Getting Bulk Storage Projects Built

Unpredictable periods of operation are one of the disadvantages of wind and solar technologies. If there were an economic means of storing the energy from the time of production to the time of demand, the value of renewable energy sources would greatly increase. Here are some ideas for how to bridge that gap.

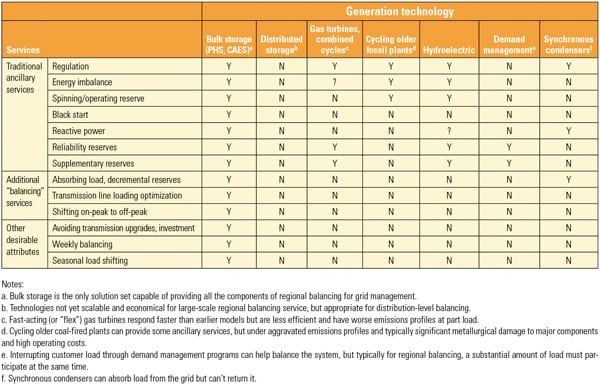

Bulk energy storage technologies (typically larger than 50 MW and grid connected at transmission level voltages) add needed flexibility to grid operations and enhance the reliability and security of electricity supply. Unlike traditional generation and transmission assets, bulk storage facilities respond within minutes to add or absorb small or large increments of capacity to and from the grid. These technologies also represent an economic development and export opportunity. Such attributes are now widely recognized by the industry. Thus, it is not our intent here to review these attributes, which can be found in many respected references, but rather to focus on the policy framework necessary to monetize these attributes (Figure 1).

|

| 1. Good business case. Four or five energy storage technologies are expected to exhibit an attractive internal rate of return (IRR) in the near future, based on an analysis of the availability of technical alternatives, the technical complexity of the implementation, its match with long-established business models, and other supporting business and industry trends. Calculations are based on estimated storage prices for 2015 to 2030. Source: The Boston Consulting Group, “Revisiting Energy Storage: There Is a Business Case” |

Over the past year in particular, many conditions necessary for bulk energy storage to play a larger role in U.S. electricity grid management and operations have converged.

First, the Federal Energy Regulatory Commission (FERC) implemented FERC Order 755, which supports the use of energy storage facilities for ancillary services, and FERC Order 1000, which allows “multi-value” transmission projects to recover costs from ratepayers on a regional basis. FERC also issued a Notice of Inquiry on Electric Energy Storage Technologies and Ancillary Services to determine how storage assets should be treated for accounting purposes.

Second, two states with the largest electricity systems in the country—California and Texas—are implementing state-level policies conducive to storage. Not surprisingly, these two states are also among the most aggressive in developing renewable energy.

Third, the distributed energy storage sector is suffering from a variety of issues related to scale-up, operational safety, under-capitalized firms, private sector (venture capital and private equity primarily) funding levels, and general disenchantment with government-sponsored research and development. History suggests that at least a few of the companies pursuing these technologies will ultimately navigate the arduous path to a grid-scale commercial product. However, the sector as a whole, not unexpectedly by any means, has clearly suffered setbacks this past year.

Finally, it bears repeating that bulk storage technologies—primarily underground cavern-based compressed air energy storage (CAES) and pumped hydroelectric storage (PHS)—have consistently exhibited the best economics on a life-cycle cost basis, compared with virtually all of the scaled-up distributed storage technologies, with the possible exception of lead acid battery chemistry.

The Policy Gap

With dozens of active PHS and CAES projects around the country, a fair question to ask, given this convergence of conditions noted above, is, What’s the problem in getting commercial bulk storage projects online? The answer is that there are still several widely acknowledged benefits and value streams associated with bulk storage for which cost recovery/financial return is elusive under current policy and electricity market mechanisms.

