As Nuclear Giant AREVA Reforms, Framatome Is Resurrected

Reforging its core business to return to competitiveness after record losses of €4.83 billion in 2014, French nuclear firm AREVA has split its five operational business units and rebranded them—again. All its assets related to the design and manufacture of nuclear reactors and equipment, fuel design and supply, and services to existing reactors now fall under Framatome, which until January 4 was known as New NP. Operations related to the nuclear fuel cycle will be undertaken by Orano, which until January 23 was known as NewCo.

Creation of the AREVA group itself was an overhaul effort. The company was formed in 2001 with the merger of Framatome, Cogema, a nuclear business of German giant Siemens, and French propulsion and research reactor arm Technicatome. Framatome—short for Franco-Américaine de Constructions Atomiques—was created in 1958 by Schneider, Merlin Gerin, and Westinghouse Electric to exploit the emerging pressurized water reactor (PWR) market. By 1975, the company had become the sole manufacturer of nuclear power plants in France, equipping French state-owned utility EDF with 58 PWRs, and gradually taking on more projects overseas, building reactors like South Africa’s Koeberg, South Korea’s Ulchin, and China’s Daya Bay and Ling-Ao. In 1989, Framatome and Siemens created a joint company called Nuclear Power International to develop the EPR, a third-generation reactor that complied with both French and German nuclear regulations. The companies eventually merged in 2001, retiring the Framatome name and giving birth to AREVA.

One of the company’s most prominent contract wins came in 2003 from Finnish utility Teollisuuden Voima Oy (TVO) for construction of the world’s first EPR, Olkiluoto 3, in southern Finland. In 2007, AREVA also signed a contract with EDF for an EPR in Flamanville, France, and separately with Taishan Nuclear Power Co., a joint venture 70% held by China Guangdong Nuclear Power Holding Corp. and 30% by EDF. Two years later, Siemens withdrew its capital in Areva NP—AREVA’s specialized nuclear steam supply system arm—citing a “lack of exercising entrepreneurial influence within the joint venture” as the reason behind the move, and transferred its 34% stake to the AREVA group.

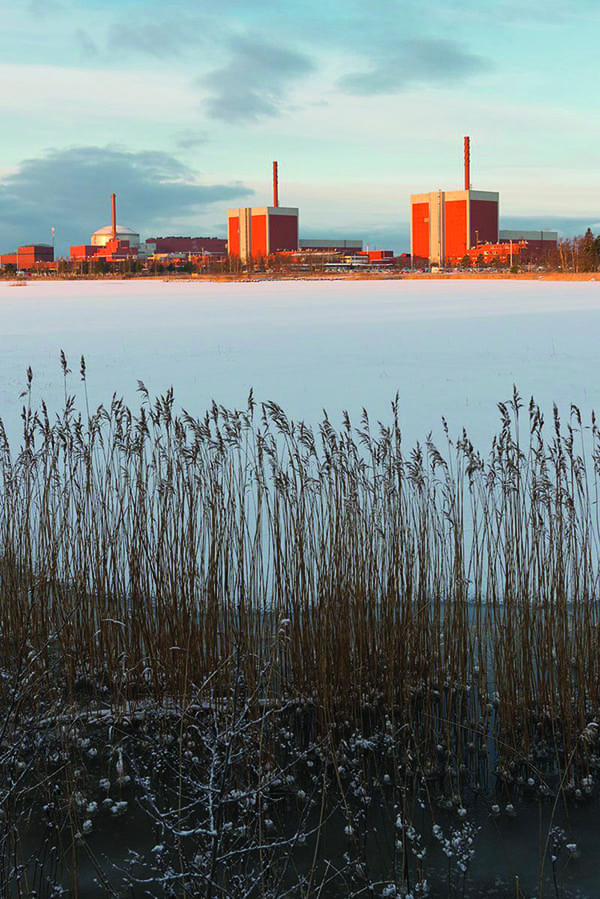

But plagued by delays and cost overruns at Olkiluoto 3 (Figure 3) and Flamanville 3, as well as at a research reactor construction project, and financially hemorrhaging from renewable energy contracts, AREVA’s finances began to fall into disarray, reaching record losses in 2014. In 2015, EDF moved to snap up between 51% and 75% of the troubled nuclear giant’s reactor business, encouraged by the French government’s attempts to address a rivalry between the two majority state-owned companies.

In November 2016, AREVA and EDF signed a contract conferring to EDF exclusive control of a new entity—New NP—that oversaw AREVA’s reactor design and equipment manufacturing, fuel design and assemblies manufacturing, and reactor services. Closure of the sale was completed in December 2017, and EDF became the majority owner (holding 75.5% of shares) of New NP, while Mitsubishi Heavy Industries took on 19.5%, and Paris-based international engineering firm Assystem held 5%.

Then in January 2018, the companies rebranded New NP, reviving the Framatome name in a move to harken to its celebrated legacy. Staffed by 14,000 employees worldwide, Framatome today has an “existing global fleet of some 440 reactors representing output of around 390 GWe in 31 countries, and with new nuclear capacity on its way, the nuclear market presents opportunities in the areas of components, fuel, retrofits and services,” the company noted in January.

The name’s luster has this year already been burnished by two significant developments for the company. On January 25, the French Nuclear Safety Authority (Autorité de Sûreté Nucléaire [ASN]) gave Framatome and EDF the green light to resume manufacture of forgings for the French nuclear fleet at its 2006-purchased Le Creusot site (Figure 4), which was taken offline following the French regulator’s 2015 discovery of an anomaly in the composition in certain zones of the Flamanville EPR pressure vessel head and bottom head. In 2016, a quality audit identified “irregularities” in paperwork on nearly 400 plant components produced at the forge since 1965. Preventative measures ordered by ASN stemming from that debacle in December 2016 shut down more than half of France’s reactor fleet, sending contract prices across Europe soaring.

Also, on January 25, Framatome finalized and launched Enfission, a 50-50 joint venture with Lightbridge Corp., to commercialize the U.S. fuel technology developer’s metallic fuel. Lightbridge says that the “seed-and-blanket” design can safely operate at increased power density compared to standard uranium oxide fuel. For Framatome, which provides next-generation fuel assembly designs to more than 100 of about 260 light water reactors around the world, the partnership will strengthen its position in the global fuel market.

As part of restructuring efforts in June 2016, meanwhile, AREVA also created a separate company focused on the nuclear cycle, which it called, simply, “New Company” (NewCo). On January 23, that company was renamed “Orano.” The name is derived from Ouranos, a Greek god who personifies the heavens and was father of the Titans, and who in Roman mythology became “Uranus.” In 1789, German chemist and mineralogist Martin Heinrich Klaproth named his newly discovered rare metallic element “uranium” for the planet Uranus, which had also been recently found.

For Orano, the name is important because it “symbolizes a new start,” said CEO Philippe Knoche in January. “We have big ambitions for Orano, namely for it to become the leader in the production and recycling of nuclear materials, waste management, and dismantling within the next ten years.” Knoche also said, however, that the company’s name is written in lower case because the prospect of rebuilding a profitable operation will be done “with humility.” For now, the company’s operations will bank on reprocessing and nuclear growth in Asia rather than investing in new mines, owing to low prices of uranium, which have slipped 80% over the last decade as the nuclear sector sees a general slowdown.

—Sonal Patel is a POWER associate editor.