CCUS: Big Opportunity and Hard Questions

For the world to avoid a climate catastrophe, carbon capture is likely a necessity, not an option. To meet the Paris Agreement’s objectives—keep warming below 2C and preferably near 1.5C—net zero carbon emissions must be achieved circa 2050, and some carbon dioxide will have to be extracted from the atmosphere. Deployment of carbon capture, utilization, and storage (CCUS) may be essential to these objectives. According to the International Energy Agency (IEA), “Reaching net zero will be virtually impossible without CCUS.”

A window has opened for CCUS in the U.S. The federal Energy Act of 2020 includes authorization for new CCUS demonstration projects and an extension of the “45Q” tax credit eligibility period for CO2 sequestration. The proposed Biden infrastructure plan includes further enhancements to 45Q including direct payments in lieu of tax credits. A federal court threw out the Trump administration’s weak carbon control plan, opening the door for the Biden administration to implement an aggressive climate policy.

These developments expand the opportunities for CCUS, but also set a clock ticking—decisions will have to be made on formulating and meeting carbon emissions targets, including the role of CCUS. This article will identify key issues that American policymakers must resolve to develop a successful CCUS strategy, including for the power industry.

The Need for CCUS

CCUS policy discussions of CCUS in the U.S. are entangled with arguments over the fate of coal-fired power plants. These are distinct issues, and government and industry must make this clear to garner public and political support for carbon capture. Regardless of whether coal-fired power survives, CCUS is likely needed to meet national and global carbon goals.

CCUS is critical to climate strategies because of its adaptability. CCUS can be used to capture CO2 from power generation, heavy industry, hydrogen production, and, through the intermediary of biomass or via direct air capture, from the atmosphere. CCUS also plays a role in what has been called a “just” transition to a low-carbon economy. Not all regions have access to good renewable resources or low-cost natural gas. In some places, ending local fossil fuel production and consumption may be economically and politically infeasible. In these cases, CCUS will be essential to carbon control.

CCUS is also central to the least-cost pathways to net zero. Renewables are not always the lowest cost option for carbon reductions, particularly for hard-to-abate sectors like cement production, and it may not be economic (nor politically viable) to prematurely retire new and efficient coal-fired generators, particularly in Asia. The IEA put it plainly: “A failure to develop CCUS for fossil fuels would substantially increase the risk of stranded assets and would require around USD 15 trillion of additional investment in wind, solar and electrolyzer capacity to achieve the same level of emissions reductions. It could also critically delay progress on BECCS [bioenergy with carbon capture and storage] and DACCS [direct air capture with carbon capture and storage]: if these cannot be deployed at scale, then achieving net-zero emissions by 2050 would be very much harder.”

Does It Work? The Petra Nova Experience

Is CCUS a viable technology or a chimera? The technical challenge has been scaling-up and adapting petrochemical industry technology to larger gas volumes, lower pressures, and lower CO2 concentrations. This challenge appears to have been met by the Petra Nova project in Texas, a $1 billion demonstration project funded with federal and private investment. Petra Nova used amine-washing of the flue gas to remove 90% or more of the CO2 from a 240 MW slipstream at NRG’s coal-fired W.A. Parish Unit 8. During its 2017–2020 demonstration period, the project encountered various technical problems, but none were insurmountable and over time operations improved. In 2019, the facility captured 95% of the total volume of CO2 targeted. Petra Nova was a demonstration project, but it appears to have set the stage for commercialization.

But if Petra Nova was a technical success, it is also a cautionary tale. Petra Nova has been mothballed since May 2020 because it is uneconomic. The financial rationale for the project was based on using the captured CO2 to increase recovery from an oil field; an NRG spokesman plainly stated that “The economics of [petroleum sales] are what make this a valuable prospect. It’s not selling the CO2.” But oil production increased less than expected and oil prices dropped, making the project a financial failure. Even before the plant was mothballed NRG had taken three impairment charges totaling $310 million against the project.

The Petra Nova experience raises core issues for policymakers. First is compensating for the high cost of the technology. In addition to capital investment and operating costs, a CCUS facility imposes a steam and electricity load equivalent to about 25% to 30% of the host’s net generation. The Department of Energy’s (DOE’s) own conclusion, in its final report on Petra Nova, was that “the economics of large-scale carbon capture facilities are challenging.” Although CCUS technology costs are expected to decline, even on the order of 20% to 30%, government incentives will still be needed to drive CCUS deployment.

