Reducing Weather-Related Risks in Renewable Generation

You can’t control the weather, but you can control how you handle the ways it affects your renewable plant. From financial hedging to accurate predictions, the tools in a plant owner’s arsenal are more capable than ever.

The Black Oak Wind Farm project is an 11.9-MW wind facility under development in Tompkins County, N.Y., a few miles west of Ithaca. For the most part, Black Oak is unremarkable—the community-owned facility will consist of seven GE 1.7-MW turbines and will sell power under a 10-year power purchase agreement (Figure 1).

But Black Oak is a groundbreaker in one very important respect: It is the first wind project to use a long-term hedge mechanism to protect its investors against future wind-related risks to its income. Provided by asset manager Nephila Capital, the wind hedge, which settles off actual power production rather than wind speed, allows Black Oak to transfer the risk of lower-than-expected wind volumes, thus giving the project improved revenue certainty over the duration of the hedge.

Marguerite Wells, Black Oak’s project manager, told POWER they decided to go with a wind hedge because her group has so few resources behind it. “We were interested in finding the cheapest financing we can and reducing the cost of capital.” With little background in power generation, Wells was looking to play it safe.

In discussing a possible power purchase agreement between Black Oak and nearby Cornell University, Wells was introduced to Boston-based firm REsurety. She explained that in her initial dealings with potential financing companies, the costs of financing the project threatened to end it. This was because of the very conservative assumptions the financing groups were making about the wind farm’s potential revenue.

The hedge, Wells explained, “makes sure we can always pay our debts.” If revenue is down because wind volumes are lower than expected, the project will be protected. Even better, she said, “[the hedge] even pays for itself in a slightly lower cost of capital. Peoples’ investments are more secure, so they can take a lower rate of return.”

Still, Wells confessed that it took her a few weeks to “get her head around” the idea.

Old Idea, New Applications

REsurety worked with Black Oak and Nephila to structure the hedge. Lee Taylor, REsurety’s CEO, told POWER that while the approach has considerable promise for renewable generators—the firm currently has hedging contracts under review or in the structuring process for more than 300 MW of capacity—it’s still a new idea with some unique characteristics.

Weather-related hedging mechanisms are routine in other forms of generation but are so far almost unheard of in renewables, despite the obvious benefits hedging could provide. In some respects, such mechanisms are like other types of risk management: They transfer risk from one party seeking to increase the stability and predictability of its investments to another party looking to aggregate and diversify exposures, collecting a premium in exchange for their risk-taking capacity. But there are also some important differences, Taylor said. “The risk-takers in this market operate more like insurance firms—and in some cases are insurance firms—that have a fundamentally different outlook than a trader.”

The main distinction with renewables, especially wind, is that the risks are tied to much-less-easily correlated indexes than heating- or cooling-degree days and fuel prices. “The basis risk uncertainty in wind hedging has kept a lot of potential buyers out of the market,” explained Taylor. Because wind speed and solar insolation are so localized, it is difficult to accurately predict power output across an entire wind or solar farm from a single meteorological station. Also, wind power generation is not perfectly correlated with instantaneous wind speed because other weather-driven factors like shear, temperature, direction, and turbulence can all influence power output. That means that new and sophisticated analytics and data are necessary to structure and settle a wind hedge. REsurety, for example, employs its analytics in order to structure weather hedging contracts that settle off of actual power production, not wind speed.

Still, according to Taylor, several macro-factors have increased the attractiveness of wind hedges. As wind generation has become a more mature industry, turbine hardware and development costs have fallen and become more standardized. At the same time, project outputs across the industry have in many cases fallen well below projections, while some areas have experienced prolonged, unexpected periods of low wind volume.

This latter factor has resulted in lenders taking much more conservative approaches to project loans, assuming worst-case-scenario wind volumes. It is not unusual for wind farm lenders to assume annual wind volumes that are 30% (or more) below expected levels. With assumed revenue being so much lower, access to debt financing is restricted and the cost of that debt can increase, perhaps to the point of making the project uneconomic, as Wells discovered.

Shifting Risk

Of course, a hedge is not just about reducing one party’s costs of financing. It also requires a second party willing to take on that risk. And it’s there that wind and solar hedging is still in the early stages.

From one perspective, renewable risk hedging is attractive to large investors, because it is not correlated with the performance of the financial markets and is mean-reverting (in other words, over time, wind volume will tend to remain near historical averages). But while the financial markets have a wide variety of parties willing take on all sorts of risks, the opportunities for accessing wind volume risk are limited because active risk-transfer markets for it are limited—a party wishing to offload the risk later may have trouble finding a buyer. Taylor said that right now, reinsurance firms and large institutional investors, in the form of investor-linked-securities funds, are the main customers.

There are various ways such a hedge can be constructed. One way in which wind hedges differ from other hedges in the energy sector is that longer terms are available, up to 10 years (as is the case for Black Oak). This is because, in contrast to fuel price hedges, in which uncertainty increases the further out one goes, wind volume tends to become more predictable over longer periods because weather patterns are expected to revert to the mean. This makes the risk for wind farm output more quantifiable.

Hedges can also be structured either as swaps, where there is a single price point (“strike”) determining which party pays out, or as collars, where there are upper and lower strikes, in between which neither party pays. A study Taylor conducted in 2013 demonstrated that collars tended to produce the biggest increase in a project’s net present value, though in every case REsurety considered, hedging wind volume risk produced an increase.

Given the apparent advantages of hedging wind volume risk, why hasn’t it caught on yet?

One barrier is that awareness of these financial instruments appears quite low: Many project owners may not even be aware they exist.