In largely regulated jurisdictions, storage isn’t a “sanctioned” asset class like generation, transmission, or distribution assets for the purposes of recovering costs either through regulated rates of return or through contracts between utilities and third-party or merchant/independent project developers. In market-oriented jurisdictions, monetizing the costs of bulk storage through energy, capacity, renewable energy credits, and/or ancillary services typically still leaves substantial benefits unpaid for. The most notable of the ancillary services important to storage is frequency regulation, for which tariffs and products have been developed in many organized electricity markets.

Whether in regulated or competitive regions, the grid still must absorb shocks to the system, and the intermittency/variability of renewable energy has magnified this need. Thus, grid owners/operators need “shock absorbers,” flexible options that can respond quickly to system upsets, assets that can add load to the system when necessary, assets that can absorb load from the system, customers that will reduce their load demand from the system, and so on.

The electricity grid is described as the world’s largest machine, or a just-in-time inventory system, because electricity per se cannot be stored, although it can be stored as energy in other forms. It bears noting that 22,000 MW of PHS already operates throughout the U.S., and one CAES facility has been operating for almost 20 years. However, virtually all of these facilities were built by vertically integrated utilities before policies encouraging competition in electricity supply were enacted.

In practice, the benefits and value streams associated with balancing, or “shock absorption,” vary greatly, depending on the location within the transmission or distribution system (and the differing voltage levels) where balancing is conducted. Now that electricity supply and delivery has been disaggregated, the value and benefits accrue to different stakeholders. However, the problem is similar to the inability of certain transmission projects to move forward because it was simply too difficult to apportion the value, and recover the costs, to/from each class of ratepayer that would benefit from having the transmission line in place. Thus, through the leadership and initiatives of several independent system operators (ISOs), FERC instituted Order 1000, which allows approved “multi-value” projects to recover costs through an adder on transmission tariffs across the region. Methodologies have been developed and approved that quantify the value of these regional benefits.

Proposed Solutions and CAREBS’ Functional Approach

At the federal and state levels, myriad policy solutions have been proposed, and some instituted, to support the addition of energy storage facilities, including:

- Creating markets for grid ancillary services, the most accepted thus far being frequency regulation (for example, in PJM, MISO, CAISO, and NE-ISO).

- Creating new market products, such as ramping or flexible ramping in the organized markets to reflect the response value and flexibility of storage (in CAISO, MISO, and others).

- Allowing an investment tax credit for storage facilities (Storage Technology for Renewable and Green Energy Act of 2011, S.1845, pending before Congress).

- Reducing the interval for bids into the market to sub-hourly to accommodate so-called “Limited Energy Storage Resources” and creating a “real-time” regulation market (New York).

- Mandating or encouraging a minimum level of storage capacity in the market, that utilities procure a minimum level of storage, and that methodologies be developed to assign a “resource adequacy” value to storage, as is common for generation and transmission resources, and institute pay for performance and forward procurement of flexible capacity (California).

- Defining electricity used to charge storage devices as wholesale not retail (Texas).

- Creating a “national interest value” tariff that would support distributed storage (National Alliance for Advanced Technology Batteries proposal).

As a complement to these initiatives, The Coalition to Advance Renewable Energy through Bulk Storage (CAREBS) advocates a functional policy solution that:

- Simplifies the task of integrating renewable energy into grid operations without further distorting existing ratemaking or market mechanisms, or sacrificing reliability.

- Avoids picking winners and losers and protecting existing or future asset classes by focusing on the grid or market functional need and not the technology or the asset.

- Minimizes government intrusion into the marketplace while supporting core objectives of expanding access to renewable energy without sacrificing reliability or further burdening ratepayers.

- Leaves the determination of the need for investment to those who own and operate the grid, who can make judgments about present and future need for balancing.

The solution CAREBS proposes builds on a strategy already moving forward for transmission and current practices in grid management.

