Global Monitor (September 2006)

Demand records fall nationwide

It’s been warm around POWER’s editorial office in Arizona these past few weeks. When the thermometer doesn’t see the south side of 100F, even at night, it’s officially "hot."

We weren’t alone in our misery. All seven regional independent grid operator regions were scorched and set new peak-demand records during the mid-July heat wave. No system disturbances due to the extreme heat were reported, although some operators called for conservation measures to maintain their reserve margins. So said the ISO-RTO Council (IRC), which represents the seven U.S. independent system operators (ISOs) and regional transmission organizations (RTOs). ISOs and RTOs serve two-thirds of the U.S. population.

The peak-demand records, all set within a three-day period, were as much as 9.9% higher than those set in 2005. Regional grid operators reported a new aggregate peak record for electricity usage of 483,233 MW; last year, their peak demand was 475,717 MW.

Looking at the numbers by ISO/RTO:

- California ISO delivered 46,561 MW on July 17, surpassing the previous record of 45,431 MW set on July 20, 2005.

- ERCOT peaked at 62,396 MW on July 17, exceeding the previous record of 60,274 MW set on August 23, 2005.

- ISO New England established a new record for demand of 28,021 MW on July 18, surpassing the 26,885 MW consumed on July 27, 2005.

- Midwest ISO reached a new demand peak of 132,658 MW on July 17, topping the previous record of 131,434 MW set on August 3, 2005.

- New York ISO served a record peak load of 33,939 MW on July 17 without enacting emergency procedures. That broke the record of 32,075 MW set on July 26, 2005.

- PJM Interconnection experienced peak demand of 139,746 MW on July 17, surpassing the record 133,763 MW of July 26, 2005.

- Southwest Power Pool’s 2006 demand peak of 42,947 MW occurred on July 19. The previous record was 38,852 MW, set on the same date last year.

GE’s ABWR to be STP’s edge

The American nuclear power renaissance took another step forward this summer with several notable project proposals, the addition of another plant to Entergy’s nuclear stable, and the setting of two new deadlines for Yucca Mountain.

Deep in the heart of Texas, GE Energy’s nuclear business and South Texas Project Nuclear Operating Co. (STPNOC) announced that they have agreed to study the deployment and begin licensing activities for two GE advanced boiling water reactors (ABWRs) that would be located at South Texas Project Electric Generating Station (Figure 1).

1. More of a good thing. South Texas Nuclear Project is looking to add two GE advanced boiling water reactors (ABWRs) to its 2,600-MW site in Bay City. Courtesy: South Texas Project

Other utilities considering building new nukes (such as Tennessee Valley Authority) have looked closely at the ABWR but selected either GE’s enhanced simplified boiling water reactor (ESBWR)—submitted to the U.S. Nuclear Regulatory Commission (NRC) for final design approval one year ago—Areva’s European pressurized water reactor (EPR), or Westinghouse Electric’s AP1000 design for fear they might be left with orphan units. Such fear now may be unfounded.

The two proposed reactors would be built adjacent to the two-unit, 2,600-MW plant that STPNOC operates in Bay City, Texas, about 90 miles southwest of Houston. The plant is owned by Austin Energy (16%), CPS Energy (40%), and NRG Texas LLC (44% ownership).

On July 27, representatives of STPNOC, NRG, and GE met with the NRC to discuss their intention to prepare a combined construction and operating license (COL) application for the two-unit ABWR project. With that step, NRG joined a growing number of gencos that have notified the NRC of their potential interest in building new, advanced reactors.

The NRC issued a final design certification for the GE ABWR in 1997, allowing it to be used in U.S. projects. The ABWR is a "Generation III" design that is more advanced and said to be safer than existing reactors in operation. For example, the ABWR design incorporates digital controls and locates two additional recirculation pumps inside the reactor containment vessel (Figure 2).

2. Certified design. The ABWR design uses modern digital controls and places the recirculation pumps inside the containment vessel. Source: Tokyo Electric Power Co.

GE’s ABWR is the only proven Generation III reactor operating in the world today. Four units are currently running in Japan; the first started up in 1995 (Figure 3). Two more ABWRs are nearing completion in Taiwan, and construction has begun on a seventh unit in Japan. Additional ABWRs are in the planning stages. The four Japanese units’ "baseline" construction and operational data allow utilities considering ABWR technology to be more certain about project costs and payback periods.

