Battery Energy Storage Returns Set to Decline

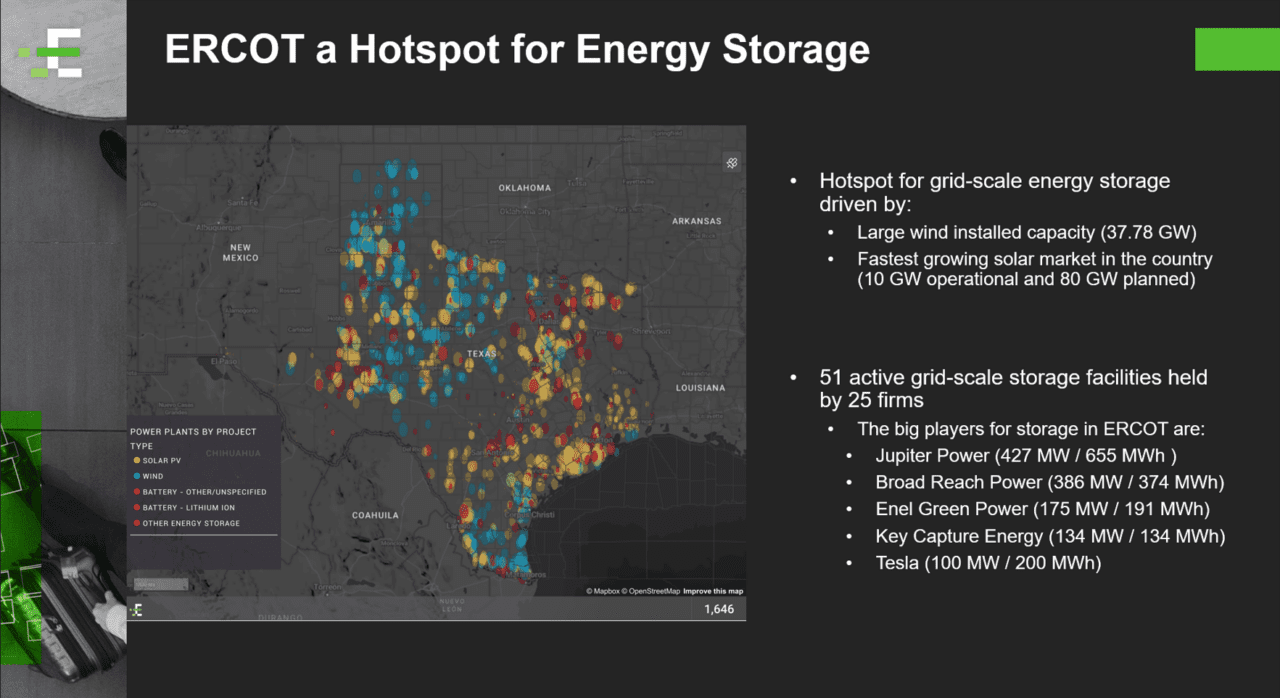

In certain markets, battery energy storage systems are approaching critical mass as they make significant impacts on operations and pricing for certain services. Market frameworks, volatility and decarbonization efforts have drawn developers en masse to California and Texas, in particular (Figure 1). Focusing on Texas (ERCOT), Enverus shows that battery energy storage systems generate the vast amount of their revenue by providing ancillary services. With rapid growth in battery capacity, prices for ancillary services are poised to fall as early as the first quarter of 2023.

Figure 1 | Top 10 States With Operating and Under Construction Battery Storage Projects

