U.S. Nuclear Power Plant Closures [Slideshow]

According to the U.S. Energy Information Administration, nuclear power has accounted for about 20% of electricity generated in the U.S. each year since 1990. In fact, the U.S. nuclear fleet out produced France—the country with the next highest nuclear generation—by more than two to one in 2012. Russia was a distant third, generating less than a quarter of the U.S. total.

But times of late have been tough for U.S. nuclear generators. Natural gas prices are at historic lows, leading to cheap gas-fueled generation. Even with climate concerns and a worldwide movement to reduce CO2 emissions, the market is not rewarding nuclear power’s zero-carbon generation. In competitive markets, nuclear power is not competitive.

Since October 2012, U.S. nuclear plant owners have closed or announced closure of 14 reactor units at 11 plant sites. Many of the units had already gone through the lengthy process of obtaining 20-year license extensions, which would have allowed them to operate until the 2030s in some cases.

The following slideshow offers a look at the facilities and information about the plants.

In a comment on the New Jersey bill submitted on March 20, industry group EPSA commended the bill's sponsors for "not rushing to judgment as ZECs are highly controversial." Public Service Enterprise Group—the state's largest electricity provider—"only started claiming that its nuclear plants may not be recovering their cost of capital to justify future investments and could be cash flow negative by 2020," it noted.

"This is apparently based on a comparison with illiquid forward power prices that may or may not accurately measure future revenues from these plants," it added (EPSA's emphasis). "For starters, if revenues below cost of capital and need to fund future investments are the standards to trigger consumer subsidies, many non-nuclear power plants (including those of EPSA members) would also qualify for out-of-market subsidies. Where would subsidies end?"

The national trade association for independent power producers and marketers also pointedly noted that ZECs are being pushed by utility holding companies that "own both market-based generation and cost-based retail distribution utilities to finance new corporate strategies to boost earnings by exiting competitive generation to focus on more assured earnings from their retail rate-regulated utilities."

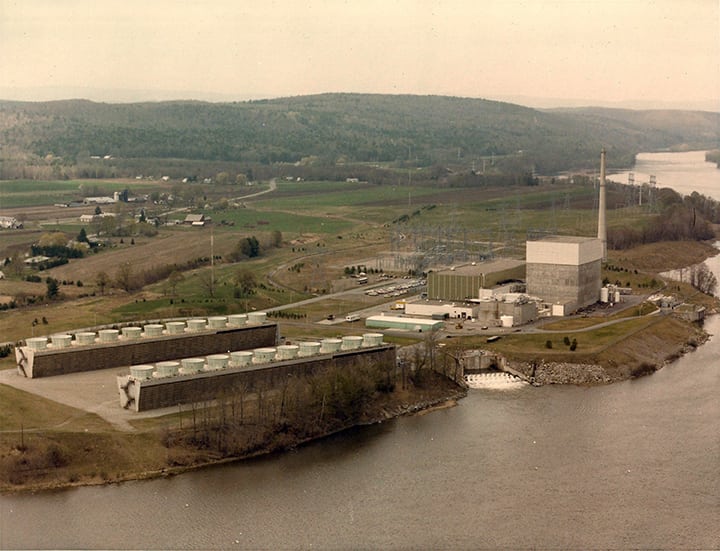

The Oyster Creek unit is the oldest operating reactor in the U.S., having begun commercial operations Dec. 23, 1969. Exelon announced the retirement of the 625-MW plant on Dec. 8, 2010. The Ocean County, N.J.–facility is expected to be permanently closed in 2019. Courtesy: Exelon Nuclear

It’s not all gloomy for the U.S. nuclear fleet, however. Five units are in various states of construction. Watts Bar Unit 2 is nearing commercial operation after a long and storied construction that spanned decades. V.C. Summer Units 2 and 3 in South Carolina and Plant Vogtle Units 3 and 4 in Georgia are also expected to join the U.S. fleet by the end of 2020, but even with these additions the total nuclear capacity in the U.S. will decline.

For more on nuclear plant closures, see the following:

- “Nuclear Plant Closings: What About the Workers?”

- “Entergy to Permanently Close Troubled Pilgrim Nuclear Plant”

- “PG&E Moves to Retire 2.3-GW Diablo Canyon Nuclear Plant”

- “Oyster Creek, Closing Early, Now Dealing with Transformer Replacement”

- “Fort Calhoun Nuclear Power Plant to Close by Year-end”

- “Exelon Makes Good on Threat—Quad Cities and Clinton Nuclear Plants to Close”

- “Entergy Announces Closure of FitzPatrick Nuclear Power Plant”

—Aaron Larson, associate editor (@AaronL_Power, @POWERmagazine)