3. Generation III design. The 8,200-MW Kashiwazaki Kariwa facility in Niigata Prefecture, Japan, is powered by five 1,100-MW boiling water reactors (BWRs) and two 1,350-MW advanced BWRs. Courtesy: Tokyo Electric Power Co.

Entergy buys Palisades plant

Why spend the considerable time, effort, and money to license and build a new nuclear power plant when you can buy a used one for $380 million?

That’s how much Entergy Corp. has agreed to pay Consumers Energy—the principal subsidiary of CMS Energy—for its 798-MW Palisades Nuclear Plant near South Haven, Mich. (Figure 4). With the addition of Palisades, Entergy (the second-largest nuclear power company in the U.S.) will own 11 reactors and manage a 12th. Entergy previously announced plans to prepare COLs for two-unit additions to its River Bend Station near St. Francisville, La., and Grand Gulf Nuclear station in Port Gibson, Miss.

4. Even dozen. Entergy has bought the Palisades Nuclear Plant in Michigan from Consumers Energy for $380 million. It now manages 12 reactors. Courtesy: U.S. EPA

As a condition of the purchase, Entergy has agreed to sell 100% of the output of Palisades to Consumers Energy for 15 years at a "reasonable" price.

The $380 million sale price represents $242 million for the plant itself, $83 million in nuclear fuel (based on current market prices), and $55 million in related assets. Entergy will be paid $30 million for accepting responsibility for the contents of the Big Rock Point Independent Spent Fuel Storage Installation near Charlevoix, Mich. It also assumes responsibility for the eventual decommissioning of the Palisades plant.

Palisades has been a steady, but not stellar performer, with an average capacity factor of 89% from 2002 through 2005. In 2004 the plant set a record among CMS Energy generating units by operating continuously for 478 days.

The sale is estimated to close in the first quarter of 2007, assuming its approval by the Federal Energy Regulatory Commission, NRC, and the Michigan Public Service Commission.

Dithering over desert disposal

Convincing people that nuclear reactors are safe is one thing. Assuring them that there are ways to store nuclear waste safely for millions of years is quite another. The need for the latter may be rendered moot by new technologies that reprocess spent fuel before it can be considered nuclear waste. An example is the UREX process developed by Argonne National Laboratory now being considered by the Global Nuclear Energy Partnership (www.gnep.energy.gov). Nuclear fuel reprocessing has been banned in the U.S. since 1977. (POWER will take a close look at reprocessing technology possibilities in our November/December issue.)

Until reprocessing of spent fuel is proven and legalized, storing the fuel in the hope of a technology breakthrough is the only option for nuclear utilities. They have been trying to advance development of the Yucca Mountain nuclear waste repository (Figure 5) beyond Square One, where it has stalled, for decades. This August, Barnie Beasley—president and CEO of Southern Nuclear Operating Co., a subsidiary of Atlanta-based Southern Company—continued the drum-beating when he expressed strong support for the Nuclear Fuel Management and Disposal Act (S. 2589) in testimony before the U.S. Senate Committee on Energy and Natural Resources.

5. Nowhere, man. The DOE has a nounced a "date certain" for applying for a Nuclear Regulatory Commission license for the Yucca Mountain nuclear waste repository in Nevada. Courtesy: U.S. DOE

According to Beasley, the biggest impediment to the removal of spent fuel from 126 U.S. plant sites has been Washington’s failure to fund and implement current law. "While new legislation to amend the Nuclear Waste Policy Act is important, it is even more critical that the federal government commit itself to the implementation of existing law," he said.

Washington’s commitment to solving nuclear power’s second-largest image problem has taken so long it could be assigned a half-life. Although the Nuclear Waste Policy Act was passed in 1982, the use of a geologic repository for spent fuel dates back to a 1957 recommendation by the National Academy of Sciences (NAS). The U.S. began studying the suitability of Yucca Mountain in Nevada, 100 miles northwest of Las Vegas, for this purpose in 1978.

In 2001, the NAS confirmed four decades of international scientific consensus that geologic disposal is the best method for managing used nuclear fuel. Congress approved a geologic disposal site at Yucca Mountain in 2002. The 2005 Energy Policy Act included provisions that encourage the construction of new nuclear power plants, illustrating confidence in the ability of the U.S. to manage its used reactor fuel in the future. Another confidence-booster has been the DOE’s safe operation of a geologic waste disposal site near Carlsbad, N.M.