Source: Enverus PRISM Project Tracking Analytics

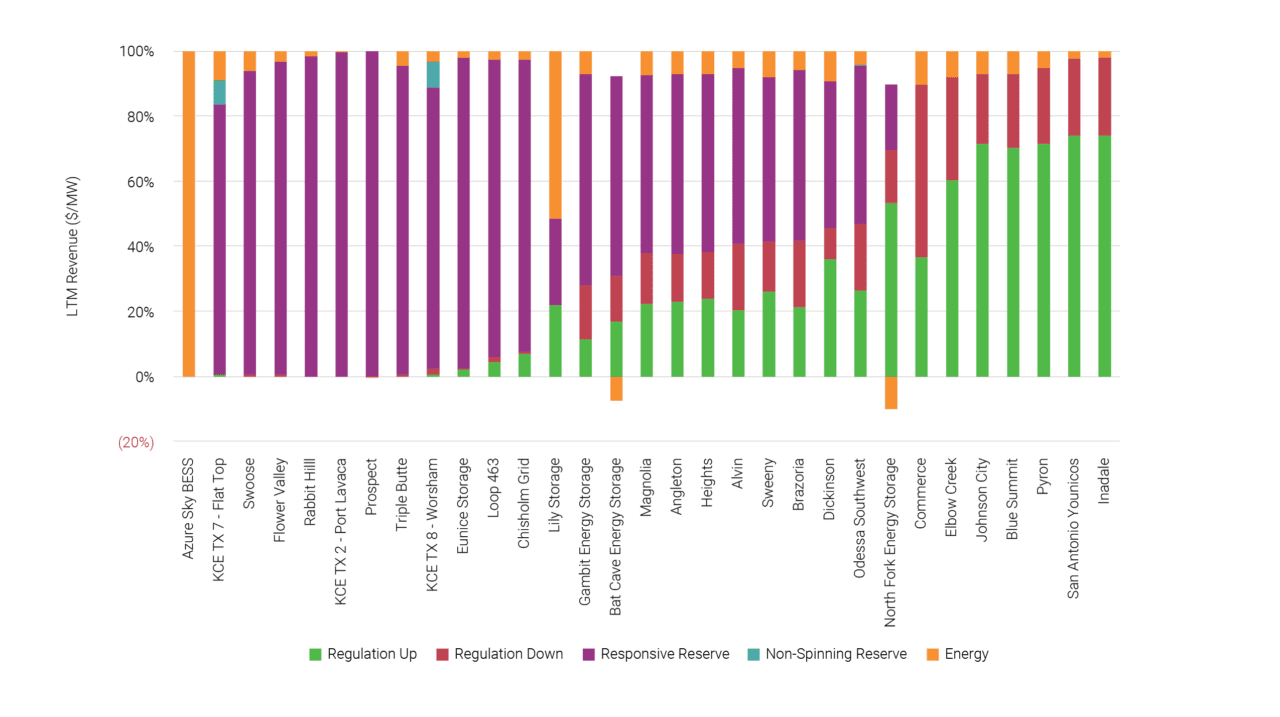

Currently, storage assets and operators show a preference for providing ancillary services in ERCOT (Figure 2) versus an arbitrage strategy (charging when prices are low, discharging when prices are high). Storage assets are well suited to provide ancillary services due to the limited nature of energy storage and the benefit of payments for capacity committed to ancillary services. Since batteries have limited capacity, they have the potential to earn more revenue from ancillary services by running frequent small partial cycles and maintaining their state of charge instead of fully charging and discharging.

FIGURE 2 |Energy Storage Revenue by Type

Source: ERCOT Storage Report Series, Enverus Intelligence Research, Inc.

Market information shows energy storage assets are mainly following a price-taker approach, banking on the higher marginal costs of coal and gas to make a profit providing ancillary services. As more storage assets enter the market, they will be the predominant technology providing ancillary services and these assets will set the price. When storage assets become the marginal bidder for ancillary services, as they already are for Regulation Up and Regulation Down, there will be a shift from price-taking behavior. Figure 3 shows operating and proposed storage capacity versus ancillary services requirements over time. Enverus research suggests there are two primary factors that weigh heavily on the bids for ancillary services- cost of capital and cost to charge.

FIGURE 3 | Forecast of Ancillary Service Requirements and Storage Project Capacity

Source: ERCOT Storage Report Series, Enverus Intelligence Research, Inc.

The fall in Regulation Up and Regulation Down price has already occurred. Average Regulation Up prices have dropped by nearly half, from approximately $24/MWh on average in 2021 to $13/MWh in 2022. Over the same period Regulation Down prices have dropped from around $25/MWh to $10/MWh. The timing of the fall corresponds well to when storage started setting the price more often than thermal generators. Enverus data shows that prices for Regulation services are not arbitrary. The prices are in line with cost of capital plus the cost of deployment. Enverus states the cost of deployment correlates well with average low prices often seen during the overnight hours. Enverus also suggests Responsive Reserve and Non-Spinning Reserve will also see prices fall when storage saturates their respective requirements.

In a recent ERCOT Storage Report Series webinar, Juan Arteaga from Enverus Intelligence Research discusses the growing energy storage in the state.

