Turkey Opens Electricity Markets as Demand Grows

Turkey’s growing power market has attracted investors and project developers for over a decade, yet their plans have been dashed by unexpected political or financial crises or, worse, obstructed by a lengthy bureaucratic approval process. Now, with a more transparent retail electricity market, government regulators and investors are bullish on Turkey. Is Turkey ready to turn the power on?

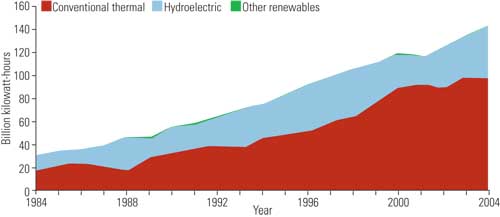

Power projects invariably encounter financial, political, technical, and environmental challenges. In the past, those problems have been magnified in Turkey. But recently, Turkey, once known for strict government planning and control of all aspects of its economy, has made substantial moves to open its markets and reduce government control of foreign trade and outside investment in power markets. Additionally, many segments of publicly owned industries have been privatized since 2001. The results have been tremendous: Turkey’s gross domestic product has grown an average of 6.9% over the past six years, although growth in 2009 is projected to be only 1% or 2%, according to Isbank. The consensus is that Turkey must have immediate and substantial investment in its electricity generating infrastructure if the country is to maintain its recent impressive record of economic growth (Figure 1).

1. Installed capacity. Conventional thermal and hydro generation sources have traditionally dominated Turkish power generation. Today, wind, geothermal, landfill gas, and solar power combined account for approximately 1% of Turkey’s installed capacity. Source: U.S. Energy Information Administration, International Energy Annual

Economic growth usually translates into increased electricity consumption. Turkey has experienced an average annual rise in energy consumption of 8.5% from 2001 to 2008. The 2008 consumption levels of 198 billion kWh are perilously close to the amount of power that domestic installed capacity is able to provide. Indeed, before the financial crisis began to affect 2008 consumption figures, many analysts feared blackouts in 2009.

This report, a POWER exclusive, was compiled with on-the-ground research and extensive interviews of key industrial and political figures who make up Turkey’s power sector. It closely examines Turkey’s plans to create a power infrastructure capable of providing the reliable electricity supplies necessary for sustained economic growth.

Building Demand

Though the effects of a global economic slowdown in Turkey have decreased the country’s growing demand for electricity by about 10%, the slowdown will only be temporary. Turkey’s electricity consumption per capita is a mere 3,000 kWh — less than a quarter of the consumption of some of its neighbors in the European Union (EU). Rapid urbanization coupled with a young and growing population will put strong upward pressure on electricity assets. Indeed, Turkey will have to double its installed capacity of 40,000 MW by 2020 in order to cope with expected demand growth, according to Turkey’s Ministry of Energy and Natural Resources (MENR).

Recent disputes involving natural gas supplies from Russia have strengthened the Turkish Government’s resolve to achieve a greater level of energy independence. Government officials hope that by using a mix of renewable, nuclear, and more-efficient thermal power plants, Turkey can reduce the costs and risks involved with importing gas from Russia, Syria, and Iran. Turkey has no nuclear power plants, although it is known to be discussing the purchase of CANDU reactors from Canada. (Read more about these reactors on p. 28.) Turkey has adequate internal reserves of uranium, and the CANDU reactor does not require uranium to be enriched. But many inside and outside of Turkey oppose constructing a nuclear plant in Turkey because of potential earthquakes.

In addition to constructing new plants, a range of environmental projects is planned for existing plants, including retrofitting older coal-fired plants with flue gas desulfurization systems. New renewable power facilities are being considered, building on Turkey’s strong tradition of building hydroelectric plants. There are also designs to tap into the country’s enormous wind, solar, and geothermal potential (Figure 2).

2. Total Turkish energy consumption, 2006. Source: EIA International Energy Annual 2006

An Evolving Regulatory Environment

The privatization of Turkey’s electricity assets was first attempted three decades ago, but a combination of ongoing political, legal, and economic factors have left the process far from complete. We begin with a brief history of how the regulatory framework has evolved to explain the current market and how it is likely to develop.

Privatization of Turkey’s power infrastructure was first considered in the 1980s as part of the mandate of the Motherland Party’s Prime Minister Turgut Ozal. Ozal saw privatization as a way to reduce Turkey’s debt and increase its global competitiveness. Yet the privatization of the State Economic Enterprises, which controlled the key industries, contradicted the precepts of the Turkish Republic’s founder, Mustafa Kemal Ataturk, whose "statism" principle placed a strong emphasis on the role of government in industry. Subsequently, there was significant opposition to privatization from many trade unions, politicians, and bureaucrats.

In 1984 the Turkish parliament, or Grand National Assembly, passed the Energy Privatization Law 3096. This far-reaching law allowed the private sector to build and operate electricity generation, transmission, and distribution assets. It was also known as the BOT law, as it was planning to use the world’s first build-operate-transfer model and, crucially, it would force investors to eventually hand assets back to the state at the end of an agreed-upon contract term. The system planned to reassure investors by offering sovereign bank guarantees to cover any potential losses.

The BOT model initially failed to make much headway. "The main stopping point was that investors wanted to know that if there was a legal dispute, then they could resolve the matter through international arbitration; the original legal framework of Law 3096 did not allow for this," explained Ahmet Danisman, general manager of Turkey’s first private energy company, AkEnerji.

In 1994 legislators looked to resolve this issue by amending Law 3096 so that it would include international arbitration, but this was overruled in 1996 by the Constitutional Court. The problem with BOT was that as the asset was eventually returned to the state, it was regarded as state property and therefore subject to administrative law as opposed to commercial or international law.

