Added Regulatory Hurdles Will Accelerate Coal Plant Retirements

The U.S. Environmental Protection Agency is developing a number of new regulations for the power sector governing air emissions, cooling water intake structures, and coal combustion waste disposal methods. Combined, these regulations have the potential to drive as much as 40% of existing coal-fired generating units to retire in the next 10 years, representing about 51 GW.

Over the past two-plus years, we have heard the regulatory drumbeat for the coal-fired power sector quicken and increase in volume. The U.S. Environmental Protection Agency (EPA) has, in quick succession, begun new rulemaking to reduce air emissions, established criteria for using once-through cooling water and its structures, and reopened the question of coal ash waste classification and disposal. The regulatory approach, driven largely by legal requirements, has also changed from past administrations. The plant-level, rather than market-based, structure of most expected regulations will force utility and merchant generators to address new control technology uncertainty, and how that uncertainty impacts future resource planning, in a relatively short period of time.

Under the coming rules, the critical uncertainties and trade-offs surrounding compliance planning will shift away from second-guessing legislative efforts and potential reliance on emission credit (allowance) markets. The EPA is developing a set of new rules within the confines of existing law and, in many cases, subject to court-ordered deadlines. That means that these rules will be implemented, barring any moves by Congress to actively delay their implementation (unlikely) or develop a legislative alternative (even less likely).

The role of allowance markets in the EPA’s compliance calculations will also be diminished. With the exception of the new Clean Air Transport Rule, expect the EPA rulemaking over the next two years to focus on compliance requirements at the plant level, rather than on broader regional or national cap-and-trade mechanisms, as was the case with the Acid Rain Program begun in 1995. As a result, compliance uncertainties are shifting away from allowance market economics and legislative analysis toward the economic viability of each plant and the effectiveness of controls at achieving the necessary emission reduction levels. However, the same fuel and power market factors, including natural gas prices, will be just as relevant as in the past. In addition, uncertainty over future CO2 regulations adds another layer of complexity to future resource planning.

New Rules, No Legislation

The EPA is currently working on a number of new regulations under the Clean Air Act (CAA), Clean Water Act (CWA), and Resource Conservation and Recovery Act (RCRA). The most pressing of those for coal-fired generators are the Clean Air Transport Rule (CATR) and the hazardous air pollutants maximum achievable control technology standards (HAPs MACT) under the CAA, the cooling water intake structure requirements under the CWA, and the coal combustion residuals- (ash-) handling requirements under RCRA. The EPA has proposed these new rules under the existing laws but has yet to finalize them. The final CATR and HAPs MACT rules are due this year, in July and November, respectively, while the water intake and ash rules are not due until 2012. Three of the four proposed rules (excluding CATR) require compliance at the plant level if plants wish to continue operating.

Air Rulemaking. The EPA introduced CATR as the replacement for the Clean Air Interstate Rule, which the U.S. Court of Appeals (D.C. Circuit) remanded back to the agency in 2008 for reconsideration. Of the four rules noted above, CATR is the only program with an allowance-trading component. It will implement a cap-and-trade program to reduce emissions of SO2 and NOx in the eastern U.S. to help states meet and maintain National Ambient Air Quality Standards for particulate matter (PM) and ozone. The EPA plans to start the program in 2012 with two regional allowance trading programs for SO2 emissions, one for annual NOx emissions, and one for ozone season (May through September) NOx emissions. Starting in 2014, the rule will limit allowance trading by requiring that emissions in affected states meet or fall below state-specific allowance budgets (caps) that the agency is developing.

The most anticipated new regulation by owners of coal-fired capacity is the HAPs MACT, or Toxics Rule (see “Anticipating the New Utility MACT Rules,” January 2011 in the POWER archives at https://www.powermag.com). The rule, proposed by the EPA on March 16, 2011, requires control of three hazardous air pollutants: mercury, hydrochloric acid (as a surrogate for the acid gases), and PM (as a surrogate for the nonmercury metals).

The proposed rule also calls for routine equipment maintenance to ensure optimal fuel combustion to reduce emissions of organic air toxics and dioxins/furans. Affected sources will include all coal-fired units over 25 MW. The rule imposes emission standards at the plant level for each surrogate gas.

Because the proposed MACT regulations allow for plant averaging, owners will be required to decide if they need to control each unit to meet the standard or retire some or all units at a plant. Plants will have three to four years from the publication date of the final rule to comply, depending on extensions that may be granted by the states.

