.

The question remains: Will these systems be enough to spur consumers to alter their energy consumption? Many more consumers may choose instead to use other networked devices, such as laptops, tablets, and smart phones, to monitor and control their energy usage.

9. Asia Pacific Smart Grid Adoption Will Accelerate Even More

Smart grid technology can provide solutions for Southeast Asia’s developing countries, as well as for the more advanced economies in China and Japan. In the case of all three of these Asian markets, it is clear that investments in smart grid technologies will as a whole radically increase in 2012 and beyond.

Though quite small in scale, initial smart grid rollouts in Southeast Asia (which will be consuming over half of all Asia Pacific electricity by 2020) are focusing on remote or smart meters, investments in SCADA systems, and small steps toward automation.

In contrast, China is investing big in the smart grid, with estimates of $250 billion (about ¥1.6 trillion) by 2016, according to government sources. The prime goal is to upgrade the intelligence network by 2020 to help solve power imbalance issues and enhance transmission efficiency. China’s transmission capabilities lag behind those of other industrialized nations, with line losses of 8% compared to 2.5% in Europe and the U.S. As POWER has noted in previous articles (see, for example, “China’s 12th Five-Year Plan Pushes Power Industry in New Directions” in the January 2012 issue), China is emphasizing ultra-high-voltage transmission line construction—including high-voltage direct current—to stretch transmission all across its huge mainland. Though China is also investing in smart meter deployment, we believe the capability of these meters barely meets the standard definition for smart meters in terms of the data quality they will provide.

Japan had not seen much value in smart grid technology in the past, but that changed in March 2011 due to the disaster at the Fukushima Daiichi nuclear power station. Along with bolstering its own power infrastructure, Japan is looking to create business opportunities by tapping its technology leadership with the so-called “smart community” concept, which embraces renewable energy sources and central energy management systems for monitoring and controlling power flows. Along with smart homes and EVs, smart communities apply IT and sensor networks to create intelligent transportation systems. Social healthcare systems are also part of this effort to make cities smart.

Interestingly enough, Japan will deploy this new “smart city” concept in the Tohoku region, which was affected by the tsunami disaster in 2011. Constructing a more energy-efficient power infrastructure also less vulnerable to natural disaster is a crucial goal for Japan, and smart meter deployments have increased accordingly.

10. Stimulus Investments Will Bear Mixed Fruit

Much hoopla surrounded the Obama administration’s investment of taxpayer dollars into the smart grid back in 2009. A total of $4.5 billion was invested under the broad umbrella of the smart grid under the American Recovery and Reinvestment Act of 2009 (ARRA). The Obama administration deserves some kudos for at least recognizing the value of government’s role in stimulating innovation with new technology for the power grid.

The original plan capped individual grants at $20 million, which would have fostered many small projects distributed among many technologies, business models, and geographies. Due to political pressure from utilities (and large vendors) that cap per grant award was increased to $200 million before the final RFPs were released in May of 2009. Looking back, that may have been a critical mistake.

Raising the cap encouraged large utilities to focus largely on the deployment of smart meters. While this was a necessary step in the development of a smart grid, utilities tend to become preoccupied with rate-basing opportunities. Too many of these ARRA project awards were therefore cookie-cutter generic smart meter deployments that may have happened anyway. As a result, stimulus funds deployed on behalf of the smart grid have, in some cases, been frittered away on poorly designed rollouts of smart meters and AMI, underwriting utility overhead charges instead of creating new green jobs.

Studies show that smaller, community-based distributed energy projects generate two to three times as many jobs as large-scale renewable energy projects. One can assume a similar multiplier for distributed smart grid experiments focused less on utility data collection and more on pushing the envelope with renewables integration and other problem solving. Thus, smaller projects with municipal utilities may have been a better employment gains bet.

The key role for government is to fund research and development that would not occur in the private sector. Requiring a matching fund commitment for ARRA awards was wise. But one wonders what could have been if more of these ARRA funds had been steered toward more cutting-edge ideas such as microgrids, virtual power plants, and renewables integration—elements of the smart grid that offer the greatest utility to utilities, power producers, and consumers.

— Bob Gohn is vice president, research at Pike Research.