Ensuring Resource Adequacy in Competitive Electricity Markets

Planning for resource adequacy—something that was relatively simple in the context of vertically integrated utilities—continues to be a difficult issue in competitive electricity markets. Whereas state public utility commissions used to have exclusive authority to determine what generation needed to be built and when it was to be available, this responsibility has been assumed by RTO/ISOs in regions with competitive markets. Each region approaches resource planning differently, and each region faces unique problems.

Resource adequacy for an electric power system means that there are sufficient generation and demand-side resources available to meet customers’ current and projected electricity needs, including a reserve margin. A number of recent events have demonstrated that, despite extensive efforts over a number of years, the regions of the country that have embraced competitive electricity markets are still struggling to find the best method to ensure resource adequacy.

Before the era of competitive electricity markets, resource adequacy was relatively straightforward. Vertically integrated utility companies had state-imposed legal obligations to maintain sufficient power resources to serve all customers connected to their systems. Utilities benefited from having generation assets earning a return in their rate bases and therefore had an incentive to propose new generation whenever they could justify the need to their state utility regulators. Some states still follow this model.

Forming Electricity Markets

Beginning in the 1990s, competitive electricity markets began to be adopted as a way to reduce electricity costs for consumers. The Federal Energy Regulatory Commission (FERC) issued its Order No. 888 in 1996 requiring transmission-owning utilities to provide open access transmission services so that wholesale power sellers could compete for a large pool of buyers. Following FERC’s lead, a number of states required their regulated utilities to separate their generation from transmission and distribution functions for the purpose of allowing retail customers to choose from whom to buy electricity.

In these “retail choice” states, the traditional public utilities are no longer required to build generation to meet load growth, because their only remaining supply obligation is to purchase energy sufficient to serve customers on their systems who have not chosen an alternate supplier. How to ensure resource adequacy when no single entity has a “build” obligation has been an issue since the beginning of competitive markets.

Almost all of the states that have adopted retail competition are within regions that have formed Independent System Operators (ISOs) or Regional Transmission Organizations (RTOs). In those regions, utilities have given control over their transmission lines to an independent entity whose task is to operate one transmission system for the region. These system operators have set up organized markets where buyers and sellers can trade energy the day before and the day of the scheduled delivery. The ISOs/RTOs have also assumed the dominant role in establishing resource adequacy constructs for their regions, although not all states in ISOs/RTOs have abandoned the traditional build obligation for utilities.

The rest of this article discusses the different approaches to resource adequacy that have been taken and the challenges they continue to face, with a focus on three of the ISO/RTOs. It also briefly discusses two other ISO/RTOs that are still trying to resolve resource adequacy issues and looks at how resource adequacy was recently addressed in the context of power system reliability standards.