Water Rulemaking. Section 316(b) of the CWA addresses withdrawals for cooling by point sources subject to the National Pollutant Discharge Elimination System (NPDES) program (see “Cooling Water Intake Structure Regulations,” October 2008). The EPA’s proposed rule under 316(b) will cover large existing thermal generating units (Phase II facilities, including coal-fired, nuclear, and other steam units) with flow design rates of 2 million gallons/day or greater for the impingement part of the standard and 125 million gallons per day for entrainment. It also will require compliance investments at plants with once-through intake systems. Compliance with the new regulation will be determined by the state and phased in over time as units come up for new NPDES permits.

Ash Rulemaking. Following the ash pond failure at Tennessee Valley Authority’s Kingston plant in 2008, the EPA released a proposed rule in April 2010 for the disposal of coal combustion residuals (CCRs). CCRs include fly ash, bottom ash, boiler slag, and flue gas desulfurization materials (see “New Federal Rules for Coal Ash Storage on the Horizon,” May 2009). In its proposal, the agency offered two potential regulatory approaches: one under RCRA Subtitle C and another under Subtitle D. Both approaches require that ash handling going forward be converted from wet to dry handling. Regulation under Subtitle C would require that such waste be handled as hazardous, which would impact disposal costs for ash at all plants. Subtitle D would not treat the ash as hazardous but would still effectively require that plants convert from wet to dry handling and close existing ash ponds. A subset of the Subtitle D approach, titled “D prime,” would allow plants to keep their existing ash ponds in place. The EPA will publish the final rule in 2012.

Compliance Costs Rise

Aside from the newest units, nearly all coal-fired plants will need to make some level of investment to comply with all of the new rules, and most plants will require investments in multiple types of controls, potentially including water and ash-handling equipment. Some types of controls will, however, provide compliance benefits across more than one rule.

For those plants that must reduce emissions to comply with CATR, control options will include wet or dry scrubbers and dry sorbent injection (DSI) for SO2, and selective catalytic reduction and selective noncatalytic reduction, along with combustion controls, for NOx. Affected entities under CATR will also be able to rely on allowance trading for compliance, so controlling emissions will remain an option rather than a necessity in most states.

The SO2 controls that might benefit a unit under CATR will also contribute to reductions in acid gases to comply with the HAPs MACT. The EPA, in its regulatory impact analysis of the HAPs MACT (see “Reducing Toxic Air Emissions from Power Plants” at http://1.usa.gov/fGHxEm), projected installations of dry scrubbers and DSI systems to control for acid gases. It also projected fabric filter and activated carbon injection (ACI) systems to help control for mercury and the other surrogate pollutants. Depending on their existing control configurations, most affected sources under the rule will require one or more of those controls to attain compliance.

Plants that must close their surface impoundments under the new CCR rule will incur several costs in transitioning to dry disposal methods. Costs will include those associated with conversion to dry management of bottom and fly ash, installation of additional wastewater treatment facilities to offset the lost use of the surface impoundment, and disposal of the coal ash in a landfill.

Compliance with the water intake rule could require technologies ranging from relatively low-cost options, such as wedgewire screens, low-flow caps and variable-speed pumps, to more capital-intensive options, including complete cooling tower installations.

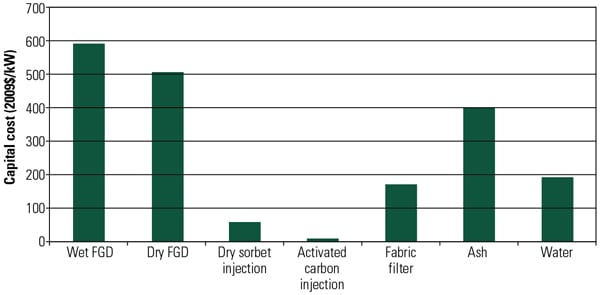

The magnitude of the capital investment that the rules will require at a particular unit or plant will depend on its existing controls, cooling water intake equipment, and ash-handling methods. The compliance cost will also be a function of the unit’s size (due to economies of scale realized with control installations) and plant-specific considerations, including the availability of space to accommodate air pollution control equipment and proximity to a landfill for CCR disposal. Figure 1 shows capital investment costs for many of the controls and other equipment that plants may need to comply with the collection of rules.