On July 18 of this year, the DOE announced that it will apply for an NRC license for Yucca Mountain no later than June 30, 2008. According to the DOE, if needed legislation is enacted, the repository would open and begin accepting waste on March 31, 2017.

In his testimony, Beasley emphasized how much money already has been invested in Yucca Mountain. "To date, consumers of nuclear power have committed more than $27 billion in fees and accrued interest into the fund, and continue to pay at a rate of $750 million each year. However, only some $9 billion has been spent on the project, leaving a balance in excess of $18 billion," he said.

According to the DOE, further delays in federal receipt and movement of spent civilian reactor nuclear fuel will only add to utility damage claims. They also will increase taxpayer liability for the lifecycle costs of operating sites for storing high-level radioactive waste from Department of Defense nuclear weapons programs, as well as for Yucca Mountain’s fixed costs.

Tourist trash-to-energy plant

We now move far from workaholic D.C. to the Canary Islands, where life is meant to be enjoyed—but disposal of waste of another kind still is a concern.

Located about 65 miles off the northwest coast of Africa, the Canary Islands—an autonomous community of Spain—rely on tourism for more than 30% of GDP (25 billion euros in 2001). Disposal of solid waste is an environmental problem and political issue throughout the Canaries, an archipelago covering 2,875 square miles.

The new Salto del Negro municipal waste treatment plant in Las Palmas de Gran Canaria, the capital of Grand Canary Island, is a practical solution to the problem. The plant (Figure 6) digests up to 75,000 tons/year of trash from Las Palmas—a city of 380,000—and several nearby towns and villages, converting it to biogas that is 65% methane. The biogas fuels a combined heat and power (CHP) plant from Minneapolis-based Cummins Power Generation whose lean-burn, 4-stroke engine-generator sets (Figure 7) are designed to run on low-Btu gas. Completing a circle, the exhaust heat from the engines is returned to the treatment plant to accelerate the digestion process. Any electricity produced by the gensets and not used by the treatment plant is sold to the local utility, which pays a "green" premium for it.

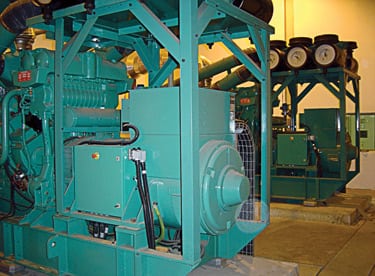

6. Garbage to gold. Cummins supplied the two engine-generator sets for this biogasfueled combined heat and power system in the Canary Islands. Courtesy: Cummins Power Generation

7. Tailored for trash. The two lean-burn, 1,370-kW gensets are designed to run on low-Btu fuel. Courtesy: Cummins Power Generation

The CHP system at Salto del Negro comprises two 1,370-kW model GQMA gensets spinning at 1,500 rpm and producing at 230V and 50 Hz, a PowerCommand Digital Master Control, and low-voltage switchgear. A third genset is scheduled to be added within a year. Cummins Power Generation also supplied all of the system’s ancillary equipment (radiators, heat exchangers, expansion tanks, etc.) and supervised its installation and commissioning.

Brooklyn says "Yo!" to microturbines

Dump those liquids, remove your shoes, and fasten your seat belt. It’s time to leave the Canary Islands and return to America—to Brooklyn, to check out another interesting CHP plant. This one is the largest installation of microturbines serving a residential complex in the U.S. Its 13 model C60 units from Capstone Turbine Corp. (Chatsworth, Calif.) generate 600 kW and hot water for seven of Clinton Hill Apartments’ 12 buildings (Figure 8).

8. Brooklyn lodgers. More than half of Clinton Hill Apartments’ 1,200-plus units now get all their electricity year-round from 13 Capstone Turbine Corp. microturbines fueled by natural gas. During the summer, the turbines also supply hot water, enabling four old and dirty oil-fired boilers to be shut down. Courtesy: Energy Spectrum

As well as being notable for its size and cost ($2 million), the project underscores how many disparate parties are interested in getting involved in environmental and energy-efficiency initiatives today. Besides Capstone and the Clinton Hill Apartment Owners’ Corp. (the co-op’s management board), the following entities played a role in the project:

The New York State Energy Research and Development Authority (www.nyserda.org), which offers financial and technical assistance to the state’s businesses, industries, municipalities, and residents with an eye toward addressing New York’s energy and environmental needs. NYSERDA paid the co-op board $758,500 to execute the Clinton Hill project, providing nearly 40% of its cost.

