EIA: U.S. Coal Stockpiles Lowest Since 1978

The U.S. Energy Information Administration (EIA) recently said it expected coal-fired power generation in 2021 to be 22% higher than in 2020, producing the first year-over-year increase in U.S. electricity generation from coal since 2014. That higher generation, though, has reduced inventories of coal at the nation’s power plants, with EIA on Dec. 7 reporting its most recent accounting of coal stockpiles showed inventories at their lowest level in more than 40 years.

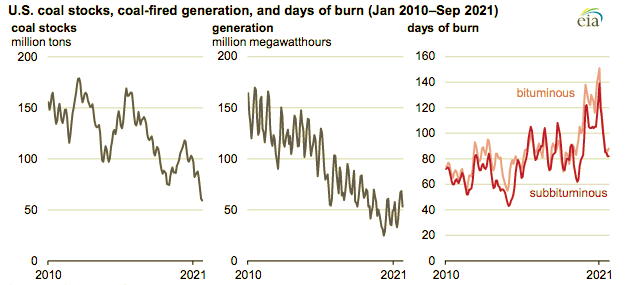

The agency on Tuesday said coal-fired generation this year has been buoyed by mostly stable prices for coal, while the price of natural gas moved higher. The EIA reported coal stockpiles at U.S. plants totaled about 80 million tons at the end of September (Figure 1), the lowest level since March 1978. The agency said that while the increased use of coal this year is a factor, it also said stockpiles have fallen over the past several years as more U.S. coal-fired plants have been retired, and remaining coal plants are operated less often, reducing the need for larger inventories.

The EIA in its report published Tuesday said that U.S. coal-fired power plants usually stockpile “much more coal than they consume in a month,” and acknowledged that “physical delivery constraints in the supply chain limit how quickly coal plants can increase their stockpiles.” The group said coal consumption by power plants is usually higher in summer and winter when temperatures are warmer or colder, and lessens during spring and fall when milder temperatures are present.

The agency also cited “days of burn,” what it called “another metric to monitor the sufficiency of coal supplies.” That data (Figure 2) accounts for power plant retirements, and the lower utilization of coal-fired generation capacity. Days of burn is a “forward-looking estimate of current inventory levels [that] uses past consumption patterns to estimate the number of days an inventory level will last, assuming power plants receive no additional coal.”

The government agency said that “because of less coal consumption as well as coal capacity retirements over the past three years, the days of burn of U.S. coal remain within the typical range, even though total stocks are low.”

Some energy officials have expressed concerns about the ability of coal-fired power plants to have enough coal on hand through this winter season, due to mine closures that have lowered U.S. production of coal, and supply chain disruptions.

Power grid operators are monitoring coal inventories. PJM, the regional transmission organization (RTO) serving much of the Northeast, and operator of the nation’s largest electricity system, has instituted what it called temporary changes to rules governing minimum inventory requirements at power plants as a way to provide more flexibility for coal-fired generators. The RTO said the move was in response to low coal stockpiles at some plants, and continuing supply chain disruptions.

The North American Electric Reliability Corp. (NERC) in its recent 2021–2022 Winter Reliability Assessment warned that a major portion of the U.S., from the Great Lakes into Texas, could face power shortages if extreme winter weather occurs in the coming months, noting concerns about more than just the supply of coal. NERC said its warning came along with the possibility of disruptions in the supply of natural gas, and continued low rates of hydropower generation.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).