What Does the Market Expect from Gas Plants?

With the country awash in natural gas and new construction dominated by gas-fired plants, one would think that integrating these plants into the grid would be simple. Like politics, integration problems appear to be local.

In a world of conflicting priorities, uncertain demand, and uncertain fuel price trajectories, what does the electric power market need from gas-fired power?

In a word: Everything.

That was the message from a panel of industry representatives assembled to discuss the future of natural gas plants at ELECTRIC POWER 2013 in Chicago.

Dr. Paul M. Sotkiewicz, chief economist, markets, for PJM, began by telling attendees, “Our objective is to maintain reliability and operate fair and efficient nondiscriminatory markets.” Nevertheless, while PJM is fuel-neutral, he noted that the ISO is facing 20 GW of impending coal retirements by 2016—about 10% of installed capacity—most of which is likely to be replaced with gas-fired power.

Competitive markets value efficiency, he said: the more efficiently you can run, the more money you will make. That provides an incentive for building newer, more efficient combined cycle plants.

The market also places a premium on operational flexibility and reliability. “The quicker you can move, the more accurately you can follow dispatch signals,” the more profitable you will be. “The market will reward those resources that can do this,” he said.

The newest gas-fired plants are capable of responding more quickly than older assets. “That makes gas very competitive,” he noted.

Gas-electric coordination is not the pressing issue in PJM that it is elsewhere, he said, in part because of the substantial existing gas infrastructure. It is important in winter, though, because of the increased domestic demand.

Still, Sotkiewicz argued that it’s not hard to ensure you have the gas you need with responsible planning. “It’s just a matter of being willing to pay the price for it.”

|

|

|

1. A wide range of needs. Panel members for the “What Does the |

Environmental Issues Are Also Important

With increasing attention to emissions, the market is demanding assets that can meet regulations efficiently. Modern combined cycle plants have substantial advantages over fossil-fuel plants. “It’s a no-brainer,” he said.

Sheryl Torrey, director of trading analytics and operations for NV Energy, reviewed the laundry list of demands on the typical gas plant: optionality, flexibility, efficiency, cycling, load following, and reduced outages (Figure 1). And of course all of it, she said, needs to be delivered at low costs.

David A. Frederick, manager of fuel procurement for FirstEnergy, noted that the massive influx of shale gas from the Marcellus shale play has changed the economics of gas-fired power in the PJM region. Consequently, coal generation has fallen 33% since 2008, while gas generation has grown 173%. Both trends are ahead of national changes, substantially so for gas.

The result has been to markedly flatten the supply curve in PJM. While the $50/MWh point in 2008 was at 112,000 MWh, in 2012, it had stretched out to 162,000 MWh.

“We aren’t spending as much money for reliability,” he said.

And though PJM is facing a large number of coal plant retirements, the new capacity being proposed should be enough to replace it, particularly since PJM is arguably oversupplied at the moment, with baseload capacity currently at 90% of load, leaving peak units in excess. The expected retirements will leave about 5% of the load for peaking units.

Consequently, despite the influx of cheap Marcellus gas, “It’s going to be hard for merchant players to enter the market,” at least in the short term. The current economics will struggle to support new plant construction.

