O&M and Human Stresses Caused by Low Gas Prices

Plentiful supplies of low-cost natural gas have changed unit dispatch orders across the U.S., led to thermal stress–induced maintenance issues at cycling coal plants, and resulted in management challenges at coal and gas units alike. This scenario is unlikely to change so long as gas holds its competitive edge over coal.

The first quarter of 2012 proved to be a good one for Calpine Corp., the Houston-based independent power provider.

During an Apr. 27 earnings conference call, CEO Jack Fusco said the quarter would go down as one of the best in Calpine history after the company produced some 29 billion kilowatt-hours of electricity, 50% more than during the same quarter in 2011 and equal to its production during the summer 2011 peak season.

Calpine’s results came during a quarter in which electricity demand was below normal, largely the result of sluggish industrial demand and mild winter weather, which cut demand for electric space heating. But key to Calpine’s record performance was an unprecedented period of low natural gas prices, the result of a bonanza of natural gas production from unconventional sources such as tight sand and shale geologies. Fusco said plentiful supplies drove natural gas prices down to levels that made Calpine’s fleet of simple cycle and combined cycle machines competitive not only with power plants fired by Central Appalachian bituminous coal but also with lower-cost subbituminous coals from the West’s Powder River Basin (PRB). The low natural gas price environment was “driving opportunities for Calpine that have not existed in the history of the company,” Fusco said during the late-April conference call.

Indeed, low natural gas prices created—and continue to foster—opportunities as well as headaches for power generators across large parts of the country. Simple cycle and combined cycle units that last year may have dispatched only after nuclear, hydro, and coal generation sources were dispatched leapfrogged baseload coal during the first six months of 2012 and forced many coal units into unfamiliar turndown and cycling modes. These cycling swings placed beyond-design stresses on multiple pieces of equipment, including boilers, pulverizers, and emissions equipment as well as myriad pumps, valves, and mechanical controls.

Regardless of whether a unit is dropping load or cycling on and off, operators will add a significant number of starts to all major motors (such as fans and pumps). This likely will change the maintenance frequency for motors that may have run for years without issue.

The switch from baseload to cycling duty also has left many coal units with operations personnel in an unfamiliar role, ramping their power plants up and down on a daily basis or even shutting down units entirely. Meanwhile, operators and maintenance crews at gas-fired units have had to adapt to a new paradigm of running their plants flat-out during the work week and relying on weekend lulls in demand to perform maintenance.

These operating and maintenance scenarios may be the norm in coming years if gas supplies remain plentiful and if price volatility is held in check. One notion gaining credence across the industry is that so long as natural gas prices remain low relative to coal, then simple cycle and combined cycle units will run in preference to coal-fired units during the fall and spring shoulder seasons, in addition to the summer peak season. This paradigm would, if realized, affect everything from fuel procurement to maintenance and long-term capital investment decisions to power plant staffing and training. (See “Global Gas Glut” in the September 2011 issue or the archives at https://www.powermag.com.)

“A fundamental change in the natural gas supply base,” the result of shale gas development, has led to an equally fundamental change in the electric power supply base, said Michael Rutkowski, managing director for energy at Navigant Consulting. The extent to which natural gas has claimed market share from coal became further evident July 9 when Patriot Coal Corp. filed for bankruptcy, reportedly the first U.S. coal producer to seek court protection since gas prices began to fall. The company and nearly 100 affiliates were part of a Chapter 11 filing in the U.S. bankruptcy court in Manhattan.

“The coal industry is undergoing a major transformation and Patriot’s existing capital structure prevents it from making the necessary adjustments to achieve long-term success,” Chairman and Chief Executive Irl Engelhardt said in a statement.