PJM: Mandatory Capacity Auctions

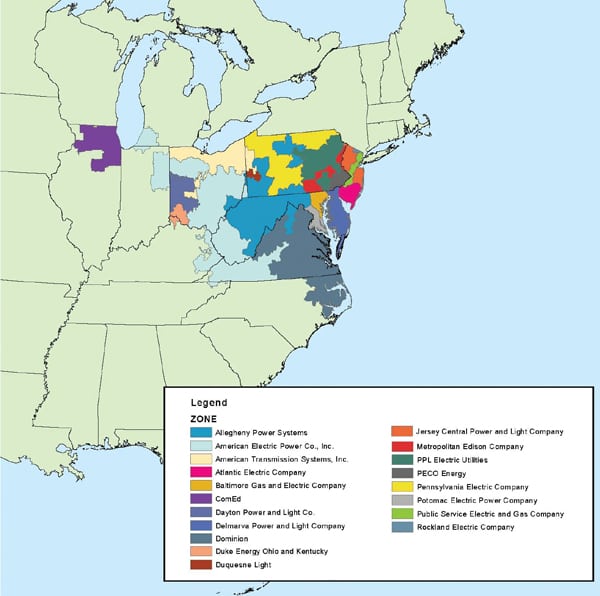

PJM Interconnection LLC (PJM) provides transmission service in all or parts of 13 eastern states (Figures 1 and 2). In 2004, FERC found that PJM’s electricity market design (which had price caps on certain generators and a day-ahead capacity requirement) was not offering adequate compensation for generators to recover costs, thus raising concerns about future generation adequacy. After extensive stakeholder discussions, FERC in 2006 approved of PJM establishing an electric capacity market called the Reliability Pricing Model (RPM) to address resource adequacy. Generally, capacity is a resource that can be called upon to generate electricity or reduce demand as directed, although regions have specific criteria as to deliverability and availability to qualify as a capacity resource.

|

| 1. PJM service territory. Courtesy: PJM Interconnection LLC |

|

| 2. The PJM control center. Courtesy: PJM Interconnection LLC |

Under RPM, an annual May auction for capacity is held three years before each June-to-May Delivery Year, and incremental auctions are held closer to the Delivery Year. The auction establishes capacity prices that will be paid to resources committed for the Delivery Year, including localized prices for transmission-constrained delivery areas.

The auction prices are generally valid for the Delivery Year only, but certain new generation can get a two-year price commitment. Owners of most generation resources located within PJM are required to offer their capacity into the auction, and load-serving entities (LSEs) are assigned a capacity obligation by PJM based on their loads. There is an exception from auction participation for certain LSEs that plan to serve their entire load with identified resources. Demand response and efficiency resources may voluntarily participate in the auction.

Offers in the auction are accepted based on where they fall with respect to a downward sloping line on a graph known as a “demand curve.” The vertical axis of the graph represents a price range for supplying capacity expressed in $/MW-day. The horizontal axis represents the quantity of capacity PJM has determined is needed for the Delivery Year to serve load and a reserve margin. The sell offers are stacked until they reach a point on the demand curve that represents PJM’s capacity need. All offers that clear receive the clearing capacity price for the Delivery Year. A unit of PJM is the counterparty to sellers in the auction and bills the LSEs for their capacity obligation at the auction clearing price.

PJM calculates a value called the “cost of new entry” (CONE), which is an estimate of the cost of installing a new combustion turbine, and is a significant parameter used to establish both a price ceiling and a price floor for certain aspects of the auction. The ceiling is intended to prevent market manipulation by sellers who wish to inflate capacity prices, and the floor is intended to prevent market manipulation by sellers with affiliated capacity buyers that could benefit from driving capacity prices lower.

The RPM auction is governed by numerous rules, some of which have been the subject of vigorous debate, that are intended to ensure that the auction produces a capacity price high enough to incentivize the maintenance and new entry of generators in both constrained and unconstrained areas. The price also must protect consumers from unreasonably high charges, and there must be sufficient monitoring and controls to prevent market manipulation by those who may want to increase or decrease the auction price.

The RPM model has both supporters and detractors. PJM asserts that RPM has successfully maintained ample reserves for the PJM area and has allowed for the construction of significant new capacity. Detractors argue that RPM is overly complex, has not provided adequate incentives for new capacity where it is most needed, and overcompensates existing inefficient capacity to the detriment of more efficient new entrants. Others have argued that the one- and two-year price commitments for capacity that clears the auction are insufficient for developers and lenders to invest in new resources.

This past year saw direct challenges to the RPM model by two states within PJM—New Jersey and Maryland—which contend that RPM is not producing enough generation capacity within their states to ensure reliability and keep local capacity prices reasonable.

In early 2011, New Jersey enacted legislation that required the state’s local distribution companies (LDCs) to enter long-term contracts with developers of new in-state generation at capacity prices set by bidding. The developers were required to offer all of their new capacity into the RPM auction at a price ensuring it would clear—for example, $0—so that they would receive the RPM clearing price. If the RPM price received by the developers was above or below the contract price, the differences would be settled by the developers and the LDCs exchanging funds.

The Maryland Public Service Commission in September 2011 also found that RPM failed to attract new generation within that state, and it required LDCs to issue RFPs for capacity and energy from new in-state natural gas generators that would be bid into RPM.

