Global Monitor (March 2008)

What a difference a month makes. No sooner did the FutureGen Alliance announce its long-awaited decision about the location of the zero-emissions demonstration plant than the DOE did an abrupt about-face and dropped out of the project, ostensibly due to its rising cost (Figure 1). There is no joy in Mattoon, Ill., these days.

1. The FutureGen that never will be. It looks as if an artist’s conception may be all we’ll ever see of FutureGen. The DOE abruptly backed out of the project and is now looking to invest in the carbon capture and sequestration portion of several commercial IGCC projects. Source: FutureGen Alliance; modification: Leslie Claire

The DOE attempted to soften the blow by noting that the department has decided to spread (hedge?) its investment dollars over a broader playing field by focusing on support of the carbon capture and storage (CCS) technology portion of several commercial integrated gasification combined-cycle (IGCC) plants now under development. The aim of the so-called “restructured” FutureGen remains the same: accelerate the commercial deployment of CCS technology—seen as crucial to the continued use of coal under an economywide CO2 cap—at IGCC plants.

The estimated cost of the original FutureGen rose from $1 billion when the project was first announced in 2003 to $1.8 billion today, although the DOE’s cost-share commitment rose “only” from $800 million to $1.1 billion. The department said it “anticipates” that up to $1.3 billion will be available for the restructured project, subject to congressional appropriations from fiscal year 2007 through fiscal year 2020.

Taking a different path. The DOE quickly released a formal request for information (RFI) seeking expressions of interest from plant developers who would consider participating in the revised initiative. The RFI notes the restructured program “will help shape a competitive Funding Opportunity Announcement in the second quarter of the year.”

The goals for the new projects remain the same: demonstrate the feasibility and viability of the IGCC-CCS system but “at a commercial scale of at least 300 MW per unit plant power train, per demonstration.” Qualifying projects will be required to demonstrate approximately 90% CO2 capture and storage and the ability to store 1 million metric tons of the gas annually in a saline aquifer. However, for these new projects, the DOE will contribute “not more than the incremental cost associated with CCS technology.”

Insulating the department from a reprise of the inevitable cost escalation of such projects, the RFI stipulates that, “Since under this approach FutureGen is focused on a commercial power train, the project recipient will be responsible for absorbing project cost growths with the remainder of the plant as it would in any other commercial venture.”

Qualifying plants must be capable of 99% sulfur removal and 90% mercury removal. They also must have a nitrogen oxides emission rate of less than 0.05 lb/mmBtu and a particulate emission rate of less than 0.005 lb/mmBtu. In addition, qualifying projects must help establish standardized technologies and protocols for the deployment of IGCC-CCS, including those for CO2 monitoring, mitigation, and verification. Furthermore, the DOE wants projects to demonstrate that IGCC-CCS plants meet commercially accepted operability and reliability standards and can accurately quantify the CO2 storage potential of possible underground reservoirs.

Congress unhappy with decision. The reaction on Capitol Hill was unsurprising. “After our meeting today, it is clear that Secretary of Energy Sam Bodman has misled the people of Illinois, creating false hope in a FutureGen project which [the DOE] has no intention of funding or supporting,” Sen. Richard Durbin (D-Ill.) said in a written statement. “In 25 years on Capitol Hill, I have never witnessed such a cruel deception.”

Not helping Bodman sooth all those ruffled political feathers was C.H. “Bud” Albright, a DOE undersecretary. During a conference call with supporters of FutureGen after the DOE’s retreat from the project, he said the federal government isn’t interested in “building Disneyland in some swamp in Illinois.” Albright’s written apology followed quickly after Sen. Dick Durbin and Rep. Timothy Johnson, R-Ill. excoriated Albright for insulting the Land of Lincoln.

Mickey and Goofy were unavailable for comment.

U.S. nuclear plants have record year

U.S. nuclear power plants posted all-time record highs for electricity production and efficiency in 2007, according to preliminary figures released by the Nuclear Energy Institute. U.S. nuclear plants generated approximately 807 billion kWh in 2007, exceeding by more than 2% the previous record high of 788.5 billion kWh set in 2004.