Second, because the sector is so new, little standardization exists in the market, meaning that solutions must be custom-tailored for each project. That makes it harder to find parties willing to take on the risk.

Third, accurate risk assessment for something as variable and localized as wind farm output requires highly robust data. Past efforts at risk trading in wind power typically foundered on poor data, which made the products uneconomic for wind developers.

It’s there that things may finally be changing.

Time for Big Data

Obviously, weather-related hedging depends heavily on predicting the weather, and predicting the future requires understanding of past trends. But many of the factors affecting wind and solar plant performance—such as solar irradiance and highly localized wind speeds—haven’t been measured to the degree necessary to make accurate predictions of output, until relatively recently, which means the data quality hasn’t been good enough for this sort of risk assessment. And it’s also taken advances in computing power and data mining to make use of the information. Put another way, the number crunching simply hasn’t been up to the task until the past couple of years.

Global weather measurement company Vaisala, which acquired renewable energy consultant 3TIER in 2013, provides weather forecasts for 130 GW of renewable capacity worldwide, amounting to more than 900 different projects. It’s developed robust datasets of wind speed and solar irradiance, but its solar dataset for the U.S., for example, goes back only about 15 years (its wind data is more robust, going back about twice that far).

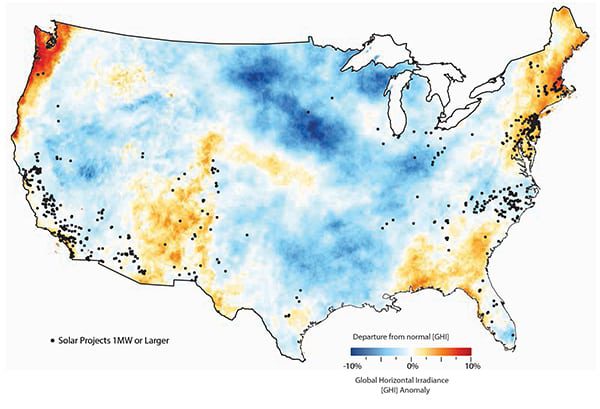

Still, what it’s seen is that even desert locations during the summer, far from being continually sun-drenched, in fact experience considerable variations in year-over-year irradiance. Its 2014 review of June-to-August irradiance showed most of the U.S. falling at least 10% below the 15-year average (Figure 2).

Of particular note in the Vaisala study was a focus on the Ivanpah Solar Electric Generating Station in California (POWER’s 2014 Plant of the Year), which has drawn controversy this summer for falling below its planned output. The Vaisala study found that the Ivanpah site experienced direct normal irradiance 5% to 8% below average in July and August. Further, the site has experienced solar irradiance either above or below expectations in 10 out of 15 summer months over the past five years.

“The impact of solar variability on the balance sheet can and will make the difference between profitability and loss,” Richard Pyle, Vaisala’s energy segment director said. “It therefore has a significant influence not only on individual project sites but also on the international standing of solar energy as a viable investment proposition.”

What this suggests is that even optimal sites like Ivanpah can expect to see considerable variation in output. Worse, there is a growing consensus among experts in the field that reliance on only a few years of data, or even a single year, in forecasting renewable plant output places project owners at considerable risk of over- or under-performance in the long term. As datasets grow, it’s become clear that anomalous levels of wind volume and solar irradiance can persist for up to 10 years or more, and that, like rainfall, periodic wind “droughts” can be expected.

The problem goes beyond utility-scale generation. One of the biggest current challenges for utilities in the western and southwestern U.S. is variable output from rooftop solar panels. Yet very little data collection exists to understand how much rooftop solar power is being generated moment-to-moment. But an innovative project from Boulder, Colo.–based Enduring Energy named Solar Retina aims to change that.

The Solar Retina project hopes to gather crowd-sourced information on rooftop solar generation directly from homeowners in order to create a real-time, region-wide picture of how much electricity is being generated. Though still in the early stages, the project shows potential.

Making It All Work

All of this means generators and utilities need to be well prepared for variations outside normal daily fluctuations. Yet that as well is new territory for many in the power sector.

John Dirkman, senior product manager, smart grid global, with Schneider Electric, told POWER that while using weather forecasts to support reliability and anticipate outages is old hat for utilities and generators worried about bad weather or hurricanes, it’s been much less of a concern for entities in areas like the western U.S. and Hawaii—up to now. “If you’ve got a large percentage of renewable generation on your grid, weather becomes a real concern.”

Dirkman explained how Schneider Electric recently worked with Burbank Water & Power in suburban Los Angeles to help that utility better plan for fluctuations in wind and solar output. Using decades of load history, combined with weather data from the National Oceanic and Atmospheric Administration and other sources, their advanced distribution management system is able to accurately predict output so that the utility can better meet demand rather than needing to patch last-minute shortfalls in generation.

The system is sophisticated enough to predict not just daily trends but also minute-to-minute output by tracking incoming cloud cover and localized wind patterns. This gives the utility a much greater ability to plan its generation and reduce spot-market purchases. It also enables it to keep its system in better balance by reducing unexpected changes in supply and demand.

The uncertainties of the weather will always be a major factor in renewable plant operation, but it’s clear more tools than ever are available to improve efficiency and profitability. And that opens the door to players who might be unable to participate otherwise.

“To be honest, I would be nervous building this project without the hedge,” Wells said. “I am just a little person who happens to have access to a windy spot.” ■

— Thomas W. Overton, JD is a POWER associate editor.

[This story has been updated to correct the attribution for Figure 2 and related text in the article.]