U.S. Confronts Pipeline Gaps While Europe Juggles Renewables and Debt

U.S. optimism has been restored by reports of abundant, reasonably priced natural gas to fuel most new generation; however, huge gaps in the fuel delivery system (thousands of miles of pipelines are needed) will soon challenge gas plant development. Meanwhile, the cloud of sovereign debt hangs over all major capital projects in Europe, where the UK moves ahead with new nuclear projects while many of its neighbors shut the door on nuclear and struggle to finance their commitment to renewables.

“It’s the economy, stupid.” That pungent phrase coined by legendary politico James Carville guided the successful 1992 presidential campaign of Bill Clinton. Today, 20 years later, Carville’s dictum might well serve as the guidepost for another presidential campaign and for the nation’s energy future.

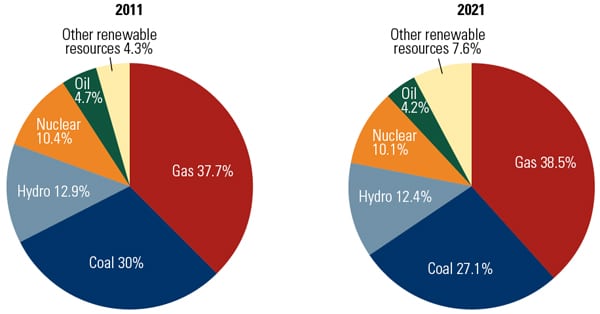

In the past four years, the U.S. has seen an uneven recovery from a deep recession to no or extremely slow growth, with 2011 shaping up as a disappointing year, but one with real economic growth. Goldman Sachs Inc. has estimated 2011’s gross domestic product (GDP) growth at a rather anemic 1.5%. Third-quarter GDP growth was just 1%, and Goldman predicted the final quarter will be only slightly higher. Electricity production growth for the year looks to be a meager 0.3%.

The shape of the economy for 2012 is unclear, although few economists predict boom times. Last summer, the great fear was a steep decline in the economy, a “double-dip” recession, with a return to the economic downturn of 2007–2008. Wall Street odds makers were pegging the chances of a double dipper at about 35%. However, that has not happened, and anxiety about a return to recession has receded. In November 2011, the U.S. Federal Reserve Bank lowered its forecast for economic growth through 2013 but did not predict economic decline ahead, only more slow growth. As a result, the Fed said it would take no new steps to stimulate growth in the world’s largest economy. The U.S. central bank predicted economic growth of 2.5% to 2.9% in 2012, considerably below its 3.3% to 3.7% forecast in June last year.

Private forecasters are also predicting slow but positive economic growth for the U.S. economy. JP Morgan is pegging growth at 0.5% for the first quarter of 2012. Citigroup is projecting 2012 GDP will increase by 2.1%.

Defining Our Times

The National Bureau of Economic Research, the recorder of U.S. economic growth, defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” In concrete terms, the generally accepted rule of thumb for a recession is two consecutive quarters of declining GDP. In a recent survey of 39 economists by USA Today, only one predicted a drop in GDP in any of the coming five quarters. “Recession is not our base case, but you have to consider other outcomes,” investment analyst Janney Montgomery Scott told the newspaper.

Last April, in its Annual Energy Outlook, the Department of Energy’s Energy Information Administration (DOE’s IEA) noted that 2010 economic growth “partially offset the decline in 2009.” The EIA’s best estimate of 2011 economic growth was 2.7%; its low estimate was just over 2%, and its high case was over 3.0%. Since then, the EIA has scaled back its growth assumptions even further. In its September short-term outlook, the statistical agency said it is now assuming that “U.S. real gross domestic product grows by 1.5 percent this year [2011] and 1.9 percent next year.”

The EIA notes that the economy drives energy use: “Energy consumption per capita declined from 337 million Btu in 2007 to 308 million Btu in 2009, the lowest level since 1967. In the [Annual Energy Outlook 2011] Reference case, energy use per capita increases slightly through 2013, as the economy recovers from the 2008–2009 economic downturn.”

Many economists posit a direct relationship between economic growth and the growth in demand for electric power. Although the one-to-one relationship that characterized earlier periods no longer exists, it does seem to be the case that more economic activity demands more electric power. The current conventional wisdom is that a percentage increase in economic growth yields an increase in electric demand of roughly 0.6%.

Demand growth has real consequences in the electricity business. The Tennessee Valley Authority (TVA), for example, is justifying its decision to resume work on the long-mothballed Bellefonte nuclear plant with an estimated long-term growth in regional electric demand of around 1%. If the economy continues slow growth during the next several years, or if a double-dip recession occurs, TVA’s Bellefonte decision could be costly to the region’s electric customers. A recent Nashville Tennessean article noted that the Electric Power Research Institute is projecting annual long-term electricity demand growth that’s only half what TVA projects.

The notion of a lock-step relationship between economic growth and electric demand has skeptics. One is Jim Rogers, the long-time industry executive now in charge of North Carolina’s Duke Energy. Rogers told an industry conference recently that the past 50 years’ trend of economic growth driving electric sales growth is changing. Rogers said at the Edison Electric Institute’s financial conference in Orlando in November that structural changes in the U.S. economy are altering the relationship between the economy and electricity. “I do not see the manufacturing base coming back. Our economy is becoming less energy intensive, by 3% each year,” he said (Figure 1).