The 104 nuclear plants operating in 31 states also achieved a record-setting average capacity factor of 91.8%, surpassing the 2004 record of 90.1%, according to preliminary figures. For example, Exelon Nuclear’s 17 generating units produced a total of 132.3 million MWh in 2007—the highest annual production ever for the nation’s largest operator of commercial nuclear reactors. Exelon’s fleet also achieved an average capacity factor of 94.5%—an all-time record for the company and the fifth consecutive year the number has been over 93%.

The industry’s average electricity production cost—encompassing expenses for uranium fuel plus operations and maintenance—also set a record last year. Average production cost was 1.68 cents/kWh in 2007, besting the previous low of 1.72 cents/kWh set in 2005, according to preliminary data.

Attesting to the affordability of nuclear energy, 2007 was the ninth straight year that the industry’s average electricity production cost has been below two cents/kWh and the seventh straight year that nuclear plants have had the lowest production costs of any major source of electricity, including coal- and natural gas–fired power plants.

Electricity production from nuclear power plants was bolstered by the refurbishment of Browns Ferry 1 in Athens, Ala., which returned to service in May 2007. Tennessee Valley Authority (TVA) completed the 1,155-MW project within its five-year schedule at a cost of about $1.8 billion. The industry also implemented plant “uprates,” or power production capacity increases, at two plants: a 55-MW increase at Browns Ferry 1 (Figure 2) and a 13.7-MW increase at Progress Energy’s Crystal River reactor in Florida. Uprates pending for 2008 include 15% power uprates for each of the three Browns Ferry units. Approval for them is expected this fall. A total of 912 MW of uprates at 11 individual units are pending approval in 2008, according to the Nuclear Regulatory Commission.

2. New and uprated. The Nuclear Regulatory Commission approved a 5% power uprate for Browns Ferry 1 restart, and Tennessee Valley Authority has an application for 15% power uprates pending for all three Browns Ferry units. Approval is expected in the fall. Courtesy: TVA

Final figures on the industry’s 2007 performance are expected this spring.

Westinghouse wins TVA contract

Westinghouse Electric Co., a group company of Toshiba Corp., has won a contract valued at approximately $200 million in support of the completion of Tennessee Valley Authority’s (TVA’s) Watts Bar Nuclear Plant Unit 2 (Figure 3), located near Spring City, Tenn. When completed, the plant will produce approximately 1,200 MW of power. The TVA estimates the 54-month refurbishment will cost about $2.49 billion.

3. Finish what you start. Westinghouse will supply reactor components for TVA’s 54-month-long restart of Watts Bar Unit 2. Courtesy: TVA

Westinghouse’s scope includes the upgrade and replacement of most instrumentation and control systems, supply of new reactor coolant pumps, steam generator services, crane replacement and upgrades, nuclear steam supply system plant design engineering services, drive rods, licensing services, and safety analysis.

The TVA-planned project duration is 54 months. Commercial operation of the unit is scheduled for early 2012.

Watts Bar Unit 2, originally a Westinghouse pressurized water reactor, was approximately 80% complete when the utility halted construction in 1985, citing a projected decrease in electricity demand. In 2007, TVA announced that it would complete Unit 2 and that Bechtel Power Corp. would lead the engineering, procurement, and construction work.

UniStar Nuclear to file for COL

UniStar Nuclear Energy (UNE), a strategic joint venture between Constellation Energy and the EDF Group, announced that it has notified the Nuclear Regulatory Commission (NRC) of its plans to submit a combined construction and operating license (COL) application in late 2008 for a potential advanced-design nuclear reactor at Constellation Energy’s Nine Mile Point Nuclear Station in upstate New York.

UNE submitted a letter on Feb. 8 to the NRC formally selecting Nine Mile Point as the site for a potential “U.S. evolutionary power reactor” (EPR) (Figure 4). UniStar noted that it has yet to make a final decision to build a new reactor at Nine Mile Point.

