As Renewables Surge Ahead of Coal, Lawmakers Introduce National Renewable Standard

A bill introduced by Senate Democrats on June 26 establishes a national electricity standard that would require large retail suppliers to source at least 1.5% of their power from renewables by 2020 and gradually grow that share through 2035.

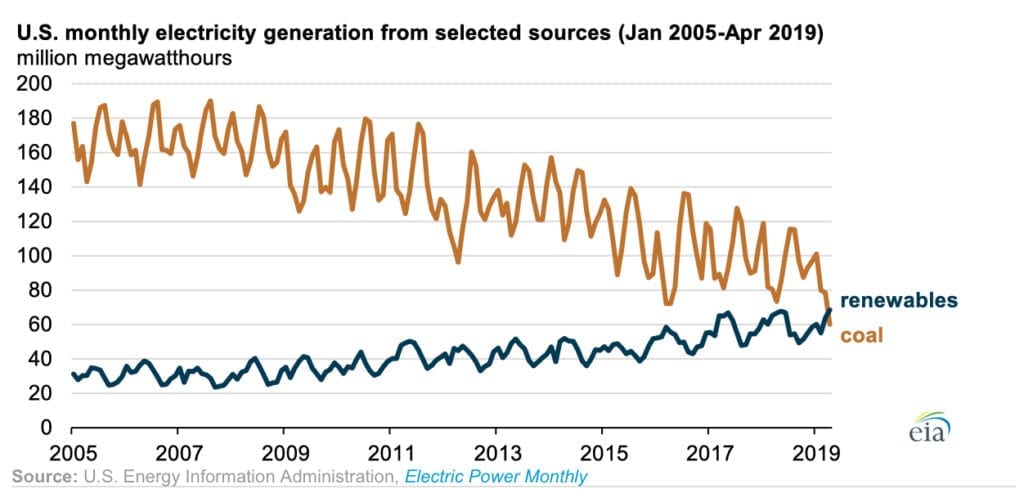

The measure comes a day after the Energy Information Administration (EIA) revealed monthly generation from renewable sources exceeded coal-fired generation in April 2019 for the first time in the U.S.

A Federal Electricity Standard for Renewables

The Renewable Electricity Standard Act of 2019 introduced by Sens. Tom Udall (D-N.M.), Martin Heinrich (D-N.M.), Sheldon Whitehouse (D-R.I.), Tina Smith (D-Minn.), and Angus King (I–Maine), would amend the Public Utility Regulatory Policies Act (PURPA) of 1978—a law that has historically played an important role in the development of renewable technologies and the power sector’s transition to competitive markets—to ensure future growth of renewables.

The bill seeks “to achieve at least 50% renewable electricity nationwide in just 15 years—putting the U.S. on a trajectory to decarbonize the power sector by 2050,” a statement from Sen. Udall’s office said on Wednesday. That’s “roughly double business as usual and nearly triple current levels (17.6% in 2018),” it noted.

However, it also includes a provision that encourages states to create their own renewable or clean energy standards, which it says would function “above the federal renewable electricity standard.”

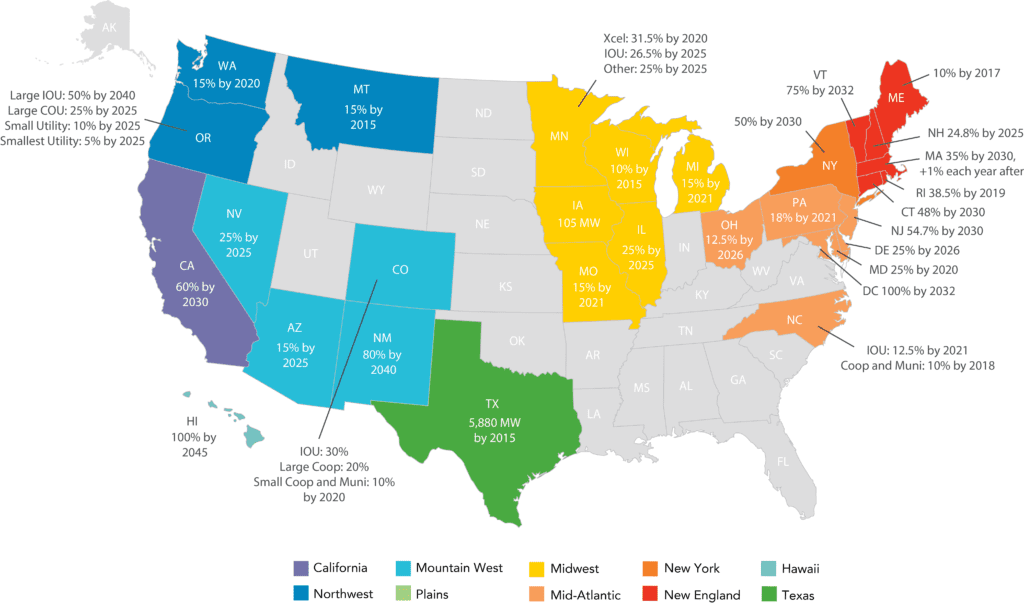

At the end of 2018, 29 states and Washington D.C. had a renewable portfolio standard (RPS), while eight states had renewable portfolio goals. State RPS targets range widely—from 10% to 100% renewable energy, and at least seven states—California, Hawaii, Massachusetts, New Jersey, New York, Oregon, and Vermont, and Washington, D.C.—have requirements of 50% or greater.

According to the EIA, states with legally binding RPSs collectively accounted for 63% of electricity retail sales in the U.S. in 2018. If it is enacted, the bill would mainly affect retail electric suppliers, who would need to source an increasing percentage of their “base quantity of electricity”—or the total quantity sold, measured in kilowatt-hours—from renewables.

