The POWER Interview: GE Unleashing a Hydrogen Gas Power Future

Since the 1940s, when General Electric (GE), launched its gas turbine operations, the company has pioneered and commercialized a lengthy list of gas turbine technologies, large and small. As the decarbonization movement gains pace and more renewables flood the landscape, the company’s gas turbines have taken on new crucial roles to provide dispatchability and flexibility.

But as questions about the long-term use of natural gas—a fossil fuel—in a carbon-free energy ecosystem emerge, the company is building on years of experience exploring how GE gas turbine technology could run on hydrogen fuels, as Dr. Jeffrey Goldmeer, director of Gas Turbine Combustion & Fuels Solutions for GE Power—and GE’s topmost hydrogen expert—told POWER in an interview this month.

POWER: How did you become involved in hydrogen?

Goldmeer: I’ve been in my current role as the fuel-flex leader for the gas turbine business for 12 years. I came to GE Power out of GE Global Research Center, where I worked in combustion for six years, and for the last three years at the R&D center, I actually managed the combustion team there. My background is in combustion and fuels, my PhD is in combustion. So I’ve been doing combustion and/or fuels in one way or another for my entire career.

As part of my job, I watch for trends in the industry and attend different industry seminars, events, engage with customers. So I try and understand what our customers are asking for, what are the global trends. And about two years ago or so, I started getting an inkling that … our customers are starting to scratch their heads a little bit more about hydrogen. And it really became very evident last year that that was becoming a big deal. I was in Europe for a conference called Electrify Europe … and I talked about hydrogen there, and a lot of customers were interested in a white paper we’d written, and which we’ve since updated. And that really was an absolute trigger moment. I think it’s only built more and more. I’m not sure I can read the industry trades on any given day without some story of hydrogen, in some manner, shape, or form.

POWER: Why, in your view, has there been this emphatic attention to hydrogen of late? What is its potential in the future power system?

Goldmeer: It’s a really good question and I’ve been thinking a lot about it. Part of it has to do with just the nature of our industry. We are a long-cycle industry. It takes a long time for things to happen, and as our customers are thinking about what happens to their existing assets—which may be a few years old, maybe older than that—as customers are thinking about the purchase that they know they’re in the process of making today or might be making in the future, and to look at trends around them, I think they’re questioning what happens to these assets, which we know have lifespans that are measured in decades. And I think they’re trying to understand ‘What does that mean?’ If the world pivots to decarbonize fuels—hydrogen being one of them—what does that mean for those assets? Do those assets effectively stop being valuable or valued because they can’t be used in the ecosystem? And they’re looking first of all to us as [original equipment manufacturers (OEMs)] to say, ‘Hey GE, can that gas turbine that I bought from you a year ago, or 10 years ago, or I might buy from you in two years, if the world evolves to require decarbonize energy, and hydrogen is the carrier, is that something we can still do?’

POWER: Generating hydrogen isn’t really a new concept. What’s changed on that front, and will there be enough of a supply to run a future fleet powered with hydrogen?

Goldmeer: Yes, hydrogen and the concept of making hydrogen is not new. Jules Verne was very prophetic. A hundred and some odd years ago, in one of his books, he talked about how hydrogen might become … a next generation source of energy replacing coal. I think we can look at this kind of in two ways. There’s what we’ll call industrial usage, and then we’ll call utility-scale application. In the industrial world, the use of hydrogen for power in some ways has been happening all around us for decades. In those cases, you’ve got what would be a steel mill, a refinery, but you basically get a process gas that’s got some amount of hydrogen in it, and instead of flaring the gas, they’re putting it into a gas turbine to burn it. There are many examples of turbines that have been doing that for decades.

