Solar PV O&M Best Practices in a Rapidly Changing Market

A surge in the installation of large-scale solar photovoltaic (PV) systems around the world has underscored the importance of cost-effective operations and maintenance practices to boost lifecycle plant economics.

In 2000, the world had installed just 1 GW of solar photovoltaic (PV) capacity (in DC terms—see the sidebar, “AC or DC?”), a number that had surged to 39 GW by 2010 and 176 GW in 2014. Fueled by supportive policies and climate concerns, it is poised to see even more explosive growth: Investors may sink $2 trillion into solar PV between 2015 and 2040, predicts the International Energy Agency (IEA) in its World Energy Outlook 2015. That could mean that by 2040, the global market could exceed 1,000 GW of installed capacity.

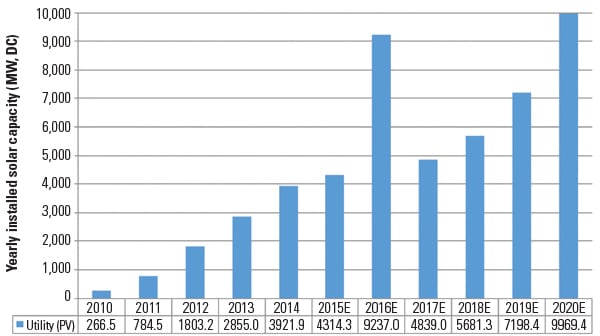

So far, solar PV on buildings—including residential and commercial systems—have dominated the sector, accounting for more than 60% of global solar PV capacity in 2014. But while the European Union will continue focusing on building-sited PV, the U.S., China, and India will step up deployment of utility-scale PV, the IEA suggests, pushing global capacity of utility-scale solar PV to increase almost eight-fold from 2014 to 2040. The U.S. alone is anticipated to add 41 GW between 2015 and 2020 (Figure 1).

|

|

1. Yearly U.S. utility-scale solar photovoltaic capacity additions. Courtesy: SEIA/GTM Research U.S. Solar Market Insight |

That’s a lot of solar panels. And a massive pool of resources will be required to keep them working optimally.

A Surging Solar PV O&M Market

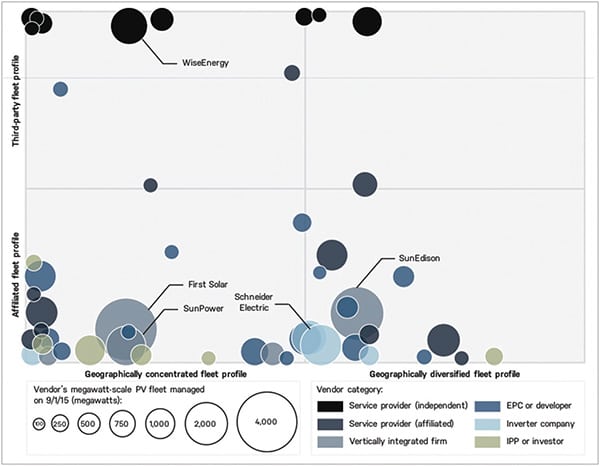

According to a November 2015 report published by GTM Research, the global market for megawatt-scale operations and maintenance (O&M) for PV installations was preparing to surpass 133 GW by the end of 2015 and expected to more than triple by 2020, totaling more than 488 GW, driven predominantly by China, the U.S., and Japan. The relatively juvenile market is currently in a state of flux as investors and vendors vie for market share, as PV O&M expert Cedric Brehaut, a consultant with market research firm SoliChamba, who authored the GTM Research report, told POWER (Figure 2).

Traditionally, the largest and fastest growing providers had been engineering, procurement, and construction (EPC) or development firms. Today, vertically integrated firms manage about 10 GW of the world’s fleet, followed by affiliated service providers (8 GW), independent service providers (ISPs, 6.2 GW), and EPCs (6.2 GW). Lately, the market has tipped in favor of ISPs, who were once marginal players, said Brehaut. These include asset managers like Europe-based Vector Cuatro and WiseEnergy and O&M providers like greentech and ENcome Energy Performance. Among U.S. companies, O&M and asset management provider Solarrus (parent company of True South Renewables and MaxGen Energy Services) has grabbed a notable chunk.