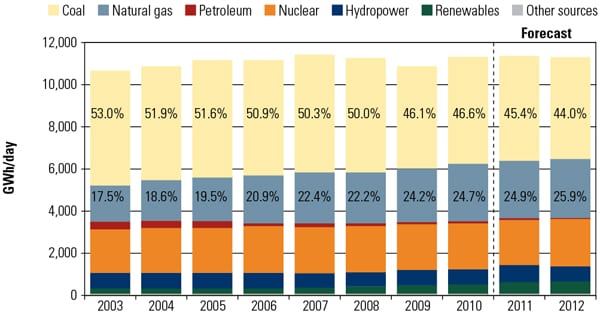

|

| 1. Electricity consumption is fairly flat. Total U.S. electricity consumption grew only 0.3% in 2011, and the EIA expects 2012 electricity consumption to decrease by 0.6% compared to 2011. Last year, the EIA predicted that electricity growth would be stagnant in 2011 and then resume long-term growth of about 1.5% per year. Historical data show that from 2000 to 2009, demand grew by 0.5% per year. Source: EIA, Short-Term Energy Outlook, November 2011 |

Due to slow economic growth and recent changes in the economy and the electricity industry, the overall capacity of the electricity system in the U.S. and Canada is in good shape, according to the North American Electric Reliability Corp. (NERC). NERC’s 2011 summer estimate, for example, found a 25.1% reserve margin in the U.S. and a 35.9% margin in Canada.

The EIA notes that summer 2011 was somewhat warmer than usual, with cooling degree-days through August about 2.8% higher than the same period in 2010. That put no real strain on the U.S. power system, except in Texas, whose grid is isolated from the rest of the country, where a prolonged heat wave and drought caused some outages and voltage reductions. For 2012, the EIA says it expects total consumption of electricity to shrink by 0.6%, compared to projected 0.3% growth for 2011 (Figure 2).

|

| 2. Future electricity growth is flat. The EIA predicts that electricity growth will be a negative 0.6% during 2012 but will recover and grow at 1% per year in following years. Source: EIA, Short-Term Energy Outlook, November 2011 |

If electricity demand continues to grow slowly in the future as it has for the past few years, then the NERC assessment of reserve margins seems to be spot on. The weak link, according to NERC’s 2011 Long-Term Reliability Assessment of system reliability, consists of recent and expected Environmental Protection Agency (EPA) regulatory actions. NERC believes the EPA’s regulatory onslaught will cause a significant number of coal-fired plant closures (see sidebar “NERC Points Finger at EPA for Risking System Reliability”).

Coal Under Siege

The year 2011 ended with coal in seeming decline. Utilities across the coal belt announced plant retirements, and the Sierra Club claimed “victory!” over 153 coal projects in the U.S., up from 123 such claims last year. The environmental group got a major boost for its “Beyond Coal” campaign when New York’s billionaire Republican mayor Michael Bloomberg announced a commitment of $50 million of his personal fortune over four years to the project. Michael Brune, the club’s executive director, pronounced the gift “a game changer, from our perspective.”

That’s likely an overstatement. It’s hard to see how an environmental group, even as well-funded as the Sierra Club, can have much influence on the future of coal beyond the margins. It’s really about the economy and continuing changes in fuel markets that make natural gas, not coal, the fuel of choice for most new generation.

The DOE’s National Energy Technology Laboratory coal power plant database tracks the continuing decline in new coal plant activity, reflecting the soft economy. At the end of 2010, the latest period for which the agency has reliable data, 12 coal-fired electric generating plants were under construction in the U.S., down from 22 the year before. That represents a decline of 6,135 MW, down from 13,755 MW in 2010 to 7,619 MW in 2011.

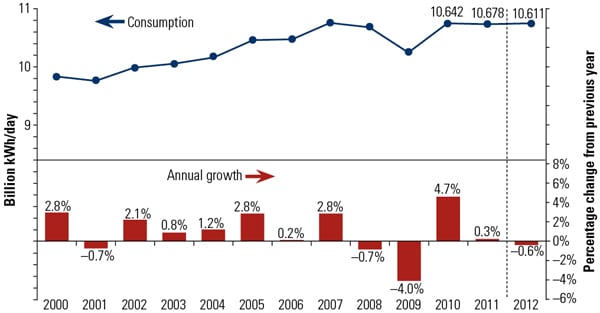

As we noted last year, the coal plant pipeline is emptying, and the EIA projects a gradual decline in coal’s share of the generating market, falling from 48% in 2011 to 45% in 2035, so the Sierra Club’s celebration may be premature by decades (Figure 4). Fewer new plants are entering the construction queue and more are closing down. Last year American Electric Power announced it would shutter some 6,000 MW of coal capacity. As noted by Industrial Info Resources, Duke Energy, Southern Co., Louisville Gas and Electric Co., and Luminant have also announced major closures. These constitute the Sierra Club’s claimed “victories.”

|

| 4. Coal use drops in 2012. Coal consumption in 2011 was up slightly over the prior year but is expected to drop in 2012. Data are presented as a percent change from the previous year. Source: EIA, Short-Term Energy Outlook, November 2011 |

Many of the shuttered plants are small and antiquated, kept alive, according to some commentators, mostly to serve as allowance-generators if “cap-and-trade” environmental legislation had become a reality. Once it became clear that cap-and-trade was dead-and-buried, there was little incentive to keep inefficient, elderly coal plants alive.