Clean Air Communities (www.cleanaircommunities.org.), a nonprofit dedicated to implementing air pollution reduction and energy-efficiency strategies in New York City communities disproportionately affected by air pollution. CAC was established in 1999 as a collaborative effort of the Northeast States Center for a Clean Air Future, the Natural Resources Defense Council, and the New York State Department of Environmental Conservation. It too provided funding for the Clinton Hill project.

Consolidated Edison of New York Inc. (www.coned.com), the Big Apple’s incumbent electric utility. It provided CAC’s initial funding of $5 million and benefits from the 600-kW load reduction that the Clinton Hill microturbines represent.

Brooklyn-based Energy Spectrum (www.energyspec.com), a specialized energy consulting group that develops strategies and solutions for minimizing energy costs and maximizing benefits for its clients, primarily large New York–based business developers.

In addition to the power it produces year-round, the CHP system (which is fueled by natural gas) enables four oil-fired hot-water boilers within the apartment complex to be shut down during the summer, when air pollution is at its worst in New York City. For doing that, the project has earned a New York State emissions reduction credit worth about $86,000.

According to David Ahrens, project manager for Energy Spectrum, the high-efficiency, low-emissions CHP system has reduced Clinton Hill’s energy costs and usage by 40%. He added that incorporating cogeneration into new or existing real estate complexes such as Clinton Hill "has proven to produce benefits such as lower oil consumption, improved reliability, and increased property values."

POWER digest

FutureGen names four finalists. Following an extensive technical review, the FutureGen Alliance (www.futuregenalliance.com) has announced its short list of candidate sites to host a $1 billion, first-of-its-kind, near-zero-emissions coal-fired power plant. Of 12 competing sites in seven states, the Alliance concluded that the following four are best suited to host the first FutureGen facility:

- Mattoon, Illinois

- Tuscola, Illinois

- Heart of Brazos (Jewett), Texas

- Odessa, Texas

"FutureGen will help meet the world’s growing demand for clean electricity, fuel our global economy, and sustain livelihoods," said Dr. Charles Goodman, chairman of the FutureGen Alliance. "We have maintained an aggressive schedule since this international partnership formed in late 2005, and [this] announcement marks another important milestone in developing this critical technology solution."

The four remaining sites will now advance to the next two steps of the selection process: a comprehensive review by the U.S. DOE of their compatibility with the National Environmental Policy Act (NEPA) of 1969 and a more detailed site characterization. Late next year, following completion of DOE’s NEPA review, the Alliance will select a final site, setting the stage for plant construction. The first FutureGen plant is slated to come on-line in 2012.

PG&E’s unfinished business. San Francisco–based Pacific Gas and Electric Co. (PG&E) has received approval from the California Public Utilities Commission to acquire, complete, and operate Contra Costa Unit 8—a natural gas–fired, 530-MW, 2 x 1 combined-cycle project that Atlanta-based Mirant Corp. began but never finished building.

PG&E expects to complete construction and commissioning of the plant by 2008 at a cost of about $300 million. It would cost the utility much more to build a plant of similar capacity from scratch.

Relinquishing Contra Costa Unit 8 was one of the conditions of Mirant’s 2005 settlement agreement with the State of California to resolve claims that the company manipulated the wholesale market during the 2000/2001 electricity crisis. Mirant agreed to transfer to PG&E the equipment, permits, and construction contracts for the plant, which is located near Antioch.

Wärtsilä win in Tanzania. Helsinki-based Wärtsilä Corp. has signed a $73 million engineering, procurement, and construction contract with Tanzania Electric Supply Company Ltd. to site a 100-MW natural gas–fired power plant in Dar es Salaam, the nation’s capital, by May 2007.

Wärtsilä will equip the plant with twelve 20-cylinder Wärtsilä 34SG gensets. Delivering up to 9 MW at 750 rpm, they are among the most powerful gas engines on the market today and can be a cost-effective alternative to gas turbines.