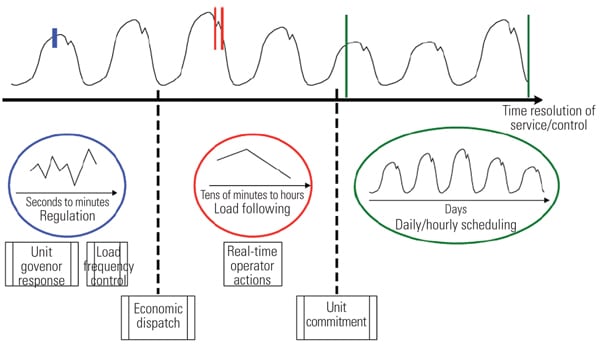

First, grid balancing isn’t new, although the higher penetration of renewable energy enlarges its importance generally and requires that balancing be conducted within shorter time intervals. Grid balancing (Table 1), part of which involves traditional ancillary services, today is done with the generating assets that are the most flexible (that is, those that can reduce or increase load quickly), including hydroelectric plants (in the Pacific Northwest), older and smaller fossil-fired units (in much of the Midwest and in Western states) that can cycle, demand side management (especially California, and fast-response gas turbine generators (most everywhere). Unfortunately, the holistic costs for grid balancing—many of which are not routinely quantified by utilities, or which impose externalities (emissions penalties, reliability impacts, and so on) that do not show up in costs—are not transparent or known with any degree of precision on a real-time basis. Therefore, better ways of providing the balancing service, such as with bulk energy storage, are difficult to evaluate properly (Figure 2).

|

| Conventional generation technologies cannot produce all the ancillary, balancing, and other services required by a modern grid. Source: CAREBS |

|

| 2. Timing is everything. Operations planning timeframes dictate the required resources. For example, frequency regulation may require a response of 1 to 2 seconds following a system disturbance, 5 to 10 seconds for primary frequency response, and 10 seconds to several minutes for normal regulation. Load following requires ramping synchronous loads during the shoulder hours on either side of the daily peak load. A system of units is dispatched on an hourly or daily basis through automatic generation controls. Source: MISO |

Most notably, bulk energy storage has one attribute critical for load balancing that the other options do not: the ability to absorb load from the system and then return it at a later time (the round trip efficiency between the energy input to charge the storage facility and the energy output must be built into the system economics). Generators can only put load onto the system. Synchronous condensers (rare in the U.S.) can absorb load but cannot return it. Reducing demand through agreements with customers can quickly reduce the need for supply but isn’t necessarily dependable or available in large capacity increments; nor does it serve as a regional balancing solution. In addition, some options, such as relying on gas-fired generators, could add vulnerabilities by stressing allied infrastructure, such as natural gas pipelines.

Second, FERC, several ISOs, and a few states have already solved a similar set of issues facing transmission by allowing “multi-value” projects to recover costs on a regional basis. A new transmission line not only delivers renewable energy from one area to a dense load center, for example, but it also strengthens the stability and reliability of the electricity grid generally. The positive environmental impact of connecting a wind-rich area with an urban load center accrues to the region as a whole.

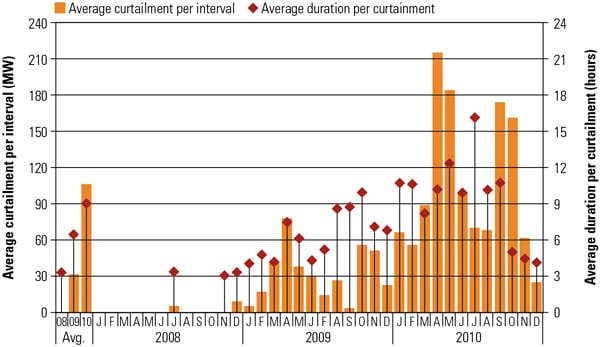

Bulk energy storage is no different. In addition to bringing more renewable energy to more people more of the time, it is a “grid optimization” tool. Utilities that operate a bulk storage facility today are happy to recount how invaluable the facility is to guaranteeing reliability of electricity supply and solving grid management problems as they arise in real time. Every ISO/regional transmission organization (RTO) that includes one or more bulk storage facilities understands how valuable that facility is to managing the grid and the market. Keep in mind, however, that the investment was recovered under a different vertically integrated business model (Figure 3).

