The State of U.S. Mercury Control in Response to MATS

As this month marks the compliance date for the Mercury and Air Toxics Standards (MATS), it’s a good time to take a step back from the many months of concern and consideration of options to see how coal-fired power plants are actually responding to the new rule. It’s also a good time to acknowledge that the most effective MATS compliance strategy is not a set-it-and-forget-it one.

Except for units with a year’s extension, April 16 is the deadline for compliance with the U.S. Environmental Protection Agency’s (EPA’s) Mercury and Air Toxics Standards (MATS) for hundreds of coal-based power plants in the U.S., many of which, for the first time, have an applicable mercury standard. By now, most plant owners have made a MATS compliance decision that involves shutting down a plant or choosing a mercury control strategy. But April 16 isn’t the end of the story.

Units Affected by MATS

First, a brief review of the numbers. The MATS rule for mercury control applies to about 1,000 coal-based electric generating units in the U.S. The primary fuel for electric generating units over 25 MW included in the 2012 Energy Information Administration (EIA) Form 860 database shows about 55% bituminous-fired, 38% subbituminous-fired, 3% lignite, and 4% other coal or coke. The capacity totals approximately 310 GW. The reference case projection for retirements by 2020 in the EIA’s 2014 Annual Energy Outlook is 50 GW by 2020, from this base of 310 GW, leaving 260 GW of coal operating past 2020.

The EPA’s original regulatory impact analysis showed a total of 460 coal-based plants that MATS applied to, representing just over 1,000 units (from 2009 EIA data). Many units blend coal, and their strategies on coal are evolving, adding a significant variable that must be managed in light of ongoing compliance planning. Various reports and projections of unit retirements have been made, suggesting that the number of units to which MATS will ultimately be applied may be reduced even further.

Coal plants have several retirement drivers, fundamentally driven by higher operating costs and reduced revenues. Increased operating costs are driven by the age of the fleet (about 41 years average as of the 2012 EIA database), compliance with EPA regulations, higher fuel costs, and other capital upgrades. Revenues are dampened by competition with natural gas and renewables as well as increased end-use efficiency and flat demand growth.

Where capacity factors are low and units are adjusting operation to be load-followers rather than base-loaded units, the value of keeping the generation and making upgrades to meet environmental regulations can shift significantly. Smaller, older units have a harder time absorbing new costs or downturns in generation and will be the ones most likely to retire.

According to the Edison Electric Institute (EEI), approximately 70 GW of coal fleet retirements are projected to take place from 2010 to 2022. When compared to the 2009 EIA database, that would imply about 265 GW of generation that will be operating under MATS in 2022. In another study, the Brattle Group reported 15 GW of retirements confirmed in 2012–2013, with another 25 GW announced by 2016 and a further 8.4 GW projected by 2021.

The net estimates from various sources seem to be that about 250 to 260 GW of coal generation still will be operating in 2021, but some projections have higher retirement rates, depending on assumptions regarding natural gas pricing, the Clean Power Plan, and other pending regulations.

Compliance Extensions and Legal Challenges

Compliance extensions to 2016 have been obtained by many facilities, estimated by the National Association of Clean Air Agencies in October 2014 to be 145 plants or 32% of applicable units. This additional time enables plants to compare technologies, source equipment and reagents or sorbents, test and prove out equipment reliability, get measurements systems ready, and have a margin for meeting compliance. In some cases, retirements are planned in this timeframe.

The final startup/shutdown reconsideration rule was issued in November, spurring additional power plant requests for extensions as owners grapple with the decision between two startup alternatives and define the requirements as they apply to each unit.

The Utility Air Regulatory Group (UARG) filed a lawsuit in January objecting to the new procedures as “unworkable as written,” citing safety concerns with operation of equipment not designed to start at such a low load. In its comments on the startup/shutdown rule, the Institute of Clean Air Companies (ICAC) recommended a work practice standard tied to achieving key emission control system temperatures for good operation on a unit-by-unit basis. The four-hour timeframe may be too restrictive for many units.

