GE Will Decarbonize Uniper’s Gas Power Fleet

GE Gas Power and Uniper have agreed to roll out a detailed decarbonization roadmap that may entail hydrogen-friendly upgrades to all GE gas turbines and compressors at the German generation giant’s gas power plants and gas storage facilities across Europe.

Under the agreement, GE Gas Power and Uniper will form a joint working group to explore, assess, and develop technology and service options for decarbonization of Uniper’s 4-GW GE gas turbine fleet. The working group will then roll out a roadmap “to develop an assessment of potential upgrades and [research and development] programs needed to drive decarbonization” by early 2021.

In a joint statement on July 21, the two companies noted the agreement stems from a relationship that “spans decades.” Uniper “has been first to adopt many of GE’s industry-leading technologies, like for example the Uniper power stations of Grain, Connah’s Quay or Enfield in the UK or the Uniper gas storage facilities in Germany like Etzel or Epe,” the companies said.

But the fleet-wide decarbonization agreement inked this June is unique for GE’s Gas Power business, and it points to growing efforts by the major American gas turbine manufacturer to exploit the lucrative niche in an ever-more competitive global gas turbine market. It will provide “the opportunity for a holistic decarbonization assessment across many GE technologies,” the company said.

For Uniper, which already has a similar deal with Siemens and has spearheaded several “clean gas” solutions of late, the agreement provides yet another opportunity to leverage the latest technological innovations, and it furthers the fossil-heavy company’s ambitions to exit coal and become a carbon-neutral generator in Europe, at least, by 2035.

Reviving a Legacy Business

The agreement suggests that GE, which has pioneered and commercialized a lengthy list of gas turbine technologies since the 1940s, is intensifying its focus on technologies that will give its gas turbine fleet continued play as decarbonization picks up pace in the power space.

As GE executives noted during an investor call to outline the company’s second-quarter earnings on July 29, GE was already in the process of turning around its troubled power business before the COVID-19 pandemic roiled supply chains, prompted service delays, and depressed revenues by 10% compared to the first half of last year. Over the last six months, notably, GE Gas Power recorded only 15 orders for gas turbines—compared to 35 during the first half of 2019—and only two were for its HA-class turbines.

“Our ability to close transactions has been impacted by constrained customer budgets and access to financing due to oil prices and economic slowdown, especially in Gas Power,” the company notes in its July 29 10-Q filing. “Looking ahead, we anticipate the power market to continue to be impacted by overcapacity in the industry, increased price pressure from competition on servicing the installed base, and the uncertain timing of deal closures due to financing and the complexities of working in emerging markets and the ongoing impact of COVID-19. Market factors such as increasing energy efficiency and renewable energy penetration continue to impact long-term demand,” it said.

Still, GE is optimistic that gas generation has a marked role to play to further decarbonization efforts. Gas-fired generation is available “at scale today” and can play a role as an effective contributor to power industry decarbonization “due to the multitude of environmental and economic benefits it provides via efficiency, fuel flexibility, and post-combustion carbon capture,” a GE spokesperson told POWER on July 29 when asked how the agreement factors into GE’s overall business strategy.

The fleet-wide agreement with Uniper appears to have already spurred interest from GE’s customers related to “similar agreements and efforts.” But to be successful, “this must be an industry-wide priority,” the spokesperson noted.

However, as Dr. Jeffrey Goldmeer, Emergent Technology Director for Decarbonization at GE Gas Power told POWER in June, designing low-carbon technology options for its gas power units isn’t new to the company. “Gas turbines, whether operating today or installed in the future, can be upgraded to run on renewable (zero-carbon fuels) like hydrogen. In fact, GE has been leading the industry in low-Btu fuel capability for more than 30 years; GE gas turbines have more than 6 million operating hours across 70+ sites using hydrogen and similar low-Btu fuels,” he said.

GE has also been developing advanced combustion technology for applications using hydrogen as fuel. “The DLN 2.6e combustion system, which was initially developed as part of a U.S. Department of Energy High Hydrogen Turbine program, has demonstrated capability to operate on 50/50 blends of natural gas and hydrogen; this capability is available as an option on GE’s 9HA and 7HA.03 gas turbines.” (For more about the history of GE’s hydrogen technology development, see “The POWER Interview: GE Unleashing a Hydrogen Gas Power Future.”)

GE’s work with Uniper, however, will focus on a broad gas turbine installed base that includes LM2500 and LM6000 aeroderivative gas turbines, as well as 6F, 9E, 9F, and GT26 heavy-duty gas turbines, the spokesperson noted, which is why the company considers the agreement an “opportunity for a holistic decarbonization assessment across many GE technologies.”