Legislators, however, did finally manage to make the BOT model more attractive by keeping the sovereign guarantees at 100% of the investment; the original approach reduced the guarantees incrementally over the contract term. Shortly after this change, 1,389 MW of gas-fired plants and 803 MW of hydroelectric plants were constructed under the updated BOT model before the conditions attached to the International Monetary Fund (IMF) rescue package for Turkey in 2001 restricted the further granting of sovereign guarantees.

Not content with the levels of private investment attracted by BOT, MENR created an alternative system under the BO Law, passed in 1997. It created a build-operate model that was designed to avoid the constitutional problems associated with the ownership of generation. The first construction under the BO model, which only applied to thermal plants, began in 2000.

While the myriad changing laws and regulations are complicated to follow, it’s clear that the uncertainty froze investment in the electricity sector. Perhaps the most telling legal anecdote concerns what occurred in 1997 and 1998, when MENR exercised a clause in Law 3096 that allowed for the transfer of operating rights of existing power plants and distribution assets. MENR conducted a series of tenders for the assets and signed transfer contracts with companies. But another legal challenge, this time from a trade union, derailed the process.

Another effect of this stop-start privatization process was that by 2000 the majority of private sector investment in the power sector was from auto-producers — large conglomerates that produced electricity and heat primarily for their own industrial use. Today, most of the important Turkish power companies have experience as auto-producers, including Enerjisa, AkEnerji, and Ayen Enerji. "Our background in auto-producing means that we gained skills and know-how in the energy industry before some of our peers," claims Selhattin Hakman of Enerjisa.

Privatizing Plants

Perhaps the most defining moment of the protracted privatization process came in 2001 with passsage of the Electricity Market Law 4628. The law kept the license model, whereby companies effectively rent the right to operate an asset that they have bought or built. This ambitious legislation also redefined the state organizations that control generation, transmission, and distribution assets to facilitate their privatization, construct an electricity trading mechanism, and create an independent body to regulate the overall electricity market. Eight years later, Law 4628 has made significant, if somewhat slow, progress.

One fundamental action of Law 4628 was to separate the former Turkish Electricity Transmission and Generation Corp. (TEAS) into separate bodies for generation (EUAS), distribution and trading (TETAS), and transmission (TEIAS). The idea behind unbundling these assets was to ease their eventual privatization. Indeed, this move was another step in the process that was started in 1994 when TEK (Turkish Electricity Corp.) was split into TEAS and TEDAS (responsible for generation/transmission and distribution respectively).

Privatization made another step forward when TEDAS was split into 20 regional distribution companies controlling 98% market share in electricity distribution across Turkey. Four of these distribution companies were offered for sale in 2008 and, despite the turmoil in the world’s capital markets, all were eventually sold.

Law 4628 also makes provisions for the privatization of generation assets. In accordance with the law, EUAS has prepared six portfolios of power plants to be privatized. Each portfolio ranges from 2,000 MW to 3,000 MW of installed capacity totaling 45 power plants. EUAS is not planning to withdraw from the market completely, however, and analysts expect it to retain a generating capacity of approximately 7,000 MW.

Unfortunately, the generation privatization timetable was delayed when the Privatization Administration, which is charged with overseeing the plan, was forced to issue another tender for a consultant after its original choice, Lehman Brothers, collapsed.

Designing a New Market

Many feel that the most important element of the 2001 law was the creation of a market mechanism. Under the law, the majority of electricity is traded through bilateral contracts, but approximately 15% of the electricity is bought and sold through the balancing and settlement mechanism. The system operates under an eligible consumer concept whereby any market participant that requires more electricity supplied to it by the grid is free to choose its supplier on a market with hourly rates.

The physical balancing of the system is handled by the National Load and Dispatch Centre (NLDC), while the Market Financial Settlement Centre (MFSC) accounts for the monetary transactions. Both centers work under the auspices of TEIAS. The NLDC is also responsible for producing hourly consumption estimates that are used as a guide for scheduling activities for the next day. Currently, a day-ahead scheduling method is used, which means that consumers use consumption estimates to request how much electricity they will need 24 hours in advance.

In essence, the system allows generators to make money by selling electricity for higher prices according to supply and demand. However, some doubts have been cast on the system. At the end of 2008, Energy Market Regulatory Authority (EMRA) officials admitted that, "Recently very serious questions are raised concerning price manipulations within this mechanism," according to the Secretariat General for EU Affairs.

Yet market participants have dismissed the importance of these claims for two reasons. First, they say the system has succeeded in attracting investment to the sector. They point to the difficulties faced by gas-fired plant owners before the balancing and settlement mechanism was established when rising gas prices were not reflected in the electricity price set by the government. Many generators had to close their plants or run at a loss. They also highlight the fact that the current system is transitional and is intended to make way for a more sophisticated spot market by 2010.

Private sector players have also welcomed the tough stance that EMRA has taken on allegations of price manipulations. Although the Turkish electricity market remains a complex mix of public and private bodies and transitional systems, an independent, active regulator is essential to the development of a competitive energy market.

The director general of EMRA, Hasan Koktas, told POWER, "We are fully aware that in order to attract direct foreign investment, it is crucial that we have a transparent uncomplicated bureaucracy. Turkey is in the process of liberalizing its energy sector in alignment with the principles of the EU."

The most recent major piece of energy legislation was the Renewable Energy Resources Law 5346. This law is generally perceived to have been successful in attracting investment to the renewable market and, at the time this article was written, a new law with differentiated tariffs for the various types of renewable technologies was being prepared.

Tough Economic Times

The privatization of Turkey’s power industry has been a long and complex process that has encountered several economic and political hurdles. Indeed, Turkey was one of the first countries in Europe to liberalize its electricity market but has seen many of its neighbors complete the process more quickly. Even after the Electricity Market Law passed in 2001, progress has been slow, as power investors were initially wary after having their fingers burned in previous years.