4. New NY nuke. UniStar Nuclear has announced its intent to file a combined construction and operation license based on the U.S evolutionary power reactor design (shown here in an artist’s rendering) for its Nine Mile Point Nuclear Station. Source: NRC

“We are working to be in a position to make a decision to break ground for a new reactor at the Calvert Cliffs site at the end of 2008, depending upon the outcome of several issues, including economics and federal loan guarantees,” said Michael J. Wallace, chairman of UniStar and executive vice president of Constellation Energy.

In addition to advanced-design reactors in New York and Maryland, UniStar is also working with PPL and AmerenUE, as well as emerging energy companies such as AEHI and Amarillo Power, to develop potential U.S. EPRs in Pennsylvania, Missouri, Idaho, and Texas.

AEP ranks second in U.S. construction

American Electric Power’s aggressive program to install emissions-reduction equipment on its existing plants and build new generation facilities has grown to become the largest in the utility industry and the second-largest in the nation. Those rankings are based on capital invested, according to a November 26, 2007, report in Engineering News-Record. Only Alcoa had more construction in progress last year. In 2007 alone, AEP completed installation of advanced emissions-control equipment on 3,500 MW of coal-fueled generation and started and finished construction of a 340-MW gas-fueled power plant.

AEP’s capital investments for generation and environmental retrofits in 2006 and 2007 totaled more than $3.8 billion. A significant portion of that total was committed to installing emissions-reduction equipment on AEP’s generating fleet in West Virginia and Ohio. In West Virginia, the company completed installation of flue gas desulfurization systems, or scrubbers, to reduce SO2 emissions and a selective catalytic reduction (SCR) system to reduce nitrogen oxide emissions on 1,600 MW at the company’s two-unit Mitchell Plant in Moundsville. AEP also installed a scrubber on its 1,300-MW Mountaineer Plant in New Haven.

In Ohio, AEP completed installation of a scrubber on a 600-MW generating unit at the Cardinal Plant in Brilliant. The Cardinal Unit 2 scrubber and associated projects totaled approximately $285 million. Cardinal Unit 2 is owned by Buckeye Power but is operated by AEP. AEP is finishing a second scrubber on Cardinal’s Unit 1 that will be operational this spring. Cardinal Unit 1 is owned and operated by AEP.

AEP’s newest power plant, the Harry D. Mattison Plant, located in Tontitown, Ark., also came on-line in 2007. Two of the four simple-cycle, natural gas–combustion turbines were operational in July 2007. Two additional units came on-line in December 2007. The $131 million plant was completed nearly a year ahead of schedule.

AEP’s construction program will continue in 2008 as the company moves forward with work already in progress to install emissions-reduction equipment at three additional plants. AEP is installing scrubbers on three generating units at Amos Plant in St. Albans, W.Va. (Figure 5). It also has begun work on a third scrubber at Cardinal Plant and is installing a new scrubber, upgrading an existing scrubber, and installing an SCR system at the Conesville Plant in Conesville, Ohio. The Conesville Unit 6 scrubber upgrade will be completed in 2008. The new Conesville Unit 4 scrubber and SCR should be on-line in 2009. The Amos scrubbers will be completed in 2009 and 2010, and the third Cardinal scrubber will be operational in 2010.

5. Billions and billions. Scrubbers are being added to each of the three units at AEP’s John E. Amos Plant in St. Albans, W.Va., as part of the utility’s record-breaking investment in power plant environmental upgrades. Amos Units 1 and 2 are rated at 800 MW each; Unit 3 is a 1,300-MW unit. At a total of 2,900 MW, Amos Plant is the largest power plant on the AEP system and one of the largest in the country. Courtesy: AEP

Additionally, AEP will complete 340 MW of new simple-cycle, natural gas–fueled generation in Oklahoma in 2008: 170 MW at its Riverside Plant in Jenks and another 170 MW at its Southwestern Plant near Anadarko. The company also will begin work on a 480-MW, combined-cycle natural gas–fueled plant in Shreveport, La., and initiate completion of the 580-MW combined-cycle natural gas Dresden Plant in Dresden, Ohio. Both plants are scheduled to be on-line in 2010.