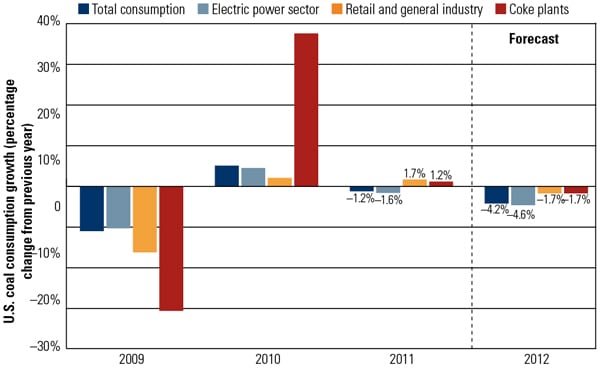

In fact, the DOE, through the EIA, is standing firm with its estimate that new EPA regulations governing the operation of coal-fired plants will cause only 8.8 GW of plant closures in its base case analysis in the coming years. That small number of closures is inconsistent with the large number of analyses performed by independent organizations that have concluded that around 50 GW are in jeopardy (Figure 5). (Also see “The Future of Coal” in the May 2011 issue of POWER in our archives at https://www.powermag.com.) Even Energy Secretary Steven Chu said, “We’re going to see massive retirements within the next five, eight years.” In fact, more than 8 GW of coal-fired plant closures have been announced just during the past 12 months.

|

| 5. Comparison of predicted capacity retired due to new EPA regulations. Many organizations have prepared predictions of the amount of coal-fired generation expected to be lost as a result of the EPA’s recent regulatory measures. The strict and moderate cases reflect different assumptions about the final rules. Source: The Committee on Energy and Commerce, Hearing on “The American Energy Initiative,” September 12, 2011 |

In announcing coal plant retirements, the utilities uniformly blamed prospective federal environmental rules, particularly the EPA’s pending Cross-State Air Pollution Rule (CSAPR). Dallas-based Luminant, the largest electric generator in the Lone Star State, said last fall that its decision to shut two coal-fired plants and derate two others was entirely driven by the CSAPR. A study by National Economic Research Associates claimed that the EPA rule will cause electric rates to spike by as much as 23% and cost the country 1.4 million jobs by 2020.

The CSAPR is just one of a battery of coal-centric regulations that the EPA is considering, including air toxics, ozone, and coal ash controls. Together, they could represent a major challenge to the nation’s cheapest fossil fuel.

But there are reasons to treat the regulatory threat with at least a grain of salt. Last September, Exelon’s top lobbyist, Joseph Dominguez, said the utility industry can absorb the new rules without major disruptions. “The rules have been in the works for about a decade and the electric utility industry is well-positioned to respond, with more than 60% of coal-fired power plants already equipped with pollution control,” he said. A Vectran official earlier said his company could also meet the terms of the cross-state rule with little difficulty.

An August report by the Congressional Research Service (CRS) said that utility industry warnings of a regulatory “train wreck” for coal are overblown. “The primary impacts of many of the rules,” said the CRS, “will largely be on coal-fired plants more than 40 years old that have not, until now, installed state-of-the-art pollution controls. Many of these plants are inefficient and are being replaced by more efficient combined cycle natural gas plants, a development likely to be encouraged if the price of competing fuel—natural gas—continues to be low, almost regardless of EPA rules.”

The unstable U.S. economy has also complicated development of advanced coal-fired technologies, notably the on-again, off-again FutureGen project aimed at demonstrating capture and storage of carbon dioxide from coal combustion. First announced by the Bush administration in 2003, the project has faced a series of obstacles. Most recently, Ameren, the utility that would host the project, said in mid-November that its shaky financial condition means it can’t continue with the project. According to The New York Times, Ameren told its partners it can’t go forward, even with $1 billion in federal subsidies in hand, and has decided to withdraw from the project and retire the 200-MW Unit 4 at its Meredosia plant in Illinois. Meanwhile, the FutureGen Alliance has pledged to move forward on the project and possibly purchase the Ameren plant as the site for FutureGen 2.0.

Gassed-Up

Last year, as he surveyed the generating landscape, industry veteran John Rowe, outgoing Exelon chief, predicted that “coal will remain King.” Rowe added, “Gas will be Queen.”

Unlimited Gas Supplies. Indeed, gas is poised to gain generating market share through all of 2012, and well beyond. As our “Global Gas Glut” report (Sept. 2011) demonstrated, the combination of an old oil industry technology, hydraulic fracturing, and a new, directional drilling technology has turned natural gas into a truly revolutionary force in generation. Gas, which until about five years ago was regarded as a diminishing resource, now seems capable of fueling the U.S. energy economy on a scale only previously claimed for coal. Fracking and horizontal wells have made it possible to produce gas cheaply in many areas of the U.S., even close to population centers and industrial markets.

How much shale gas is available? The figures are astonishing. Both the DOE’s EIA and the Interior Department’s U.S. Geological Survey (USGS) have produced astounding resource estimates. Last year, the EIA estimated the amount of “inferred reserves” in the Marcellus Formation in the Mid-Atlantic states at 410 trillion cubic feet (Tcf). The Marcellus—which underlies major portions of New York, Pennsylvania, Ohio, Virginia, and West Virginia—is just one of a half-dozen major shale gas formations. The USGS estimated “undiscovered resources” of shale gas in the Marcellus at 84 Tcf. Both estimates are more than 10 times previous agency predictions about the prevalence of shale gas.