These plans by the states collided with an RPM auction rule, recently amended by PJM to apply to state-sponsored resources, which requires that planned new gas-fired generators must offer their capacity into the auction at a price no lower than 90% of the CONE value, unless the generator could show special circumstances. This rule is intended to prevent market manipulation by those who might wish to depress capacity prices. However, the new gas generators sought by New Jersey and Maryland may not clear the auction at an offer price of 90% of CONE, which would undermine those states’ efforts to build new local generation.

FERC issued two controversial orders in 2011 that upheld the RPM rule, finding that the states’ programs would subsidize the proposed new plants, which would depress price signals in the auction. The states argued that FERC was interfering with their traditional resource management responsibilities; FERC responded that it had statutory responsibilities to govern capacity markets. Those states and others have appealed FERC’s orders to court, which may present the issue of whether ISO capacity market rules under FERC’s jurisdiction have priority over state resource planning jurisdiction.

ERCOT: The “Energy Only” Approach

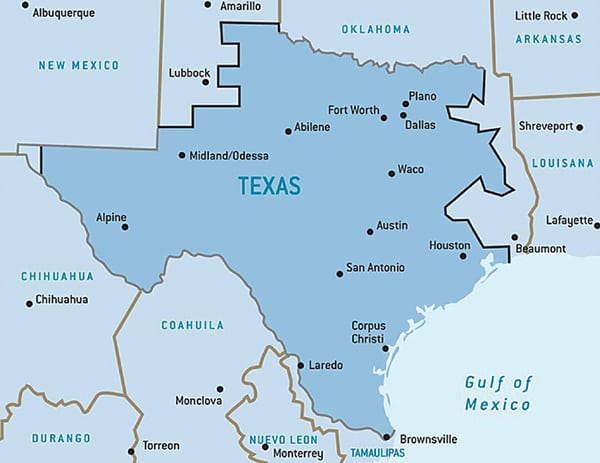

The Electric Reliability Council of Texas (ERCOT, Figure 3), which is not under FERC’s jurisdiction, is the ISO that operates the transmission system for most of Texas. It has taken an approach to resource adequacy completely different from PJMs.

|

| 3. ERCOT service territory. Courtesy: ERCOT |

ERCOT has embraced retail competition, but it has no capacity requirements for load servers and no capacity market. Rather, ERCOT’s approach to resource adequacy is known as an “energy only” market. LSEs in ERCOT must purchase energy as needed to supply their customers through bilateral contracts or energy markets. The energy price alone is relied upon to provide resource adequacy. As the Texas Public Utility Commission (PUC) describes this system in its January 2011 report, “Scope of Competition in Electric Markets in Texas, Report to the 82nd Texas Legislature,” “[t]he supply of generation relative to demand will influence energy prices, which in turn can serve to encourage or discourage development of new generation.”

To facilitate market transparency, the Texas PUC requires ERCOT to make available a wide range of information about the status of the ERCOT system, including long-, medium-, and short-term projections for load, resources, and transmission. Some economists believe that energy-only market structures with uncapped energy prices can support resource adequacy because prices during scarcity would provide sufficient price signals and compensation to justify new construction. However, most regulators, including those in Texas, are unwilling to allow energy prices to be totally uncapped. Energy prices in ERCOT are currently capped at $3,000/MWh.

Until recently, there has been sufficient generating capacity in Texas to maintain a comfortable reserve margin. However, during the past year, questions have been raised about whether ERCOT’s resource adequacy approach will continue to be sufficient given load growth and generator retirements for environmental reasons. In December 2011, ERCOT announced that it was “very concerned” about the significant drop in the capacity reserve margin, projecting that it will likely fall below the 13.75% minimum target beginning with summer 2012. However, ERCOT has since indicated its reserve margin could now be met because a generator reversed its decision to mothball two coal units.

