POWER Offshore Wind Notebook: GE Boosts Haliade-X to 14 MW; Dominion Kicks Off 2.6-GW Virginia Project; Vestas Absorbs MHI Vestas

The past week has marked several significant developments in the offshore wind segment. GE Renewable Energy snagged a key agreement for the third 1.2-GW phase of the 3.6-GW Dogger Bank wind farm in the UK, saying the project will use an “upscaled” 14-MW version of its Haliade-X wind turbine. In a potential win for Siemens Gamesa, Dominion Energy filed a construction and operations plan for its 2.6-GW wind farm offshore Virginia—the biggest project planned in the U.S. so far—aiming to begin construction in 2024.

Meanwhile, Danish wind turbine manufacturer Vestas re-entered the offshore wind market through an acquisition of shares in MHI Vestas. And, as the segment picks up momentum, major global wind asset owners launched a notable effort to break their dependency on original equipment manufacturers (OEMs) for performance data.

GE Snags Deal for 14-MW Haliade-X Turbines at Dogger Bank

GE Renewable Energy on Dec. 18 said it is poised to supply its upscaled 14-MW Haliade-X turbines for Dogger Bank C under an agreement with SSE Renewables and Equinor, which are developing the UK project under a joint venture.

Dogger Bank C is the third 1.2-GW phase of the massive 3.6-GW project. Located about 130 kilometers (km) off England’s northeastern coast, the full project is slated to be completed in 2026. Under a lucrative deal signed in September—the first contract for the Haliade-X—GE agreed to supply 190 13-MW Haliade-X turbines for the project’s first two phases, Dogger Bank A and B.

The agreement with Dogger Bank’s owners on Dec. 18 includes the 14-MW wind turbines and a service supply agreement to provide operations and maintenance support for five years. However, GE said these agreements will be finalized in the first quarter of 2021, paving the way for installation of the 14-MW turbines in 2025.

The agreement marks yet another boost for GE’s Haliade-X wind turbine, which derives in part from the Haliade 150-6MW machines that the company put online at Block Island, Rhode Island, in 2017. Since GE unveiled the first 12-MW Haliade-X model in late 2018, testing it conducted of a prototype installed in the Netherlands’ Port of Rotterdam showed that the turbine model could “outperform its original goals and reach 13 MW.” POWER has reached out to GE for comment on how the machine will reach 14 MW.

In press materials related to the first contract for the Haliade-X in September, the company said the turbine set a “world record earlier this year when it generated 288 MWh of electrical energy in a single day. That’s enough to power 30,000 homes in Rotterdam, where the first prototype is located.” Along with Dogger Bank, the Haliade-X is so far also the turbine of choice under preferred supplier agreements for the 120-MW Skip Jack and 1,100-MW Ocean Wind projects off the coast of New Jersey and Maryland, which are being developed by Danish renewable energy company Ørsted. In December, GE also became the preferred supplier for the 800-MW Vineyard Wind 1, a project offshore Massachusetts that was slated to come online in 2023 but is currently on hold.

GE says the 13-MW Haliade-X is “an enhanced version” of the 12-MW prototype, which has been operating in the Netherlands since November 2019 and which recently secured its provisional type certificate from DNV-GL. The uprated 13-MW Haliade-X features 107-m long blades and a 220-m rotor. The 14-MW turbine has the same dimensions, including the same 248-m height, rotor, and blade size as the 13-MW machine, and it has the same swept area of 38,000 square meters.

Its larger capacity, however, could help improve Dogger Bank’s bottomline, suggested Halfdan Brustad, vice president for Dogger Bank at Equinor. “Once again, GE has demonstrated competitiveness with its ground-breaking Haliade-X, and we are delighted we will be working with them across all three phases of Dogger Bank Wind Farm,” he said. “Turbine innovation has played a huge role in bringing down the cost of offshore wind, and these world-leading turbines will help us deliver renewable electricity at the lowest cost possible for millions of people across the UK.”

By boosting the Haliade-X turbine to 14 GW, GE’s machine is now in stiff competition with Siemens Gamesa Renewable Energy’s (SGRE’s) newly launched SG 14-222 DD offshore wind turbine model, though SGRE says its 14-MW mammoth turbine can reach 15 MW with a “Power Boost” function. SGRE, too, has made progress in sealing first-of-a-kind deals for its giant turbine. In May, SGRE announced it would conditionally supply the turbine model to Dominion Energy’s 2.6-GW Virginia Offshore Wind (VOW) commercial project. And this June, SGRE said it conditionally received an order for 100 units of the SG 14-222 DD for innogy’s proposed 1.4-GW Sofia Offshore Wind Farm in the UK. Construction of the offshore direct drive (DD) turbines—machines that use new SGRE 108-meter-long B108 blades—is expected to begin in 2024.