The two figures are not in conflict, despite some hyperbolic press reports to the contrary; instead, they are additive. According to an analysis by the nonpartisan Washington environmental think tank Resources for the Future, “In theory, as the 84 Tcf becomes discovered and evaluated, some of the estimate will be added to the amount of inferred reserves.” Overall, the EIA now estimates total U.S. natural gas reserves at 2,552 Tcf, with shale gas constituting 827 Tcf. Prior to 2005, shale gas made up only about 4% of U.S. production. By 2010, that figure had risen to 23% the energy forecasting agency says. Between 2006 and 2010, shale gas production grew by 48% annually, according to the EIA.

Estimates of growth in shale gas production are uniformly bullish. By 2035, the EIA predicts that gas from shale formations will make up half of U.S. gas production. However, there are issues that remain unsolved, including how to move this new gas from where it can be accessed to where it will be used, given the scarcity of available pipelines (see “Transporting New Natural Gas Supplies,” next page). How best to use these new natural gas resources is another subject of hot debate.

Along with the large resource projections, analysts note that gas prices are likely to remain stable (Figure 6). The great abundance of gas means growing demand is unlikely to put pressure on prices anytime soon. Shale gas producers such as Chesapeake Energy are routinely offering generators 10-year fuel supply contracts at stable prices (Figure 7).

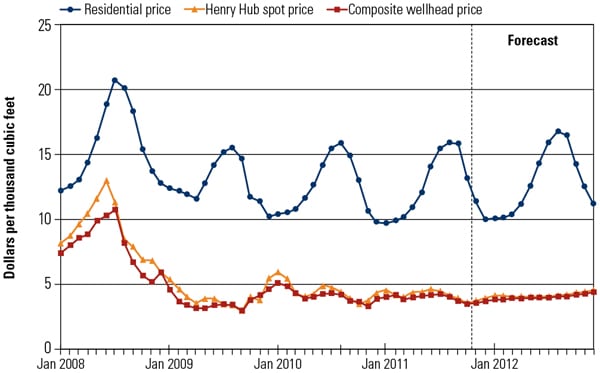

|

| 6. Natural gas prices to remain stable. The EIA predicts a very slight increase in average natural gas prices during 2012. Source: EIA, Short-Term Energy Outlook, November 2011. |

|

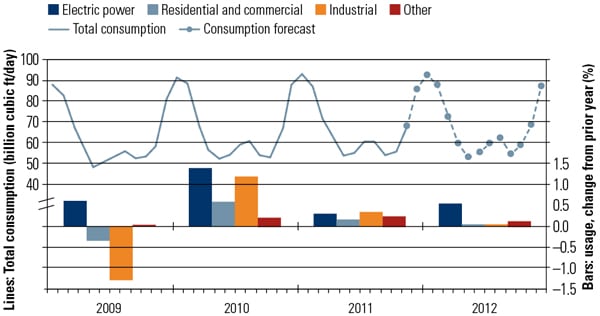

| 7. Natural gas usage growth continues. The use of natural gas grew in 2011, and growth is expected to continue in 2012. Gas use for electric power is expected to grow the most in 2012. Source: EIA, Short-Term Energy Outlook, November 2011. |

Shale gas is often found with crude oil, as in the Bakken Formation in North Dakota, or with natural gas liquids in the Marcellus shale. Those higher-value commodities mean that “the breakeven cost for natural gas has fallen to zero,” further insulation against gas price volatility, according to an analysis by the Federal Energy Regulatory Commission. Recent figures from the Goldman Sachs Commodity Index (GSCI) demonstrate the newfound stability of natural gas prices. Between 2008 and 2010, in the teeth of a major worldwide recession, the GSCI doubled. But gas prices were flat, as gas is now isolated from external forces that have driven its price in the past, such as the price of crude oil.

Another Layer of Regulation. This gas supply celebration, however, is about to be crashed by an EPA and DOE that are bound and determined to pile federal regulations on top of state oversight that will surely throttle future shale gas development. One of the more serious criticisms of using fracking technology to reach natural gas hidden a mile or more below the surface is that the chemicals used in the process contaminate nearby water wells, usually reaching no more than a few hundred feet deep. During testimony before the U.S. House Oversight Committee in late May 2011, EPA Administrator Lisa Jackson responded to questions about the safety of fracking by saying, “I’m not aware of any proven case where the fracking process itself has affected water.” A study by Duke University researchers released in May also found “no confirmed cases of an underground source of drinking water contaminated as a result of a hydraulic fracturing operation.”

The Energy Policy Act of 2005 exempted fracking from EPA regulations under the Safe Drinking Water Act, shifting that regulatory responsibility to the individual states. Even so, the EPA, in 2010, began a study on the “relationship between hydraulic fracturing and drinking water,” apparently looking for alternative means to regulate the shale gas extraction industry. That search seems to have been productive. In late October, the EPA announced plans to develop natural gas well wastewater standards. In late November, the EPA announced plants to “initiate a dialogue process to seek public input” on a set of reporting requirements on the fluids used for fracking, not the mud, under the Toxic Substances Control Act.

At the same time, a consortium of state regulators and industry stakeholders called FracFocus is busy developing a set of voluntary chemical reporting standards, while the FRAC Act, introduced in both the Senate and House, would add another layer of federal oversight to the state regulation of gas wells. Finally, a number of environmental organizations have asked the EPA to regulate each well by developing greenhouse gas emission standards for gas wells.