To date, the company has deployed a broad range of combustion technologies across its gas turbine portfolio that “enable a wide range of hydrogen concentrations—up to 100% (by volume)—on its aeroderivative and B/E class fleet,” the spokesperson confirmed. “Our advanced-class fleets (F, H-class) have configurations that allow operation on fuels up to 50%–60% (by volume) hydrogen concentration (depending on the specific gas turbine)—with technology paths to higher concentrations depending on customer needs.”

Why Hydrogen Is the Future for Gas-Heavy Uniper

For Uniper, the agreement is another lynchpin for a strategic goal it set at the beginning of this year to achieve climate neutrality in its European generation business by 2035 and the rest of the world by 2050.

Decarbonization, notably, is also a major undertaking that reflects ambitions outlined by Fortum, Finland’s state-controlled utility, which this March ended a more than two-year takeover battle with Uniper’s ownership and acquired stakes that were previously held by activist funds Elliott and Knight Vinke. Fortum, which now holds 69.9% of the German energy group, has pushed for “increasingly clean gas, energy storage, and other flexibility solutions that provide security of supply in the next decades.”

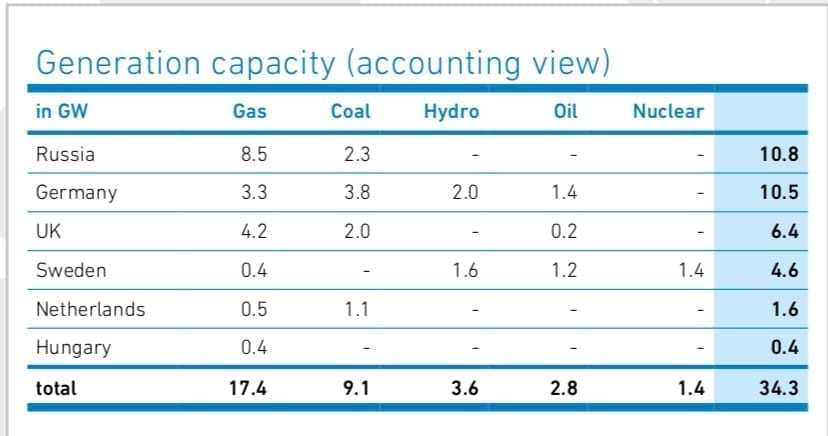

But the task ahead for Uniper, which has 11,500 employees and activities in more than 40 countries, is colossal. Uniper currently owns 34 GW of installed generation capacity. About 50%—17.4 GW—is gas-fired, mostly in Russia, Germany, and the UK, as well as in Sweden, the Netherlands, and Hungary. In total, the company’s European gas-fired fleet is about 9 GW. About 26% of Uniper’s fleet is coal-fired, and the remainder is hydropower and nuclear.

Meanwhile, Uniper also has several gas storage facilities (with a total capacity of 7.5 billion cubic meters) in Germany, Austria, and the UK. “Gas storage facilities are basically the link between continuous gas production and seasonally fluctuating gas sales (summer/winter) and are necessary to overcome supply disruptions,” the company explained. The drive for decarbonization has furnished those assets with a new function: “Today, storage capacities can be booked freely on the market so greater flexibility of injection and withdrawal rates is required. Underground gas storage facilities are also gaining in importance in the supply of flexible low-carbon gas-fired power stations. They bridge the gap at short notice when renewable energy from the wind or sun is temporarily unavailable.”

While GE and Uniper did not provide cost details related to the project, Uniper told POWER that to realize its decarbonization ambitions, it plans to invest approximately €1.2 billion in green technologies and decarbonization over “the next couple of years.”

Initial research and development is already fueling enthusiasm for the strategy. Among notable projects that point to how Uniper could decarbonize its gas assets are the WindGas Falkenhagen project, a power-to-gas pilot that started up in August 2013, and the 2015-commissioned WindGas Hamburg plant. In 2018, Uniper began producing 1,400 cubic meters per day of synthetic methane derived from 1 MW of wind power via a 2-MW alkaline electrolyzer, and it continues to feed it into gas distribution pipeline networks at its Falkenhagen, Germany, site. Uniper plans to follow up these projects by shaping a “green” hydrogen economy in Germany’s “chemical triangle,” at Reallabor Bad Lauchstädt, and then by installing hydrogen-compatible gas turbines.

In tandem, notably, Uniper is exploring a concept for the use of regeneratively produced hydrogen in the refinery process in cooperation with a refinery site in Lingen. And it is also involved in “living lab” support projects “Energiepark Bad Lauchstädt” and “Norddeutsches Reallabor,” where the large-scale demonstration of sector coupling and a post-use concept for the WindGas plant will be developed.

‘Europe Will Need a Huge Amount of Hydrogen’

The push for renewables-produced hydrogen is rooted both in new uses for renewables as well as hydrogen’s vast potential, CEO Andreas Schierenbeck suggested during Uniper’s annual general meeting on May 20. “In Germany, €1.2 to €1.4 billion of wind power goes unproduced because it can’t be transported from the north to the south. People in Germany are already paying for this phantom power, so it makes sense to convert it into another energy source,” he said. “I believe that the energy transition can’t succeed without hydrogen.”

