Chile to Pursue Dramatic Coal Generation Reduction

Chile joined the ranks of nearly two dozen countries that have announced a phaseout or a moratorium of coal generation, pledging not to continue building coal-fired power plants unless they are equipped with carbon capture and storage (CCS).

The January 29 announcement by the country’s energy ministry and electric power generators’ association, Asociación de Generadoras, is a significant development for the country that relied on coal for about two-fifths of its power generation in 2016. The trade group, whose members comprise some of Chile’s largest generators, including AES Gener, Cerro Dominador, Colbun, EDF, Enel Chile, Engie, Orazul Energy, Pacific Hydro, and Statkraft, noted in a statement that a transformation of Chile’s power mix is already underway, driven in part by a larger goal to procure 70% of national electricity generation from renewables by 2050.

The decision marks a new direction for the country’s energy policy. Chile’s power sector has rapidly evolved over the past decade, shaped by institutional and policy reforms, and natural disasters, in particular a 2010 earthquake, which disrupted power supply and transmission. An important consideration driving these changes is the country’s long and narrow geography, which poses unique infrastructure challenges. Meanwhile, Chile hosts the world’s best solar resources in the Atacama Desert to the north, and the world’s longest national mountain ridges and shorelines, which provide immense wind, hydropower, geothermal, and ocean energy potential—much of it currently untapped.

To meet soaring power demand bolstered by an economy driven by exports, generation capacity in the country tripled from 6.5 GW in 1997 to 23 GW by the end of 2017. Yet, the government expects power demand will more than double through 2050. And because it remains an electricity island, with only one cross-border connection, Chile must produce all its own power needs sustainably.

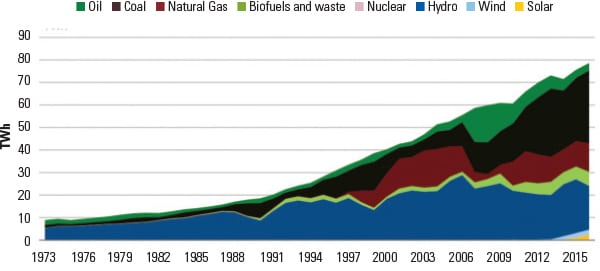

Over the past decade, its power mix, too, has evolved. Gas capacity dwindled between 2004 and 2007, when Argentina restricted gas exports on which Chile was reliant. A crippling drought in 2008, meanwhile, forced the country to rethink its reliance on hydropower. Both events sent the share of coal in power generation soaring from 10% in 2003 to 24% in 2009 to 41% in 2016 (Figure 5).

Renewables will now take on a significant role in Chile’s future mix, Asociación de Generadoras said in January. Annual competitive auctions introduced in 2012 to encourage market competition have prompted a dramatic reduction in power prices as participants increased. Solar and wind, in particular, emerged as market-competitive technologies—without direct subsidies. In the 2017 auction, for example, where 2.2 TWh per year from 2024 to 2044 were contracted at average prices of $32.50/MWh, 46% was from renewables projects (25% solar/wind, 16% solar, and 5% wind), according to the Ministry of Energy.

By 2030, between 8.8 GW and 16 GW of new solar photovoltaic (PV) and wind will be added to Chile’s grid, reaching a penetration of between 38% and 47%, the trade group noted in January. That means that by 2030, Chile’s power profile will be markedly different, with solar PV covering a 30% share, hydro a 29% share, wind a 12% share, and other renewables adding 4%. Thermoelectric plants will make up the remaining 25% share.

While Chile won’t build new coal plants, thermoelectric power—which includes coal, gas, and diesel—are still needed to provide flexibility, the group noted, citing a study it commissioned to analyze the long-term effects of greater penetration of variable renewables. The study was prepared by a consortium of consulting firms, including Rio de Janeiro-based PSR and Santiago-based Moray, which was founded by power sector executives to provide perspectives for decision-making.

According to Asociación de Generadoras Executive Vice President Claudio Seebach, to accommodate more variable generation, power plants in Chile would need to have the capacity to turn on and off, quickly raise or lower their operations, or operate at lower efficiency ranges, which implied higher costs. Costs incurred by coal and gas generators to provide that flexibility could more than triple, ranging from $150 million to $350 million annually by 2030, depending on the scenario. Seebach said, however, that the net economic and environmental benefits of more renewables outweighed flexibility costs. Even so, he called for the design of adequate mechanisms to identify, measure, value, and allocate flexibility costs.

Chile joins a string of countries, states, and organizations that have announced they would phase out existing traditional coal power or issue a moratorium on new coal power stations without CCS. The “Power Past Coal Alliance,” an initiative launched by the UK and Canada in November 2017, has quickly amassed 34 members, including 23 countries. Most are small and don’t host substantial coal capacity. Among larger countries are: Angola, Austria, Belgium, Costa Rica, Denmark, El Salvador, Ethiopia, France, Italy, Mexico, Netherlands, New Zealand, Portugal, Sweden, and Switzerland.

—Sonal Patel is a POWER associate editor.