The plant, which will be fueled by gas from Songo Songo Island, will help alleviate Tanzania’s electricity supply shortage by meeting about half of Dar es Salaam’s demand.

"Africa is a growing power plant market for W�rtsil�," said Christoph Vitzthum, group VP for W�rtsil�’s power plants division. "The interest in our gas-fired power plants is particularly significant, as this large contract shows."

Even wind is bigger in Texas. The Lone Star State has overtaken California as the nation’s largest producer of wind power. A report recently released by the American Wind Energy Association (AWEA) says that Texas now hosts 2,370 MW of wind power capacity, edging past California by 47 MW.

California had led the U.S. in wind power capacity since 1981, when the first commercial wind farms in the country were built there. In fact, at one time more than 80% of worldwide wind power capacity was located in the Golden State. Since then, the world and the rest of the U.S. have caught up.

According to AWEA, 822 MW of wind power capacity have been installed in the U.S. so far this year in 13 states. Texas gained its lead largely through the expansion of FPL Energy’s Horse Hollow Wind Energy Center, which grew from 210 MW to just over 500 MW. AWEA expects 2006 to set a new record with 3,000 MW of new capacity expected to be installed. Since the U.S. currently hosts 9,971 MW of wind capacity, the country will undoubtedly hit the 10-gigawatt milestone by year’s end. For comparison’s sake, the U.S. electric power industry’s total installed generating capacity at the end of 2004 was a shade over 1,000 GW, according to the Edison Electric Institute.

Iceland orders more Japanese geothermal. Tokyo-based Mitsubishi Heavy Industries Ltd. (MHI), in a consortium with Mitsubishi Corp. (UK) Plc and Balcke-Dürr GmbH (a German engineering company), has signed a turnkey contract with Orkuveita Reykjavikur, the municipal utility of Iceland’s capital, to build two more 40-MW geothermal power plants at Hellisheidi.

MHI received an order to deliver Units 1 and 2 to the site in 2004, and the latest order (for Units 3 and 4) brings to 10 the number of geothermal plants ordered from MHI by Iceland since 1978. When all of them are commissioned, the country’s total geothermal capacity will hit 340 MW. To date, MHI has delivered geothermal power plants totaling more than 2,500 MW to 12 countries other than Japan.

Hellisheidi is about 12 miles east of Reykjavik, and most of the electricity generated there will be used by nearby aluminum refineries. Units 3 and 4 are slated to go on-stream in September and November 2008, respectively. Each power plant consists of a steam turbine-generator, a condenser, and a cooling tower. The steam turbines will be manufactured by MHI, the generators will be supplied by Mitsubishi Electric Corp., and Balcke-Dü;rr will fabricate the condensers and cooling towers.

TXU asks for emissions cap. Dallas-based TXU Corp. has found itself waging a war of words in the media after announcing in April its intention to spend $10 billion to build 9,079 MW of new capacity fired by pulverized coal and lignite in east Texas within the next few years. The company says about one-fourth of that amount will be spent on best available air-quality controls for the new units and to retrofit existing coal-burning units with better emissions-reduction technologies. However, several local and statewide environmental organizations remain skeptical about TXU’s promised emissions reductions, complaining that the company’s verbal promises are not legally enforceable.

In a preemptive strike that should neutralize the naysayers, TXU has voluntarily asked the Texas Commission on Environmental Quality (TCEQ) to implement and enforce a systemwide cap on key emissions from the company’s existing and proposed coal-fired units. In a letter to the TCEQ, Mike McCall—CEO of TXU Wholesale—wrote, "If approved, this unprecedented step will establish a binding contract between TXU and the state. It will guarantee that TXU will make the air cleaner by reducing more emissions than are added by the new units. We believe other Texas power developers should abide by this same high standard."

TXU has formally asked for systemwide limits on emissions of NOx, SO2, and mercury that are 20% lower than 2005 levels. If the utility stays under the caps, its net emissions would decline even with the addition of the new units because their emissions would be more than offset by reductions. Another way to look at it: TXU’s fleetwide emission rates per megawatt-hour would fall by nearly 70%.

"Some have been skeptical about our commitment to reduce emissions by 20%. This request to create a legal contract to solidify the commitment clearly demonstrates otherwise," wrote McCall. To view his letter and more information on TXU’s plan, visit www.reliabletexaspower.com.