I think the question that we’re looking at today that’s very different is can we generate hydrogen for the sole purpose of generating hydrogen to use for power? Now, we can think of hydrogen as basically chemical energy storage. Why are we making hydrogen? Maybe we’re making it because there’s excess renewable power. Maybe because we want to displace a carbon-containing fuel. Whatever the reason, we’re now talking about generating utility-scale levels of hydrogen. And that’s where I think the world is trying to understand what’s happening here, and again, we’re viewing this from the lens of our customers, who are asking us, ‘GE, if the world starts to do things, whether it’s a high carbon tax, whether it’s [carbon dioxide] emissions are going to be more strictly regulated, what happens with the turbine?’ And my focus really has been helping customers answer that fundamental question. If that pivot occurs toward a hydrogen-based economy or toward a decarbonized fuel requirement, can we support our customers, whether it be new customers or existing customers, in that transition?

I think it’s absolutely worth watching. Again, when you talk to folks around the world, when you read the reports coming out of Europe, out of Australia, New Zealand, and they are heavily focused on creating a hydrogen economy and creating a lot of hydrogen. In many cases, the concept is the so-called ‘green hydrogen’—hydrogen via electrolysis, driven by renewable power. I think the studies that you could look at today, whether it be from the International Energy Agency in its ‘World Energy Outlook’ or others, would tell you that that as a snapshot of today, hydrogen would cost more than natural gas. But I think what we need to think about is we’re not looking at today, we’re looking at the future. What happens in 10, 20, 30, 40 years? What happens to the technology in terms of maturation, in terms of reduction of cost? We don’t know what the future will bring, but we want to make sure that we are prepared to support our customers, and again, that’s part of that process we’re going through now. No one really knows what that future’s going to look like. There are many paths to get to a potentially decarbonized future, and fundamentally, we want to support our customers, partner with them, as we walk through this together.

POWER: What is GE doing in the hydrogen realm amid all this uncertainty?

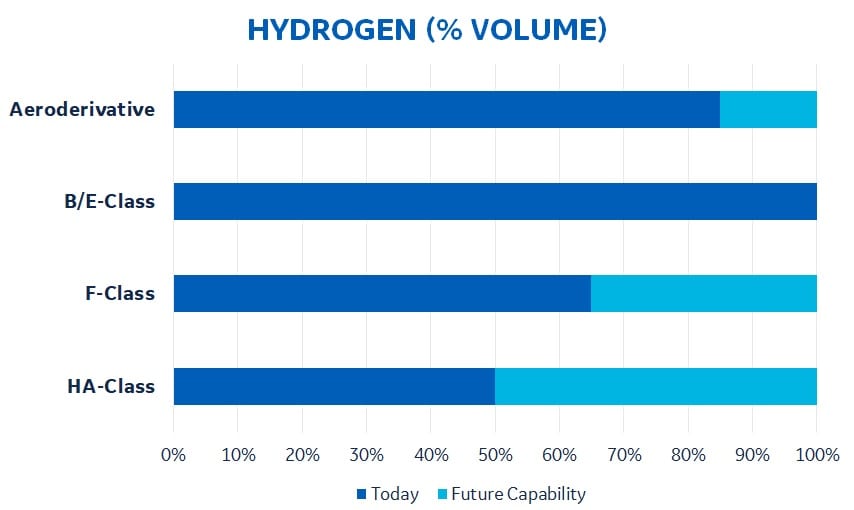

Goldmeer: A lot of this comes from our experience with the industrial cases. We have [several GE gas turbine modes, including] 6Bs, 7Es, 6Fs, 7Fs that are working in this space with fuels that have hydrogen today, whether it’s an [integrated gasification combined cycle (IGCC)] plant or a refinery. We actually have a 6B that’s running in Asia on a fuel that somewhere between 70% and 95% hydrogen—it varies. We’ve installed over 70 to 75 gas turbines burning low-Btu fuels that contain hydrogen, and those turbines combined have over 4 to 4.5 million operating hours. There are other fuel categories that mimic, from a heating value perspective, hydrogen and natural gas blends, and if I throw those turbines in then we have something like 6 million operating hours. And so part of our experience comes from actually having been doing this for decades.

Our first gas turbine working in an IGCC project, if I recall correctly, it was the late 1980s. So, we’ve been doing this for 30 years. Part of this is continuing to take lessons from the industrial sector for these fuels and applying them to this large-scale utility side. So we continue to learn about what it means to be working with fuels that have hydrogen. And a lot of these lessons are things around the plant. How do you modify a natural gas plant to run with fuels that have hydrogen?