Then in 2008, just as international utilities were returning to the country and local players were ramping up their operations, the credit crunch hit developers’ ability to finance projects and complete planned mergers and acquisitions. However, there is growing confidence in the regulatory environment, as evinced by the number of foreign energy companies making large investments in Turkey. Furthermore, despite encountering problems as it worked to define market regulations, EMRA is generally perceived to be improving bureaucratic procedures while adapting to changes in the market.

Those dissatisfied with the pace of reform should remember that the first privatization law was passed only one year after a military coup, and that between 1991 and 2003 Turkey was governed by 10 different prime ministers representing six different political parties. This constant changing of administrations, most of which were coalitions, made it difficult to forge a consistent approach toward privatization. Energy investors will hope that the recent success of the moderately Islamic, pro-business Ak Party in securing a third successive term will create the stability required for investment and liberalization.

Fossil-Fueled Plants Under Fire

Both coal- and gas-fired power plants have come under increasing criticism in Turkey for damaging the environment and increasing the country’s dependence on energy imports. Yet Turkey needs approximately 40,000 MW of new installed capacity by 2020. With nuclear appearing a distant option and renewables expected to have a limited impact in the near future, it becomes clear that much of the growth will come from coal-fired and gas-fired thermal power plants, according to MENR estimates. Furthermore, even if a significant portion of Turkey’s considerable renewable potential is developed, much of the extra electricity generated will still need to be supported by baseload power resources because key renewable technologies use weather-dependent, variable sources of energy.

Turkey has traditionally relied on fossil fuels for generating electricity, although its dependence on various fuels has changed over time. For much of the early part of the republic (from 1923 to 1963), hard coal was the favored fuel. Eventually, it was supplanted by oil, which, following the price instability of the 1960s and 1970s, gave way to domestically produced lignite by the early 1980s. However, gas-fired plants were built steadily throughout the 1980s and 1990s, and gas officially overtook lignite in 1999.

Dash for Gas

Today, gas-fired plants (Figure 3) account for almost 50% of Turkey’s electricity generation, while hard coal and lignite fuel 21% of power production, according to MENR estimates.

3. Gas fuels half. Natural gas fuels nearly half of the power generated in Turkey. The Adana Combined Cycle plant uses a General Electric Frame 6 gas turbine. Courtesy: Enerjisa

On a macro-economic level this increasing dependence on natural gas to produce electricity increases Turkey’s exposure to volatile gas prices and supply disruptions. The rapid rise in gas prices in the first half of 2008, for example, caused Turkey’s budget deficit to significantly increase, according to Oxford Business Group. Such increases had even worse effects before the creation of the balancing and settlement mechanism; in June 2006 Ak Enerji had to close two gas-fired plants because of high natural gas costs. "One successful aspect of the balancing and settlement mechanism has been that it has allowed generators to pass on fuel costs more effectively to the market," said Ahmet Danisman, CEO of Ak Enerji.

The Politics of Fuel Supplies

On a geopolitical level, Turkey’s dependence on natural gas gives its two major suppliers, Russia and Iran, political leverage over Turkey. Indeed, the success of a Russian company in the recent tender for building and operating Turkey’s first nuclear plant was attacked by the local press for placing even more energy security under Russian control.

Furthermore, both Russia and Iran have unreliable track records as suppliers. Russia supplies 67% of Turkey’s imported gas through the Blue Stream pipeline, which runs under the Black Sea, and the Trans-Balkan pipeline, according to the U.S. Energy Information Administration (EIA). Russia’s almost yearly disputes with Ukraine have had a ripple effect on the Trans-Balkan region and reduced Turkish supplies in the region around the capital, Ankara.

Meanwhile, Turkey’s second-most-important supplier, Iran, regularly cites inclement weather as a reason to cut gas exports to Turkey, the most recent instance being in 2008. Work on the Iran-Turkey pipeline was also stopped due to attacks from the Kurdish separatist movement, the PKK.

Diversifying Gas Supplies

The government is looking to resolve these supply issues by investing heavily in infrastructure for transporting and storing gas. One project currently being constructed with World Bank support is a massive storage facility beneath a large salt lake that lies south of Ankara (Figure 4).

4. Conduit country. Turkey’s location makes it a natural conduit between the gas-rich countries of the East and high-demand markets of the West. Planned infrastructure projects will increase the security and availability of gas for Turkish power plants. Source: EIA

Another is Nabucco, a €7.2 billion, 2,000-mile pipeline project that plans to offer Europe an alternative to Russian energy by providing gas from Azerbaijan and Turkmenistan. This complex project is currently bogged down in a quagmire of regulations and political intrigue, but the Turks have already made it clear that if they are to be part of this or any similar pipeline, they will not only participate as a transit country but will also take their share of the resources.

Much of the demand for improved gas infrastructure is linked to gas’s rising popularity as a direct fuel for cars, cooking, and heating in Turkey. But gas-fired electricity generation will also benefit from these developments, as they will create a more secure supply of gas.

With a stable fuel supply, gas-fired power plants have many advantages that mean that they are likely to remain the most common form of power generation in Turkey for some time. Gas-fired plants have lower capital costs than nuclear or large hydro projects, a quality that is especially important in the current credit climate. Another benefit is that gas-fired plants take less time to build than hydro or nuclear plants. They can also be built close to the load, unlike nuclear or hydro, and their modular functionality allows them to operate efficiently at different power outputs.

These benefits are helping gas-plant investors to secure financing even in these troubled times. Ece Ertac, the managing director of Sinerji, a financial consultancy that focuses on power projects, explained: "We recently arranged the finance for a gas-fired plant. It is more difficult at the moment because banks are not willing to give long-term loans so investors need to inject more equity — but it is possible."

