New Jersey Opens Solicitation to Triple Offshore Wind Commitment, Outlines Pathway to 7.5 GW by 2035

New Jersey on Sept. 9 opened a second state offshore wind solicitation that could triple its committed capacity from 1.1 GW to 3.5 GW. The state this week also laid out a final strategy for how it will achieve its November 2019–expanded offshore wind target of 7.5 GW by 2035.

New Jersey’s five-member Board of Public Utilities (NJBPU) voted unanimously on Wednesday to open the state’s second solicitation, which seeks to award between 1.2 GW and 2.4 GW of offshore wind energy. Under the second solicitation, the board will accept applications between Sept. 10, 2020, and Dec. 10, 2020. “The Board anticipates awarding the resulting offshore wind projects in June 2021,” it said.

The board on Wednesday also issued a “Second Solicitation Guidance Document,” which it said was developed “through a robust public stakeholder process and provides the solicitation’s mechanics and timeline, project application requirements, and evaluation criteria.” NJBPU is now gearing up for the third solicitation for “at least” 1.2 GW, which will likely be issued in 2022 on track with Gov. Phil Murphy’s proposed solicitation schedule. After that, solicitations will open every two years until 2028.

Under the first solicitation issued in September 2018, NJBPU sought applications for 1.1 GW of offshore wind. It ended with the June 2019–award to Ørsted for its 1,100-MW Ocean Wind project. That project, which Ørsted is slated to build with PSEG’s support, will deploy GE Haliade-X 12-MW turbines 15 miles off the coast of Atlantic City. While the project is still in the developmental phase, it remains on track despite the pandemic to commence operations in 2024, Ørsted says on its website.

New Jersey’s Roadmap to Achieving 7.5 GW of Offshore Wind

The second solicitation is a “major step forward” in New Jersey’s plans to deploy up to 7.5 GW of offshore wind capacity from zero today over the next 15 years, NJBPU noted. Set via the November 2019–issued Executive Order No. 92, the governor’s target expands an initial January 2018–set goal to achieve 3.5 GW by 2030. The successful realization of 7.5 GW would represent 50% of New Jersey’s projected 2035 load.

“This second solicitation not only reinforces our commitment to fighting climate change and achieving 100% clean energy by 2050, but it secures New Jersey’s foothold as a national leader in the growing U.S. offshore wind industry,” Gov. Murphy said in a statement on Wednesday.

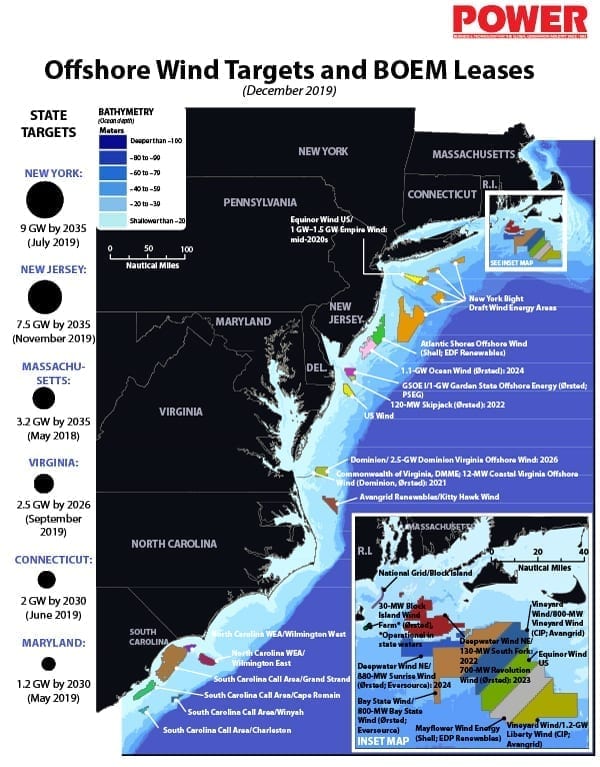

But, as the state’s “master” energy plan released this January suggests, the state has much work to do. New Jersey is competing with several Atlantic states, which are also looking to boost their offshore wind portfolios. Other states include Massachusetts, Rhode Island, Connecticut, New York, Delaware, Maryland, and Virginia. Collectively, these states have commitments or goals reaching 24 GW of offshore wind by 2035 (Figure 1).

The final New Jersey Offshore Wind Strategic Plan (OWSP) NJBPU released on Wednesday notes that offshore wind development is “technically complex and capital intensive, consisting of large components and a vast footprint—the locations of project elements range from offshore waters, to coastal ports, to onshore electrical grid interconnections and transmission infrastructure conveying electricity to ratepayers.” It also involves “a complex network of global, regional, and local supply chain manufacturers and suppliers.” Additionally, New Jersey’s priorities mandate economic benefits as well as environmental responsibility. “New Jersey leaders and stakeholders have consistently stated that offshore wind resources should be developed in a careful and responsible fashion,” the OWSP underscores.