Defining the Scope

Many gas market analysts distinguish between “opportunistic” coal-to-gas switching, which they define as a short-term decision to run gas rather than coal units based largely on the price of gas, and long-term decisions to build new gas-fired units or convert an existing coal-fired unit to natural gas combined cycle. Evidence of the former emerged starting last fall and continued into the spring, as Calpine’s earnings call suggested. Evidence of the latter has been slower to emerge and is driven by factors such as environmental rules, the pace of economic recovery and demand growth, and long-term forecasts about natural gas availability and price volatility. In turn, availability and volatility may be influenced by increased use of natural gas as a transportation fuel and by efforts to build export facilities to tap into demand for liquefied natural gas in markets such as Japan and Korea, Rutkowski said. “We continue to see coal-on-gas competition even if natural gas prices rise somewhat,” he said.

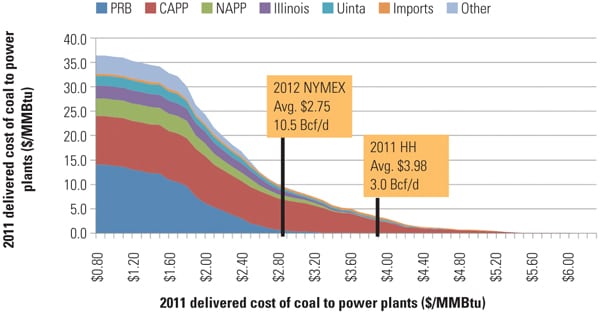

So far, opportunistic coal-to-gas switching has been largely regional in scope. Figure 1 summarizes analysis by Bentek Energy, a Colorado-based gas fundamentals research firm that suggests natural gas gains a competitive edge over coal as gas prices fall below $4 per million Btu (MMBtu). The firm’s analysis suggests that the first coals to be competitively disadvantaged are relatively high-cost Central and Northern Appalachian coals. For example, at the Henry Hub (the site in Louisiana where a large number of gas pipelines interconnect and which is used to set the benchmark price of natural gas across the U.S.), an average gas price of $3.98/MMBtu creates a market environment that favors burning around 3 billion cubic feet (Bcf) more natural gas per day for electric power generation. As the price of natural gas falls, the potential for natural gas to competitively displace coal rises.

Referring again to Figure 1, at a price of around $2.75/MMBtu, as much as 10.5 Bcf/d of additional gas demand for power generation could result. At that price, not only are Appalachian basin coals competitively disadvantaged, but so too is coal sourced from the Illinois and Uinta basins, as well as imports. A $2.75 gas price also exerts increased competitive pressure on PRB coal, which is widely burned by power plants that rely on its low sulfur content to help reduce air emissions.

|

| 1. Low gas prices put pressure on coal. As natural gas prices fall, increasing amounts of coal from a variety of basins become competitively disadvantaged and may create the conditions for price-motivated, opportunistic switching. For comparative purposes, the delivered cost of coal is shown in terms of $/MMBtu. Source: Bentek Energy |

Power generators in the Southeast and Northeast were among the first to displace PRB coal burning in favor of natural gas generation when gas prices began to drop last year. Their decisions to switch were influenced by transportation costs, which are at their highest when PRB coal moves from surface mines in Wyoming and Montana to power plants as far away as Georgia.

Higher Gas Burn for Southern

In addition to Calpine, the natural gas revolution has also affected more traditional utilities that have historically relied on coal to fuel their plants. The switch to natural gas generation in the Southeast was confirmed by Thomas Fanning, Southern Co. CEO, who said during an April 25 earnings conference call that his utility’s natural gas combined cycle fleet achieved an average capacity factor of 70% during the first quarter. Based on price projections, he said the utility could burn more than 600 Bcf of natural gas this year, or about 1.7 Bcf per day.

Southern Co. reports that its fuel mix for 2012 will be 47% natural gas and only 35% coal, a marked change from five years ago, when the company produced 70% of its electricity using coal and only 16% from natural gas. Fanning said Southern Co.’s first-quarter gas purchases accounted for more than 2% of all U.S. natural gas consumption, making the company the third-largest user of natural gas among utilities.