|

| 3. MISO wind curtailments 2008 to 2010. Wind generation grew to 3.8% of total U.S. generation in 2010. However, there were also 2,117 wind curtailments in 2010 caused by grid congestion or because the wind generation was surplus to requirements because it was produced during off-peak hours when demand for electricity is low. Energy storage technologies have the potential to absorb the surplus off-peak energy and release it to the market during peak periods when prices are high. Energy storage has the potential to alleviate wind curtailment and the need for additional transmission and generation to meet peak demand. Source: MISO |

Thus, CAREBS advocates a straightforward set of policy steps to quickly realize the benefits of adding regional bulk storage by defining and monetizing the balancing function:

- Acknowledge the growing importance of “balancing” in grid operations, especially under high renewable energy penetrations, by formally defining a balancing (or compensating) function.

- Acknowledge that the benefits of this balancing function accrue to all ratepayers in the jurisdiction.

- In the organized competitive markets, separate and distinguish those aspects of balancing that are not already covered by existing market mechanisms—these value streams can be recovered through existing market mechanisms for energy, capacity, renewable energy credits, and ancillaries—so that double-dipping is avoided.

- Ensure that utilities and ISO/RTOs make the full costs of balancing transparent to all market participants.

- Require that all integrated resource planning exercises, capital budgeting, cost evaluations, forecasting, and grid modeling and simulation evaluate the need and costs for the balancing function separately from the need for generation, transmission, and distribution assets.

- Allow all assets that can provide such “balancing” services to compete—including bulk energy storage, hydroelectric, gas turbine/generators, demand management programs, and fossil plants that can cycle—for the privilege of providing the services.

- Allow investment recovery for providing the balancing or “shock absorption” function through a mechanism similar to multi-value transmission projects since the concept is the same.

This set of policy steps will work in regulated jurisdictions, organized markets, and can be considered by FERC and the state governments. In practice, it may be best in some situations to consider ancillary services as included in the balancing function. In other situations, especially in markets where components of ancillary services are already procured by the ISO/RTO through market mechanisms, it may be best to define balancing as those services, attributes, or benefits that are not already available through other means. Some jurisdictions would contract for capacity, energy, and balancing, while others might contract for capacity, energy, ancillaries, and balancing. Fully regulated markets with largely unbundled utilities could independently contract for balancing services or provide them through traditional means.

The ultimate goal is to lower the cost of electricity to ratepayers, not to create new protected classes of assets or continue to protect those that already exist.

Final Thoughts

Bulk energy storage has unique attributes for providing balancing or “shock absorption” for grid management: It is truly large-scale (individual systems run from 50 MW to 700 MW); it manages the grid on a regional, or wide-area, basis; it can absorb large increments of capacity from the grid and return that capacity at a later time; the CAES and PHS technologies are fully commercial, with warranties and guarantees necessary for financing and the comfort of grid owners/operators; and it represents the only large-scale storage technologies that are economically competitive in today’s marketplace, especially against low natural gas prices.

Under a formal and transparent process for evaluating the need and costs for grid balancing, CAREBS believes that bulk storage can compete without new subsidies or mandates, because it is the only solution set capable of providing all components of the balancing function. The policy steps outlined here will create the playing field necessary for grid owners/operators to leverage the benefits bulk storage brings to their stakeholders.

— Jason Makansi (jmakansi@ pearlstreetinc.com) is president of Pearl Street Inc., a technology deployment services firm and executive director of The Coalition to Advance Renewable Energy through Bulk Storage, a public policy and outreach organization. CAREBS members include Dresser-Rand Corp., Haddington Ventures LLC, HDR Engineering, TetraTech, Magnum’s Western Energy Hub, Eagle Crest Energy Co., WindSoHy, and Hydrodynamics Group LLC.