Another trend that is telling of the O&M market’s potential is that over the past few years, “a number of developers and EPCs have turned their focus to O&M and/or asset management, many of them creating subsidiaries or spin-off companies dedicated to this new service business,” Brehaut said.

Insource or Outsource?

Considering the crowded market, arguments can be made for performing O&M internally, as well as for hiring a service provider, or for combining insourcing and outsourcing. Experts told POWER that entities that typically consider the in-house option include utilities with portfolio sizes beyond 100 MW or those looking to slash operational expenses (like European PV generators facing feed-in tariff cuts), as well as independent power producers.

The consideration typically hinges on the cost of O&M. And while cost is significantly lower for solar PV than for any other renewables, it varies wildly, depending on an assortment of factors. Major variables influencing the extent and cost of PV O&M range from site characteristics and environment—including the size of the system and type of installation (whether it’s roof-mounted or ground-mounted, for example)—to the availability of water. The scope of O&M service and scale, meanwhile, determine labor and infrastructure needs, as do the size and density of the plants in a company’s portfolio.

Yet, knowledge gaps remain. An expert from the International Finance Corp. pointed out that because few large-scale solar projects have been generating beyond the end of their design life, it’s difficult to predict O&M costs beyond a 25-year timespan.

Consider O&M from the Start

Whether or not O&M will be outsourced, system owners should consider O&M during design, engineering, and construction to help drive the selection of low- or no-maintenance alternatives, if available. This also allows owners to make use of connected inverters for remote testing and updates and provide access to and clearance around equipment. Keeping O&M in mind from day one will enable them to apply the 2016-issued “IEC 62446-1:2016” (Requirements for testing, documentation and maintenance—Part 1: Grid-connected systems—Documentation, commissioning tests and inspection), which requires documentation of the system, array testing, and a whole-system performance test.

If the decision is made to outsource O&M, vetting the financial solvency of the O&M service provider will be necessary, because financial distress could have a “negative impact” on the level of system quality, says the Solar Access to Public Capital (SAPC) working group, whose membership includes more than 450 solar developers, financiers and capital managers, law firms, rating agencies, accounting and engineering firms, and other stakeholders engaged in solar asset deployment.

Also, it is prudent to verify that a contractor uses a company health and safety manual to keep injuries at bay, making sure that all site personnel will be equipped with complete personal protective equipment for the task, including fall protection from roofs and arc flash protection for working on live circuits. Finally, contracts should clearly articulate insurance requirements, it recommends.

O&M Best Practices Are Evolving

Over the years, as more utilities have become solar power generators, some common goals have evolved that have given shape to PV O&M best practices. Essentially, the goals are to maximize system economics by increasing plant uptimes and decreasing service costs. Critically, operators also want to protect asset value and longevity and comply with applicable regulations.

Although practices and approaches are not standard and have been implemented in various proprietary ways, over the years a few basic strategies to achieve these goals have emerged. A handful of best practices guides are also in the works, including one from the PV O&M Collaborative, which is part of SAPC. A free version of the group’s working paper (nrel.gov/docs/fy15osti/63235.pdf) has been made available by the National Renewable Energy Laboratory (NREL).

One setback to having different O&M practices is that performance metrics are defined differently, that paper notes. “A system characterized by a guarantee to deliver 1,000 MWh/year would be difficult to compare and bundle with another that has a guarantee to be operational 90% of the time. Investors need clear performance metrics and evaluation methods.” Also, differences in types of systems, geographic location, and climate conditions can “confound securitization” by investors, it says, noting that investors want to know exactly how much it will cost to perform required O&M. “Cost estimates must be uniform and predictable so that they can be bundled, yet they should reflect the factors that cause O&M costs to vary from site to site.”

A PV O&M Plan

SAPC recommends establishing an O&M plan that considers the context of the performance period required to generate a sufficient return on investment. The O&M manager should retain this plan and archive all initial planning, warranty, design, and other system specification documents; that manager should also revise the plan as the system is built, maintained, and modified over time.

Typically, the asset life—about 25 years—is considered the performance period, even though ownership may change. An aligning monitoring program is also chosen, and a system owner may seek a performance contract wherein a specified performance indicator—such as MWh/year energy delivery—is guaranteed.