Carbon-Limited Options

Bearing in mind these advantages, perhaps the most serious objection to using more gas for electricity generation is environmental. Although gas-fired plants are a lot cleaner than their coal counterparts, and developments in combined-cycle technologies have improved their efficiencies, there is still the problem of CO2 emissions. Turkey’s EU membership ambitions and recent signing of the Kyoto Protocol have put it under increased pressure to reduce its greenhouse gas (GHG) emissions (see sidebar).

Rich in Coal

Turkey’s other thermal option, coal, has even worse environmental consequences. In addition to CO2, coal-fired plants create fly ash, nitrogen oxide, and sulfur dioxide. Turkey has two types of coal that can be sourced locally: brown coal, or lignite, and anthracite, a hard coal. Turkey is rich in lignite, with 10.3 billion tonnes of proven reserves, but it has a limited supply of approximately 1.3 billion tonnes of anthracite, according to MENR.

Lignite is a low-grade coal with high amounts of carbon (25% to 35%), ash (6% to 19%), and moisture (reaching 66%). These qualities can make controlling the emissions of lignite-fired plants particularly challenging (Figure 5). If Turkey wishes to exploit its vast reserves of lignite without damaging its environmental and international agreements, it will have to employ modern coal-firing technology with extensive emissions control systems.

5. Fueled by Turkish lignite. The lignite-fired Cayirhan Power Plant, located in Ankara, has four units, 2 x 150 MW and 2 x 160 MW. Courtesy: Türkiye Müteahhitler Birligi

Unfortunately, Turkey does not have a good record when it comes to lignite-fired generation. The country’s biggest plant is the pulverized coal – firing 2,800-MW Afsin Elbistan plant in southeast Turkey (Figure 6). Unit A began operating in 1983 and Unit B in 2006. Unit A has attracted criticism as none of its flue stacks has a desulphurization unit, while its electrostatic precipitator system cannot handle the amounts of coal required when the plant is firing at full capacity. Furthermore, there is no fly ash dam facility at the plant, and the ash is stacked in an open dump, where it can be blown into surrounding areas by strong winds.

6. Controversial coal plant. The Afsin Elbistan-B Power Plant is a 4 x 360-MW lignite-fired plant located in Kahramanmaras. The plant entered service in 2006. Courtesy: Skoda Export

MENR has offered tenders for the rehabilitation of Unit A and for the additional construction of two more units, but it eventually cancelled the tenders, citing a combination of technical and economic reasons. The Afsin Elbistan case has frustrated proponents of coal-fired generation in Turkey because it has tarnished the industry’s image. "I oversaw the construction and operation of Afsin Elbistan unit A and the problems it now has stem from a lack of investment in operation and maintenance and rehabilitation in recent years," said Hema Enerji project coordinator Emin Kirecci.

Kirecci is currently overseeing the construction of a 1,100-MW coal-fired plant in Amasra, west Turkey, that will use hard coal. This plant is using supercritical technology to increase its efficiency and lower CO2 emissions, while de-NOx units will dramatically cut the amount of nitrogen oxide that escapes into the environment. Desulfurization units are also being employed to remove sulfur dioxide. The 135-MW Hema Plant is using fluidized bed technology to reduce NOx and SOx.

"Turkey has to utilize its coal resources, therefore it is down to private sector companies to build modern, efficient and environmentally friendly plants to provide cheap, clean, and domestically produced energy," added Kirecci.

Looking to Clean Coal

Another hope comes from rapidly developing clean coal technologies. A small-sized Turkish technology company, Detes Energy, holds the Turkish license for the British Gas Lurgi technology, which would enable it to convert lignite into a synthetic gas. The company recently signed a contract with German firm Environtherm Gmbh to build a 125-MW plant that would also produce methanol.

Detes Energy senior partner and technical supervisor, Dr. Mustafa Tolay, said, "This technology has the potential to help Turkey generate electricity from its lignite in a much more environmentally friendly way than at present. The technology is proven, and there are worldwide references; it just requires investment."

Tolay also claims that the higher costs of generating electricity using this method, as compared to conventional lignite-fired plants, will be offset by the sale of the chemical by-products produced in the process. Though it remains to be seen how significantly this technology will contribute to Turkish electricity generation, Detes is a good example of the high-technology companies operating in Turkey that are ready to add value to the sector.

O&M Options

Another way that Turkish gas- and coal-fired plants can reduce their environmental impact is by fostering a conscientious operations and maintenance (O&M) culture. Nedim Ergin, general manager of Turkish valve supplier Vastas, explained: "Many people talk about Turkey needing to build new power plants, but they forget that we can produce more electricity by increasing the operating capacity at our existing plants. More efficient plants are also better for the environment."

Vastas supplies valves for the 770-MW combined-cycle Baymina plant located near Ankara. New private ventures like Baymina have high capacity factors, whereas many of the older, government-run plants are operating at much lower efficiencies. Successive governments have cut back nonessential repair work, believing that the plants were soon to be sold to the private sector.

Cemal Yucer, chairman of Ankara-based service and maintenance firm Proterm, said, "I worked for the state generating company for many years, and it had a very high technical competence. However, it is difficult for them to always fund the projects that they want to, and with so many plants to build and maintain, it is not surprising that maintenance was not always allocated the funding it needed."

"This is different with private companies, who value O&M because they see money spent on such services as an investment not a cost. Money spent on O&M will result in less downtime, fewer hours lost through injury and a more controlled plant environment," added Yucer.

Attuning to the difference in culture between state-owned entities and private companies is one of the most important aspects of the privatization process. Hasan Ozdemir, chairman of the Prokon Ekon group of companies, explained: "Public institutions (such as EUAS) have been successful in improving Turkey’s electricity infrastructure, but I feel that the advantage of private companies is that they can respond more quickly to changes in market conditions."

Although the government has pledged to diversify the generation mix, generating power on a macro scale involves a combination of social, economic, and political issues. Just as Turkey has a commitment to cut harmful emissions, it also has an obligation to provide cheap, secure electricity that can power economic growth and improve the lives of its people.