The schedule requires retailers who sell more than 1 TWh a year to source at least 1.5% of their power from renewables in 2020, but to increase that share by 2% every year between 2021 and 2029. In 2030, the annual percentage increase would rise to 2.5% through 2035. For retailers who sell less than 1 TWh, the percentage increases would be half of what is stipulated for large retailers. Retailers would satisfy the bill’s requirements through federal renewable energy credits (1 kWh is one credit), which are obtained by purchase or exchange, and which will be tracked through state or regional tracking systems.

Eligible renewables include solar, wind, ocean, tidal, geothermal, landfill gas, and hydrokinetic power, as well as from what it calls “renewable biomass” and “incremental hydropower.” Notably absent from the bill is power sourced from existing hydropower facilities and wood-to-energy biomass plants.

Under the bill, “renewable biomass” includes crop byproducts and residues that are harvested from actively managed agricultural land that was cleared before 2019, closed-loop biomass, byproducts of wood or paper mill operations, small diameter trees, logging residues, and trees removed for “ecological restoration.” It defines “incremental hydropower” as generation that has been achieved from upgrades at existing hydro facilities. As a spokesman from the National Hydropower Association (NHA) confirmed, this limits eligible hydropower to upgrades, efficiency, and non-powered dams.

“As Congress and states continue to develop clean energy goals, it’s clear that hydropower, existing and new, must play a key role in achieving carbon emission reduction targets,” the trade group told POWER on June 27. “In fact, hydropower is the renewable that integrates other renewables like wind and solar onto the electrical grid. We believe that hydropower, in all its forms, should be counted as an eligible renewable, and we will continue working with members of Congress as the bill moves forward.”

Why a National Renewable Standard?

The legislation says the measure is needed for several reasons, including that renewable power is the “cheapest new form of electricity in many regions” of the U.S. It also says that every state “must transition to carbon-free electricity by 2050” to meet U.S. climate goals, and that renewable energy is a “virtually unlimited” resource that can help avoid pollution.

The bill says states without high levels of renewable power “should not be penalized for past inaction,” but it suggests they should comply with an annual percentage increase schedule. As notable is that it gives the Energy Secretary the authority to allow states to opt-out of the federal standard if they produce more than 60% of their power from renewables or have a program that will ultimately exceed the federal standard. And in another significant provision, it directs the Federal Energy Regulatory Commission to ensure transmission providers identify the electric transmission needs driven by the bill.

Udall’s statement noted the bill has already received endorsements from a wide range of groups such as American Council on Renewable Energy (ACORE), American Wind Energy Association (AWEA), Appalachian Voices, Climate for Health, ecoAmerica, Environment America, Environmental Law and Policy Center, Environmental Working Group, Health Care Without Harm, Interwest Energy Alliance, League of Conservation Voters, National Wildlife Federation, Physicians for Social Responsibility, Rocky Mountain Institute, Sierra Club, Solar Energy, Industries Association (SEIA), Union of Concerned Scientists, and the Wilderness Society.

Initial reactions to the bill, which began trickling in on Wednesday, were mostly from renewable trade groups. Tom Kiernan, CEO of AWEA, for example, said the measure proposed a “flexible framework for states to make meaningful power-sector carbon emissions cuts, fueled by market competition between renewable energy technologies.” Kiernan added, “This is the kind of policy, along with improvements to transmission planning and permitting, that is needed to build a 21st century clean economy, drive major new investment in wind farms, grow demand for U.S. factories, and cut consumer energy bills.”

Renewables (as well as Nuclear) Surge Ahead of Coal

The national renewable electricity standard was introduced barely a day after the EIA revealed that renewable generation had surged ahead of coal in April. Renewable sources—including utility-scale hydropower, wind, solar, geothermal, and biomass—provided 23% of total electricity in the U.S. that month, compared to 20% from coal, the EIA said on June 26, citing data from its Electric Power Monthly.

The milestone was fueled by record generation from wind (30.2 TWh) and near-record generation from solar (6.9 TWh), which includes PV and solar thermal. Solar PV set an all-time monthly record in June 2018 with 7.3 TWh. Conventional hydropower facilities also produced higher amounts of power, owing in part to melting snowpacks. Hydropower generated 25.4 TWh; geothermal contributed 1.3 TWh; and biomass, landfill gas, and wood-derived fuels added a combined 4.6 TWh. That brought total generation from renewable sources in April to 68.4 TWh.

Comparatively, in April, coal plants produced 60 TWh—a little less than the nation’s nuclear plants, which produced 60.6 TWh. Petroleum liquids and pet coke, combined, produced 1.2 TWh. Natural gas and other gas dominated the national power scene, producing 103.9 TWh.

“This outcome reflects both seasonal factors as well as long-term increases in renewable generation and decreases in coal generation,” the EIA noted. Power generation from fuels such as natural gas, coal, and nuclear is often at its lowest point during spring and fall months, owing to temperatures that are moderate and lower power demand for heating and air conditioning, which leads many plants to schedule planned maintenance outages, while renewables tend to pick up due to seasonal conditions.

However, it also noted that coal generation has declined markedly from its peak a decade ago. “Since the beginning of 2015, about 47 GW of U.S. coal-fired capacity has retired, and virtually no new coal capacity has come online,” the EIA said. “Based on reported plans for retirements, EIA expects another 4.1 GW of coal capacity will retire in 2019, accounting for more than half of all anticipated power plant retirements for the year.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

Updated (June 27) to include RPS data and map.