Hydrogen has a wide range of applications, Schierenbeck noted. “It can be used in fuel cells to promote new forms of mobility and as the basis of synthetic fuels.” But it is also “an energy storage medium that can store renewable energy flexibly in response to supply and thus help balance supply and demand.” It is also a prerequisite for sector coupling. “In those areas where renewable power can’t be used directly, green hydrogen and its derivatives (power-to-x) create new opportunities for decarbonization, for example in maritime and air transport.”

Uniper is convinced that in the years ahead, “Europe will need a huge amount of hydrogen,” and inevitably “cost factors and a lack of production capacity” will prevent it from “at least initially,” producing hydrogen from renewables alone. “Our proposal is very simple: let’s build the infrastructure necessary for tomorrow’s hydrogen economy as rapidly and efficiently as possible and then produce as much hydrogen as possible as quickly as possible,” said Schierenbeck.

The approach may require all hands on deck, he suggested. In April, Uniper signed a similar deal with Siemens Gas and Power to develop decarbonization projects and promote sector coupling. While the scope of the Siemens agreement also includes evaluating the hydrogen utilization potential of Uniper’s existing gas turbines and gas storage facilities, according to an April press release, the focus of the work with Siemens will be “to define what role … hydrogen can play in the future evolution of Uniper’s coal power plants.” Uniper recently announced it would close or convert its coal plants in Germany by 2025 “at the latest.”

As Uniper spokesperson Georg Oppermann told POWER on July 28, “The cooperation with Siemens does of course focus on the assets manufactured by Siemens—gas turbines in Germany and elsewhere—but is also a long-term partnership on other assets in the context of decarbonization.” The decarbonization project with GE, on the other hand, will “focus on the turbines and compressors, which were provided by GE in the past with a focus on UK and the Netherlands.”

GE’s Competitors Are Banking Heavily on Hydrogen

Like GE, Siemens’ Gas and Power, notably, is also focusing heavily on helping customers achieve their decarbonization goals, and according to Siemens AG CEO Joe Kaeser, that “shift to a sustainable and economically viable energy supply will require major investments,” which poses a “great opportunity” for Siemens Energy.

Speaking on July 9 at an Extraordinary Shareholders’ Meeting—when 99.36% of Siemens shareholders voted to approve the spin-off of the company’s energy business to Siemens Energy AG—Kaeser also noted he had requested Siemens Energy’s executive board to “rapidly submit a plan for exiting coal-fired power generation in a way that meets the needs of our stakeholders.”

The future of the independent company will be deeply rooted in “hydrogen solutions,” Kaeser suggested. “This potential must be maximized.” On July 8, the European Commission rolled out the Clean Hydrogen Alliance between governments and the private sector to advance the production, distribution, and consumption of hydrogen produced with renewable power, Kaeser noted. “Plans call for investing up to €180 billion and creating around one million jobs by 2050,” he said.

“This move is also urgently necessary because the structural transition from fossil fuels to renewable energies will take its toll. There will be a price to pay in terms of jobs, qualifications and the regional distribution of value creation—in other words, with regard to policies for selecting business locations. Here, we urgently need a joint plan for mastering the challenges and seizing the opportunities,” he said.

Siemens Gas and Power is already heavily invested in exploring that potential. Aligning with a target set by European industry association EUTurbines, Siemens Gas and Power in January 2019 rolled out an ambitious roadmap to ramp up the hydrogen capability in its gas turbine models to at least 20% by 2020, and 100% by 2030.

Mitsubishi Hitachi Power Systems (MHPS), another fierce gas turbine market contender, is also banking on the hydrogen market. While the company this March received a first-of-its-kind contract for two M501JAC power trains “specifically designed and purchased as part of a comprehensive plan to sequentially transition from coal, to natural gas and finally to renewable hydrogen fuel,” the company is also exploring building out enabling hydrogen infrastructure. In May 2019, for example, it announced an initiative with Magnum Development, the owner of a large and geographically rare underground salt dome in Utah, to develop the massive Advanced Clean Energy Storage project, which is strategically located near Intermountain Power Agency’s 1,800-MW Intermountain Power Project (IPP) in Millard County, Utah.

The company is reportedly making progress on similar deals, and it plans to provide renewable hydrogen fuel capability for every gas turbine it sells “going forward,” as Paul Browning, MHPS’s Chief Regional Officer of the Americas and co-Chief Regional Officer of Europe, the Middle East and Africa (EMEA), said. “This allows our customers to purchase a natural gas power plant today, and convert it over time into a renewable energy storage facility. This gives plant operators flexibility now and into the future to choose what mix of natural gas power generation and renewable energy storage best meets the needs of their electrical grids.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).