American Electric Power (AEP) reported in April that its natural gas consumption had increased 62% over the past year and that its gas-fired combined cycle plants were, with one exception, running at an 85% capacity factor. The utility’s coal use is expected to drop from an average of 80 million tons a year to about 55 million tons this year. Industry-wide, coal-fired generation has dropped by 13% from 2007 through 2011 while gas-fired generation has increased 13%, according to the latest U.S. Energy Information Administration data.

Southern Co. and AEP’s experiences were matched by at least one independent power producer besides Calpine. “The most dramatic changes have been in the southeast and mid-Atlantic states,” said Todd Jonas, vice president of operations at Omaha, Neb.,–based Tenaska, in an interview with POWER. Many of the company’s fleet of 15 gas-fired units experienced “significantly higher” dispatch and capacity factors of combined cycle plants well above 50% during the first half of 2012. Jonas said some of those combined cycle plants posted capacity factors that have “at least doubled if not tripled” from 2011. “Obviously, it’s very welcomed,” he said, adding that the plants—including the 845-MW Tenaska Gateway Generating Station (Figure 2)—are designed and built to support high capacity factor profiles.

|

| 2. Center of the action. Steve Webb (left) and Shane Holeman, operators at the natural gas–fired Tenaska Gateway Generating Station monitor activities at the 845-MW plant near Mount Enterprise, Texas. Many control room operators are learning to deal with more frequent dispatch. Courtesy: Tenaska |

Natural gas’s newfound competitiveness was acknowledged in mid-June by Jim Rogers, CEO of the newly merged Duke Energy and Progress Energy, who told an industry meeting, “Today we’re dispatching hydro first, then our nuclear, then natural gas before even our most efficient coal plants.” He said gas prices would have to exceed $4.25/MMBtu before the utility would start dispatching even its most efficient coal units ahead of natural gas.

One consequence of low natural gas prices is higher coal inventories. An Indiana coal plant reported having 1 million tons of coal on the ground at the end of June, equal to around a 70-day supply or roughly double what the plant’s operator considers optimal. What’s more, GenOn declared a force majeure last spring in an effort to stop coal deliveries as inventories grew to what it said were levels that compromised safety. And some utilities resorted to forced coal burns in an effort to reduce their inventories and make room for additional deliveries.

Less Switching in the West

Low natural gas prices helped opportunistic switching move west this past spring into states such as Wisconsin, Minnesota, and Texas. Coal-fired power plants in the Rocky Mountains showed little evidence of opportunistic coal-to-gas switching, however, largely due to their proximity to western coal supplies, which kept transportation costs low and helped coal remain competitive. In the Pacific Northwest, improved hydro generation conditions through the spring kept gas demand low. And in California and Nevada, increased use of renewables and energy efficiency measures favored natural gas over what few coal-fired units have survived California’s long-standing campaign against the fuel.

“We’re not as long and strong on coal” as in past years, said Kevin Geraghty, vice president of generation at Las Vegas, Nev.,–based NV Energy. In spring 2011, the company’s six coal-fired units ran as baseload. By mid-June 2012, just two coal-fired units at its 557-MW, four-unit Reid Gardner generating station (Figure 3) were operating, even in the face of summer-like temperatures above 100F and high air-conditioning demand. “It’s straight economics,” Geraghty said. The Southwest has more than enough available capacity, with more on the way as major renewable energy projects near completion.

|

| 3. Cycling coal plant. NV Energy’s four-unit, 557-MW Reid Gardner coal-fired station dispatches just two units when the market favors a 10,000 Btu/kWh heat rate plant, raising morale issues for power plant personnel who previously were accustomed to baseload operation. Courtesy: NV Energy |

Geraghty said the utility began preparing in 2009 to reduce its reliance on coal, largely in anticipation of federal environmental regulations. A first step for the utility was to change its coal procurement strategy from long-term contracts to spot-market purchases. Doing so enabled the company to reduce its exposure to take-or-pay coal and rail contracts and to become more flexible in commodity markets.