A final note about U.S. gas supplies: Offshore oil and gas production is quickly declining, not because of well depletion but because of federal government policies. Today, only 2.2% of offshore areas available for lease have been leased for oil and natural gas production. Overall, oil and natural gas production on federal lands has declined by 40% since 2000, and sharply since 2003. The good news is that oil and natural gas production has increased on private and state lands over the same period. For example, North Dakota oil production has increased 250% over the past decade. It is no coincidence that North Dakota has the lowest unemployment and fastest job growth rate (twice that of Texas) in the U.S.

The Death of the Nuclear Renaissance

The much-anticipated reflowering of the U.S. nuclear industry in 2011 turned into a wake instead, and the sector is likely to remain dead in 2012.

When Congress passed the Energy Policy Act in 2005, the premise was that some simple federal support—loan guarantees, special tax considerations, and the like—would give the nuclear generating business a bit of government oomph needed to get the industry building new nuclear plants. The concept behind the legislation was that the industry only needed a modest boost to overcome financial obstacles. The U.S. would then see a rebirth of a proven generating technology that has seen little new construction activity in more than 30 years.

The crux of the case for new nuclear was that conditions were ripe for rebirth with some midwifery from Uncle Sam. The case for new nukes seemed compelling. Low fuel costs and the absence of greenhouse gas emissions from nuclear would overcome the new plants’ high capital costs. It seemed, in the famous words of a former CIA director in another context, a slam dunk.

But a few untoward events intervened: the arrival of cheap, plentiful natural gas; collapsing debt markets and a stumbling world economy that reduced electricity demand; and an earthquake and tsunami in Japan. For 2012, the story of nuclear power, at least in the developed world, looks like a rerun of the 1993 box office hit Groundhog Day.

Today, only one new nuclear plant is under construction in the U.S. That plant, the TVA’s Watts Bar Unit 2, is a restart of a project the giant, government-affiliated power agency mothballed in the 1980s. The Watts Bar project is already behind schedule and over budget, according to the TVA. The utility’s board has approved restarting another stalled project, its Bellefonte unit, but has yet to get a green light from federal regulators.

Southern Company, with a conditional $8 billion federal loan guarantee in place, insists it will go forward with its Vogtle station expansion but needs Wall Street to sign on before the feds will release the guarantee. Southern CEO Tom Fanning recently told Fortune magazine that his company is committed to going ahead with the two new units at Vogtle and has the size and deep pockets to afford its $6.4 billion (46%) share of the project. Southern has said it plans to build the project even if Washington bails out of it.

But Atlanta-based Southern is now the only company in the queue for the federal government’s nuclear power plant loan guarantees. The two other major seekers after Washington’s largess—NRG and Constellation Energy—have dropped out. Chicago-based Exelon, the nation’s largest nuclear generator with 17 units, and would-be acquirer of Constellation, does not share Southern’s passion for new nuclear plants. CEO John Rowe told reporters in November that reviving Constellation’s plan to add a new unit at the Calvert Cliffs site is “almost inconceivable.” The Calvert Cliffs project, Rowe said, is “utterly uneconomic.”

Lucas Davis, an analyst for Resources for the Future, predicts a grim future for nuclear new build in the U.S. In a recent paper, he lays out the economic case against nuclear that Rowe has perceived. “Even excluding financing costs,” he writes, “current estimates of construction costs show that nuclear is substantially more expensive than coal and natural gas. A recent U.S. Department of Energy study reports overnight costs for nuclear of $5,300 per kilowatt, versus $2,800 for coal and $1,000 for natural gas. This study was completed just before the Fukushima crisis and thus does not incorporate any cost increases due to closer regulatory scrutiny.”

Which Way Will Wind Blow?

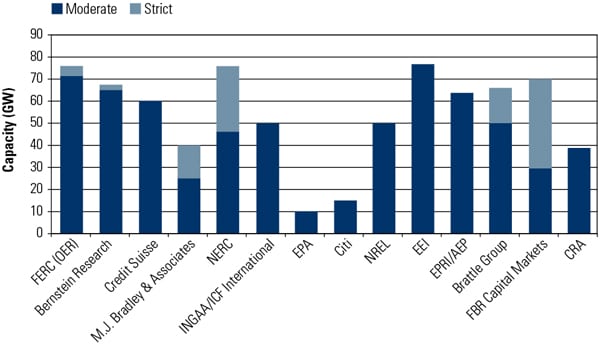

With gas gaining speed while coal and nuclear development is becalmed, how are renewables faring? The future looks much like the past: Live by the government or die by the government. While renewables (including hydro) make up only about 10% of total U.S. electric generation—380 billion kWh out of a total 3,779 billion kWh, according to the EIA—they have seen solid growth over the past decade, and there’s more to come, albeit from a small base. Wind power will grow about 22% during 2011, but growth in 2012 is expected to drop to about 13% because the production tax credits are expected to expire at the end of 2012. Hydro power was up 23% in 2011, the highest level since 1999, due to high levels of precipitation in the Pacific Northwest, but hydro is expected to return to normal levels in 2012, offsetting the growth of wind power (Figure 8).

|

| 8. Few new plant builds. According to EIA data, virtually all of the new plants installed in 2011 were either gas-fired or renewable, principally wind. For 2012, that trend continues; the lost coal capacity is replaced by gas-fired plants. Source: EIA, Short-Term Energy Outlook, November 2011 |

According to many analysts, that growth is almost entirely a result of government policies, including state-driven generating mandates and federal and state tax subsidies. Again this year, the renewable energy industry will marshal its forces to try to convince Congress that renewing the goodies that keep the self-proclaimed green power growing is good for the nation. The extension of energy tax benefits has become an annual event in Washington energy politics.