AEP anticipates finalizing approvals and beginning work on its proposed 600-MW baseload coal-fueled plant in Hempstead County near Texarkana, Ark., in 2008. The company recently received construction approval from the Arkansas Public Service Commission for the plant. Other regulatory approvals are pending. AEP continues working to obtain approval to build two 630-MW integrated gasification combined-cycle plants: one in New Haven, W.Va., and the other in Great Bend, Ohio.

China moving to the driver’s seat

A new study of worldwide technological competitiveness suggests China may soon rival the U.S. as the principal driver of the world’s economy—a position the U.S. has held since the end of World War II. If that happens, it will mark the first time in nearly a century that two nations have competed for technology leadership as equals.

The study’s indicators predict that China will soon pass the U.S. in the critical ability to develop basic science and technology, turn those developments into products and services, and then market them to the world. Though China is often seen as just a low-cost producer of manufactured goods, the new “High Tech Indicators” (HTI) study done by researchers at the Georgia Institute of Technology clearly shows that the Asian powerhouse has much bigger aspirations (Figure 6).

6. Downhill slide for the U.S. The change in the technological standing of these nations is dominated by one feature: a long and continuous upward line that shows China moving from “in the weeds” to world technological leadership over the past 15 years. Source: Georgia Tech Technology Policy and Assessment Center

“For the first time in nearly a century, we see leadership in basic research and the economic ability to pursue the benefits of that research—to create and market products based on research—in more than one place on the planet,” said Nils Newman, coauthor of the National Science Foundation (NSF)-supported study. “Since World War II, the U.S. has been the main driver of the global economy. Now we have a situation in which technology products are going to be appearing in the marketplace that were not developed or commercialized here. We won’t have had any involvement with them and may not even know they are coming.”

Georgia Tech has been gathering the high-tech indicators since the mid-1980s, when everyone wanted to know which country would be the “next Japan”—a competitive producer and exporter of technology products. The current HTI 2007 information was gathered for use in the NSF’s biennial report, “Science and Engineering Indicators,” the most recent of which was released January 15.

Georgia Tech’s “High Tech Indicators” study ranks 33 nations relative to one another on “technological standing,” an output factor that indicates each nation’s recent success in exporting high-technology products. Four major input factors help build future technological standing: national orientation toward technological competitiveness, socioeconomic infrastructure, technological infrastructure, and productive capacity. Each of the indicators is based on a combination of statistical data and expert opinions.

The 2007 statistics show China with a technological standing of 82.8, compared with 76.1 for the United States, 66.8 for Germany, and 66.0 for Japan. Just 11 years ago, China’s score was only 22.5. The U.S. peaked in 1999 with a score of 95.4.

Recent statistics for the value of technology products exported—a key component of technological standing—put China behind the U.S. by the amount of “a rounding error”: about $100 million. If that trend continues, Newman noted, China will soon pass the U.S. in that measure of technological leadership.

On the input indicators calculated for 2007, China lags behind the U.S. In “national orientation” China scored 62.6, compared with 78.0 for the U.S. In “socioeconomic infrastructure,” China rated 61.2, compared with 87.9 for the U.S. In the other two factors China also was behind the U.S., scoring 60.0 versus 95.5 for “technological infrastructure” and 85.2 versus 93.4 for “productive capacity.”

China has been dramatically improving its input scores, which portends even stronger technological competitiveness in the future.

“It’s like being 40 years old and playing basketball against a competitor who’s only 12 years old—but is already at your height,” Newman said. “You are a little better right now and have more experience, but you’re not going to squeeze much more performance out. The future clearly doesn’t look good for the U.S.”

New solar cycle poses risks

National Oceanic and Atmospheric Administration (NOAA) scientists have reported that a new 11-year cycle of heightened solar activity showed signs of beginning when the cycle’s first sunspot appeared in the sun’s Northern Hemisphere. Increased solar activity increases risks for power grids; critical military, civilian, and airline communications; GPS signals; and even cell phones and ATM transactions.

“This sunspot is like the first robin of spring,” said solar physicist Douglas Biesecker of NOAA’s Space Weather Prediction Center (SWPC). “In this case, it’s an early omen of solar storms that will gradually increase over the next few years.” SWPC is the nation’s first alert for solar activity and its effects on Earth.