For overwhelming economic and political reasons, Turkey is likely to continue relying on coal and gas to fuel the lion’s share of its electricity generation. The country needs to face up to the challenges created by using fossil fuels. The most effective way it can do that is by applying and developing new technologies. This can range from new combustion techniques to the latest O&M procedures. Indeed, the imminent need for new generating facilities is a timely opportunity for Turkey to secure a cheap, clean baseload power supply for the future.

Hydroelectric Power Potential

With mighty rivers such as the Euphrates and the Tigris, 25 river basins, and a varied topography, it should come as little surprise that Turkey has 16% of Europe’s theoretical hydropower potential and 1% of the world total, according to the General Directorate of State Hydraulic Works (DSI). Furthermore, unlike the other clean energy sources (solar, wind, and geothermal), which Turkey also has in abundance, hydroelectric power is already making a significant contribution to the country’s electricity generation.

The political desire to exploit more of the estimated 433 billion kWh of theoretical hydro potential has been strengthened by volatile gas prices and intermittent service from its two main suppliers, Russia and Iran (Table 1).

Table 1. Turkey’s hydropower potential. Source: DSI

The DSI has set the target of exploiting all technically and economically feasible hydropower potential by 2023 — the 100th anniversary of the much-venerated Mustafa Kemal Ataturk’s founding of the Turkish Republic. This date is especially poignant, as Ataturk, who laid the foundations for the DSI, saw hydropower as a means for Turkey to grow in strength.

Turkey started building its first large-scale hydropower plant 60 years ago, and there are now more than 172 plants in operation with a total installed capacity of 13,700 MW producing an average of 48,000 GWh/year — 19% of the electricity generated annually, according to the DSI.

Although the nameplate capacity of 13,700 MW is considerable, current projects are only using 35% of the country’s economically and technically feasible hydropower potential of approximately 140 billion kWh, according to the DSI. To give some international perspective to that figure, the U.S. utilizes 87%, Japan 78%, Norway 68%, and Canada 56% of their economically feasible hydropower potential.

At present there are an additional 148 hydroelectric projects under construction with a total installed capacity of 8,000 MW and projected annual output of 20,000 GWh. Looking even further ahead, the DSI has marked out another 1,418 projects that would add 22,000 MW of installed capacity and ensure that Turkey was using 100% of its economically and technically viable water potential. Government targets and plans are always nice to look at on paper, but most reading this report will want to know the reality on the ground (Figure 7).

7. A drop in the bucket. The Cindere plant is a good example of Turkey’s many mini-hydropower projects. The plant, located in Denizili, produces electricity from three 8.5-MW turbines. The plant entered service in 2007. Courtesy: Türkiye Müteahhitler Birligi

DSI Deputy Head Tuncer Dincergok explained: "We have been set this target and are working hard to meet it, but obviously it is impossible to say that we will use 100% of the economically viable potential. There is a finite amount of engineers, materials, and finance that can be used to construct these projects. Subsequently, we can direct these resources in the most efficient manner at those projects where it makes most sense. As such, even though we may not reach the 100% figure, we can reach a significant part of it."

Skeptical of New Hydro

Some in the industry are more skeptical. Aldonat Koksal, a managing partner of Ankara-based hydroelectric power plant (HEPP) design and consultancy firm HidroDizayn, said, "There are a number of technical challenges that will prevent that target from being realized. The present energy transmission lines will not be able to carry all the produced power, while the existing construction facilities (equipment and manpower) would not be sufficient to construct all projects within 10 years’ time."

One step that Turkey has taken to boost its hydro construction capability was to involve the private sector to meet the goal of exploiting 100% of the country’s hydropower resources by 2023.

The 2001 Electricity Market Law allowed the DSI to send projects to EMRA, which then issues a tender for licenses. The system also allows companies to plan their own projects and submit them to the DSI and EMRA for approval.

This process took time, however, as secondary legislation was also needed to establish the water use right agreements for electricity production activities. It was not until March 2005 that EMRA, which was also created by the 2001 Electricity Law, began issuing licenses. The length of time that it took for the licensing process to be clarified frustrated many investors, though times have since improved as all parties become more familiar with the procedures.

EMRA has so far granted licenses for 498 hydropower plants to the private sector, 30 of which have been completed. When EMRA began issuing licenses, it found the local private sector champing at the bit. In a March 4 interview, the DSI noted that one reason for this was that the activities of the DSI, which built a total of 55 hydropower plants with 10,783 MW capacity from 1954 until 2009, fostered a wealth of hydropower expertise in Turkey (Figure 8).

8. One of many. The EUAS-operated Gezende hydropower project went online in 1994 and produces electricity from three 53-MW Francis turbines. The dam is 71 feet high. Courtesy: BM Muhendislik ve Insaat AS

"The DSI was like a school for us," said Ibrahim Tugsuz, chairman of Ciltug and Tegtug, companies that produce hydro mechanical equipment and develop and operate HEPPS, respectively. "When I was a mechanical engineer on the Keban Dam project in the 1970s, we needed a large number of foreign consultants as we did not have the engineering expertise. After the success of large projects like the Keban and Ataturk HEPPs, a generation of Turkish engineers has gained invaluable experience and know-how that we can now export to other parts of the world," he added.

Wasted Licenses

Unfortunately, these "serious" players were joined in the process by ranks of speculative investors whose sole intention was to acquire a license that they could resell to a project developer. This had the effect of raising project costs and delaying development times, as construction could not begin until a genuine developer bought the license.

"A number of licenses were awarded to investors who had no intention of carrying out the project but simply wanted to make a quick profit," explained Bulent Ocel, general manager of hydro producer Arsaan Insaat. "Many of them had no detailed technical knowledge of the license that they held. They had not completed any feasibility studies and, as a result, the prices that they were demanding for the licenses were not realistic."

