Global Monitor (May 2008)

National Grid divested of Ravenswood

London-based National Grid plc will sell Ravenswood Generating Station (Figure 1), a facility in Queens, N.Y., that provides more than 20% of New York City’s overall peak load, to TransCanada Corp. for $2.9 billion this summer. Ravenswood Generating Station was a 2004 POWER Top Plant.

1. Sold! Ownership of Ravenswood Generating Station in Queens, N.Y., will pass from National Grid to TransCanada this summer. Courtesy: National Grid plc

National Grid was obligated to divest itself of the 2,840-MW facility to fulfill a condition of the New York Public Service Commission (NYPSC) order approving the company’s $7.9 billion acquisition of KeySpan LLC, a New York utility, in August 2007. The gross asset value of Ravenswood in KeySpan’s last audited accounts was $1.2 billion at Dec. 31, 2006. The station reported an operating income of $138 million for 2006.

The Ravenswood acquisition by TransCanada is subject to regulatory approvals from the Federal Energy Regulatory Commission and the NYPSC, and to clearance under U.S. anti-trust and foreign investment laws. Approvals from these bodies are expected in the next few months.

In addition to Ravenswood’s vital supply, TransCanada will own, or have interests in, over 10,200 MW of power generation in Canada and the U.S. The company’s activities in the U.S. Northeast include hydroelectric generation assets of 567 MW on the Connecticut and Deerfield Rivers in New England, and Ocean State Power, a 560-MW gas-fired combined-cycle power plant in Rhode Island. TransCanada is also currently vested in a proposed 132-MW wind energy project in western Maine.

The Ravenswood Generating Station, which began operating in 1963, is primarily fueled by natural gas. Its multiple units employ steam turbine, combined-cycle, and combustion turbine technology.

GE to sell Baglan Bay plant

GE Energy’s mammoth Baglan Bay gas-fired station, near Port Talbot in South Wales, will also be up for sale by the end of the year (Figure 2).

2. For sale. The Baglan Bay station installed the first GE 50-Hz Frame 9H system. Courtesy: General Electric Power Systems

GE Energy plans to put an estimated price tag of $986 million on the 500-MW plant so it can concentrate on plans to build and operate proposed nuclear stations in Britain, according to the Western Mail, a Welsh publication. GE has not yet issued a public statement regarding the planned sale.

The Baglan Bay Power Station was recognized as one of POWER’s Top Plants of 2003 for its first launch of GE’s 50-Hz Frame 9H system (see POWER, July/August 2003, p. 45). It was the first gas turbine combined-cycle system capable of breaking the 60% fuel efficiency barrier. Hailed for increasing thermal efficiency by using steam from the bottoming cycle to cool the hot gas path parts without relying on film cooling, the H system recently surpassed 24,000 hours of service.

Since 2003, three 50-Hz systems gas turbines have been installed at the Futtsu Thermal Power Station in Japan. They are scheduled to enter commercial operation this year. GE has also installed its first 60-Hz version of the technology at the $500 million Inland Empire Energy Center in southern California. The two 107H combined-cycle systems are expected to produce a total of 775 MW when the plant comes on-line this summer.

From prairie grass to power

Alliant Energy Corp. and Prairie Lands Bio-Products Inc. are jointly assessing ways to create a commercially viable market for switchgrass, corn stalks, and similar agricultural products for use as fuel. The energy services provider expects that the products will constitute up to 10% of the fuel source for a proposed 630-MW hybrid plant in Marshalltown, Iowa, cutting substantially into coal burned at the facility.

Prairie Lands, a nonprofit organization whose 60 members are switchgrass growers, is evaluating potential environmental, economic, and agricultural benefits of switchgrass (a tall native North American grass used for hay and forage) and other such products. The organization is also identifying cost-effective and efficient methods to harvest, aggregate, process, and deliver alternative fuel stocks to the power plant.

The assessment will build upon successful switchgrass test-burn demonstrations conducted during the Chariton Valley Biomass Project, a 2006 venture funded by Alliant and the Department of Energy. That project investigated and demonstrated the technical feasibility, environmental benefits, and potential business viability of cultivating switchgrass to replace a portion of the coal fuel supply at a similar Iowa plant.

According to Alliant’s web site, one of the greater benefits of burning switchgrass is improved air quality due to a natural process: The plant collects CO2 emissions during the growth process and sequesters the greenhouse gas in the ground through its roots.

Alliant supposes that a commercial project of 35 MW would require as much as 200,000 tons of biomass from 50,000 acres and that it would involve as many as 500 farmers.