Another issue for policymakers highlighted by Petra Nova is the wisdom of relying on enhanced oil recovery (EOR) as the financial underpinning for a CCUS project. In the short-run, relying on EOR puts the project at the whim of volatile oil prices. Over the longer-term (which may not be that long, as peak oil demand approaches), relying on sales of a fossil fuel to support a technology, which is an element of a policy designed to reduce the use of fossil fuels, is arguably self-defeating.

Coal and CCUS

CCUS was once essentially a coal story: CCUS was the solution that would keep coal viable in a carbon-controlled future. But that story is obsolete. Natural gas reserves and supplies are ample, and the combination of inexpensive natural gas and modern combined cycle power plants provides a more efficient and less costly means of generating electricity than coal boilers. Combined cycles and stand-alone gas turbines are also better suited for load following and meeting peaks in a renewable-centric grid, while also providing firm capacity (particularly units with fuel oil backup).

The utilization of American coal plants has plunged in recent years due to the lower variable costs of gas, wind, and solar generation. A coal plant with CCUS would need mammoth subsidies to dispatch under current conditions. Moreover, the universe of coal-fired retrofit candidates in the U.S. is limited, arguably less than 65 GW of coal capacity (using criteria of minimum unit size of 200 MW, at least 15 years remaining until planned retirement, and less than 40 years old). There are no firm plans to build new coal plants in the U.S., and although the federal government has continued to promote coal technology, such as through the Coal FIRST program, significant capacity additions are unlikely. Domestic competition from natural gas and renewables, and the political headwinds, are too powerful. But overseas is a different matter.

Asia is probably a much better market for CCUS coal retrofits than the U.S. The average age of coal-fired capacity in Asia is about 20 years, and in China about 13 years, compared to 40 years in the U.S. and about 35 years in Europe. The Asian market is also large. As of January 2021, 1,648 GW of coal-fired capacity was operating or under construction in Asia, of which 517 GW is outside of China. Total U.S. coal capacity is about 219 GW and dropping.

Developing Asian nations are unlikely to completely abandon their investment in new coal-fired plants. If the largest market for coal CCUS is overseas, American industry and government must decide how to effectively compete. Decisions may have to be made about R&D priorities; that is, between work aimed at export markets and research that will have the biggest payoff in the U.S., such as adapting CCUS for gas-fired generation.

Natural Gas and CCUS

A renewable grid with battery storage will still need dispatchable thermal power. A 2021 study by the National Academies concluded that the “variability of wind and solar makes it impossible to maintain a reliable electricity system with these sources alone.” Gas-fired combined cycles, not coal boilers equipped with carbon capture, will probably fill the thermal generation role because of their superior economics and load-following performance. However, the CCUS technology that has been developed to date for coal plants cannot, so to speak, be simply slapped onto a natural gas combined cycle (NGCC) plant. One review observes that “It may come as a surprise that [carbon capture] for natural gas-fired combined cycles is even more challenging than for coal-fired plants.” This is because of significant differences in the exhaust gas. For instance, the exhaust from a NGCC has a higher oxygen content and a lower CO2 concentration, factors that impact the design and operation of the CCUS system.

The IEA has pinpointed CCUS for gas-fired plants as an area where a near-term push from R&D is needed. DOE’s National Carbon Capture Center is now bringing online a new facility that will allow the laboratory to conduct its “first test runs of carbon capture technologies using actual natural gas-derived flue gas.” That this is only happening in 2021 is indicative of the past coal focus of CCUS research. Going forward, policymakers may need to rebalance R&D from coal to natural gas and other CCUS applications.

Hydrogen

Hydrogen combustion in gas turbines, which yields no greenhouse gases, is another means of preserving thermal power. But hydrogen is climate-friendly only if its production is a low- or zero-carbon process. The ideal is “green” hydrogen made from the electrolysis of water using wind or solar electricity. An alternative is to produce “blue” hydrogen from steam methane reforming (SMR) of natural gas or (less likely) coal gasification with CCUS. These processes yield hydrogen and a CO2 waste stream that can be captured with CCUS. Economics currently favor blue hydrogen; green hydrogen is estimated to be about two to three times more expensive.