The situation was exacerbated by legislators’ efforts to encourage investment in energy by reducing the barriers to entry. For example, one clause in the 2001 Electricity Market Law sought to encourage the use of domestic energy resources by only requiring producers using local fuels to pay 1% of the total license fee.

EMRA responded to private sector complaints and used its statutory power to audit licensees and cancel a license if it felt the developer had failed to meet the terms of the contract. To date 15 licenses have been cancelled and the holders are banned from participating in future bidding rounds for the next three years. In 2007, EMRA also introduced bid bonds of 10,000 YTL ($6,326) for every MW of power for which a license was purchased.

"While in principle it was a good idea, the bid bonds were not high enough to stop speculative investors from applying for licenses," said Ferhat Malick, hydro energy expert at Brightwell Investments. Ironically, the most effective restriction on speculative investors has come from the global financial crisis. Energy investors and banks are increasingly selective in choosing projects and will no longer tolerate the exaggerated fees levied by speculative investors.

If that is one of the positive effects of the financial crisis for the development of Turkish hydropower, there have been many negative ones.

In general, Turkish banks are in a much healthier condition than their European counterparts, as strict reforms enforced after the Turkish economic crisis in 2001 reduced their exposure to the credit crunch. Nonetheless, they are becoming increasingly selective and have difficulty financing large syndicated projects of over $50 million. Large hydropower projects are particularly affected because, though the operation costs are low, the initial capital expenditure is relatively high.

One example of this is Arsaan Insaat. The company had planned to develop eight hydro projects this year but, due to the increasing cost of credit and the difficulties of obtaining it, it has had to cut back to four. Allen Baker, global head of energy for Société Générale, explained: "Raising international debt from banks is difficult in every circumstance. There aren’t enough banks which have the risk appetite to finance these projects. Even if Turkish banks are relatively strong, they will need the help of international banks, who may not be able to step in for a while."

One advantage for hydro, however, is that about 50% to 70% (depending on the project) of the cost is construction work that is funded and carried out locally. Although there are international banks involved in the Turkish energy sector, the vast majority of private sector hydropower plants have been financed by Turkish banks and built by Turkish companies.

TKSB is a leading Turkish financer of hydro projects, and to date it has financed 69 hydropower plants. TSKB Executive Vice-President Burak Akgoc explained why Turkish hydropower projects have been popular with investors and why they might bear less of the brunt of the financial crisis than other energy investments: "Hydro was predominant because there was more statistical information available for the investors. The DSI had data ranging back for more than 40 years with information on almost all the rivers in Turkey. This gave investors the statistical support that has been lacking with other forms of renewable energy, such as wind."

Looking for Partners

With a lack of easy credit, Turkish firms are looking for alternative ways to finance projects. One way is to attract foreign investment through a partnership or joint venture. A good example is Turkish hydropower producer Borusan Enerji, which built up an impressive portfolio of hydro licenses totaling 912 MW before selling 50% of the company to German utility EnBW (Energy Baden-Wuttenburg). The partners plan to spend $1.27 billion over the next three to four years to develop 1,000 MW of mostly hydropower projects.

"Borusan Holding is a massive company and could finance the investments itself. However, in these times of financial crisis there are advantages to splitting the investment," said Borusan Enerji General Manager Deniz Unal.

Another means of attracting investment common to the hydro industry is through Export Credit Agency (ECA) financing. This is because, although Turkish firms have experience in developing projects, nearly all of the electromechanical equipment for HEPPs has to be imported. Turkey is one of the top six most frequent users of ECA finance in the world.

This was confirmed by Société Générale’s Turkish general manager, Pierre Lebit, who said, "We are looking at the financing of a number of energy projects. However, the situation on the ground has changed. Before the crisis, the Turkish banks were very aggressive with very competitive pricing. Since the crisis, and the increased cost of funding, a number of clients have shifted to ECA financing, which I believe is more appropriate."

Yet while electromechanical equipment needs to be sourced abroad, there is a strong local service sector that can install and maintain the foreign equipment used in Turkish HEPPS. Indeed, the continued participation of foreign manufacturers in Turkey has led to a skills transfer. One example of this is Ayken Elektric, a mid-size installation service company.

"We began working as a subcontractor for Schneider Electric in small hydro projects. As we worked with them we were able to perform more tasks, and when they decided that they did not want to focus on installations, we were able to take control of more of the work," explained Ayken Elektric General Manager M. Koray Eryilmaz. "Now we are able to perform electrical engineering to international standards, but we are more competitive on price, as we lack the overheads of a multinational firm."

Paradoxically, despite often being perceived as "green energy," the most significant challenge in the development of large hydro projects in Turkey is the environment. Since 1993 hydropower projects with a reservoir capacity of more than 0.1 km 3 have needed a satisfactory environmental impact assessment before construction can begin.

Mega Hydro Project Planned

One project that has attracted fierce criticism for its negative social and environmental effects is the South-Eastern Anatolia (GAP) project. Consisting of 22 dams, including 17 hydropower projects, the GAP project is intended to double the area of Turkey’s irrigable farm land and provide 7,000 MW of power, according to the DSI. Although it will bring benefits to Turkey, there are fears that making such a radical change to the natural habitat of the area will harm biodiversity. The project will also involve flooding areas of ancient Mesopotamia and its rich archaeological sites and artifacts that reflect the mix between the Middle-Eastern and Anatolian cultures.

GAP authorities have responded to the criticism by forming schemes designed to minimize the project’s impact. An assessment of GAP’s impact on biodiversity was completed in 2004, and the wildlife project was established in 2002. Regarding cultural protection, rescue missions have begun to salvage some of the items that will be lost when the large reservoirs are created, but there are some immovable items whose existence in the future will be consigned to a photograph.

A spokesman for the DSI said, "It is a part of the GAP philosophy to consider the positive and negative impacts of project implementation and to take measures in advance to curb negative ones while reaping the maximum from the others."