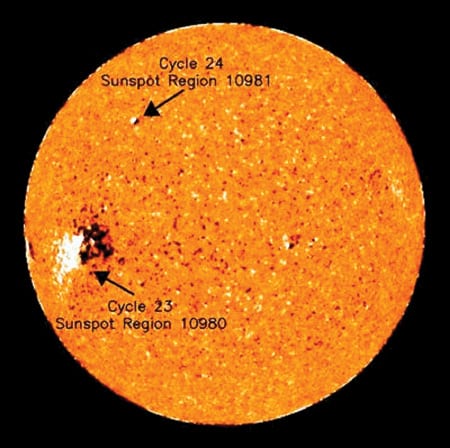

A sunspot is an area of highly organized magnetic activity on the surface of the sun. The new 11-year cycle, called Solar Cycle 24, is expected to build gradually. The number of sunspots and solar storms is expected to reach a maximum by 2011 or 2012, though devastating storms can occur at any time (Figure 7).

7. See spot run. The first official sunspot belonging to the new Solar Cycle 24 is shown in the northeast quadrant of Earth’s sun. The large sunspot region just south of the equator is part of the waning Solar Cycle 23. Source: NOAA

During a solar storm, highly charged material ejected from the sun may head toward Earth, where it can bring down power grids, disrupt critical communications, and threaten astronauts with harmful radiation. Storms can also knock out commercial communications satellites and swamp GPS signals. Routine activities such as talking on a cell phone or getting money from an ATM machine could suddenly halt over a large part of the globe.

The new sunspot, identified as #10,981, is the latest visible spot to appear since NOAA began numbering them on January 5, 1972. Its high-latitude location at 27 degrees north, and its negative polarity leading to the right in the Northern Hemisphere are clear signs of a new solar cycle, according to NOAA experts. The first active regions and sunspots of a new solar cycle can emerge at high latitudes while those from the previous cycle continue to form closer to the equator.

Dutch favor power from natural gas

News from the Netherlands tells us that the Dutch are very busy building new, high-efficiency gas-fired power stations all over the country (Figure 8). Given Netherland’s extensive natural gas fields in the North Sea, a gas pipeline infrastructure more than 6,300 miles long (in a country less than half the size of New Jersey), and the fact that the country is a net exporter of natural gas to the European Union, its choice of fuels makes perfect sense. Consider the latest three project announcements.

8. Dutch treat. Substantial North Sea natural gas resources and extensive infrastructure for moving gas make the fuel a natural for power generation in the Netherlands. Source: About.com, Geography

Alstom. Alstom Power won an order worth over $580 million from Dutch utility company Electrabel Nederland to build an 870-MW turnkey combined-cycle power plant in Lelystad, located in the center of the country. Flevocentrale will be the first GT26-based combined-cycle power plant built by Alstom in the Netherlands. Alstom has been a key player in the Dutch power generation market for a long time; 60% of the electricity generated in the country is being produced by Alstom equipment.

Alstom will design and build a fully integrated plant and provide the main power plant components, including two GT26 gas turbines and associated equipment such as steam turbines, turbogenerators, and heat-recovery steam generators (HRSGs). Worldwide, 81 Alstom GT24/GT26 gas turbines are in commercial operation.

Siemens. Siemens Energy Sector will build a turnkey combined-cycle plant—a 430-MW facility called Rijnmond II—at the Vondelingenplaat industrial and port facility, approximately two miles south of Rotterdam. The purchaser is the international independent power producer InterGen, headquartered in Burlington, Mass.

The scope of supply includes an SGT5-4000F gas turbine, a water-cooled generator, a steam turbine, plus all electrical and instrumentation and control equipment. Following the start of commercial operation, scheduled for mid-2010, Siemens will assume responsibility for plant services over a period of 12 years. The order for Siemens, including a long-term service agreement, is worth over $460 million. The entire project is estimated to cost approximately $700 million.