When stating its concern about reserve margins in a December 1, 2011, news release, ERCOT noted that its role in the competitive market is to inform policymakers and the market of the need for increased generation resources or demand response efforts, “but ultimately ERCOT does not control the supply of electricity needed to meet the demands of our growing economy.”

However, despite this “hands-off” approach to resource adequacy, when load requirements threatened to overtake supply in August 2011 because of extreme hot and dry weather, ERCOT contracted to bring some mothballed generating plants back into service. This action caused controversy because it changed the market dynamics in the energy markets without notice. In early 2012, ERCOT has been developing rules under which it may call mothballed plants back into service.

The most recent report by ERCOT’s independent market monitor (2010 State of the Market Report for the ERCOT Wholesale Electricity Markets, prepared by Potomac Economics Ltd., released in August 2011) found that, because of market regulations and ERCOT’s curtailment activities at peak loads, the market clearing price in ERCOT during scarcity events has not produced sufficient revenues required for new entry in three out of the four years from 2007 to 2010. Accordingly, it remains to be seen whether an energy-only market that includes a price cap and other controls to prevent outages due to insufficient capacity can successfully ensure resource adequacy in the long term.

MISO: Capacity Requirements Plus a Voluntary Auction

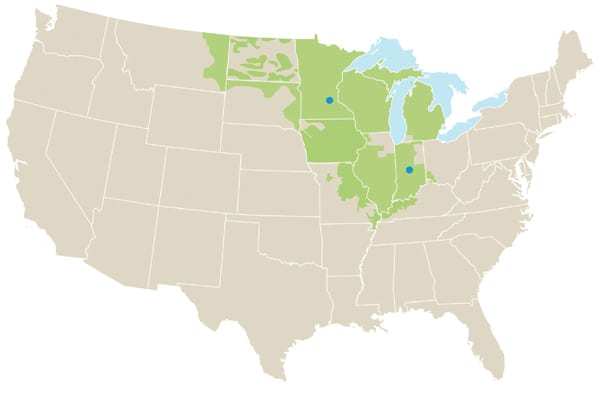

The Midwest Independent Transmission System Operator Inc. (MISO) operates the transmission system in all or parts of 11 Midwestern states (Figure 4). MISO began developing a resource adequacy plan in 2004, and by 2008, FERC approved of its basic approach, subject to certain market monitoring adjustments that were still ongoing in 2011.

|

| 4. MISO service territory. Courtesy: MISO |

MISO’s resource adequacy construct establishes a reserve margin for each LSE for each zone the LSE serves, although MISO defers to a reserve margin mandated by a state for an LSE. Based on an LSE’s forecasted peak demand, demand-side resources, and reserve margin, MISO annually establishes the Planning Reserve Margin Requirement (PRMR) that each LSE must have during the next Planning Year that begins June 1.

Those owning resources that can be delivered into MISO may dedicate them to meeting resource requirements in MISO if they convert the capacity value of such resources into Planning Resource Credits (PRC) in MISO’s capacity tracking system. A PRC represents one MW-month of capacity for a specified month during the Planning Year, and the energy from capacity converted to a PRC must be offered into day-ahead and day-of energy markets for the Planning Month.

LSEs must demonstrate on a month-ahead basis during the Planning Year that they have acquired sufficient PRCs to meet their PRMR obligation. LSEs may self-supply their PRCs, buy them through bilateral transactions, or obtain them in MISO’s voluntary capacity auction. In the event that an LSE does not obtain enough PRCs to cover its PRMR for a month, it is subject to a deficiency charge that must be paid to MISO, which then distributes it among LSEs that were in compliance.

MISO’s voluntary capacity auctions for PRCs, which started in 2010, are held monthly, shortly before the upcoming Planning Month, and all cleared PRCs receive the auction clearing price. MISO settles the auction by charging buyers and crediting sellers.

The voluntary auction was quite controversial when proposed to FERC. Some stakeholders opposed any a centralized capacity market in MISO, and others contended that the voluntary auction should be mandatory. In reality, MISO has a capacity surplus that has resulted in very low auction prices.