The proposed plant, Sutherland Generating Station Unit 4, is expected to be operational by 2013. Alliant is considering incorporating an additional 19-MW equivalent of steam cogeneration in the project for use by nearby industries.

Renewables experience 40% growth

Clean energy powers on—and is projected to escalate exponentially—in spite of a sluggish economy. According to a new report from Clean Edge Inc., revenues for the renewables industry surged 40% in 2007, with returns for solar photovoltaics, biofuels, and wind surpassing the $20 billion mark for the first time.

Global revenues for solar photovoltaic products, wind power, biofuels, and fuel cells collectively shot up from $55 billion in 2006 to $77.3 billion in 2007. Of the four energy markets, wind power (new installation capital costs) earned the highest revenue—$30.1 billion, while the fuel cell and distributed hydrogen market, the lowest—but newest—of the four, saw returns of $1.5 billion. In 2007, $25.4 billion worth of biofuels were produced: 13 billion gallons of ethanol and 2 billon gallons of biodiesel. Solar photovoltaics, including modules, system components, and installation, totaled $20.3 billion last year, and worldwide system installations stopped just shy of 3,000 MW.

The Clean Energy Trends 2008 report projected that growth for the four sectors will more than triple over the next decade, to $254.5 billion by 2017. Global installed solar photovoltaic capacity is expected to increase eightfold to 22,760 MW, and wind power capacity is expected to reach to 75,781 MW (Figure 3).

3. Global green energy growth. Clean Edge Inc. projects considerable revenue growth for renewables over the next 10 years. Courtesy: Clean Edge Inc.

The largest growth rate is expected in the nascent fuel cell and distributed hydrogen market, which is projected to increase tenfold to $16 billion. Comparatively, the rate of growth for solar photovoltaic, wind, and biofuels is projected to slow to 13.8% annually from the 50% average sustained over the past four years.

This year, the renewables industry will see continued growth, however, with five trends contributing to it: the growing participation of overseas companies in the U.S. wind power market, a renaissance for geothermal energy, the launch of electric vehicles by small start-up companies (as opposed to large automakers), the use of clean technologies for ocean-faring ships, and the design and construction of new sustainable cities.

The sustainable city

Realization of a zero-carbon, zero-waste, and car-free city may seem futuristic—but it has already begun. In February 2008, the government of Abu Dhabi in the United Arab Emirates broke ground on Masdar City. The 2.3-square-mile district on Abu Dhabi’s outskirts (Figure 4)—which the Abu Dhabi government hopes will someday be occupied by 1,500 businesses and 50,000 residents—is entirely designed for sustainable living.

4. Zero-carbon city rising. An aerial view of Masdar City in the United Arab Emirates. Courtesy: Foster & Partners

Skylights and breezeways are incorporated into architectural designs, and the city aims to utilize only power from renewable sources. In addition to zero emissions, the city will rely on sustainable materials, food, and water. It will also house the Masdar Institute of Science and Technology, a graduate university dedicated to renewable energy. The $22 billion project will be built in seven phases and is expected to be completed and fully functioning by 2015.

Solar recharger for developing countries

Because they live in developing or emerging countries that cannot or do not set up a permanent power supply network, an estimated 1.6 billion people around the world still rely on traditional oil lamps to perform nightly tasks.

Around Lake Victoria in Kenya, about 30 million people stave off darkness by burning kerosene lamps. Not only is it harmful to their health, according to Siemens subsidiary and lighting manufacturer, OSRAM, burning kerosene for light emits 67 tons of CO2 each year in Africa—almost equal to Finland’s annual CO2 emissions. Globally, the figure swells to 190 million tons.

To alleviate this problem, OSRAM constructed an off-grid kiosk-like solar station called an “Energy Hub” (Figure 5). The project was piloted in Mbita, a small town on the banks of Lake Victoria, which is easily accessible by locals who need to charge electrical appliances such as rechargeable lamps and cell phones inexpensively. The project’s success has prompted OSRAM to open three more Energy Hubs in the region.

5. Power station. This solar-powered “Energy Hub” will allow Kenyans near Lake Victoria to recharge small electrical appliances and reduce their dependence on kerosene. Courtesy: OSRAM

Seeking CCS solutions

On a larger scale, the North American coal-fired generating industry has been scrambling for economically viable ways to retrofit existing infrastructure with carbon capture and sequestration (CCS) solutions. Power producer TransAlta Corp. recently announced it will partner with technology developer Alstom on a project to develop an extensive CCS facility in Alberta, Canada. The company anticipates a reduction of CO2 emissions from its coal-fired plants of 1 million tons per year.