Rijnmond II is the third order for a combined-cycle power plant posted by Siemens since liberalization of the Dutch power market in 2000. The company had already supplied key components for the 820-MW Rijnmond I plant, which began commercial operation in 2004. In early 2007, Siemens secured the contract for the Sloecentrale combined-cycle power plant in Vlissingen Ost.

Mitsubishi. Mitsubishi Heavy Industries (MHI) has received a full turnkey order from Nuon N.V., a major Dutch energy company, for three power trains of natural gas–fired gas turbine combined-cycle (GTCC) systems. Each is rated over 430 MW, for a total of approximately 1,300 MW to be installed at the Nuon Magnum Plant. The GTCC order is Nuon’s second submitted to MHI. The first was the Ijmond blast furnace gas-fired combined-cycle system delivered in 1997. The new plant is scheduled to produce power in 2011.

Nuon Magnum will be built in Eemshaven in the northern province of Groningen. The company plans to convert Nuon Magnum to an IGCC plant in the future, which would allow it to be fueled by coal and biomass.

Each train will consist of an M701F4 gas turbine, a steam turbine, generators, an HRSG, and other balance-of-plant components. MHI will manufacture the gas and steam turbines; Mitsubishi Electric Corp. will manufacture the generators.

POWER digest

News items of interest to power industry professionals.

GE sends four LMS100s to Latin America. GE Energy has received contracts from three companies totaling over $142 million to supply four 50-Hz LMS100 simple-cycle gas turbines. These are the first sales of the 50-Hz version of this new turbine package that boasts of 44% thermal efficiency.

Pampa Energia purchased the first 50-Hz LMS100 for its Pampa Guemes project expansion in the province of Chubut, Argentina. Commercial operation is expected in the third quarter. Following this purchase, Inversora Ingentis S.A., a special-purpose company created by Emgasud and Pampa Holding, purchased two LMS100 units as part of a 500-MW development project that will ultimately generate 400 MW of turbine and 100 MW of wind power.

The Chilean power company Colbun S.A. also recently purchased an LMS100 gas turbine unit. Its system will be commissioned mid-year at the Los Pinos project near Charrua in Region VIII outside of Santiago, Chile. Colbun has been a power producer in Chile since 1986 and has both hydro and thermal power generating assets. The LMS100’s fast 50-MW-per-minute ramp rate will complement Colbun’s hydro generation in meeting fluctuating power demand.

The Chilean power market is very similar to that in deregulated U.S. states in terms of its use of nodal prices and spot markets. Santiago is located in the Central Integrated System (SIC) and has a total capacity of 8.4 GW and a peak demand of 6.1 GW. The SIC power market is supported by roughly 70% hydroelectricity and 25% natural gas and is in need of nearly 600 MW of new capacity annually to meet firm reserve margin needs.

RWE Power to develop new power storage system. RWE Power has signed a memorandum of understanding (MOU) with GE for the joint development and validation of a zero-emission storage technology (advanced adiabatic compressed air energy storage or AA-CAES) with higher efficiency than is currently available. The development project is aimed at finding alternative paths for large-scale energy storage in an effort to better align supply and demand.

“The highly fluctuating power input is expected to increase in the future, if only because of the planned massive expansion of wind energy,” explained Dr. Johannes Lambertz, CEO of RWE Power AG, Fossil-Fired Power Plants portfolio. “Therefore it is important to address this challenge and develop concepts for efficient storage in due time.” He continued, “RWE Power and GE will initially conduct a joint feasibility study to be completed by end of 2008. Based on the findings of this study, a first demonstration plant is scheduled for 2012.”

AA-CAES is a zero-emission storage technology with higher efficiency than currently available energy storage solutions. A major challenge will be to develop a compressor technology that can withstand high temperatures during compression and ensure high availability of compressed air energy storage (CAES) for power plants. To prevent this heat from being lost, it is extracted from the compressed air, before the latter is stored in a cavern, and directed to a separate thermal energy storage facility.

“We’re excited about this project because we believe that thanks to GE’s vast experience in compressor technology, we have the capability to study and propose unique solutions as an alternative to the current state of art,” said Claudi Santiago, president and CEO of GE Oil & Gas, which will study the compressor technology required.