Additionally, a Supreme Court decision reviewing the D.C. Circuit’s decision in White Stallion Energy Center, LLC v. EPA is expected in June and may result in different limits or compliance requirements. However, in the meantime, April 16 remains the compliance deadline.

Mercury Control Choices

In order to get a picture of how affected units are planning to comply with MATS, ICAC surveyed its more than 80 member companies that represent suppliers of air pollution monitoring and control systems, equipment, chemicals, and services for stationary sources in the U.S. and Canada. The group developed a database of mercury control reagent and sorbent feed systems based on results from a survey of its members in which the members identified specific installations along with each power plant’s likely mercury control strategy. The database has certain limitations in that not every technology supplier is an ICAC member and not all member companies contributed to the database. However, a picture emerges of technologies that are being widely applied to coal-based units, 398 (181 GW) of which are captured in the database.

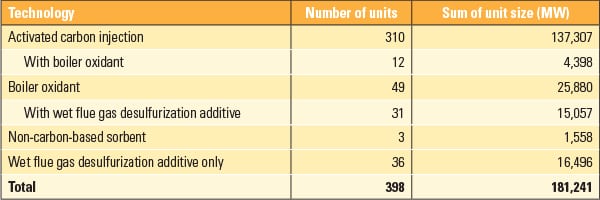

Table 1 shows that the dominant technology is activated carbon injection (ACI), with 310 confirmed installations on 137 GW of coal-based capacity. This includes all coal types (broadly grouped as bituminous, lignite, subbituminous, and blend). Boiler oxidants are installed on 4 GW of the ACI units and 26 GW of additional units without ACI for a total of 30 GW (61 units). On 15 GW the boiler oxidants are combined with a wet flue gas desulfurization (WFGD) additive only. WFGD additives are used alone on 16.5 GW (36 units) for a total of 31.5 GW of WFGD additives. Non-carbon-based sorbents (alternatives to activated carbon) were reported as the technology of choice on 1.5 GW (3 units).

Many of the current ACI systems being installed include design accommodations for alternative sorbents that provide flexibility in sorbent selection for future operation of these systems.

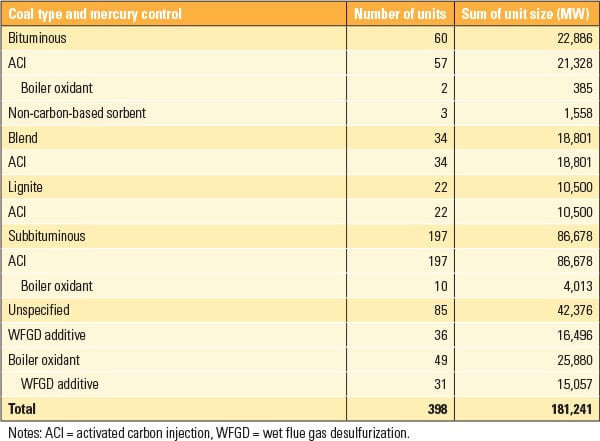

The data by coal type (Table 2) are somewhat less complete because of unspecified coal types for 85 units (42 GW). All of the WFGD additives (31.5 GW) and the majority of boiler additives (26 GW) show no specific coal type. Of the reported coal types, subbituminous coal plants (87 GW, 197 units) utilize ACI, with 10 of those units also employing a boiler oxidant. Bituminous coal plants (23 GW, 60 units) utilize ACI or alternative sorbents, with two of the ACI units also using a boiler oxidant. Blended coal plants (19 GW, 34 units) and lignite coal plants (10.5 GW, 22 units) have ACI.

|

| Table 2. Different control choices for different coal types. Source: ICAC |

As companies start up and operate their emissions control systems, many issues arise for the first time, including integrating feedback control with their unit operation, managing balance-of-plant impacts, handling the new materials, using continuous emissions monitoring systems or sorbent traps full time, managing data, and handling reporting complexities. Units may have different issues based on size, as smaller units may be more likely to dispatch as load-following or seasonal operation, requiring more attention to turn-down issues.