“Coal with a 10,000 heat rate doesn’t compete well with 7,000 heat rate gas,” Geraghty said. “It’s just out of the money.”

Farther east, meanwhile, the combination of low demand and opportunistic coal-to-gas switching caused the 1,200-MW Clifty Creek station in southern Indiana to reduce its output almost nightly starting last winter and continuing during the spring shoulder season to around 480 MW to 500 MW, a minimum load based on what’s needed to keep the station’s selective catalytic reduction (SCR) systems operating efficiently.

Coal Unit Maintenance Issues

Cycling to follow load or turning down a coal unit due to lower overall demand has an effect on almost every component, the result of thermal stresses as temperatures within the unit rise and fall.

Coal units were designed to run as baseload, said Steve Hesler, project manager with the Electric Power Research Institute (EPRI). “Today, units run all over the place,” resulting in what he said are well-known damage mechanisms caused by thermal fatigue on high-temperature components. This fatigue is directly associated with frequent starts and load changes.

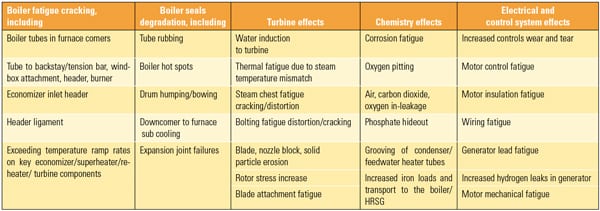

“Every time a unit is turned on or off or goes from minimum to maximum load, all components go through a temperature change,” said Steve Lefton, a vice president at Intertek-Aptech Engineering. Cold, warm, and hot starts all can have negative consequences for the boiler and the turbine, as well as balance-of-plant systems. (See “Make Your Plant Ready for Cycling Operations” and “Mitigating the Effects of Flexible Operation on Coal-Fired Power Plants” in the August 2011 issue.) Some common maintenance issues that arise with unit cycling are highlighted in the table.

Cycling has consequences on major systems. Cold, warm, and hot starts all can have negative consequences for the boiler and the turbine, as well as balance-of-plant systems. Source: Intertek-APTECH

Pulverizers. Lefton said a primary challenge that arises from cycling is starting and stopping coal pulverizers, the process of which can lead to damaging metal-on-metal contact as coal flows are adjusted up and down and as rates of inertia—critical to starting a pulverizer—are adjusted.

“This all works well when you are baseloaded, but load cycling can be damaging to pulverizers in particular,” he said.

For example, during a typical day at Clifty Creek, the station operates at full load until around 8:00 p.m., when the load coordinator calls for reduced power output. Every 30-MW drop in output means another of the plant’s 42 coal pulverizers is taken out of service, said Cliff Carnes, the plant manager. From around 1:00 a.m. until 6:00 a.m. the station operates at minimum load. As demand rises in the morning, the plant begins to restart its pulverizers. The challenge is to restart the pulverizer with sufficient coal demand to prevent metal-on-metal rubbing while guarding against jamming the equipment. During startup, electrical cross-line starts cause an inrush of current to electric motors, adding to their wear and tear.

“If you start and stop the equipment, the electric motor has so many cycles in it,” Carnes said. He said motorized equipment failures are up at the power plant.

Corrosion. A turned-down unit left unprotected for as little as three days may be susceptible to pitting and eventually cracking in boiler and turbine components. The reason is the combination of chlorides, water, and oxygen. Baseload operation typically prevents humidity from forming on unprotected surfaces and reacting with oxygen and chlorides that are present in feedwater, said EPRI’s Hesler. But a unit that is laid up and left unprotected can allow these three elements to combine, which can lead to pitting, a precursor to cracking.