Key elements of the federal subsidy, major drivers of the growth, are the production tax credit and the 1603 Treasury Grant program. The tax credit provides a deduction of 2.3 cents/kWh for projects in production. The 1603 program allows developers to take their presumed tax credits up front in cash. Greentech Media notes, “This tax bill reduction can be transferred to investors. Wall Street and other players still raking in the big bucks despite the floundering economy are willing to buy into wind projects to get those tax credits.”

But the renewable subsidies have been a sometimes thing. Congress has let the production tax credit expire, if only briefly, three times in the past decade. Renewable lobbying groups have pushed for years for multi-year extension of the tax credits, without much success. As this article was written, the 1603 program was due to expire by the end 2011, with little prospect of renewal.

The production tax credit expires at the end of 2012, and the lobbying is already gearing up for a four-year extension. The renewable industries are pegging their pitch to jobs. Denise Bode of the American Wind Energy Association (AWEA) said in a recent press release, “Wind energy means 75,000 jobs across the U.S. today and could support 500,000 American jobs across the country in manufacturing, construction, engineering, development and other fields less than 20 years from now according to a U.S. Department of Energy study.”

Upon closer inspection, the wind manufacturing jobs claims put forward by Bode are not supported by the facts. According to a recent CRS report, “U.S. Wind Turbine Manufacturing: Federal Support for an Emerging Industry,” released in September 2011, the jobs created by the wind industry remained flat during the past three years, at an estimated 20,000 total jobs. More interestingly, the report shows that the majority the 75,000 jobs cited by AWEA are in finance and consulting services, contracting and engineering services, and transportation and logistics—all temporary jobs. In 2010, according to the report, a total of 3,500 jobs were in construction and only 4,000 permanent jobs were in plant operations and maintenance. Will future wind projects add more manufacturing jobs, as AWEA claims? That depends on whether developers buy turbines in the U.S. or elect to purchase from lower-cost manufacturers in South Korea, China, or other countries.

Industry Recombinations

With the economy continuing to lag and equity and credit markets showing great swings, merger and acquisition activity slowed considerably in the third quarter of 2011, according to a report from accounting and consulting firm PwC US. The third quarter saw nine deals, with a total value of $50 million—a “near-record low for the three-month period ending September 30.” During the same period in 2010, PwC said there were 14 deals worth a total of $10.9 billion. For 2011, the deals were fewer and smaller than in past years.

John McConomy of PwC said, “A noticeable absence of large strategic buyers in the third quarter resulted, in part, from uncertainty around the fate of regulated transactions, causing dealmakers to focus on closings and successful integration of deals announced throughout the first half of the year. Stock price volatility and debt concerns also contributed to deal slowdown in the third quarter and we believe many in-process and contemplated deals are being deferred until the capital markets settle down.”

It’s also possible that business fission may replace corporate fusion in the days ahead. Following a trend evident in the oil business, Dynegy last August split asunder, spinning off separate coal-fired and gas-fired businesses from the Houston-based merchant generating company. The move came during a nasty battle over the company’s future between two groups of corporate raiders: Blackstone Group and legendary investor Carl Icahn and Seneca Capital. According to an analysis in the Wall Street Journal, the idea was to protect the company’s hard assets as the raiders battled over the corporate entity, with Icahn and Seneca ultimately emerging victorious, although owing substantial debt.

Then, in early November, after another set of complex transactions involving the debt of the coal-generating spinoff, Dynegy filed for bankruptcy protection. In the latest ploy, said the newspaper, “Dynegy is trying to force its unsecured creditors to play let’s-make-a-deal. And if the creditors don’t play ball they will be buying a showdown with Dynegy, Icahn and Seneca with about $4 billion on the line.” The Journal’ s account concluded that Dynegy’s structural game was complex and convoluted enough to make Rube Goldberg proud.

The European Outlook

In Europe, too, money was tight in 2011, as it promises to be in 2012. Previous budget crises in Spain and Ireland were bad enough, but now dire economic conditions in Greece and Italy threaten the very stability of the euro and the 17 nations that use it as their currency. Prospects in many of the other 10 European Union (EU) member states are not great either.

So money to invest in new power plants and grid upgrades is hard to find, yet a great deal of capacity needs to be added soon. The UK, for instance, will by 2018 have lost 6 GW of aging nuclear capacity and 11 GW of old coal and oil plants that must close under EU anti-pollution rules because they do not have flue gas desulfurization equipment. By 2022, Germany will have shut all 17 of the nuclear plants that historically provided nearly one-quarter of that country’s energy.

The European Commission is sticking doggedly to its plan to fill the gap with renewables: The target for 2020 remains 20% emissions reductions, 20% renewables, and 20% energy savings. However, many commentators believe that the lack of firm lower-level policies has helped to create an investment climate in which not even gas-fired plants can be built fast enough, let alone clean coal, new nuclear, wind, or solar. As the European Climate Foundation environmental think tank said recently, “institutional investors are not part of the climate conversation.”