We have to think about [balance of plant], safety systems, accessories, all these things. It’s not just the gas turbine. We have to think about the entire gas turbine combined cycle—the whole plant, anything that the fuel touches, any auxiliary systems that could potentially be impacted. But that’s also combustion technology. And so we’ve been doing development of combustion technology for, for fuel flexibility as a whole, again, for decades. It’s not just hydrogen. We focus on a whole realm of fuel flexibility, whether it be heavy liquids and crude oils for the Middle East, whether it’s naphtha and condensates—the whole gamut.

But when it comes to hydrogen, specifically, we can roll the clock back about 15 years, 16 years or so. Going back to that time period, the U.S. Department of Energy was thinking that coal was going to become a dominant supplier of fuel for the U.S. It was, at the time, but it would become more so with gas prices going up. And so they created what was known as the High Hydrogen Turbine Program. GE applied for and received funding for that program to develop gas turbine technology, specifically combustion technology, to increase the efficiency of the gas turbine when operating on a high-hydrogen fuel. The thought process behind that was that if IGCC was going to become the dominant provider of power in the future, displacing gas plants, that carbon capture might be something that we need to deal with. But obviously adding up post-combustion carbon capture system onto a power plant decreases the efficiency of the plant. So the DOE was trying to understand how could you increase the efficiency of the plant, and therefore a huge driver would be the efficiency of the gas turbine. So that’s how it evolved. In retrospect, it’s really funny to see how 15 years ago we thought coal would be the dominant fossil fuel, and here we are today where coal is in a very different place than it was 15 years ago.

So the team was looking at architectures that dealt with those characteristics of hydrogen. We took that from the combustion lab at the R&D center—I actually was the manager at the time we were doing single-nozzle testing—took that to our facility in Greenville, South Carolina, where we eventually tested a full combustion chamber. The combustion technology had a lot of advantages. It did a much better job of premixing. You can get more nitrogen oxides (NOx) if you’re not well-mixed everywhere. So small hotspots can give you local NOx increases. This combustion technology did a much better job because it was doing a better job of mixing. Because of that, the engineering team realized it had lots of advantages, not just for high hydrogen applications, but for operating with natural gas as we move to higher and higher firing temperatures. So that technology, which we think of as kind of a multi-jet injection, ended up becoming part of the combustion system that we call today our DLN 2.6e. And that’s the combustion system that we’re currently shipping on our 9HA.02 gas turbines.

So we went from, thinking about that timeline, from development of a combustion technology that was focused on high hydrogen that provided real tangible benefits to operating on other fuels like natural gas. And then we took that technology on to our latest HA gas turbines. But now we can go the other direction. Now as customers are saying to us, ‘Hey, we’re interested in utility-scale power generation, we’re thinking about HA class turbines, but we are worried about what happens in a potential future where we have to run with hydrogen.’ And the great thing is because that combustion system had its genesis in this DOE high-hydrogen program, it carries some of that capability with it. In the laboratory, we’ve already demonstrated that combustion system [can] run up to 50% hydrogen blended with natural gas.

POWER:What does GE see as the most challenging technical aspects of combusting hydrogen versus natural gas. What are technical challenges it faces as it develops an efficient gas turbine that can be wholly or mostly hydrogen-fueled?