Green hydrogen is expected to eventually close the cost gap with blue; estimates range from the early 2030s to circa 2050. There may be a window for blue hydrogen before green dominates—especially where electricity prices are high and renewable resources are poor—but the duration of this window is highly uncertain. On the one hand, a recent IEA report on achieving net zero carbon by mid-century concluded that even in 2050 about 40% of global hydrogen production will come from SMR/natural gas facilities with CCUS. But there are also developers aiming to produce green hydrogen in the U.S. at competitive prices by 2030, including a project co-sponsored by the Los Angeles Department of Water & Power. BloombergNEF recently concluded that green hydrogen will probably outcompete blue in all major markets as early as 2030, and in some locations—including the U.S.—green hydrogen will even approach price parity or better with unabated hydrogen production.

Producers may be reluctant to build SMR-CCUS facilities that will become stranded assets if electrolysis costs drop quickly. There is also a chicken and egg problem. Demand is needed to incentivize hydrogen production, but power companies and other consumers will want assurance of supply and price before they invest in hydrogen transportation and combustion facilities. Policymakers will need to determine if they believe blue hydrogen is part of the climate solution, and if so, determine what research and incentives are needed to kickstart a hydrogen industry and spur the development of CCUS technology optimized for SMR plants.

Bioenergy

BECCUS is another option for low-carbon thermal power. In this approach, biomass waste or vegetation planted expressly to pull CO2 from the atmosphere is harvested and burned to generate electricity. A CCUS system is used to capture 90% or more of the CO2 from the flue gas.

BECCUS checks several boxes: It provides dispatchable, firm (albeit slow ramping) capacity using conventional steam-electric technology; involves no fossil fuels; and perhaps most importantly, it is a carbon dioxide removal (CDR) technology. In the current controversies over strategies for reducing carbon emissions, the central role of CCUS in removing CO2 from the atmosphere may receive short shrift. In a 2018 report on limiting warming to 1.5C, the Intergovernmental Panel on Climate Change found that all of the pathways considered required CO2 removal.

BECCUS may also be part of the solution for decarbonizing aviation, a sector for which electrification is impractical. One answer is to manufacture synthetic jet fuel from blue or green hydrogen and the CO2 captured from BECCUS systems. The resulting fuel cycle will be carbon neutral or nearly so.

There is an apparent simplicity and even elegance to BECCUS, but the reality is complex. Using BECCUS to remove large volumes of atmospheric CO2 (on the order of 10 billion to 20 billion tonnes annually), as assumed in some net zero pathways, would require devoting large areas to growing energy crops. This turns the idea of a just transition on its head because of the likely disruption to food and water supplies, biodiversity, and rural communities. A recent study found that the maximum mid-century contribution of BECCUS without disruptive side effects is about 2.5 billion to 5.0 billion tonnes of CO2 annually. This is accomplished by relying largely on biomass wastes from agriculture and forestry instead of growing energy crops.

BECCUS raises important questions for American policymakers. For example, how should BECCUS fit into the mix with natural gas and hydrogen as a future source of firm thermal power; will work on carbon removal technologies like BECCUS distract from the urgent goal of reducing emissions; and how far can BECCUS be implemented in the U.S. without food, water, and community disruptions?

Steel, Cement, and Hubs

The focus of CCUS research and policy to date has been electric power, and especially coal applications. But heavy industry, which globally accounts for about 20% of CO2 emissions, may be the sector where CCUS has the greatest value. Products like cement and steel depend on high temperatures, use hydrocarbons as feedstocks, as well as fuel, and cannot be easily electrified. In these instances, CCUS is a primary option for carbon control. Tellingly, the Energy Act of 2020 and the Biden infrastructure plan include industrial CCUS demonstration projects.

The need to equip the cement, steel, and other heavy industries with CCUS systems has implications for electric power. A larger market and wider use of carbon capture may help to advance technologies and drive down costs. Implementation of carbon capture will require the development of CO2 pipeline networks and sequestration sites. Adding heavy industry to the mix should yield economies of scale that will benefit the power sector.

Also relevant to electric power is the concept of carbon capture “hubs.” The notion is to reduce costs by clustering carbon-emitting industrial and power plants so that large, relatively economical capture, transport, and storage facilities, including compressors, pipelines, and sequestration sites, can be built to serve multiple customers. However, the hub concept is fraught with questions about government direction of economic development, and of which regions and states will win and lose if certain industries are geographically concentrated.