In essence GAP is a multi-sector, regional development program, and its concerns transcend the power industry. However, the care that the DSI is taking to appease environmental and social objections should serve as an indicator of the levels of corporate social responsibility that investors will have to display in Turkish HEPP projects.

It remains to be seen if Turkey can achieve its ambitious target of exploiting all of its technically and economically feasible hydro potential by 2023, but it is clear that country has already taken significant steps in that direction. With many of the bureaucratic bottlenecks ironed out, a wealth of local hydro know-how, and a burgeoning service sector, there can be little doubt that hydro power will play its part in providing Turkey with a secure and emission-free source of power in the future.

Renewable Power Development

Turkey’s general trend of increasing consumption means that the country needs to add 40,000 MW to its installed capacity by 2020, according to MENR. Fuel security, volatile prices, the environment, and EU membership are all important issues, yet renewable power technologies may offer the perfect solution to Turkey’s electricity dilemma — especially considering Turkey’s wealth of renewable energy resources. However, with renewable energy more costly than its competitors, and some of the technologies less proven, many challenges lie ahead before alternative energies are ready to play a serious role in Turkey’s future.

Renewable energy power generation began in Turkey in the late 1990s. By 2000, approximately 1,700 MW of renewable energy projects were in the planning process, according to Professor Necdet Altuntop of the International Solar Energy Association. This included 1,379 projects, mostly wind and small hydro, that were being partly funded through a $200 million World Bank loan. Then, in 2001, Turkey was hit by a severe financial crisis, and the condition of the resulting IMF help was that Turkey had to scrap sovereign guarantees to generation investments. This led to planned renewable projects being pulled, including the cancellation of a 390-MW wind power tender that was at an advanced stage.

The reforms were intended to create a more liberalized electricity market by reducing direct government involvement in greenfield generation projects. In reality, the lack of a bank guarantee frightened many renewable investors away, leading to a five-year dry spell without any major renewable plants coming online.

New Law Pushes Renewables

The key development came in 2005 with the passing of Renewable Energy Law 5346. This aimed to encourage investment in renewable technologies by guaranteeing projects a seven-year (updated to 10 years by Energy Productivity Law 5627) feed-in tariff of 5.5 eurocents, a 99% discount on the license fee, and a free annual license fee for the first eight years following completion. Renewable projects were also offered an 85% discount on the purchase of government land and priority connection to the transmission grid.

An important distinction for investors was that the law defined river- or canal-type projects of less than 50 MW, or a hydropower plant with a reservoir volume of less than 100 million square meters or a surface area of less than 15 km 2, as a renewable project, but larger hydropower projects were not eligible for the benefits offered by the law.

The technology that responded most markedly to this new legislation was wind power. Turkey’s first commercial wind energy power plant, the 12-turbine, 7.2-MW Ares Wind Farm near Izmir, was built in 1998. Seven years later, only two more significant plants had been built, and installed wind capacity was a mere 20 MW in 2006, according to the European Wind Energy Association.

Then, in 2007, everything changed. Eight more wind farms came online, helping wind capacity leap 736% to 140 MW. In the same year a government tender for wind farm projects attracted 751 bids worth a total of 78,000 MW, according to EMRA. Today, the International Wind Energy Association notes the total installed wind capacity is 433 MW, and 3,328 MW more are scheduled to be constructed by 2010, according to EMRA (Figure 9). It must be noted, however, that observers do not expect that goal to be met, as companies are likely to request extensions due to financing problems. "The market has moved extremely quickly in a short time," noted Ms. Goknur Atalay of consultancy firm Enerjidanismanlik.

9. Wind power installed in Europe at the end of 2008 (MW). Source: European Wind Energy Association

More Help Wanted

Though the Renewable Law was the main factor in this radical change, another important element was the success of the first project that proved that this energy was economically viable. Hydropower plant operator Bilgin Elektrik developed the first 100% free market wind energy plant in 2006. The 20-turbine, 30-MW Bares II plant based in Bandirma proved to the Turkish business community that wind farms could generate both electricity and profits.

"Bandirma gave a massive psychological boost to the industry. More importantly, it showed banks that they could invest in wind power. This was key, as it made project financing for later projects more fragile," explained Bilgin Elektrik General Manager Tolga Bilgin. Bilgin, who is also chairman of the Turkish Businessmen’s Wind Association, RESSIAD, dismisses claims that the government should do more to help the industry.

"Some people say that 5.5 euro cents is too low a price (it is lower than the incentives offered by other European countries), but I say it is better than nothing. Indeed, so far producers have not had to sell to the government for this price, as the market price has been consistently higher," added Bilgin. Indeed, it is interesting to note that, due to tight supply, the open market rate has been steadily above that figure, averaging 8 euro cents per kWh.

This optimism is shared by Wadie Habboush, CEO of Turkish energy investor Habboush Group: "The government has done a good job with the Renewable Act, which helps the private sector to exploit new opportunities in Turkey. In fact, Turkey offers great potential to investors, especially in renewable energy."

Despite the enthusiasm permeating the Turkish wind industry at present, there are many who feel that some aspects, for example the 2007 tender for wind power, have been badly managed.

Christian Johannes of Ankara-based consultancy Re-Consult said, "Of the 78,000 MW applied for, about 60,000 MW are not feasible and will not be realized. Unfortunately, very few companies actually performed wind measurements, and many applications were purely speculative."

"The problem is that since 2001, when the Electricity Market Law was introduced, nobody in Turkey — and the responsibility would principally fall on EMRA — has developed a mechanism for separating the wheat from the chaff," added Johannes.

Another renewable technology that has benefited from considerable government support is small hydro. Small hydro is generally defined as a project less than 10 MW for residential or industrial use. Within that bracket a project of less than 1,000 kW is termed mini hydro and one of less than 200 kW is a micro hydropower project, according to the Turkish Electromechanics Industry, a related establishment of MENR.

