Solar Takes Off the Training Wheels

The global solar market has moved beyond its early, uncertain, freewheeling days. The luxury of behaving like start-ups has passed, and major firms in solar need to “grow up.” That at least was the message from top executives at Solar Power International (SPI), the industry’s largest trade show, in Las Vegas.

David Crane of Pegasus Capital, who left his position as CEO of NRG Energy late last year, told attendees at the opening session on September 12 that too many solar firms were still behaving like Silicon Valley start-ups, going public much too soon and trying to grow too fast. That’s not the sign of a mature industry planning for the future—something investors want to see to have long-term confidence in solar

“Public markets don’t like lurches in strategy,” noted Crane. “They don’t even like exponential growth.”

Though much of the opening session was focused on consumer solar, Steve Malnight, vice president of regulatory affairs for Pacific Gas & Electric, noted that many of the same concerns extend to utility-scale projects. Buyers large and small are increasingly looking for integrated, plug-and-play packages of solar, storage, and smart controls.

“Solar may not be the iPhone,” he said, “but it can enable customers to do more without having an environmental impact and do it guilt free.”

C.J. Colavito, director of engineering for Standard Solar, told POWER that the high-profile failures that have hit the industry recently were often the result of companies straying too far outside their core competencies in pursuit of new business. That stemmed in part from a failure to recognize that the utility-scale, commercial and industrial, and residential solar markets have very different business models.

“Look at SolarCity. They’ve dominated residential. They’re really good at it,” he noted. “But now they’ve gone very aggressively into the commercial DG space. They’ve really had a really hard time picking up on it, and they’ve lost a lot of money on a lot of earnings.”

Much of succeeding in solar, he said, “is doing what you’re good at and not trying to do what you’re not good at and don’t understand.”

Big Data Comes to Solar

One sign of maturation in the industry is a growth in the breadth and sophistication of support services available to generators to help them increase efficiency and profitability. Just as fossil generators are beginning to turn to advanced data analytics to help keep their plants competitive, solar project owners are no longer at the complete mercy of the sun: While generation still depends on solar irradiance, predicting and working with it is no longer the guesswork it once was.

Adam Adkins, a meteorologist with environmental data firm Vaisala, explained to POWER in an interview how the company has developed a decades-long data set of solar irradiance trends as well as real-time monitoring and forecasting to help solar plants have a much clearer view of what their output will be over the short and long term.

“Pre-construction developers typically use it to understand what the average output of their project will be,” he said. “In an operational sense, it’s more of a reconciliation tool. Developers can look at what the sun is doing, what the clouds are doing, and compare that to the actual output of their plant.”

In addition, owners can use past trends and forecasts to schedule maintenance outages to periods when overcast skies are likely and avoid missing periods of peak irradiance. That makes for much more predictable output, which makes it more attractive to investors and utilities.

“Having additional data sets only reduces your risk,” he said. “The closer you are to actual output, the closer your revenues are going to be to your projections. Even a 1% deviation can be a substantial hit.”

One point that is often missed, Adkins noted, is that solar irradiance is more than just sun and clouds. Other factors such as atmospheric dust, and environmental events such as wildfires and volcanic eruptions, can affect irradiance, sometimes substantially.

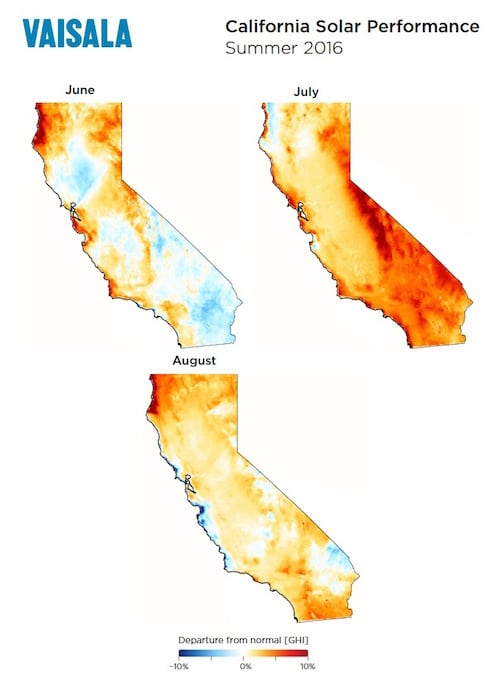

Data Vaisala released in early September showed that solar irradiance fell measurably in California during a series of wildfires. A major fire in Kern County in inland Southern California was likely responsible for a 1% to 4% drop in solar irradiance in different areas of the county in June (Figure 1).

Regulatory Reform Lags

As solar evolves, sector observers have noted repeatedly that regulatory models and rate design have often lagged behind. Those need to catch up, but what will replace them may be anyone’s guess.

The Smart Electric Power Alliance (SEPA), one of the organizers of SPI, released a report during the show calling for greater collaboration between utilities, solar stakeholders, and other groups to better promote efficiencies, define roles, identify principles of ratemaking, and foster customer choice. SEPA’s Chief Strategy Officer Tanuj Deora lamented that the report was necessary because the discussion has become so politicized.

“[E]fforts in many states to discuss electricity rate reform and net energy metering have, in some cases, devolved from reasonable policy debate to intractable conflict characterized by polarized, all-or-nothing rhetoric,” he noted in the report forward. “But such a zero-sum mentality runs counter to the reality that [distributed energy resources; DERs] provide optimal value when deployed for both individual consumer value and system benefits.”

Scott Wiater, Standard Solar’s CEO, noted that while some utilities have embraced DERs—and in particular the smart grid technologies and data that is necessary to integrate them—others have resisted taking that step and don’t, he said, “want to be that smart.”

The data, rather than being a tool, can be viewed as a threat.

“I think some utilities don’t like having that much scrutiny in how they operate,” he noted, “because they’re inefficient and the data serves to expose those inefficiencies.”

Standard Solar’s Colovito noted that many of the challenges stem from difficulties in valuing the things solar adds to the grid and talking about it in a way various stakeholders can relate to.

“Solar does provide real value to the grid as a distributed resource, but it doesn’t always provide that same value at all times and at all locations. Because of that, the utilities say, ‘Distributed renewables and especially variable resources like solar and wind never do anything,’ and the solar and wind guys says ‘Yes, we do, we always do.’”

That disconnect frustrates the communication that is necessary to properly reform regulatory and rate designs.

“The truth is that [valuing DERs is] very situational and time-based, and it really is a pretty complex system,” he said. “Decoupling that requires a sophisticated regulatory framework where the different resources are properly rewarded.”

—Thomas W. Overton, JD is a POWER associate editor (@thomas_overton, @POWERmagazine).