Moving Forward

The purpose of this review has been to highlight the issues American industry and policymakers must confront to formulate a successful CCUS policy. These issues and the questions they raise are summarized below.

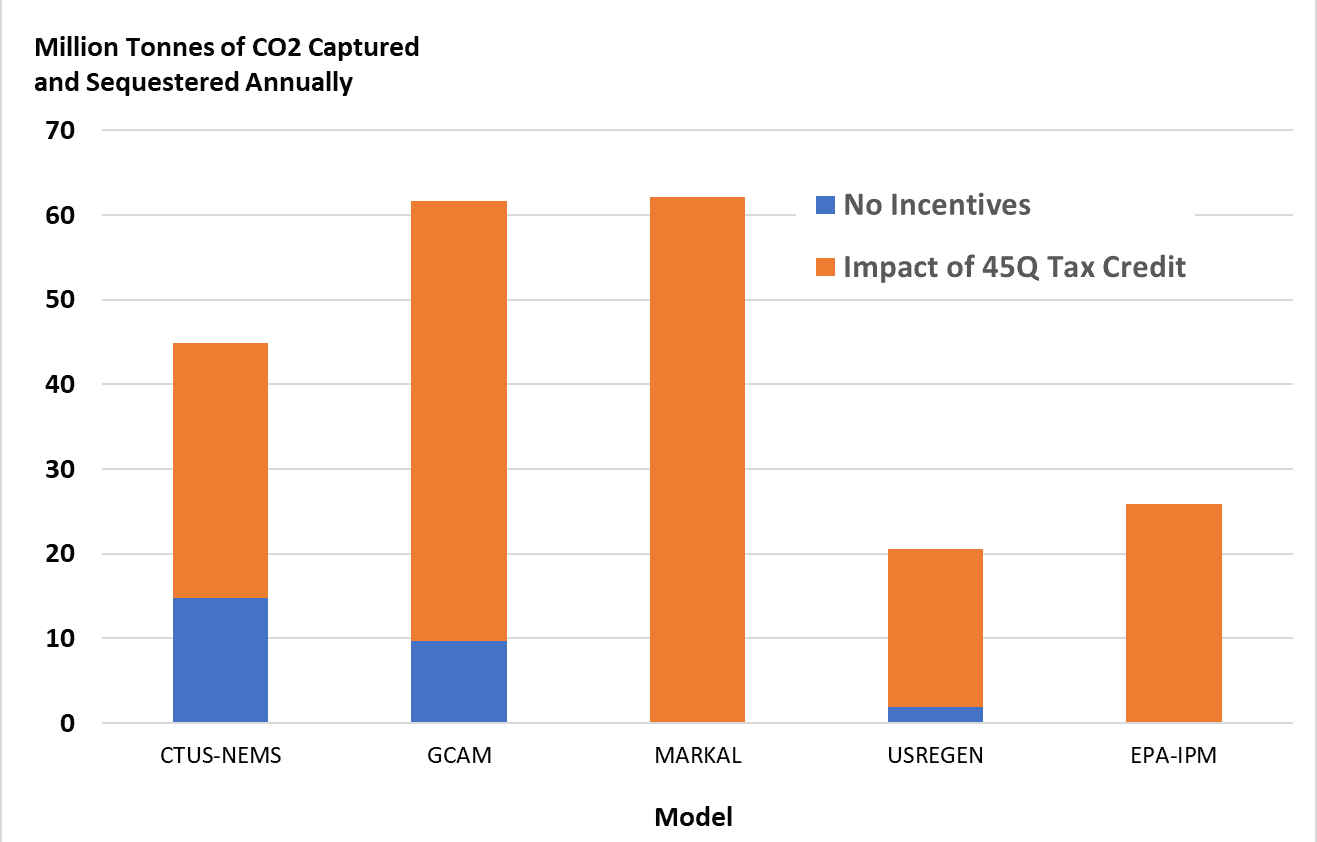

CCUS Deployment Requires Robust Government Support. While CCUS may eventually become economically self-sustaining, particularly if a carbon price is established, it needs government financial support to launch. This is illustrated by a compilation of work done for the Stanford Energy Modeling Forum 34 study on the impact of the 45Q tax credit on utilization of CCUS in 2030. The credit was evaluated using five models, including the KeyLogic/OnLocation version of the National Energy Model System with enhanced simulation of CCUS (Capture, Transport, Utilization and Storage—National Energy Modeling System [CTUS-NEMS]). As shown in Figure 1, although there is wide variation in the estimates of CO2 captured in 2030, the models all agree that without the tax credit CCUS utilization will be minimal or even nil.