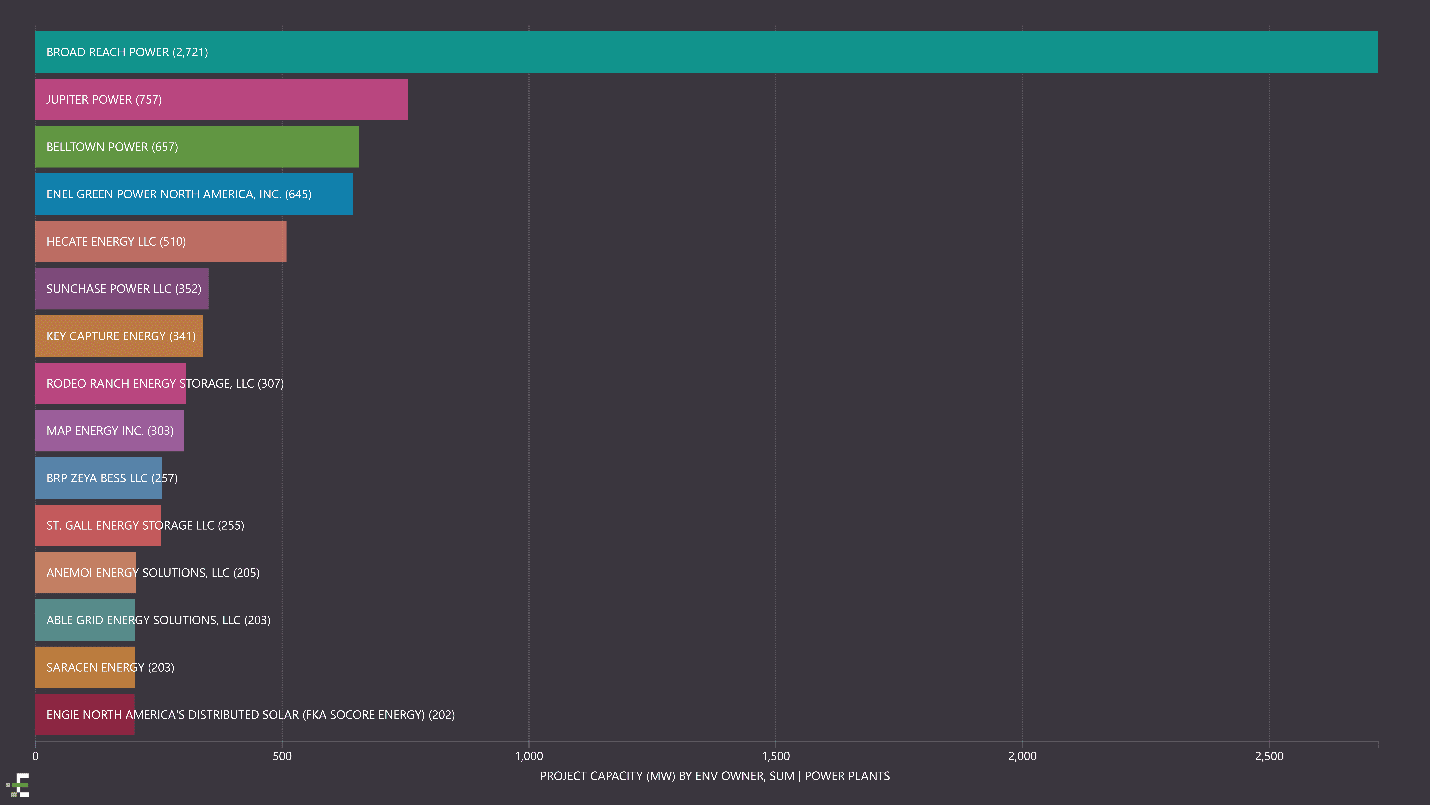

All these changes add up to significant decreases in gross profit for storage assets pursuing an ancillary services strategy. Estimates indicate the fall could be near 50%, from ~$150,000/MW in 2021 to $72,000/MW by the end of 2023. Still, storage assets should continue to prefer ancillary services strategies relative to a pure arbitrage strategy that only profits ~$40,000/MW per year, assuming intraday spreads of around $110/MWh in ERCOT. The market participants with the largest fleets are mostly niche operators, focusing on storage (Figure 4). Enterprise value will certainly be impacted as a result of diminished returns.

Figure 4 | ERCOT Storage Owners by Company

Source: Enverus PRISM Project Tracking Analytics

Despite diminishing profit margins there is still a call for storage capacity to grow. The Inflation Reduction Act extends investment tax credits to standalone storage projects, something that was previously only available to solar projects. Ongoing volatility in the face of extreme weather events and reliance on intermittent renewables will perpetuate arbitrage opportunities. At the moment, CAISO and ERCOT are the most attractive markets noted in a 2022 Storage Report but Enverus expects other jurisdictions to present ample opportunity as well. Renewable portfolio standards and efforts to decarbonize will also bolster the demand for additional storage capacity on the wholesale grid.

Authors:

Juan Arteaga, PhD, Senior Associate, ENVERUS

Juan earned his doctorate in electrical engineering and was a postdoctoral fellow at the University of Calgary. He directed his career research on the optimization of assets in power systems and electricity markets, with a focus on the integration and optimization of energy storage assets. Before getting involved in the energy industry, Juan worked as an optimization engineer in the transportation, construction and education industries.

Ryan Luther, CFA, Senior Vice President, ENVERUS

Ryan joined Enverus (RS Energy) in 2016 after graduating with distinction from the University of Victoria and earning a Bachelor of Science in Economics with a business minor specializing in finance. Ryan leads the Intelligence Team’s Power & Renewables research using advanced analytics and valuations to provide actionable insights to clients.