What 10 Charts from the DOE’s Grid Study Reveal About the State of U.S. Power

The Department of Energy’s (DOE’s) new grid study is based on analyses of federal government data collected between 2002 and 2017, a period it notes fostered critical developments in the nation’s power sector. Here are some of report’s most thought-provoking charts.

<

►

>

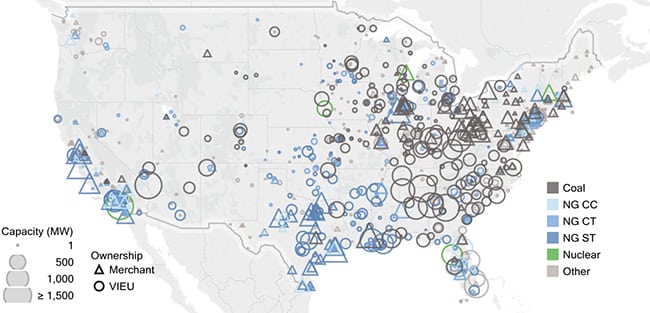

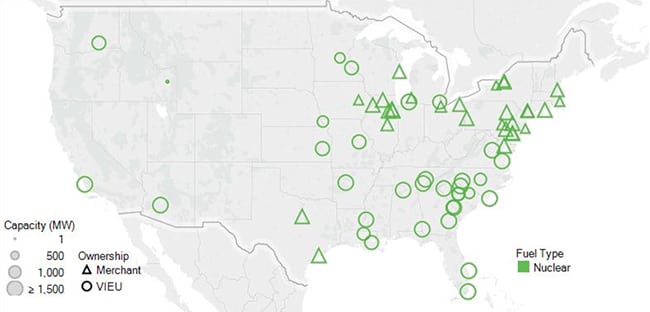

7. The nuclear fleet. Source: Staff Report on Electricity Markets and Reliability, U.S. DOE, August 23, 2017, Figure 3.13

Nuclear plants generate about 20% of the nation’s power. Of the 99 active reactors, 51 are owned by vertically owned utilities, which rely on regulated cost-of-service ratemaking. About 28 nuclear plants were spun off by VIEUs to affiliates under state electric restructuring efforts in the early 2000s. The report cites an Idaho National Laboratory report as it notes that “there is an industrywide systemic economic and financial challenge to operating nuclear power plants in centrally organized markets.” The magnitude of the gap between operating revenues and operating costs is in the range of $5–$15 per MWh, it says. For a 1,000 MW nuclear unit, approximately every $5/MWh of gap represents about $40 million in annual negative cash flow. Without action to enhance revenue (such as zero-emission credit programs) in New York and Illinois, more nuclear plants will face retirement before the end of their operating licenses in the future. Notably, however, the DOE recommends pursuit of fuel-neutral pricing mechanisms and regulations.

Nuclear plants generate about 20% of the nation’s power. Of the 99 active reactors, 51 are owned by vertically owned utilities, which rely on regulated cost-of-service ratemaking. About 28 nuclear plants were spun off by VIEUs to affiliates under state electric restructuring efforts in the early 2000s. The report cites an Idaho National Laboratory report as it notes that “there is an industrywide systemic economic and financial challenge to operating nuclear power plants in centrally organized markets.” The magnitude of the gap between operating revenues and operating costs is in the range of $5–$15 per MWh, it says. For a 1,000 MW nuclear unit, approximately every $5/MWh of gap represents about $40 million in annual negative cash flow. Without action to enhance revenue (such as zero-emission credit programs) in New York and Illinois, more nuclear plants will face retirement before the end of their operating licenses in the future. Notably, however, the DOE recommends pursuit of fuel-neutral pricing mechanisms and regulations.

For an in-depth analysis about the DOE’s grid study, see:

DOE Grid Study Points Finger at Natural Gas

Major Power Players Issue Mixed Reactions to DOE’s Controversial Grid Study

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)