|

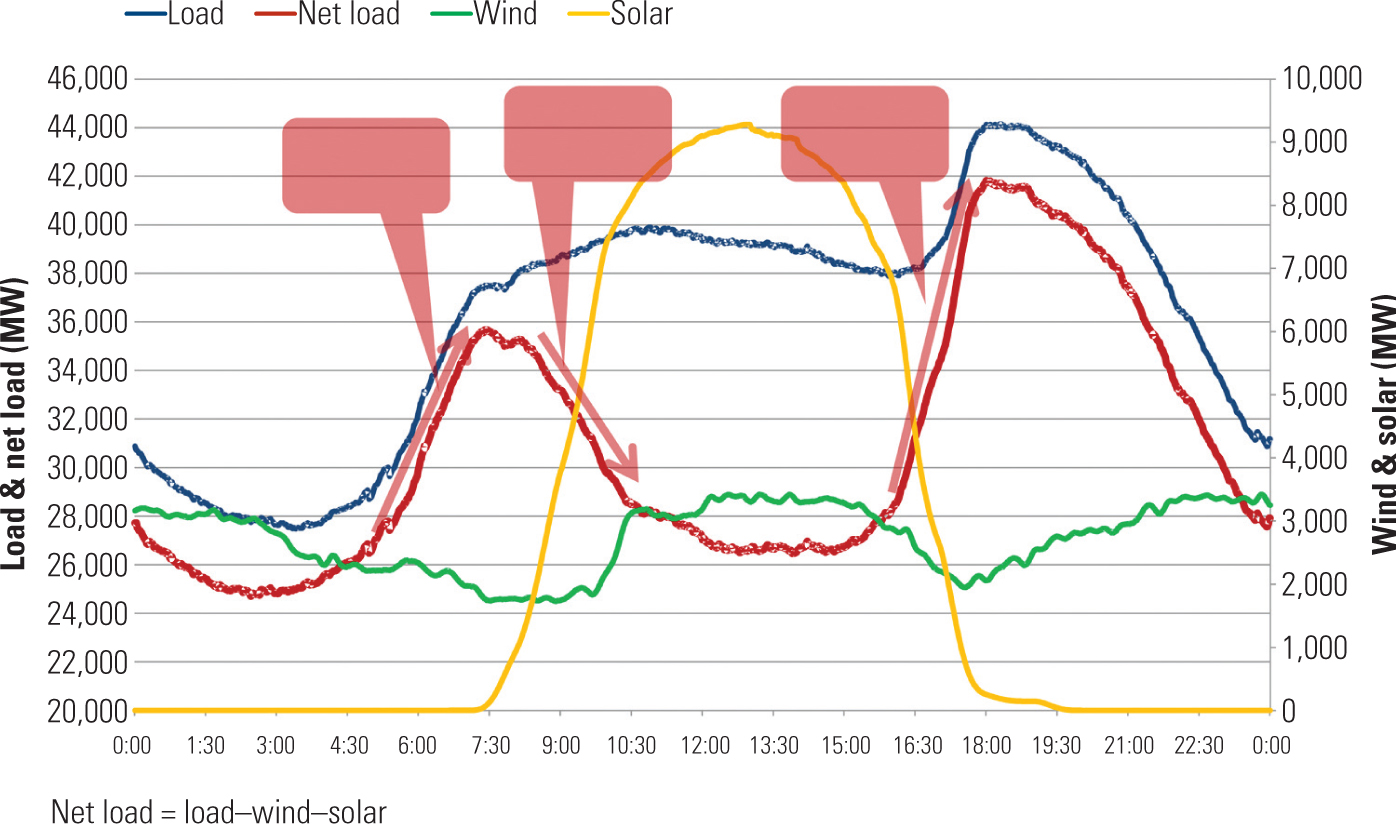

| 2. Wide swings in demand with renewables. By 2020, added renewable resources will create enormous demand for fast-ramping generation in CAISO. Source: CAISO |

The situation for gas power in California, however, is quite different, reported Clyde Loutan, senior advisor for renewable energy integration for California ISO. The large amount of renewable generation, especially solar, is creating the potential for large swings in demand throughout the day.

He showed the session a slide illustrating projections for 2020 that suggested swings of up to 13,500 MW were possible as solar capacity comes on and off the grid during the day (Figure 2). Combined with traditional less-flexible resources, the region may be facing potential over-generation conditions. All this means a strong demand for fast-ramping capacity and frequency response.

Asked what might be necessary to better incentivize construction of fast, flexible gas plants, the panelists had varying answers.

Sotkiewicz said, bluntly, “Nothing, other than the gas-electric coordination issue.” A system the size of PJM, he said, has enough diversity and market incentives in place. But size does matter, he noted, since larger regions have better ability to balance loads.

The lurking problem is coordinating gas supplies. Right now, Sotkiewicz said, “each interstate pipeline acts as its own ISO.”

For areas of western Pennsylvania and eastern Ohio, said Frederick, “It’s more of an issue of how do we get all of that gas out of the area, because we have more than we need.”

The panelists also noted that, no matter what is generating the power, the transmission assets need to be in place to move it. There, plenty of challenges remain.

As Sotkiewicz noted,