The SG 14-222 DD’s rotor diameter is slightly longer than the 14-MW Haliade-X at 222 m, and SGRE claims the machine can sweep an even larger area of 39,000 square meters—an area equivalent to about six square Eastern U.S. city blocks, or about seven NFL football fields. Another notable large turbine model vying for market share is MHI Vestas’ V164-9.5 MW turbine.

Dominion Kicks off 2.6-GW CVOW Permitting, Eyes Construction Start in 2024

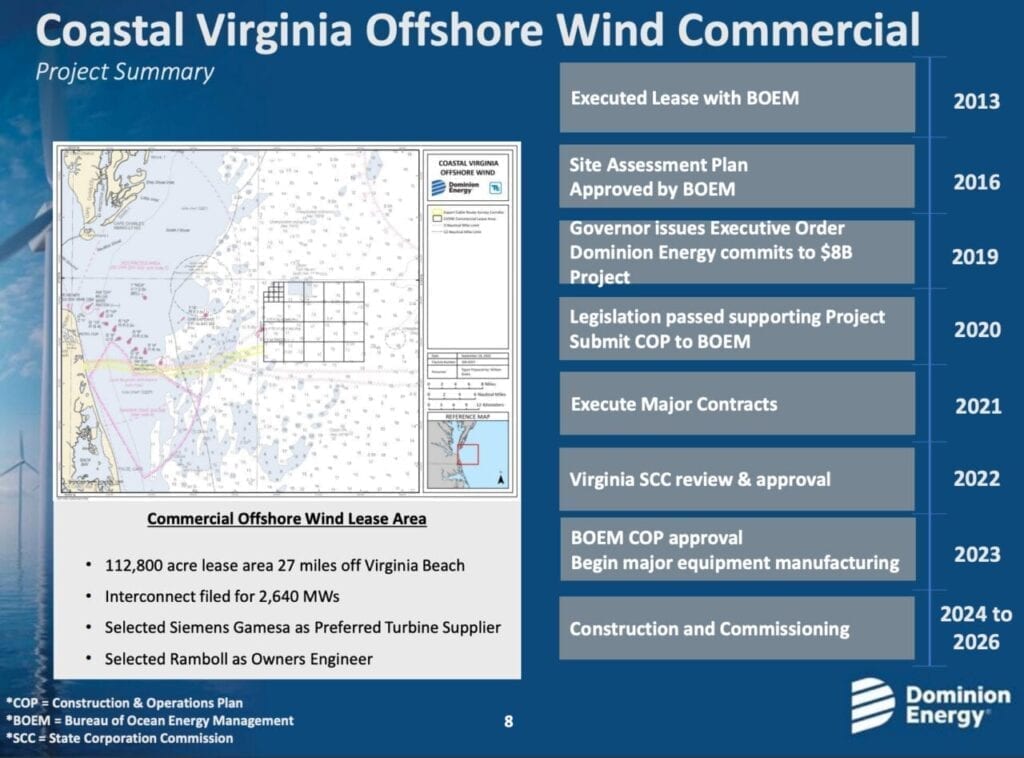

Dominion Energy on Dec. 18 revealed it had filed a required Construction and Operations Plan (COP) to build the 2.6-GW Coastal Virginia Offshore Wind (CVOW) commercial project with the Bureau of Ocean Energy Management (BOEM).

The COP for the project includes information about the construction, operations, and conceptual decommissioning plans for the offshore wind farm, which Dominion has proposed to install within a 2013-obtained 112,800-acre commercial lease area located 27 miles off the coast of Virginia Beach. The COP says that while approval by the State Corporation Commission is still pending, the CVOW commercial project is on track to commence construction in 2024 and be completed in 2026.

BOEM will now review the COP and if it deems it “complete and sufficient,” and finds that the project meets environmental and technical reviews, Dominion will submit design and implementation plans. Installation of the turbines can then begin. Company documents show Dominion expects BOEM’s review could take up to two years.

Dominion’s proposed CVOW project expands on knowledge gained from a 12-MW CVOW pilot, which is located adjacent to the commercial lease area. The pilot features two SGRE 6-MW SWT-6.0-154 wind turbines whose installation was completed by August 2020. “The two turbines are operational while the project undergoes BOEM’s technical review before officially entering service,” Dominion said on Friday.

When operational, the pilot will become the first offshore wind project to be built in U.S. federal waters. On May 26, SGRE announced it would conditionally supply SG 14-222 DD turbines to the CVOW commercial project.