Safeguards include introducing nitrogen to bottle up the system or dehumidifying and dewatering critical components. EPRI began a project in late 2011 with 10 utility participants to test the effectiveness of adding amines to feedwater. The idea is that, like waxing a car, the amines will add a protective layer to surfaces that will help keep oxygen from reacting with moisture and chlorines on critical surfaces. Hesler said the pilot project will run through the end of this year.

Emissions Controls. As a coal-fired unit turns down and operates at low loads, its heat rate goes up and its efficiency goes down. “The key to survival is the ability to operate safely and without negative effects on the environmental control equipment,” Hesler said. In particular, the coal unit’s economizer needs to maintain a high output to keep the SCR operating. SCR catalyst fouling can result from ammonium bicarbonate condensation on the catalyst. Once this happens, the catalyst is less effective at removing nitrous oxides. To help safeguard the catalyst, minimum load limits are around 50% to 60% of maximum capacity, as much as double what the turndown otherwise would be without SCR equipment.

As a final measure, Lefton recommends that plant operators know the cost of cycling their unit and the likelihood that the unit—should it come offline—will return to service in a short period of time. “We encourage all asset managers to evaluate the cost of cycling their unit off and back on,” keeping in mind that cycling adds to fatigue on high-temperature, high-pressure components that can lead to costly maintenance outages. “Cycling can be very costly,” he said, and expenses can range from additional maintenance to higher heat rates to fuel expenses, costly forced outages, and increased personnel costs.

Gas Unit Maintenance Issues

Many of the gas-fired combined cycle units that were added in the late 1990s during the last natural gas boom are at last running close to their potential, but with maintenance issues of their own. Hesler said the biggest problems encountered with combined cycle units running more frequently result from heat recovery steam generators (HRSGs), which he said can exhibit thermal fatigue “on a very large scale.” The problem stems from what he said is an HRSG’s “basic inability to control and reduce the amount of water in the system,” which can lead to distortions in headers and header tube connections. A second problem is the result of temperator spray design, which is used to control HRSG steam temperatures. If not controlled properly, a temperator can dump too much water and lead to quenching.

Major HRSG manufacturers met with EPRI researchers in late June to discuss possible improvements to temperators and drains as well as other HRSG operational issues. “The concern is that as combustion turbine ramp capabilities improve, if HRSGs aren’t improving, then the plant as a whole can’t cycle effectively,” Hesler said.

He said combustion turbine manufacturers are working to achieve fast unit starts to improve dispatch flexibility, but those efforts may be less effective if HRSGs aren’t able to respond. Hesler said that HRSG manufacturers indicated at the June meeting a willingness to produce more robust products if the industry is ready to buy them.

Tenaska’s Jonas said that more frequent gas unit dispatch has resulted in more frequent inspections, as recommended by original equipment manufacturers (OEMs). “Planning is critical as to when a major maintenance outage might occur,” he said. Some OEMs might need up to a year of lead time to make sure they have parts and people available for a major maintenance outage. Increased demand for inspections as a result of higher dispatch among gas plants becomes an exercise in anticipating when required maintenance will occur, he noted. He said some OEMs have been caught off guard by the higher demand for maintenance services, an observation echoed by NV Energy’s Geraghty.

Steve Hartman, general manager of thermal engineering for GE, said that he has not yet seen much of a difference in maintenance strategies as gas-fired units run more frequently. A unit’s combustion system continues to be the main driver in determining unit availability, and no unique issues have arisen.

“Parts like to operate in baseload mode,” he said. GE engineers have not had to develop new technology to deal with increased operations. The fleet has “hit its outages and continues to operate well,” he said.

Charlie Athanasia, vice president of Alstom Thermal Services, North America, said his company’s supply chain is in place to respond to its customers’ demand for inspection and maintenance services. He said the company is committed to deploy parts inventories to meet demand for services, such as maintenance work on the GT24 gas turbine pictured in Figure 4.

|

| 4. Workers repair an Alstom GT24 gas turbine. Alstom says its global parts chain is flexible enough to enable it to position parts where they are most needed, including North America, during this period of higher gas unit dispatch. Courtesy: Alstom |

Jonas said that running units more frequently has reduced the incidence of HRSG tube leaks at the company’s gas-fired power plants. He said that depending on the circumstances, units can continue to operate for some period of time with HRSG tube leaks until plant operators find a convenient time to bring a unit down for repairs.