Small hydro is particularly attractive to the government, as it does not require extensive infrastructure, it can serve remote areas that are not connected to the grid, it has less of an environmental impact than large hydro projects, and, perhaps most importantly in the current credit climate, it is not capital intensive.

In addition to the support offered through the Renewable Energy Law, the government has also commissioned state-owned hydro-turbine producer Temsan to create a host of small, mini, and micro turbines. There are currently 60 micro, mini, or small projects operating in Turkey with a combined installed capacity of 129 MW, and an additional 493 MW of projects are in the planning stages, according to the DSI.

Tapping the Earth

The government has also been heavily involved in the development of Turkey’s geothermal resources. Turkey has one-eighth of the world’s geothermal potential and ranks seventh in the world in terms of geothermal energy. Turkey’s geothermal resources are mostly found in the southeast of the country and are a mixture of high enthalpy (30C and above) and low enthalpy. Turkey has an estimated potential of 31,000 MWt of geothermal energy that could theoretically heat one-third of the country’s homes, according to the International Geothermal Association.

The government has set itself the ambitious target of adding 500 MWe and 3,500 MWt by 2010. One step it took to achieve this goal was the 2007 Law on Geothermal Resources and Natural Mineral Water, which clarified the licensing procedure for geothermal energy. It was also a government body, the Directorate for Mineral Research and Exploration, that carried out the preliminary work for Turkey’s largest geothermal plant, the 47-MW Aydin Germencik facility. After extensive preparatory work, the government awarded the concession to Turkish construction giant Guris. Guris completed the plant in early 2009 and is hopeful that further work and improved technology can boost the installed capacity of the plant to 120 MW.

"This project is not only good for Guris but also good for Turkey," said Guris Vice-President Ali Karaduman. "Our minister of energy attaches much value to alternative energy projects. We hope our success in geothermal plants will convince him of their worth."

Just as Bares II provided inspiration for wind developers, it is hoped that Aydin Germencik will kick-start investments in Turkish geothermal projects.

With the technology for renewable power systems continually evolving, it is important that Turkish firms either develop their own technology or gain access to foreign equipment. One example of a firm doing just that is Dokar, a turnkey power construction company. Sabri Karabay, Dokar’s general manager, explained, "We have arranged distributorships with international energy companies that allow us to offer equipment which can produce electricity from low-temperature water sources (as low as 100C) such as geothermal water, process water, etc."

There is no doubt, however, that the financial crisis could dampen the development of renewable energy in Turkey. Recessions tend to make investors more risk averse, which reduces the allure of new and less-established technologies. Furthermore, the cost per MW of renewable energy is often higher than that of its competitors. EMRA figures based on projects completed in Turkey during 2007 put the investment cost per MW of wind energy at $2 million and hydro at $1.45 million, compared to $900,000/MW for gas or coal projects.

Prime Sun Power

These financial hurdles make the support of the government even more vital. At present, legislators are discussing a new renewable energy law that would set differentiated tariffs for various types of renewable technologies. This is especially important for photovoltaic (PV) thermal solar energy, which is one of the most expensive forms of renewable technology. Turkey has an estimated solar potential of 380 billion kWh but currently only uses a very small amount for thermal applications, such as to heat water for homes and businesses.

"Turkey has already established a production base for solar thermal equipment and will be in a good position to do the same for PV in the near future," said Celal Toroglu, general manager of solar panel manufacturer Solartek. "Solar energy is good for Turkey because it is a domestic source of power; but we need to make sure that we are not importing the equipment for PV power plant installations."

There is a real sense of anticipation with regard to solar power in Turkey. Many firms are completing feasibility studies so that they can move quickly if EMRA launches the tender that is expected later this year. Observers estimate that the new legislation will create a 21 eurocent per kWh tariff for solar energy, but until that is confirmed, no one is taking anything for granted.

One challenge that has more immediate consequences for renewable technology is the limitations of the transmission network. The grid operated by TEAS is nearing the limit of its capacity. Without rehabilitation and extension, it would be unable to transmit significant amounts of extra renewable energy. Furthermore, the grid is at its weakest in many of the rural areas, where renewable projects will be located. Ertugrul Sayin, general manager of EMA Contracting, a company that installs electromechanical equipment for wind farms and connects them to the grid, explained, "A massive investment on the grid would be needed to allow renewable energy to contribute more to Turkey’s electricity generation."

Incorporating wind or small hydropower into any country’s grid is difficult because it is not a baseload power source. Small hydro also provides variable power, especially in Turkey, where rivers are particularly irregular owing to the country’s climate and topography. Turkey’s grid would need to be upgraded to cope with the fluctuating power from renewable technology, while new baseload generation plants would have to be built to provide back-up when renewable supply drops. Additional baseload power would allow operators to "firm" the energy (offer a guaranteed consistent supply regardless of weather conditions).

However, the electricity market is yet to be fully liberalized and, as a result, sophisticated market mechanisms, such as firming, that could mitigate renewable power’s variability are not likely to be introduced in the foreseeable future.

Even though their country recently signed the Kyoto Protocol, Turkish renewable producers still are unable to participate in the protocol’s carbon trading scheme. Though some Turkish firms have participated in voluntary carbon trading, they receive a lower price than that available through the Kyoto scheme.

There is no doubt that so far renewable energy in Turkey has managed to generate more excitement than electricity. Renewable technologies have the potential to wean Turkey off its addiction to imported gas, insulate the economy from fossil fuel volatility, benefit the environment, and possibly help Turkey get one step closer to that elusive EU membership. However, the extent of renewables’ contribution to meeting any of these goals will depend on regulatory support and brave investors.

—James McKeigue (james @gbreports.com), Agostina Da Cunha ([email protected]), and Daniela Severino ([email protected]) are journalists with Global Business Reports.