According to SAPC, though many performance indicators have been proposed, it is prudent to select a type of key performance indicator (KPI) that minimizes cost but ensures optimal system performance under varying conditions. KPIs include availability (or “uptime”), which refers to the percentage of time that a condition is met—“usually that the entire system is at full operating capability and not impaired for any reason.” Other KPIs include energy delivery, specific performance (or energy delivery normalized by plant rated capacity), percent of system rating, and performance ratio (defined by IEC 61724 or ASTM E2848).

Finally, compared to residential systems, utility-scale systems should have a larger focus, including financial goals and detailed monitoring. “The investment and revenue of large systems justifies more detailed monitoring for anomalies in performance and increased communications and sensors to trigger performance or corrective maintenance activities and alerts,” SAPC suggests. Considerations include monitoring with diagnostics to trigger corrective maintenance, as well as analytics to optimize condition-based O&M, such as cleaning.

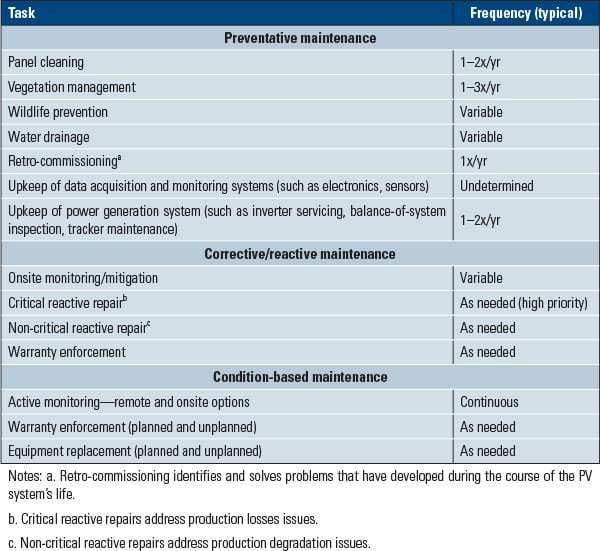

Preventative/Scheduled Maintenance. As with other power generation systems, preventative maintenance (PM) entails routine inspection and servicing of equipment to prevent malfunctions and unnecessary production losses (see sidebar, “Drones for Solar Plant Inspection”). However, operators should be wary of upfront costs associated with PM programs, which could require “superfluous” labor activity, warned the Electric Power Research Institute (EPRI) in a June 2010 white paper. Increased inspection and maintenance activity also has the potential to contribute to site wear and tear, it said.

“Preventative maintenance must be balanced by financial cost to the project. Therefore, the goal is to manage the optimum balance between cost of scheduled maintenance, yield, and cash flow through the life of the system,” SAPC clarified. Protocols will depend on system size, design, complexity, and environment.

Corrective or Reactive Maintenance. Maintenance to address equipment breakdowns can be minimized through more-proactive PM and condition-based maintenance strategies, EPRI said (see table). According to SAPC, repairs should be delayed only if there is an opportunity to do the repair more efficiently in the near future. “Response time for alerts or corrective action for the O&M function should be specified as part of the contract but will be typically 10 days or less for non-safety related corrective maintenance service,” it recommends.

|

|

Table 1. Major elements of PV O&M. Source: EPRI, 2010 |

Condition-Based Maintenance. Regimes that use real-time data to prioritize and optimize maintenance and resources offer greater O&M efficiency, promising to lower the frequency of PM measures and reduce impacts and costs of corrective measures. However, condition-based maintenance may come with a higher upfront price tag, given communication and monitoring software and hardware requirements.

Cleaning Panels

Foremost among the myriad tasks that are condition- or study-dependent is panel washing—which should be done without brushes or solvents, using just “plain water or mild dishwashing detergent,” SAPC suggests.

EPRI reported in 2010 that PV panel performance can annually degrade by 1% to 5% without washing (noting that panel efficiency itself degrades roughly 0.75% per year). Based on external factors, panel washing can improve efficiencies by as much as 10% to 15%.