Steve Holliday, CEO of British grid operator National Grid, warned last year that consumption patterns would have to change drastically by 2020 or 2030 as the share of renewables increases. He may have been talking about relatively painless demand management via a smart grid, but his comments have been widely taken to mean that the UK will face blackouts.

Coming to Grips with European Energy Policies

Europe’s proposed decarbonization is “the most massive energy program ever proposed anywhere in the world outside wartime conditions,” consultant Andrew MacKillop wrote recently in European Energy Review. Mandatory carbon trading has not significantly reduced emissions, he added, and energy market liberalization has not brought the hoped-for benefits.

Michel Cruciani of the Centre of Geopolitics of Energy and Raw Materials at Paris-Dauphine University, agrees. He claims in a study published in November 2011 by the Institut Français des Relations Internationales that liberalization has done little to lower European energy costs. In fact, he suggested, the process may have increased costs by creating regulatory uncertainty.

In 2010, the UK market regulator Ofgem said: “There is an increasing consensus that leaving the present system of market arrangements and other incentives unchanged is not an option.” The British government got the message, because in July 2011 it unveiled proposals to reform the country’s energy market and so make available the £200 billion ($317 billion) the UK needs to invest in the next 10 to 15 years, with nuclear and offshore wind as the priorities.

Key to the UK proposal are a carbon price floor; long-term contracts for low-carbon electricity; an emissions standard of 450 g CO2/kWh to permit gas-fired generation but disallow coal without carbon capture and sequestration (CCS); and a “capacity mechanism,” including demand response, to ensure adequate future electricity supplies. In November, however, several UK power executives said the proposals were unclear and that the carbon price floor would not work.

Wanted: One Voice for Europe

The EU too has decided it needs a stronger energy policy. Beyond its ambitious environmental targets, the EU does not control the generating mix within each member state, but it is often criticized for not “speaking with one voice” on international energy deals—notably, bilateral deals between Russia and individual EU members.

In September 2011, the commission said it wanted to monitor all energy deals between EU governments and third countries, with a long-term aim of negotiating energy deals on behalf of the EU. “When you see that some 60% of natural gas is imported from third countries and as far as oil is concerned 80%… it’s perfectly clear that the success of any energy policy depends on a successful EU common external energy policy,” said EU Energy Commissioner Günther Oettinger.

The EU also seems to be following the UK’s lead in specific measures to kick-start new power plant construction. According to David Buchan of the Oxford Institute for Energy Studies, the Commission’s new proposals on permitting and financing acknowledge that “market forces by themselves will not lay the foundations of low-carbon energy on time.”

Under the new rules proposed last October—though they are a long way from being accepted by EU governments—national planning authorities would have to process applications for European “projects of common interest” in less than three years (half the current average time) and give increased weight to the climate-change benefits of infrastructure such as pylons (transmission towers) and wind turbines. The Commission also proposes to use EU money to leverage private-sector finance for infrastructure projects, such as through insurance via project bonds from the European Investment Bank.

European CCS Plans Collapse

Some coal-burning nations, including the UK and Poland, will be hit hard by the EU’s 2015 closure deadline for power plants unwilling to invest in modern SOx, NOx, and particulate emissions controls. Germany, meanwhile, relies heavily on coal and so might logically choose this fuel to replace the nuclear capacity it is closing.

Yet in carbon-conscious Europe, significant new coal capacity seems unlikely, even if it were to include CCS. In May 2011, news agency Reuters listed 15 proposed coal projects in Germany that are facing significant public opposition. In Scotland, a record 20,000 people have attacked a plan by Peel Energy to build a 1.8-GW coal plant with biomass cofiring at Hunterston.

Short-term CCS plans in Europe are now looking as unpromising as they are in the U.S.—notwithstanding a proposal for a Europe-wide pipeline network, 22,000 kilometers long and costing €50 billion, to carry 1.2 billion tons/year of CO2 by 2050.

Hunterston is one of the UK’s few remaining CCS prospects, because its demonstration-scale CCS system—initially covering 20% of the plant’s output—would be funded by the European Investment Bank. All hopes of a CCS demonstrator funded by the UK government, on the other hand, have now collapsed. The latest failure came in October, when ScottishPower, National Grid, and Shell UK abandoned their plan to decarbonize one-sixth of the output of the 2.4-GW Longannet plant in Scotland. What was probably the world’s most commercially advanced CCS project fell apart over arguments about the future price of decarbonized power and the risk of cost overruns.

Better Prospects for Gas in Europe

For gas the news is brighter, at least on paper. In the UK, for example, power projects receiving planning consent during 2011 were dominated in capacity terms by around 6.5 GW of gas-fired combined cycles, with another 5.5 GW currently awaiting consent. How much of this capacity materializes is another matter.

Shale gas continues to promise much, especially in Poland. In November, Polish gas monopoly PGNiG said it could have up to 32 Tcf of shale gas at its 15 licenses. Chevron is the latest company to start shale gas drilling in Poland, joining others, including ExxonMobil, Marathon Oil, and BNK Petroleum.

France, which potentially has large shale gas reserves, has a moratorium on hydraulic fracturing, or fracking, that does not look likely to be rescinded any time soon. In the UK, public opinion was not improved by an admission that two barely perceptible earth tremors (magnitudes 2.3 and 1.5, respectively) near the town of Blackpool were probably caused by fracking. The company involved, Cuadrilla Resources, estimates that it has discovered reserves of around 200 Tcf. Even if only a small fraction of this can be recovered, it would exceed the 9 Tcf estimated to remain in the UK sector of the North Sea.