To secure long-term and expanded federal support, industry and government must build a compelling case that CCUS is an essential part of the climate solution. Doubts extend beyond environmental activists; a recent Wall Street report remarked that “despite almost 20 years of endless hype” carbon capture technology has achieved little. Policymakers must convince the public and the private sector that CCUS is neither a white elephant nor a Trojan Horse conjured up by the energy industry to justify continued use of fossil fuels.

Technical and Market Priorities Must Be Set. CCUS and related technologies are expensive; decisions will have to be made on allocating R&D spending and technology incentives. An example is hydrogen production. Policymakers must first decide if hydrogen will be a major component of decarbonization, and if so, whether to place a bet on blue hydrogen or to focus CCUS efforts elsewhere and wait for green hydrogen costs to come down.

Another question is whether American CCUS development should be driven by foreign market opportunities. The clearest example is coal-fired electric power. Coal plants may be unpopular and disappearing in the U.S., but there is a huge fleet of new coal plants in Asia that will likely operate for decades. This argues for a continued major investment to commercialize CCUS for coal although the domestic market will be small. The same logic applies to CCUS development for integrated steel and cement production, both of which are much larger businesses overseas than at home.

Find the Right Mix of Incentives. Although the 45Q tax credit for carbon sequestration was recently extended, this is unlikely by itself to be sufficient to drive large-scale deployment of CCUS. A recent study by Columbia University concluded that “CCUS projects lack sufficient policy support to obtain conventional financing” and suggested a range of additional incentives, including investment tax credits, accelerated depreciation, and production tax credits for electricity sold by CCUS-equipped generators. The IEA believes CCUS deployment will require a three-legged stool of financial supports: a value on carbon, investment and operating cost subsidies for early projects, and government absorbing the risk associated with indefinite storage of sequestered CO2.

Policymakers also need to consider how to design incentives for specific CCUS applications. Because CCUS applications are so diverse, a one-size-fits-all incentive may be suboptimal. For example, the 45Q tax credit is tied to the volume of CO2 sequestered. This makes it a less effective incentive for installing carbon capture on gas-fired combined cycles than on coal plants because the former emits much less CO2 per MWh. A different or larger incentive may be needed to encourage CCUS at gas-fired plants.

Policymakers Need to Identify and Resolve Data and Regulatory Gaps. The legal and regulatory underpinnings for CCUS development are deficient. In a 2015 report, the National Coal Council found that even basic data on sequestration sites was lacking and noted that “Without adequate characterization, CO2 cannot be captured, transported, and stored routinely and reliably at large scale.” A 2020 study by the United States Energy Association reached similar conclusions on the state of the regulatory and legal framework for CCUS, finding that “Regulatory uncertainty and inconsistency present a significant obstacle to widespread implementation of projects and infrastructure.” In 2019, the National Petroleum Council recommended a government-sponsored forum to develop standards to address legal responsibilities and insurance for long-term liabilities. The U.S. could find itself with commercial CCUS technology it cannot deploy at scale and speed because it lacks the legal and regulatory predicates for building pipelines and storage sites.

And Finally, Timing Is Crucial. A common element of proposed climate strategies is to initially focus on the low-hanging fruit—such as building wind and solar power and retiring coal plants—followed by CCUS deployment to control emissions from the remaining combustion sources and for carbon removal. For this approach to succeed, the groundwork must be laid now. The National Academies report found that work on carbon capture must be accelerated over the next 10 years to provide options for deployment in 2030–2050. As noted at the beginning of this article, the clock is ticking for decisions on how CCUS will play in America’s energy and decarbonization policy.

—Stan Kaplan ([email protected]) has worked in the electricity and fuels areas since 1978, as a consultant, regulator, utility executive, and until retiring in 2018, a senior manager with the Department of Energy. He is currently an energy consultant with KeyLogic.