Goldmeer: Let’s start fundamentally with the differences between hydrogen and natural gas. Physically, hydrogen is a smaller molecule, so we have to worry about hydrogen leaks where normal fittings and seals at certain levels, where we wouldn’t leak with natural gas. Hydrogen is much more flammable than natural gas or methane. Methane’s lower flammability limit is about 7% by volume and goes up to 20%. Hydrogen starts at about 4% on the lower flammability [scale] and goes up to about 75%. So, hydrogen is much more flammable. If you have a leak of hydrogen, it becomes more dangerous. Hydrogen flames are harder to see with the naked eye than a flame with a traditional hydrocarbon. And so immediately, when we begin to think about the implications of running hydrogen on a gas turbine, before we even talk about combustion challenges, we need to think about fundamental safety issues. That’s where things like ventilation, having the right hazardous gas detection systems, etc., become a critical part of any conversation we have with customers. The next piece of it is hydrogen’s lower heating value is about 274.7 Btu/standard cubic foot (scf), and natural gas depending on, you know, whether it’s liquefied natural gas or shale gas, is somewhere between 900 and 1,000 Btu/scf. So hydrogen carries about one-third of the heating value on a volumetric basis, which means in order to give the gas turbine the same kind of energy input, you got to flow more hydrogen—which again impacts your configuration of your accessory system and such. You’ve got to think that through.

You can’t use a standard fuel nozzle because you can’t pass all that hydrogen through it three times the flow. So you have to modify fuel nozzles in order to be able to flow that much. From a combustive perspective, hydrogen is incredibly reactive. One metric around reactivity of a fuel is the flame speed. You know, how fast that flame wants to propagate into the unburned fuel. And that’s always something that from a combustion design perspective you’re aware of so that you can maintain a margin to flame-holding and flashback issues. Hydrogen has got a flame speed that, depending on the study you look at, is about an order of magnitude faster than methane. So that hydrogen flame will want to propagate upstream into the unburned fuel much faster. So you have to have a combustion system that is explicitly configured to deal with that issue. That’s why, to burn 60, 70, 80, to 100% hydrogen in a combustion system is a real challenge. How do you deal with the fact that the flame wants to go someplace that, as a design engineer, you don’t want the flame to be?

But that being said, when you can master all of those challenges, hydrogen is a clean-burning fuel—it doesn’t carry any carbon with it—so that’s a positive. The flip-side is hydrogen burns hotter than methane or other hydrocarbons, and since NOx is a function of flame temperature, while you can get lower CO2 emissions, you actually get higher NOx emissions. And so the other thing you have to think about is—whether it’s an existing gas turbine or a gas turbine you’ll put in today and at some point you want to convert over to running some amount of hydrogen—what’s the implication for emissions?

And so imagine you’ve got an a NOx minimum you have to meet, and you know that when you go to having hydrogen, you’ll need a larger [selective catalytic reduction (SCR)] catalyst bed. A simple thing to do today would just be to make that space in the heat recovery steam generator (HRSG) a little bigger so it’s easier to add the catalyst as you need it versus 30 years from now, when you’ve got to figure out how to go put extra catalyst. [Think about] how do you handle that with an existing HRSG structure. So there are some simple things you can do today. But hydrogen in of itself, is doable. It’s just that we think have to think through all the interrelated systems and aspects to it.

POWER: How soon could we see a GE H-class gas turbine burning high-volume hydrogen?

Goldmeer: As I said earlier, for the DLN 2.6e combustion system, we have continued to do work with that system in the lab and evaluate its hydrogen capability. The number that we talk about publicly is it’s got capability to 50% [of hydrogen]. For where we are today, where we’re not seeing hydrogen-scale power plants, that’s a number that fits very comfortably in places like Europe or other places. What they’re talking about is not going from zero hydrogen to 100% hydrogen, but the discussion in many places is with incremental shifts. So maybe it’s 5% or 10% or 20%. And so in that scenario, where we’re going to walk our way up to 100% hydrogen—if that’s the path we’ll take—having a gas turbine that you would get today that you knew could run 50% hydrogen gives you some real margin. The other thing to think about is just the investment it’s going to take to make that much hydrogen. If a country were to decide they’re going to go down that path, it will take time to develop the infrastructure, update the piping, the transmission systems for gas, etc.

I think one thing I want to make sure to make people think about as we consider our future energy systems—as we think about the possibilities of being sort of carbon-free or net-carbon—is that gas turbines could be complementary to that. It’s not a gas turbine or renewable power scenario. Gas turbines can fill a niche and be part of that kind of future energy ecosystem, and I think sometimes people lose sight of that. Because of the inherent fuel flexibility of a gas turbine, it can absolutely be part of that kind of future energy system.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)