The state’s plan envisions that, for now, areas for potential offshore wind development extend along six offshore wind lease areas designated by the Bureau of Ocean Energy Management (BOEM) in federal waters. To date, 16 lease areas (the OSWP cites 17) have been awarded to several developers and have a total potential capacity of more than 21 GW. While BOEM took early steps to gauge interest in four new lease areas known as the New York Bight Call Areas near the New York and New Jersey coastlines (Figure 2), it has yet to act to formally identify them.

One reason New Jersey is moving so quickly is that it wants to become a “nexus of the majority of offshore wind industry in the U.S.,” the plan suggests. This June, the state announced plans to develop the New Jersey Wind Port, a facility in Lower Alloways Creek Township where wind turbines will be partially assembled and then shipped out to the ocean vertically. “Given the height of the turbines, offshore wind marshalling ports must be located outside of all vertical restrictions, such as bridges, and must have wharfs that can accommodate up to 800 tons, or more than two fully loaded Boeing 777s. Most existing port infrastructure along the East Coast is unable to accommodate this work,” the state’s Economic Development Authority (NJEDA) said. Work on the first of two construction phases at the facility is expected to begin in 2021.

So far, as the plan notes, the state has also made leaps in reorganizing its agency bandwidth to reorient toward a future that banks heavily on offshore wind. Since January 2018, when it established the New Jersey Offshore Wind Interagency Taskforce, it has also established the Council for the Wind Innovation and New Development (WIND) Institute, which will develop a plan for the creation of a hub for the burgeoning offshore wind industry in the Northeast region and the state.

It also created a New Jersey Offshore Wind Supply Chain Registry, which allows investors exploring offshore wind–related projects in the state to find New Jersey–based companies to partner with or purchase from. New Jersey, meanwhile, is grooming public support, adopting, for example, the Offshore Wind Energy Certificate funding rule in January 2019, which establishes the process by which an offshore wind program is funded and how revenues earned from each project flow back to ratepayers.

The state will now also prioritize developing a supportive supply chain and workforce. The plan encourages development of nacelle, turbine blade, foundation assembly, and other component manufacturing facilities in New Jersey. It is also promoting utilization of the WIND Institute to serve as a center for education, research, innovation, and workforce training related to the development of offshore wind in New Jersey, and the Northeast and Mid-Atlantic regions. On Sept. 9, notably, NJEDA and NJBPU approved the disbursement of $4.5 million to support NJEDA-led workforce development projects, and $1.25 million to support “innovative early-stage clean tech companies.”

Assessing Energy Market and Transmission Needs

Finally, the plan sets out how the state will best engage in state-jurisdictional energy policy to “optimize a wholesale energy market and electrical transmission infrastructure that facilitates the renewable energy goals of New Jersey.” Among initiatives it heralds are continued support of offshore wind renewable energy certificates (ORECs) to build a local offshore wind industry and “assess reducing incentives as the market matures.”

Currently, the state’s Offshore Wind Economic Development Act (OWEDA) establishes that a percentage of New Jersey’s electricity must be purchased from offshore wind projects through the OREC program. “The price of an OREC (dollars per megawatt hour [$/MWh]) is the all-in cost of the offshore wind project (i.e., the total project capital and operating costs offset by any tax or production credits and other subsidies or grants). The OREC price is a 20-year fixed price. The price paid by ratepayers is the OREC price less any non-OREC revenues generated by the offshore wind project including from the wholesale energy or capacity markets,” the plan explains.

It elaborates: “For each megawatt-hour generated and delivered to the transmission grid, an approved project will be credited with one OREC. In return for the sale of ORECs, Qualified Projects are required to return all revenues received, including, but not limited to, sales of energy, capacity, and, if applicable, ancillary services, into PJM’s wholesale markets.”

Still, the state acknowledges that electricity costs are already high compared to those in other U.S. states. It emphasizes that offshore wind integration must be affordable. To achieve that, it said it is continuing engagement with a number of stakeholders, including PJM—the regional transmission organization and competitive wholesale power market operator whose 13-state footprint includes New Jersey—utilities, and the New Jersey Division of Rate Counsel.

New Jersey is also assessing the cost of transmission with building out 7.5 GW of new offshore wind power, including for “backbone” transmission and an “interregional backbone” to accommodate up to 15 GW. However, it will also need basic infrastructure, including high-voltage substations required to integrate into PJM, which it currently has none located along the coast. “It is anticipated that electrical transmission grid upgrade costs will be paid by a combination of the developers and ratepayers,” the plan says.

The plan concludes that “bold action” will be needed to reach the state’s goals. Among initiatives it will pursue are to encourage developers to use the latest technology, including the largest-available wind turbine generators, to reduce the levelized cost of energy; to evaluate the incorporation of 2 GW of energy storage by 2030; and to collaborate with PJM and local utilities to develop a grid transmission study.

Finally, and as notably, New Jersey will also “advocate, along with other states, for measures that advance clean energy policies with [the Federal Energy Regulatory Commission] and PJM so that technologies like offshore wind, solar power, and storage do not face barriers to entry in energy markets.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).