Foster Wheeler awarded two CFB boiler contracts. Foster Wheeler Ltd. has been awarded a contract by Harbin Power Engineering Co., Ltd. (HPE) for the design of two CFB steam generators for the second phase of the Cam Pha Power Plant Project in Cam Pha, Vietnam. Commercial operation of the new boilers is scheduled for third quarter 2010.

Foster Wheeler has received a full notice to proceed on this contract to design two 150 MW-class CFB steam generators for HPE, a subsidiary of Harbin Power Plant Equipment Group Corp. The two boilers are designed to burn waste anthracite and slurry.

Foster Wheeler was also selected to supply two 75 MW-class CFB steam generators for Sinochem Quanzhou Petrochemical Co. Ltd., located in southeast Fujian Province in the People’s Republic of China. This coke-fired circulating fluidized bed project is part of a major residue processing project by the petrochemical company. Commercial operation of the new boilers is scheduled for the fourth quarter of 2009.

Pakistan opens new desalination/power generation plant. President Pervez Musharraf inaugurated the Defence Housing Authority’s (DHA) water desalination and power generation project in mid-February. The project produces 90 MW of power and 3 million gallons of water per day. The power is sent to the distribution system of Karachi Electric Supply Corp. and the water is for DHA’s needs. The plant’s approximate cost is $115 million.

Siemens Pakistan, Siemens AG Germany, and Sweden’s Alfa Laval provided technical assistance. Alfa Laval provided the desalination units, and Siemens Germany provided the combined-cycle power plant. The plant consists of a gas turbine, heat-recovery boiler, steam turbine, and two desalination units that produce desalinated water through the thermal evaporative process.

The combined fuel cycle uses exhaust steam from the steam turbine through condensation and distillation. The desalination plant uses modern multi-effect desalination evaporation technology, which makes operation highly efficient.

SWEPCO’s Harry D. Mattison Units 1 and 2 go commercial. American Electric Power’s Southwestern Electric Power Co. (SWEPCO) began commercial operation of Units 1 and 2 of the new Harry D. Mattison Power Plant at Tontitown, Ark., in early January.

Two simple-cycle, natural gas–fired combustion turbines were declared in commercial operation Dec. 28, 2007. For immediate service, the units have an initial combined capacity of 150 MW.

SWEPCO began commercial operation of Units 3 and 4 on July 12, 2007. Those two simple-cycle, natural gas–fueled combustion turbines also had an initial combined capacity of 150 MW. After testing is completed on each of the two pairs of units in the spring of 2008, the capacity of each pair of units will increase by 20 MW to a combined capacity of 170 MW. When complete, the four units in the $131 million project will have a total capacity of 340 MW.

“The fast-track efforts that brought Units 3 and 4 on line in time for the summer of 2007 have continued in our work to have Units 1 and 2 ready for the summer of 2008,” said Venita McCellon-Allen, SWEPCO president and chief operating officer.

“In less than seven months, the site was transformed from a pasture to an operating 150-MW power station, and now all four units are operating and will be ready at full strength of 340 MW for the summer of 2008,” McCellon-Allen said. Wood Group Power Solutions provided project management and construction services for the project.

Corrections

In our December 2007 issue’s Top Plant article on the Steel Winds Project, p. 53, we should have stated that “wind turbine ratings have gone from 700 kW to more than 2 MW over the past decade.”

In that same issue, on p. 65 in “Developing wind projects in California—or anywhere” we lost a decimal point. The Production Tax Credit is 1.9 cents/kWh. Kathryn E. George, a senior economist at Princeton Energy Resources International in Rockville, Md., kindly pointed out that the “inflation-adjusted, 10-year, 1.5 cents per kWh [PTC] credit was increased to 2.0 cents per kWh for 2007 for wind energy plants, per Notice 2007-40 of the Internal Revenue Service (May 2007).”

The January 2008 Global Monitor CWA 316(b) conference report provided an incorrect web address for Tetra Tech, which contributed the report. The correct web address is www.tetratech.com.

POWER regrets the errors.