Calgary-based TransAlta plans to pilot Alstom’s proprietary chilled ammonia process by 2012 at one of its coal-fired generating stations west of Edmonton. The first phase of the five-year project will begin this year. It aims to advance and improve understanding of CO2 capture and storage technology. The overall project is expected to cost $12 million.

TransAlta has also partnered with experts at the Institute for Sustainable Energy, Environment and Economy, part of the University of Calgary, to quantify CO2 sequestration potential in the Wabamun area west of Edmonton. The results, due in January 2009, will provide a scientific assessment of potential sequestration sites in the area surrounding several power plants, including their capacity and security.

Alstom has signed contracts with several U.S. and European companies to test its CCS technologies. The first pilot project that uses chilled ammonia to capture CO2 from coal-fueled power plants was launched in late February this year at We Energies’ 1,224-MW Pleasant Prairie Power Plant in Wisconsin (see POWER, February 2008, p. 38 for a technical description of the pilot process). The year-long demonstration project is a joint effort with the Electric Power Research Institute (EPRI) and We Energies. EPRI will conduct an engineering and environmental performance and cost analysis during the project. Alstom said that more than 20 organizations representing coal-fueled utilities in the U.S. are committed to project.

Hoover Dam could stop generating

A new study concludes that within a decade, growing water demand in the West and reduced runoff due to drought may deplete waters feeding the 2,080-MW Hoover Dam, a facility that generates power for more than a million people in Arizona, Nevada, and Southern California (Figure 6).

6. Dry dam ahead? Drought and increased demand could be threatening Hoover Dam’s ability to produce hydro power. Source: U.S. Bureau of Reclamation

Researchers at the Scripps Institution of Oceanography found that these factors are causing a net deficit of nearly one million acre-feet of water per year in the Colorado River system, which includes Lake Powell and Lake Mead. The study estimates a 50% chance that Lake Mead, already operating at a deficit, could drop too low for power production. Additionally, the Scripps researchers predict that there is a 50% chance that by 2021, Lake Mead could run dry if water demand is not curbed and climate changes continue as expected.

Japan turns to fossil fuels

Since Asia’s largest utility, Tokyo Electric Power Co. (TEPCO), shut down its Kashiwazaki-Kariwa nuclear power plant (Figure 7) following a major earthquake last July, Japan’s nuclear-generated output has plummeted—and will stay low. Reuters reported that TEPCO’s nuclear output was 79.2% lower this February than last year, and the Hokuriku Electric Power Co. announced recently that it expects to keep its sole nuclear plant closed for the business year ending in March 2008.

7. No nuke. The post-earthquake shutdown of Japan’s Kashiwazaki-Kariwa plant is requiring a shift to fossil-fueled generation. Courtesy: Tokyo Electric Power

So to meet swelling demand, the country that once derived 30% of its power needs from nuclear generation has offset that decline with fossil-fueled generation.

Japan’s 10 main utilities have generated record-high amounts of electricity for seven months straight compared with last year. Thermal generation was up 37.6% from February 2007, and last month, a Reuter’s survey found that the country’s 10 utilities will rely on 141 million barrels of oil in the business year starting April 1—a 50% increase from the volume purchased two years ago.

The Kashiwazaki-Kariwa plant has the fourth-largest generation capacity in the world, its seven reactors producing 8,212 MW collectively. Before its shutdown, the plant supplied 6% of Japan’s total power needs.

The plant was shut down after the July 16, 2007, offshore earthquake (whose epicenter was only 11 miles away) caused a fire within and destroyed a transformer building. The Japanese trade ministry ordered plant operations halted indefinitely for ongoing safety checks.

U.S. reactors produce record power

The Japanese earthquake, combined with aging facilities in the UK and unplanned outages in Germany, caused a general slump in global nuclear generation in 2007 of 3.6%, from 2.8 billion MWh in 2006, according to Nucleonics Week.

U.S. reactors, on the other hand, set a record for output, surging to 843 million MWh and utilizing an average 91% of reactor capacity. National total nuclear generation was 2.4% higher than in 2006 and 2.3% higher than in the previous record year, 2004. Though the total number of operating U.S. commercial reactors (104) remained below 1990 levels, generation was 40% higher than the 577 billion kWh produced in that year.