As power plants move into the compliance phase of the MATS regulation, ICAC member companies have resources and expertise to help plants achieve and maintain continuous compliance. For example, issues that may arise once emissions control technologies are operational include ACI/dry sorbent injection (DSI) equipment inefficiencies or availability. The continuous, reliable utilization of ACI and DSI systems may fall short of performance targets after prolonged operation due to maintenance and other issues, causing unplanned downtime and inefficiencies. Reliable operational and maintenance procedures can be put into place by working with suppliers of the equipment or sorbents.

Performance testing of ACI systems is typically conducted with sorbents manufactured under very tight quality controls. These manufacturing quality controls must be maintained for long-term operations to ensure that sorbents are consistent and target-quality. It is important for plants to ensure that suppliers have adequate quality control measures.

When to Reconsider a Mercury Control Strategy

By the time this April issue is published, most U.S. generators will have decided upon their mercury compliance path, and many will have already entered into contracts for control equipment and/or sorbent supply. However, the mercury compliance landscape is not static; technology providers continue to innovate and improve, while generating units can undergo significant changes to the way they operate. Thus, it is sometimes prudent for generators to reevaluate their mercury compliance options.

The types of situations that might prompt such a reevaluation are discussed next. Note that these circumstances also apply to generators in other countries that may now or in the future be concerned with mercury control.

Force Majeure—Noncompliance. If a supplier of a mercury control technology or product is unable to keep a utility within compliance, whether it be a performance/quality issue or an inability to supply product, there is usually a means for the buyer to exit an existing contract and look for solutions elsewhere.

Balance-of-Plant Issues. If a mercury control strategy is found to cause unforeseen balance-of-plant impacts that make it impossible for the supplied unit(s) to operate, then force majeure rules may apply.

New Technologies. There is always the possibility that a novel mercury control technology might be introduced to the marketplace. Furthermore, existing mercury control technologies are continuously being refined and improved upon by the various companies that develop and market them. New developments that offer advantages in cost-performance and/or ease of use may warrant a comparison against any control strategies that are already in place.

Fuel Switch. The type of fuel that is combusted can have very strong impacts on mercury control. A change in fuel supply may mean that a unit that was or would be compliant with a particular control strategy will no longer be so.

Changes in fuel supply are often a deliberate choice by a plant owner, and in such cases, fuel changes and any necessary changes in mercury control strategy can often be timed accordingly. In those cases where fuel changes are forced or unforeseen, it may be necessary to work with the technology provider to test and qualify alternative strategies or products that can keep the unit(s) in compliance cost effectively.

New Equipment Installations. The installation of new equipment for the control of NOx, SOx, or particulate matter can not only have a big impact on mercury emissions, but it also can sometimes eliminate the need for any additional mercury controls. If new equipment is planned for a unit, consult with both the equipment supplier and any current suppliers of mercury control products to assess the expected impacts and any product changes that may be in order.

Dry Sorbent Injection. Many plant owners may be considering implementing DSI, especially following the reinstatement of the Cross-State Air Pollution Rule in 2014. DSI can have a wide range of both positive and adverse impacts on mercury control, especially with respect to mercury sorbents.

Positive effects are sometimes observed due to the removal of SO3, while adverse effects may stem from the removal of halogen species from the flue gas and from the generation of absorbable species in ppm levels, such as NO2, by certain DSI sorbents.

With a variety of both DSI and mercury sorbents available, and the possibility to inject them on either side of the air preheater, the number of possible permutations can quickly get quite large. Whether one is treating for HCl or for SO2 will also make a huge difference, because treating for the latter typically requires much more DSI sorbent. Therefore, the addition of DSI to a unit will almost always require an assessment of any positive or adverse impacts on any mercury controls in place.

Testing of an Alternative Product Shows Significant Savings/Advantage. Many plants choose to include language in their supply agreements that permits them to test specified quantities of alternative products, both from the current supplier and from others. That language may include a provision for the plant owner to exit the contract and switch suppliers if a specified level of cost savings can be demonstrated during testing. ■

—Sheila Glesmann ([email protected]) of ADA Carbon Solutions and Richard Mimna ([email protected]) of Calgon Carbon Corp. are Mercury Control Division co-chairs for ICAC.