|

| 1. Estimated investment requirements for a representative 300-MW unit. Costs are in 2010 dollars per kW of capacity. Sources: Flue gas desulfurization (FGD) system, fabric filter, dry sorbent injection, and activated carbon injection capital costs are taken from the Environmental Protection Agency’s “Documentation Supplement for EPA Base Case v.4.10_PTox – Updates for Proposed Toxics Rule” (2011), available at http://1.usa.gov/dSXUuc. Cost estimates are based on “Cost Estimates for the Mandatory Closure of Surface Impoundments Used for the Management of Coal Combustion Byproducts at Coal-fired Electric Utilities” (2010), prepared by The EOP Group Inc. and available at http://1.usa.gov/ewpYFt. The analysis of the ash rule assumes disposal of roughly half of ash residuals in surface impoundments. The cost of installing cooling towers is based on the North American Electric Reliability Corp.’s 2010 “Special Reliability Assessment: Resource Adequacy Impacts of Potential U.S. Environmental Regulations,” available at http://bit.ly/dIfeUH. |

For a unit with no existing controls that requires the full suite of investments to comply with all of the rules, total capital costs could rise well above $1,000/kW. With new combined-cycle units coming in at about that cost (see “Updated Capital Cost Estimates for Electricity Generation Plants” at http://www.eia.doe.gov and search on “updated capital costs”), and expectations of continuing low future natural gas prices, a company would be hard-pressed to justify that level of investment, especially in units approaching 50 years of age.

In most cases, however, the decision will not be as obvious. Many units will have some level of control or equipment already in place or will be in compliance with one or more rules. In those cases, the decision of whether to comply or retire will come down to a number of factors, including whether the owner is merchant or regulated, expectations of key market drivers (including demand growth and natural gas prices), and the potential for regulation of carbon dioxide.

Rules Will Challenge Coal Fleet

Given the levels of compliance costs that units may face under the new rules, the retirement of significant levels of coal capacity may be a real possibility in the next five to 10 years. The North American Electric Reliability Corp. and other organizations completed assessments of the retirement potential prior to the release of the HAPs MACT and water intake proposals based on assumptions about what the EPA would require under those rules. Those estimates ranged from 10 GW to 66 GW (see “2010 Special Reliability Assessment: Resource Adequacy Impacts of Potential U.S. Environmental Regulations” at http://bit.ly/dIfeUH), or up to roughly one-fifth of current coal-fired capacity.

The range of projected retirements correlates well with the capacity of U.S. coal units that one might classify as at-risk based on current configurations and compliance costs estimates. By 2015, two-thirds of coal units, equivalent to 54% (174 GW) of coal-fired capacity, will be at least 40 years old. Those units average roughly 200 MW. Just over 50% of those units are controlled with a scrubber, leaving nearly 90 GW of capacity that is at least 40 years old and without flue gas desulfurization equipment. These units are most at-risk from the Toxics Rule, which will require some sort of control to reduce acid gas emissions. Roughly two-thirds of that capacity, or 60 GW, also uses once-through cooling and would require controls to comply with the water intake structure requirements.

For a recent analysis, we examined one possible combination of controls that might be required at coal-fired units to assess the capacity at-risk and estimate unit retirements. ICF International (ICF) assumed that coal-fired units would require the following to be in compliance by 2015:

- A scrubber (dry or wet), fabric filter, and ACI on units over 25 MW will be required to meet the Toxics Rule.

- A cooling tower for units drawing from coastal and estuarine water bodies (affecting 13 GW of capacity) or a package of lower-cost alternative compliance controls for other units will be required to meet the water intake structure rule on units using once-through cooling and drawing more than 50 million gallons per day.

- Units must convert to dry handling of fly and bottom ash and install wastewater treatment facilities, as necessary.

This scenario looks at one possible combination of compliance measures; there are many others. The actual measures that the EPA’s regulations require will depend on the final rules and the technology options available to each unit or plant. For example, the EPA’s findings that DSI may serve in the place of scrubbers will greatly reduce compliance costs for some units, making it more economic to control rather than retire them.