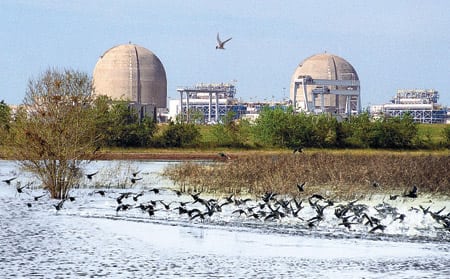

The South Texas Project’s South Texas-1 in Bay City, Texas (Figure 8) generated the largest output of any reactor in the world—12.36 MWh. Constellation Energy’s Calvert Cliffs-1 in Maryland performed the best against promised output levels, exceeding capacity level all year.

8. Record holder. In 2007, South Texas-1 in Bay City, Texas had the largest output of any reactor in the world: 12.36 MWh. Source: Nuclear Regulatory Commission

Seven units closed down in 2007: Bulgaria’s Kozloduy-3 and -4, Slovakia’s Bohunice-1, and the UK’s Dungeness A-1 and -2 and Sizewell A-1 and -2; only four reactors were added: India’s 220-MW Kaiga-3 , China’s 1,000-MW Tianwan-2 VVER, and Romania’s 706-MW Cernavoda-2 Candu unit. The four reactors added 3,100 MW to the grid. The Tennessee Valley Authority also returned to service the 1,155-MW Browns Ferry Unit 1 after 22 years. (See POWER, November 2007, p. 30 for details on the restart of Unit 1.)

Last year also saw construction of the most nuclear power reactors in recent years. Five units were officially launched: the 650-MW Qinshan II-4 and the 1,000-MW Hongyanhe-1 in China, the 1,000-MW Shin Kori-2 and Shin Wolsong-1 in South Korea, and the 1,650-MW Flamanville-3 in France.

POWER digest

News items of interest to power industry professionals.

Siemens to build combined-cycle plant in Portugal.

Siemens Energy is to build two turnkey combined-cycle units for ElecGas S.A. at Central Termoeléctrica do Pego in Abrantes, northeast of Lisbon. ElecGas S.A. is a joint venture of the independent power generation company International Power plc and the Spanish utility Endesa S.A.

Following the units’ start-up, tentatively set for 2011, Siemens will also assume responsibility for maintenance of the power train for a period of 25 years. The order, including the long-term service agreement, is valued at about $947 million.

The natural gas–firing units have a targeted efficiency of over 58% and a combined installed capacity of 830 MW. The full turnkey scope of supply encompasses two gas turbines, two steam turbines, two generators, and all electrical plus instrumentation and control equipment.

After Tapada do Outeiro and Ribatejo, which each comprise three units, Pego is the third power plant project handled by Siemens Energy in Portugal. The nation’s power demand is expected to increase by 3% annually up to 2010. The plants, with a combined capacity of 3,000 MW, will generate enough electricity to meet approximately 40% of Portugal’s demand.

RWE’s construction of twin-unit hard-coal power plant approved.

The Arnsberg regional government has approved German utility RWE Power’s planned construction of a new 1,600-MW twin-unit hard coal power plant in Hamm.

The government found that the proposed plant’s estimated efficiency rate of 46% and “capture ready” capability was in accord with the German Federal Emission Control Act. The new hard-coal twin unit is anticipated to reduce CO2 emissions by 2.5 million tons annually compared to older plants with the same output.

RWE is already preparing the construction site. The power plant’s first block will be put into service in mid-2011 and the second block in early 2012.

RWE will invest $3.16 million in the project. Twenty-three municipal utilities from four different German states are partners in the new plant. The utilities have formed a cooperative known as GEKKO (Gemeinschaftskraftwerk Steinkohle) that will hold a 350-MW share in the venture.

Nordic Windpower to manufacture wind turbines in Idaho.

Nordic Windpower Ltd., the maker of two-bladed utility-scale wind turbines, announced that it will site its new turbine-manufacturing facility in Pocatello, Idaho.

The company plans to create more than 160 new technical, engineering, and administrative jobs at the new facility. Additional positions will be opened at the company’s operational centers in California and the UK.

Volume production is expected to commence for turbine delivery in November 2008. Production is anticipated to grow to at least 20 turbines monthly by September 2009.

Foster Wheeler wins CFB contract.

Global Power Group, a subsidiary of Foster Wheeler Ltd., has been awarded a contract by Entergy Louisiana, LLC, a subsidiary of Entergy Corp., for the design and supply of two circulating fluidized-bed (CFB) steam generators.