Combined cycle units may have more flexibility to operate for extended periods, even with deficiencies such as steam leaks, but there may be less flexibility with a combustion turbine (CT). “In a steam turbine, you generally don’t expect rotating parts to come apart,” Geraghty said. A CT, by contrast, could be destroyed if a critical failure occurred during operations. As a result, the risk of running a CT beyond its recommended service hours becomes significant.

The Human Element

The shifting fortunes of coal- and gas-fired generation affect not just equipment and systems, but people as well. Moving a coal plant from baseload operation to cycling and even unit layup can have an effect on a generating unit’s personnel.

“It’s an emotional thing at a power plant to go from the feeding and caring of a plant to [a scenario in which the plant] is just silent,” Geraghty said. “It can be demoralizing.” Just two of the utility’s six units at coal-fired plants were operating earlier this year, the result of low natural gas prices and an abundance of generating capacity in the Southwest. NV Energy is working to motivate personnel by focusing on efforts to keep coal-fired units ready to dispatch, whether that order comes in 48 hours or 30 days.

EPRI’s Hesler said many operators accustomed to running a coal-fired unit for months at a time now are asked to cycle their unit more frequently. As a result, issues related to maintaining situational awareness rank among the most important challenges for operators. In particular, alarm management skills and human-machine encounters “may not be that good,” he said.

In addition, where “tribal knowledge” once may have been adequate, personnel retirements may exacerbate gaps in training that can affect operations. “There are more opportunities for errors,” he said.

Intertek-Aptech Engineering’s Lefton said that common human errors include improper boiler water levels, introducing water to the turbine, and a variety of other errors that can occur, especially during overnight hours, as operators try to cycle their plant in the dark and remotely. Intertek-Aptech has developed real-time code software to give operators temperature ramp rate information for key components during cycling, along with the cost of each cycle or load follow. An important strategy is to “train operators to operate plants to reduce cycling damage and thus cycling costs,” Lefton said.

Clifty Creek plant manager Carnes said much of his plant’s maintenance work has been pushed to weekends and nights, because the plant’s operators want to keep it online whenever it can generate revenue. As a result, the plant had to revise its approach to staffing, not just for hourly personnel but for supervisory and technical people as well.

Jonas of Tenaska said his company’s generating units are staffed for a range of dispatch profiles and haven’t changed their staffing levels. The company’s workforce is flexible enough that staff schedules can be reconfigured to adjust to dispatch levels, such as a peaking unit that is called into more frequent service. “Our simple cycle facilities are like fire houses that are ready to start at a moment’s notice,” he said. “Higher capacity factors provide the opportunity to exercise the equipment, which gives us more confidence that the plant will operate” whenever it is called on to dispatch.

At NV Energy, meanwhile, the utility began a strategy in February 2011 called Workforce 2020 to transition coal teams to work more like combined cycle teams. That means reducing staff and consolidating job classifications so that more personnel are cross-trained to perform a wider variety of tasks. One factor driving the change is an assumption that the company’s coal units will be retired. This resulted in a realization that some maintenance and operational skills can’t be sustained over the long term.

“A year ago you may have had a baseload supercritical plant, and now it’s in shutdown,” Geraghty said. “You take a look at the fixed costs, and the biggest fixed cost is labor.”

Geraghty said that some power generators believe that gas may enjoy favorable economics for another year or two before coal reasserts itself. He holds a contrary outlook, however. “Because of other pressures we don’t have the perspective in the West that it will get back to normal. I believe this is a transformational moment.”

—David Wagman is executive editor of POWER.