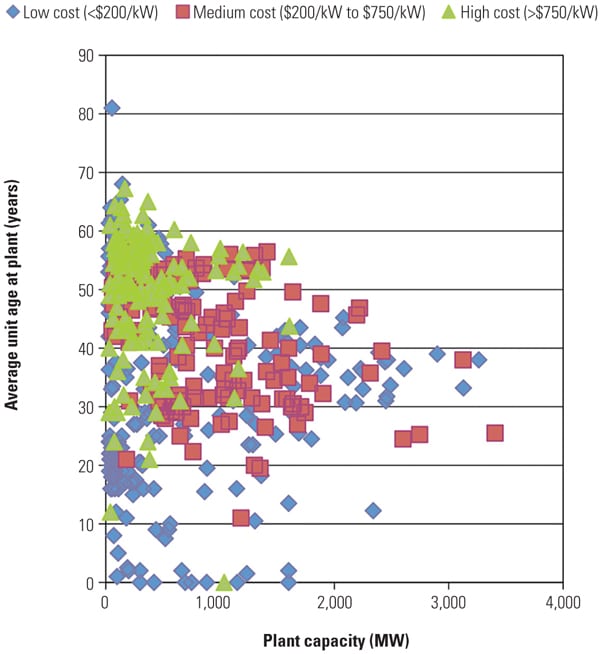

Based on the compliance scenario and capital cost estimates described above, we assigned compliance requirements for the Toxics, CCR, and water intake rules to every U.S. coal-fired unit using a two-step approach. First, we developed an inventory of units within each coal-fired plant and compared the existing control status of each to the assumed regulatory requirements. Next, for units not in compliance with one or more of the rules, we determined the controls needed and the associated investment costs required for units to comply with the expected rules. Figure 2 shows the distribution of these capital cost estimates to each generation plant as a function of average unit age in 2015 and by plant rating.

The capital cost of compliance is an indicator of units likely to retire. However, power market conditions—including market prices and the availability of generating and capacity resources and transmission to replace retired capacity—will also affect “invest” or “retire” decisions. These market factors, along with the specific market regulatory structure in effect, may force units in the high-cost category to be equally at-risk in one region while high-investment units face little risk in other regions.

Analysis Details

ICF’s Integrated Planning Model was used to project coal unit retirements across the U.S. based on the control requirement scenario and regional market conditions discussed above. We also assumed that units that chose to retire would have through 2017 to comply, allowing for some delays beyond the mandated 2015/2016 timeframe to account for regulatory relief, granted either on a case-by-case basis by the EPA or through congressional action.

For this analysis, we also assumed that fossil-fired units would face a charge on their CO2 emissions starting in 2018 at $15/ton CO2 and growing at 5% per year in real terms to reflect the possibility of future greenhouse gas (GHG) legislation.

Under these conditions, and taking into account projected coal and gas prices and costs of new capacity, we project that 51 GW of coal capacity would retire in response to the combined rules and a GHG program assumed to be in place by 2018. The average age of those plants identified for retirement will be 53 years in 2015; they average 150 MW; and over 60% of those units do not have flue gas desulfurization systems installed. This group makes up the high-cost category (Figure 2), consistent with the at-risk population discussed earlier.

|

| 2. Coal-fired generating plant potential regulatory compliance cost. For the purposes of this analysis, the “high” category represents facilities facing new capital cost investment exceeding $750/kW, averaged over the coal capacity at the plant. The “low” category captures facilities facing new investment under $200/kW, and the “medium” category captures remaining facilities. The age and relatively small size of the plants likely to incur the highest costs are evident in the chart, as most of those facilities are grouped in the upper left. Source: ICF International |

However, there is not perfect overlap between the projected retirements and the at-risk groupings. Of the retirements that ICF projected, about 14 GW were units younger than 40 years by 2015, and 18 GW were larger than 200 MW. In addition, about 20 GW of the capacity was already equipped with scrubbers. These exceptions to the rule point to the importance of market factors in evaluating unit retirement decisions.

The decision factors also point to the importance of assumptions about the effectiveness of control technologies, regulatory requirements, and future market dynamics, including natural gas prices. To the extent that compliance costs related to ash and water are lower than assumed here, or that the charge on CO2 does not materialize, for example, even some of the units with the highest assumed control costs may install controls and continue to operate.

The Toxics Rule is the single largest contributor to assumed compliance costs for most of the at-risk units and therefore is a key driver of the retirement results. However, the other rules also contribute substantial costs for many units, so retirement decisions must be considered holistically, not each time a new rule goes into effect.

Beyond the five rules (the four rules discussed earlier plus GHG regulation) considered here, plant owners will also have to account for other future drivers of each unit’s profitability. The basic calculation that owners of coal assets—and, in many cases, their regulators—need to make is this: What controls do I need to install to bring my plants into compliance, how much is that compliance going to cost, and is that investment justified based on estimated future revenue from the power (and, if applicable, capacity and ancillary services) markets? Compounding the decision-making difficulty are projections of natural gas prices, load growth, and future of CO2 regulation. Taken together, these factors will dominate and drive resource planning and capital investment decisions—now for each unit at each plant—for many years to come.

— Chris MacCracken ([email protected]) is a principal and Steve Fine ([email protected]) is a vice president for ICF International.