MISO has continued to try to improve its model for resource adequacy, and in July 2011 it proposed to FERC to totally revamp its model effective October 1, 2012. MISO claims its proposed “enhancements” will implement new market mechanisms that recognize the physical location of resources, make it easier for load-modifying resources to participate, and establish a new category for an “Energy Efficiency Resource.” MISO proposed seven zones to provide market signals that show the locational value of capacity. The existing monthly voluntary auction would be dropped in favor of an annual Planning Resource Auction that would provide clearing prices for each zone.

Under the proposal, all LSEs will meet their PRMR obligations by participating in the Planning Resource Auction, by self-scheduling their own resources in the Planning Resource Auction, or by using certain opt-out procedures. Resources that clear the auction would be dedicated to MISO’s resource adequacy for the entire Planning Year. An LSE with a resource plan that fully covers the LSE’s PRMR for a zone will be able to opt out of the auction for that Planning Year. MISO insisted that it was not trying to create a mandatory forward capacity process, as in PJM, but was merely supplementing the “largely bilateral” market for capacity in MISO.

This filing has faced extensive criticism. A large number of parties, representing many different interests, have protested it on various grounds, including that it is too complex, too vague, unnecessary to ensure resource adequacy in MISO, impinges on state authority, and its auction rules do not promote forward planning. As of the date this article was written, FERC had not issued an order in response to the proposal, but it seems clear there will be significant litigation over this proposed new resource adequacy construct.

ISO-NE and NYISO: Variations on Capacity Markets

Two other RTOs/ISOs are briefly noted here because each has distinct approaches to resource adequacy, and like those discussed above, each continues to revise its structures after years of efforts.

ISO New England Inc. (ISO-NE) has a Forward Capacity Market (FCM) with an annual auction that sets prices for capacity three years in advance. In 2011, FERC issued a lengthy order addressing significant proposed revisions to the FCM market rules, and after continued protests, issued an order on rehearing in January 2012 that discussed, among other things, buyer-side market power mitigation measures in the auction. A generators’ group has since appealed that order to court.

In the New York Independent System Operator (NYISO) region, LSEs are assigned locational capacity requirements. Monthly installed capacity markets are held and prices are established through the use of PJM-like demand curves. FERC issued orders in 2011 addressing concerns about the demand curve and CONE values that were being used to produce capacity prices. In January 2012, those orders were appealed to court.

Resource Adequacy and Mandatory Reliability Standards

In 2011, the issue of whether resource adequacy could and should be addressed through electric reliability standards was raised. In 2005, Congress required FERC to implement mandatory electric reliability standards for the bulk power system, which it has done in conjunction with the North American Electric Reliability Corp. (NERC) and regional reliability organizations (RROs). One of the RROs, Reliability First Corp., proposed a mandatory standard for its region that would require entities responsible for evaluating transmission and resource plans to annually calculate the reserve margin for their respective areas using a specific day in ten year loss of load probability criterion. NERC then asked FERC to approve the standard.

State utility commissions objected to FERC that resource adequacy was not intended by Congress to be addressed as a reliability standard, and that setting reserve margins was traditionally a state concern. FERC, noting that resource adequacy raises complex state-federal jurisdictional issues, held that resource adequacy concerns are relevant to bulk power system reliability. Furthermore, FERC said, the standard proposed here requires only that a specified analysis be performed; it does not require any entity to secure resources, nor does it preempt state action in that regard. Thus, FERC approved the reliability standard but did not determine the merits of the “one day in ten year” analysis criterion.

NERC has also been considering a nationwide reliability standard addressing resource adequacy, but nothing has yet resulted from that effort.

No End in Sight

Ensuring resource adequacy is difficult but critically important for grid reliability. It also affects significant revenues for capacity sellers and costs for buyers and raises jurisdictional issues between FERC and the states. Given those stakes, it is perhaps not surprising that, despite years of efforts, debates continue over the best approach to ensure resource adequacy in competitive markets.

— Brian R. Gish ([email protected]) is of counsel in Davis Wright Tremaine’s Energy Practice Group.