Vestas Re-Enters Offshore Wind with Dissolution of MHI Vestas

On Dec. 14, Danish wind turbine giant Vestas announced it acquired Japanese technology firm Mitsubishi Heavy Industries’ (MHI’s) shares in the MHI Vestas Offshore Wind (MVOW) joint venture, paving its re-entry into offshore wind.

Vestas Wind Systems, a Danish company that held the top spot in the wind turbine market in 2019, on Dec. 14 announced it closed an agreement initiated in late October to acquire MHI’s 50% share in MVOW. As part of the agreement, which the European Commission approved on Nov. 27, MHI acquired 2.5% in Vestas and will be nominated to a seat in Vestas’ Board of Directors.

The deal means that starting in February 2021, Vestas will effectively re-enter the offshore wind business. While Vestas divested its offshore assets in 2013 as part of a two-year-long restructuring effort to cut costs and capital expenditure, that year, it established MHI Vestas as a joint venture with MHI to preserve long-term opportunities in the offshore wind turbine market.

In its Nov. 4 third-quarter report to investors, Vestas said it has installed 123 GW of onshore turbines globally in 82 countries. It marked increasing activity in Europe and Asia Pacific, but it saw a dramatic fall in orders—of 51% compared to the third quarter of 2019—in the Americas. However, it presented a bright outlook, pointing to higher climate ambitions around the world, including the European Union’s Green Deal, and South Korea and Japan pledging carbon neutrality by 2050, and China by 2060. Stimulus packages were also “becoming more tangible with EUR 550bn to be allocated over the next 7 years,” it said.

MHI Vestas, meanwhile, reported it had installed 5.6 GW, and it had 3.9 GW under installation. During 2020, it recorded notable projects, including three V164-8.4 MW turbines as part of the WindFloat project, a POWER Top Plant award winner. In November, it also installed the first of five V164-9.5 MW turbines at the Kincardine floating offshore wind farm about 15 km off the coast of Kincardineshire at water depths ranging from 60 m to 80 m. The first 9.5-MW unit is expected to be anchored at the project site this month.

On Dec. 2, however, Vineyard Wind—a joint venture of Avangrid Renewables and Copenhagen Infrastructure Partners—named GE as the preferred supplier for its Haliade-X machines, though it had initially chosen MHI Vestas to supply 9.5-MW turbines for the project. Project officials, however, said they would temporarily withdraw from the group’s application for federal approval to build the first large U.S. offshore wind farm, saying more time is needed to conduct a final technical review after announcing a change in the turbines expected to be used in the project.

Wind Asset Owners Seek to Reduce Data Dependency on OEMs

Wind asset owners with substantial shares in the global market on Dec. 21 launched a “breakthrough” data sharing program to securely and openly exchange operational performance data.

The effort initiated under O2OWind primarily seeks to help wind turbine owners “reduce their data dependency to [original equipment manufacturers (OEMs)], improve analytics and develop a transparent global performance benchmark,” O20Wind told POWER in a statement on Monday.

“As it is today, only the OEMs can fully harvest the benefits of data analytics and benchmarking, which puts asset owners at a disadvantage,” the group, which hosts wind turbine user groups, said. “By exchanging data on tens of thousands of operating turbines worldwide, leading wind asset owners will turn insights into tangible advantages, such as better estimate risks, improving wind farm operations, as well as improving the success rate of claims related to lower than expected power production.”

The program, which has so far confirmed Enel, Engie, and Equinor as key participants, is open to any turbine owner. O20Wind said, “A significant number of companies are expected to join the project in the coming months.” It plans to host a series of seminars at the beginning of 2021 to interested parties to assess opportunities and coordinate platform development efforts.

Enel Green Power’s Head of Global O&M Wind and Storage José Alba said in a statement the initiative is especially useful for major wind generators. “We have a specific objective when we manage data, which consists in converting them to the greatest extent into useful information, allowing us to develop our own models for asset management. In order to carry out this strategy, we need the greatest possible amount of data, which we will acquire by joining this initiative,” he said.

Equinor, which expects to install a production capacity from renewable projects of 4 GW to 6 GW by 2026 and is banking heavily on an offshore wind build-out, said the initiative is especially relevant to the offshore industry. “Considering the short production series of turbines within offshore wind, sharing data among owners is a necessity to gain better control,” said Sverre Trollnes, head of Asset Management at Equinor. “We see the O2O Data Sharing Initiative as a new tool to constantly improve our operation, by enabling our lead engineers to exchange with their peers and establish these much needed operational baselines.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).