The most common method for cleaning large-scale PV installations today involves trucking large quantities of water to the site and then using a hose and squeegee to manually clean the panels, as shown in the photo that opens this article. However, this can prove time-intensive and expensive—especially in desert environments. (This can be less of a concern in other environments: A study by Arizona State University concludes that 0.2 inches of rain is nearly equivalent to physically cleaning the modules and can restore production levels to 99.5% of a cleaned module.) A 3,604-MW PV farm in Nevada, for example, could need as much as a billion gallons of water over its lifetime for O&M, says a July 2013 report from Sandia National Laboratories. Cost-wise, that could add up substantially. A number of companies are developing water-free cleaning methods, including Ecoppia and Ecovacs Robotics (Figure 4).

|

|

4. A raybot. A number of innovative solutions have been introduced over the years to tackle the labor-intensive task of solar panel washing. Ecovacs Robotics recently became a 2015 CES Innovation Awards honoree for its water-free cleaning robot that can clean utility-scale solar panels up to a 55-degree angle. The bot sweeps, blows, and vacuums the panels to remove dust and dirt. Similar solutions are gaining interest in the marketplace. Courtesy: Ecovacs Robotics |

Necessary Inspections

SAPC recommends annual inspections of AC wiring, including inspection of electrical boxes for corrosion or for intrusion of water or insects, as well as of DC wiring, looking for cracks, defects, overheating, arcing, short or open circuits, and ground faults.

Every year, inspections should also be conducted of monitoring instruments (such as the pyranometer) with handheld instruments to ensure that they are operational and within specifications. Also examine the PV array, checking all mounting systems and other hardware for corrosion or damage.

A PV module specialist should also check for hot spots using an infrared camera (Figure 5) annually, a journeyman should inspect the transformer, and an electrician should take a look at the motor to ensure electrical connections are sound.

|

|

5. Hot spots. This image was taken by a Testo thermal imaging camera, which was used to detect defective cells that can overheat and damage the surrounding cells, reducing the efficiency and power output of the system. Courtesy: Testo |

For a checklist of critical O&M activities, see documents associated with this story online at powermag.com.

Invest in Critical Inverter Inspection

Inverters are perhaps the most important component in a PV system. An inverter’s basic function is to invert the direct current output from the PV modules into alternating current (AC) to be fed to the grid. The majority of utility-scale PV installations use central inverters of 500 kW and larger that are integrated with external transformers that feed into a medium-voltage AC collection system.

According to EPRI, inverters are “far and away the main culprit for unplanned PV plant downtime.” SAPC notes that inverter reliability has continued to increase (see sidebar, “A Game-Changing Inverter Technology?”). Today, 10-year warranties are commonly available and 20-year extended warranties/service plans are also increasingly used.

|

A Game-Changing Inverter Technology? Solar PV technology is rapidly evolving, and several groundbreaking components are on the horizon, as PV O&M expert Cedric Brehaut pointed out. “A recent arrival in the U.S. market, three-phase string inverters are disruptive technology when it comes to O&M practices,” he said. That’s because “there is no need to repair a string inverter.” Until recently, installers used three single-phase inverters. “Regardless of which internal component may have failed, the resolution is the same: remove the unit and replace it with another one, which technicians typically carry in their truck. The defective unit is then sent to the manufacturer for exchange,” Brehaut said. “There is no management of spare inverter parts, and technicians do not need expertise in diagnosing and resolving issues inside the inverter.” Still, string inverters don’t come without disadvantages. For one, they tend to fail more frequently due to the larger number of inverter units per PV system. “This means more truck rolls will be necessary to perform corrective maintenance,” he said. |

Best practices recommended by SAPC include deciding whether an inverter is to be replaced or repaired based on its size, type, and associated cost. “Replacement is preferred over repair when spare parts availability and lead time trigger an upgrade,” it says.

Operators should include remote monitoring to confirm inverter status, reset the inverter, and diagnose problems. “In remote locations, it is advisable to stock component replacements onsite, especially for equipment commonly in need of repair, such as driver boards. Replacement micro-inverters should also be stored onsite,” it suggests.

Meanwhile, inverters should be inspected monthly, SAPC recommends. Inspectors should “observe instantaneous operational indicators on the faceplate of the inverter to ensure that the amount of power being generated is typical of the conditions. They should also compare current readings with diagnostic benchmark and inspect inverter housing or shelter for physical maintenance required.” ■

—Sonal Patel is a POWER associate editor.