Power Sector Link to Water Is Deep, Complex

The interlinkages between water and energy are complex and run deep, warns a United Nations (UN) World Water Development water and energy–themed report released this March. As global water demand (in terms of withdrawals) is projected to increase 55% by 2050, driven by a 400% demand surge in manufacturing, 140% in thermal power generation, and 130% in domestic use, freshwater availability is expected to be badly strained.

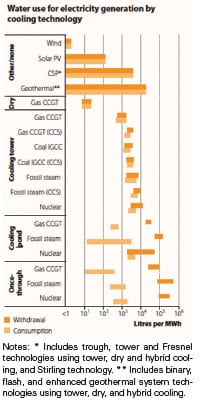

About 90% of global power generation is water intensive. Thermal power plants, in particular, are responsible for 43% of total freshwater withdrawals in Europe, nearly 50% in the U.S., and more than 10% of the national water cap in China, the report asserts. Meanwhile, to mitigate climate change and address energy security concerns, many nations have endorsed ambitious targets to double the share of renewables in the total power mix by 2030—many depending on hydropower and gas generation to address intermittency of wind and solar. All power generating sources use at least some water for cooling purposes (Figure 2).

|

| 2. Water use for electricity generation by cooling technology. Courtesy: World Energy Outlook 2012 © OECD/IEA, 2012, figure 17.4, p. 510 |

The power sector’s dependence on water introduces vulnerabilities, it finds, as periods of water scarcity and elevated temperatures can force power plants to shut down or reduce their output. And, as climate change induces more extreme weather events, the sector is exposed to higher levels of risk.

At the same time, energy is required for water provision, not only for pumping and treatment but also desalination. Use of desalination has increased significantly over the last 20 years, the report says, surging on costs that have reportedly dropped below $0.50 per cubic meter (m3). More than 16,000 desalination plants exist worldwide today with a total operating capacity of roughly 70 million m3/day—and that operating capacity could nearly double by 2020, industry observers suggest. But desalinated water involves the use of at least 75.2 TWh/year, which is about 0.4% of global power consumption, and it continues to be an expensive solution for developing countries or large water users.

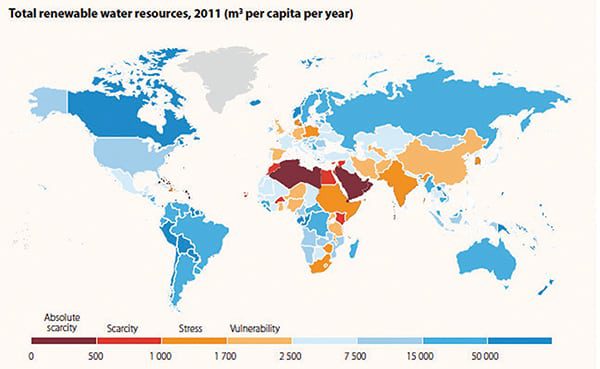

Water shortages put coal generation particularly at risk, the World Resources Institute (WRI) warned in a separate March-released report. The global research organization in July 2012 estimated that 1,199 new coal-fired power plants with a total installed capacity of more than 1,400 GW have been proposed in 59 countries—though more than 75% of that is slated for China and India alone. But more than 50% of the world’s largest coal-producing/consuming countries face “high to extremely high levels” of water stress (Figure 3), attributable to many competing demands on water resources, it said. Ranked at the top of the high water-stress risk list for major coal producers/consumers is Kazakhstan, followed by India, South Korea, Australia, Indonesia, Japan, South Africa, China, the U.S., Germany, Poland, Russia, and Columbia.

China, whose coal-fired capacity accounts for more than 66% of its national total power capacity, has average water resources of only 1,730 m3/yr per capita—barely above the UN’s “water scarcity market.” Eight Chinese provinces have fewer than 500 m3/yr per capita of total available surface water, on par with Middle Eastern countries such as Jordan or Syria. Worsening matters further is that two-thirds of China’s coal mines are located in the water-stressed north, which means at least 58% of its existing coal fleet competes heavily for water with industrial, agricultural, and domestic resources.

However, recognizing future water challenges to its energy sector, China’s Ministry of Water Resources recently announced a water allocation plan that specifies water-use efficiency and discharge requirements for existing coal plants—including mandatory air cooling technology for those facing water scarcity—and requires all new coal mines to submit a water resources planning study. Meanwhile, China’s State Council has set down three national goals for water: To cap annual maximum water use nationwide at 700 billion m3, improve industrial water-use efficiency to an internationally advanced level, and protect water quality. Those are a “step in the right direction,” the organization says, even though China “could see increased production costs in the short term as it could be more expensive to access alternative water supplies, address ongoing regulatory changes, and guard against potential disruptions,” the report says.

For India, the outlook is much more dire. More than 70% of that country’s power plants are located in water-stressed or water-scarce areas. Water risks will be borne more prevalently by unregulated generators—those not shielded by protective regulations enjoyed by India’s state-owned power sector. However, a national policy framework calls for a 20% improvement in water efficiency nationally through regulatory mechanisms, encouraging conservation and wastewater minimization, the WRI says. While the framework also calls on water users, generators included, to optimize recycling and reuse practices, several other measures could help utilities in stressed regions. These include building backup supply reservoirs and desalination plants, regulator water audits, and concrete standards for water consumption in the power sector.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)