AES breaks ground in Bulgaria. On June 6, AES Corp. (Arlington, Va.) officially kicked off construction of AES Maritza East 1. The $1.4 billion, 670-MW lignite-fired project is the company’s first in Bulgaria and represents the single largest foreign investment to date in the former Soviet ally and one of the largest greenfield investments ever in southeast Europe. Upon completion, the plant will serve as a source of baseload electricity for Bulgaria and southeast Europe.

"Bulgaria is experiencing good economic growth and political stability . . . as it prepares to join the European Union [on January 1, 2007]," said Paul Hanrahan, president and CEO of AES. "It is the kind of market we want to do business in. Our new plant will help supply Bulgaria’s growing electricity needs and maintain the country’s position as an energy hub for the region."

"Maritza East 1 will be the newest, most efficient, and cleanest fossil-fueled power plant in Bulgaria," added Matthew Bartley, executive director of AES Maritza East 1. "It will meet World Bank environmental standards and employ world-class technology and equipment. We are very pleased with the support we’ve received from the Bulgarian government on this project and look forward to a long-term partnership with them."

The two-unit plant, which is expected to come on-line in 2009, will be constructed under the terms of a turnkey contract with Paris-based Alstom, which will supply its boilers, turbine-generators, and balance-of-plant equipment. The output of Maritza East 1 will be purchased by Bulgaria’s national utility under a 15-year contract. The plant’s lignite supply will come from another state-owned entity, Maritza East Mines.

Ormat looks to Indonesia. A consortium of three companies—Ormat Technologies Inc. (Reno, Nevada), a unit of Medco Energi Internasional Tbk (Indonesia’s largest private oil and gas company), and Osaka-based Itochu Corp.�has won a contract from Indonesia’s state-owned utility PLN to develop the Sarulla geothermal power project on the island of Sumatra on an independent basis. Although Indonesia’s exploitable geothermal power potential has been conservatively estimated at 20,000 MW, candidate fields are widely distributed throughout the archipelago, so current installed capacity remains stalled at about 800 MW. Sarulla represents the largest single-contract project to date in the worldwide geothermal industry.

Medco leads the consortium, which bid to:

- Complete development of the geothermal steam field.

- Build field piping systems and three power plants (designed and supplied by Ormat) with a total capacity of 340 MW (gross).

- Create a special-purpose Indonesian company to own and operate the facilities under a concession from Pertamina, the state-owned oil and gas producer.

- Sell the plants’ electrical output to PLN under a 30-year power-purchase agreement.

Ormat also will set up and supervise the operations and maintenance of the power plants. The project is projected to cost about $600 million, of which Ormat’s share will be about $200 million. Full details will be released upon financial closing of the transaction.

The Sarulla project is expected to be built over the next five years in three phases of 110 to 120 MW each. The first power plant should be operational within 30 months, and the last within 48 months of financial closing. The output of the plants will be fed into PLN’s North Sumatra-Aceh grid. Once all three phases are complete, electricity sales are expected to provide annual revenues of $110 million to the consortium partners.

To date, Ormat has supplied and constructed five plants of this type in the U.S., the Philippines, and New Zealand. The Sarulla power plants will use air-cooled condensers and reinject 100% of geothermal fluids. According to the company, this will sustain the reservoir and minimize environmental impact.

DOE database tracks new coal plants. Every few months, the U.S. Department of Energy updates a database of existing proposals for new coal-fired power plants created by its National Energy Technology Laboratory in 2002. Among the highlights of the June 2006 release were the following two factoids:

- 154 GW of new coal-fired capacity are expected to be needed in the U.S. by 2030.

- 153 new coal plants representing 93 GW of capacity are currently "under consideration."

Proposals to build new power plants are often speculative. Ultimately, the decision to proceed with or scrap a project is based on the dynamic economics of regional generation markets. Accordingly, the information in the database should be taken with several grains of salt. However, the data can be considered a snapshot of the short-term climate for new capacity development. Based on the two facts above, it is clear that the future of coal-fired capacity is so bright that shades are required to view it.

The contents of the database are derived from public information as well as from several tracking organizations and news groups. Head over to www.netl.doe.gov/coal/refshelf/ncp.pdf and see if your favorite project is listed.