The two CFBs will be a part of the 538-MW Little Gypsy 3 Repowering Project in Montz, La. Unit 3 will have the capability of using petroleum coke, an abundant and inexpensive refining byproduct, as well as coal to produce electricity. Commercial operation of the plant is scheduled for the first quarter of 2012.

SCE&G and Santee Cooper apply for COL. South Carolina Electric & Gas Co.

(SCE&G) and Santee Cooper, a state-owned electric and water utility in South Carolina, have submitted an application to the Nuclear Regulatory Commission (NRC) for a combined construction and operating license (COL). If approved, the license would authorize the companies to build and operate up to two new nuclear generating units at their existing V.C. Summer Nuclear Station site in Jenkinsville, S.C.

The utilities have been developing their application since 2006. The NRC will now begin an approximately three-to-four-year review process. If the commission issues an approval, likely in 2011, the utilities plan to begin construction shortly thereafter and anticipate an in-service date of as early as 2016 for the first unit.

SWEPCO Arkansas coal plant approved.

The Louisiana Public Service Commission (LPSC) has approved a Southwestern Electric Power Co. (SWEPCO) request to construct a 600-MW coal-fueled power plant in Hempstead County, southwest Arkansas. The plant will cost about $1.34 billon. SWEPCO will hold a 73% investment, owning 440 MW of capacity.

The plant will be the first of its type in the U.S to use “ultrasupercritical” advanced coal combustion technology. It will feature low-sulfur coal and state-of-the-art emission control technologies, including a design that allows for the retrofit of carbon dioxide controls.

The LPSC’s approval requires that SWEPCO, a unit of American Electric Power (AEP), submit a study identifying the potential for implementing cost-effective energy-efficiency and load management programs for the company’s Louisiana customers.

The company is awaiting a ruling on an air permit, expected this summer, from the Arkansas Department of Environmental Quality before construction can begin. Construction will take approximately 48 months; the operation date is set tentatively for late summer in 2012.

The company garnered approval from the Arkansas Public Service Commission in November last year. The commission subsequently declined a third-party request for a rehearing in December. The intervenors have since appealed the case to the Arkansas Court of Appeals, where it is pending.

The baseload plant is part of SWEPCO’s previously announced plans to meet the region’s energy needs. The company has completed a 340-MW natural gas–fueled peaking plant at Tontitown in northwest Arkansas. The company also plans to build a 500-MW combined-cycle natural gas–fueled plant at its existing Arsenal Hill Power Plant in Shreveport, La.

Go-ahead granted to Appalachian Power in West Virginia.

Meanwhile, AEP’s operating unit, Appalachian Power, has been authorized by the Public Service Commission of West Virginia to build a 629-MW integrated gasification combined-cycle (IGCC) electric generating plant in West Virginia. The $2.23 billion plant, which will require approximately 48 to 54 months to complete, will be located beside the company’s existing Mountaineer Plant near New Haven, W.Va.

In addition to the West Virginia filing, Appalachian Power has filed with the Virginia State Corporation Commission (SCC) for approval to recover the Virginia share of carrying costs associated with the plant. The company also filed for an environmental permit from the West Virginia Department of Environmental Protection. The Virginia SCC is expected to rule on the IGCC plant in April.

AEP announced in August 2004 that it intended to build approximately 1,200 MW of commercial-scale IGCC generation to meet baseload needs of the seven-state eastern portion area it serves. In addition to the Mountaineer IGCC unit, AEP had planned to build a similar 629-MW IGCC unit in Meigs County, Ohio. That project has been halted, following an Ohio Supreme Court decision in March.

AEP responds to Ohio Supreme Court IGCC decision.

The Ohio Supreme Court unanimously ruled that $23.7 million of start-up costs for AEP’s Meigs County plant project charged to Ohio customers violated provisions of an electric choice law signed in 1999. The court said that construction of the plant falls into the generation portion of the company’s operations that the Ohio Legislature deregulated under the law.

A Public Utilities Commission of Ohio (PUCO) ruling in April 2006 permitted two AEP subsidiaries to recover preconstruction costs between July 2006 and 2007 for the $2 billion plant in Meigs County. Those costs were for the first of three planned phases for the plant. The ruling sent the case back to the PUCO for reconsideration.

AEP reaffirmed its commitment to IGCC generation but indicated that the company will wait for clarity about the future of electricity generation in Ohio before it determines if it can build the IGCC plant in that state.

—Compiled by Sonal Patel.