Shale gas is a decade away from reducing Europe’s dependence on gas imports from Russia, which is continuing with its ambitious Nord Stream and South Stream pipeline projects. The first of Nord Stream’s two pipelines was commissioned in November. Meanwhile, Wintershall and EDF have joined the consortium for South Stream, due to come on stream after 2015. The EU’s rival Nabucco pipeline, on the other hand, is making good progress politically but is not well supported by the big European energy companies.

No Unity on Nuclear

Nuclear power is one issue on which Brussels will never be able to control national decisions.

The big news was Germany’s decision to close all of its 17 reactors by 2022, in the wake of the Fukushima Daiichi crisis in Japan. In one sense this was no surprise. German public opinion is strongly anti-nuclear, and in 2000 the government ruled that Germany would phase out nuclear by 2020. Not until 2010 did it grant a reprieve based on the impossibility of meeting CO2 emissions targets without nuclear help.

What was a shock was the decision not to restart the seven oldest reactors shut down immediately after Fukushima. Despite Germany’s strong investment in renewables, critics say that this decision is likely to increase both carbon emissions and imports of nuclear power from neighboring France and the Czech Republic. Utilities including E.ON and RWE accept the decision but are demanding compensation, and Siemens is pulling out of nuclear engineering.

Italy has abandoned plans to restart its mothballed nuclear program, and Switzerland has said it will not replace its five nuclear plants once they reach the end of their lives, between 2019 and 2034. Belgium has conditionally agreed to phase out nuclear between 2015 and 2025.

France remains committed to new nuclear, though the new Franco-German EPR units being built at Flamanville in France and Olkiluoto in Finland continue to suffer serious delays, construction quality problems, and huge cost overruns. Olkiluoto 3 is now planned to start up at the end of 2014 (originally November 2011); Flamanville is now due to start generating in 2016.

Despite much time-wasting, the UK, too, remains politically committed to new nuclear. In November, a proposed plant to be built by EDF at the existing Hinkley Point nuclear site for startup around 2020 formally began the planning process. Other planned UK plants to be built by RWE and E.ON may fall victim to Germany’s loss of enthusiasm for nuclear, however.

Lithuania and Poland are also planning new nuclear capacity.

Swedish reactors at Oskarshamn and Ringhals, both operated by Vattenfall, shut down temporarily last year following two separate fire incidents. In light of the serious fire at Ringhals, the second since 2006, Sweden’s nuclear safety authority threatened to withdraw the plant’s operating license.

European Renewables Remain Promising, Despite Subsidy Cuts

European renewable energy projects, notably offshore wind and solar, continue to look as promising as the tough financial conditions allow. The European Wind Energy Association (EWEA) forecasts around 40 GW of offshore wind capacity by 2020, including 8 GW in Germany, 4 GW in France, 4.5 GW to 6 GW in the Netherlands, and 13 GW to 20 GW in the UK.

The most ambitious plan comes from Scotland, whose parliament says it wants 100% of its electricity consumption to come from renewables by 2020. The plan to add up to 5 GW of offshore capacity by that date is not unreasonable, considering that Scotland has a quarter of Europe’s total wind resource.

Finding enough engineering capacity could, however, be a barrier to expansion. Apart from the need to manufacture the turbines themselves, offshore wind depends on a small number of specialist installation vessels. And transmission grid operator TenneT says it is struggling to cope with the demands of hooking up nine offshore wind farms in Germany.

As always, money is a key issue. In November, the Dutch government decided that subsidizing wind power was too expensive and cut feed-in tariffs (FITs) to 50% to 85% of their former values. At that rate, the EWEA’s optimistic outlook for the Netherlands is unlikely to become reality. The UK government has said it will continue to support offshore wind as long as the costs come down: The target reduction is from the current £190/MWh ($295/MWh) to £100/MWh by 2020.

One way to cut the cost of offshore wind is to build bigger turbines. In the past year manufacturers including Vestas, Siemens, Enercon, Gamesa, Alstom, and Sinovel have all announced wind turbines in the range of 5 MW to 7.5 MW.

Another way to improve economics is to create a production-line approach, says Anders Eldrup, CEO of Dong Energy, the current leader in offshore wind capacity. In an interview with European Energy Review, Eldrup said that firm partnerships with suppliers—such as ordering 500 Siemens wind turbines at a time—are allowing his company to escape the current project-by-project approach.

Solar photovoltaic (PV) power, meanwhile, could realistically provide up to 12% of Europe’s electricity by 2020 and reach grid parity as early as 2013, according to the European Photovoltaic Industry Association (EPIA). The EU is the world’s largest PV market, with almost 30 GW of installed capacity by the end of 2010 and around 16 GW added in 2011.

By far the largest share of PV is in Germany, showing that relatively cloudy countries with well-managed FITs can perform better than sunnier nations with less-stable subsidy regimes, notes Reinhold Buttgereit, EPIA secretary general. For several years Germany’s FITs have declined steadily, in line with the falling costs of solar. The UK, in contrast, is proposing drastic FIT cuts— of more than 50% for installations below 50 kW—which threaten to strangle the country’s solar industry at birth.

—Kennedy Maize is a POWER contributing editor and executive editor of MANAGING POWER. Charles Butcher ([email protected]) is a UK freelance writer specializing in the energy and chemical industries. Dr. Robert Peltier, PE is POWER’s editor-in-chief.