Chile Presents a Coal Exit Plan

Chile, a country that relied on coal for about two-fifths of its power generation in 2016, in June announced it would mothball eight coal plants, totaling 23 GW, of its existing 28-plant coal fleet over the next five years. The plans are part of the country’s plan to generate all its power from renewables by 2040 and target carbon neutrality by 2050.

Chile’s President Sebastian Pinera unveiled the measures in a new climate change plan on June 7. The country, which will host the COP24 United Nations climate summit this December, has committed to reduce the intensity of its emissions relative to gross domestic product by 30% by 2030 from 2007 levels, though environmental groups deem the target “highly insufficient.”

Among the coal-fired plants to be mothballed are units near Tocopilla and Iquique in northern Chile; Puchuncavi in the center; and Coronel in the south. The closures could reduce annual CO 2 emissions from the current 30 million tons to four million by 2024, the government said. How Chile will replace that capacity is unclear.

Characterized by a long and narrow geography, which poses unique infrastructure challenges, Chile’s power sector has rapidly evolved over the past decade, shaped by institutional and policy reforms, and natural disasters, in particular a 2010 earthquake, which disrupted power supply and transmission. The country increasingly relied on coal power over the past decade after Argentina—a primary energy trade partner—cut its gas supply imports in 2004. Imports were resumed last year under a new agreement.

|

|

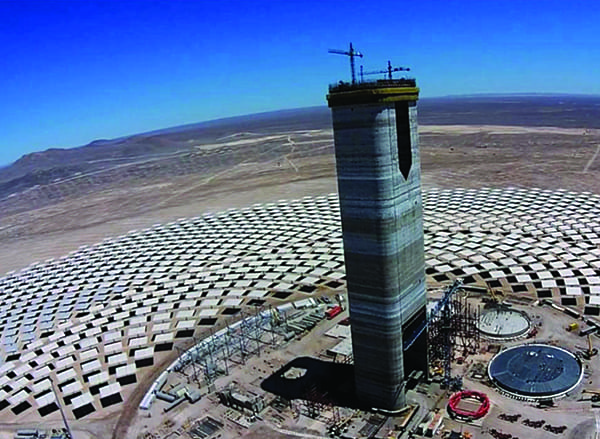

5. Among Chile’s growing portfolio of renewables projects is Cerro Dominador, a 210-MW hybrid concentrated solar power and photovoltaic power complex under construction on a 1,000-hectare site, approximately 60 kilometers from Calama at Maria Elena in the Atacama Desert. The plant could start operations in early 2020. Courtesy: ACCIONA |

Chile has, meanwhile, made notable, recent gains in boosting its renewable capacity (Figure 5). The country hosts the world’s best solar resources in the Atacama Desert to the north, and the world’s longest national mountain ridges and shorelines, which provide immense wind, hydropower, geothermal, and ocean energy potential—and much of it remains untapped. And in recent years, electricity prices have plummeted because auction regulations were modified to allow the participation of variable generation sources, such as wind and solar energy.

According to a recent study by grid operator Coordinador Electrico Nacional, if no coal plants are built and existing coal plants are retired, Chile will require about 5 GW of alternative capacity by 2040. The mix would depend heavily on natural gas over the coming decade before a mix of solar, wind, pumped hydro, and batteries take over.

BloombergNEF said in a November 2018 report that integration with the energy systems of other countries in the region will also play an important role in delivering Chile’s de-carbonization strategy. “Chile Energy Minister Susana Jimenez also plans to expand cross-border transmission interconnections, particularly with Argentina and Peru, to increase the flexibility of the grid,” it said, noting that Chile has only one international transmission line with Argentina, inaugurated in 2015.

Notably, Chile’s plan to transition to renewables is backed by industry. In January 2018, the government made its pledge not to build new coal alongside a key electric power generators’ association, Asociación de Generadoras. The trade group’s members comprise some of Chile’s largest generators, including AES Gener, Cerro Dominador, Colbun, EDF, Enel Chile, ENGIE, Orazul Energy, Pacific Hydro, and Statkraft. The companies are following through. In March 2018, for example, French company ENGIE said it would shutter its 2.3-GW Chilean coal fleet rather than sell them.

—Sonal Patel is a POWER associate editor.