Nuclear Monitor: News from France, Japan, U.S., Belgium, Germany

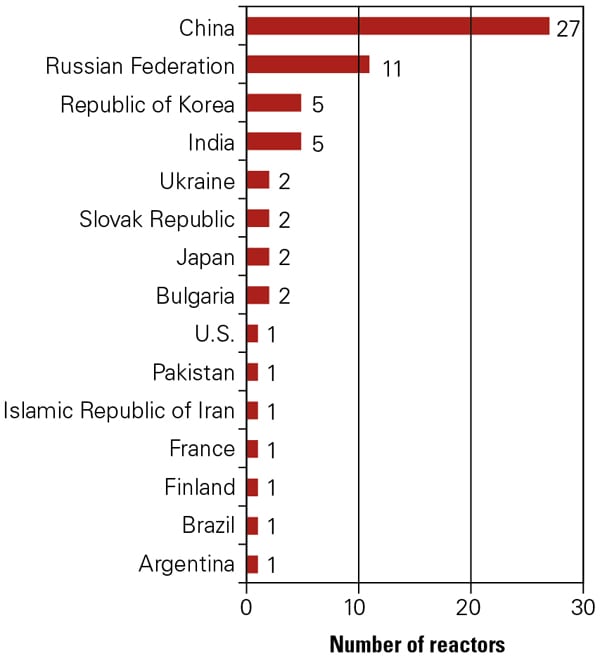

Five new nuclear reactors were connected to the grid while construction of 14 others began in 2010, the International Atomic Energy Agency (IAEA) reported in early March. Around the world, a total 65 reactors with a net power capacity of 62.9 GW were in various stages of construction—almost half of them in China (Figure 2). Meanwhile, some governments are revamping strategies to deal with heightened competition in the sector while others are pulling back to keep nuclear ambitions under rein.

|

| 2. Heavy production. Data from the International Atomic Energy Agency (IAEA) shows that 27 of the 65 reactors under construction around the world are being built in China. The agency says that 442 reactors are currently in operation, for an installed capacity of 375 GW. Last year, five reactors came online: the 950-MW Rostov 2 in Russia, India’s 202-MW Rajasthan 6, South Korea’s 960-MW Shin Kori, and two Chinese reactors—the 1,000 MW Lingao 3 and the Qinshan Phase II, Unit 3. Source: IAEA |

France Plans Overhaul of Nuclear Industry. In France, President Nicolas Sarkozy’s administration presented a plan to bolster the nation’s competitiveness in the nuclear sector after a South Korean consortium beat out French firms to win lucrative reactor supply contracts with the United Arab Emirates last year. Paris reportedly wants to quell infighting among companies like AREVA, EDF, and GDF Suez by encouraging them to jointly develop a midsize reactor. At the same time, though the country inked important nuclear cooperation accords with Saudi Arabia and South Africa this February, it has set its sights on forging partnerships with China.

In February, AREVA submitted its ATMEA1 reactor—a third-generation 1,100-MW pressurized water reactor developed under a joint venture with Japan’s Mitsubishi Heavy Industries—for pre-project design review with Canadian regulators. It also announced major milestones for the €3 billion (US$4.2 billion) Olkiluoto EPR project, saying it had finished installing four steam generators and that the project was on track for completion in 2012. The third-generation reactor project has been plagued by costly time overruns.

Japan Delays Operation of Shimane 3. In Japan—where 54 reactors provided some 30% of the nation’s power needs, and where there were plans to increase nuclear’s share to 40% by 2017 and 50% by 2030—delays were also dogging a key project even before the Mar. 11 disaster (see top story). In February, Japanese utility Chugoku Electric Power said commercial operation of its Shimane 3 reactor in western Japan would not begin until at least March 2012—rather than December this year—because control rod drives were being returned to GE Hitachi Nuclear Energy to be cleaned and reinstalled in the reactor. The plant, Chukogo’s only nuclear facility, is expected to be the biggest single advanced boiling water reactor in Japan.

Construction of two Mitsubishi Advanced Pressurized Water Reactors have been delayed by more than 17 months because of trade ministry safety checks. Tsuruga Units 3 and 4 were expected to be among the first to come online of 12 Japanese reactors that are in the planning stages.

South Texas Project Gets NRC Environmental Nod. In the U.S., the Nuclear Regulatory Commission (NRC) found no environmental impacts in an assessment for two ABWRs that are planned for construction at the South Texas Project, near Bay City, Texas, and agency staff recommended that a combined construction and operating license be issued to Nuclear Innovations North America (NINA) for the project.

Hurdles faced by that consortium—headed by NRG Energy and including Japanese firms Toshiba and Tokyo Electric Power—appear to be financial, rather than regulatory. In February, more than 170 organizations from the U.S., Japan, and other countries sent Japanese Prime Minister Naoto Kan and members of his cabinet a letter opposing a nearly $4 billion loan guarantee that Japan Bank is considering for the two-unit project. The groups warn that project costs have soared from $8 billion to $18 billion and that “with a deregulated competitive power market and some of the lowest wholesale electricity prices in the country, Texas is a particularly risky U.S. state in which to invest in expensive new reactors.”

NINA is also awaiting news from the U.S. Department of Energy on its $10.2 billion loan guarantee application.

Belgian Government to Increase Nuclear Tax Levy. Plans are being considered to increase a tax levied on nuclear power producers—primarily GDF Suez company Electrabel and SPE-EDF—above €250 million a year. The tax resulted from a 2009 agreement between the government and the utilities in return for a 10-year life extension for the country’s three oldest nuclear plants. Using 2007 data, national energy regulator CREG claims Electrabel is reaping profits of around €2 billion per year—more than three times the €652 million Electrabel says it receives from nuclear power—and therefore the firm should pay more tax. Utility executives said they would resist demands to pay more than the €245 million yearly levy agreed upon because “nothing had changed in the fundamental conditions.”

German States Take Nuclear Fight to High Court. Five German states led by opposition parties—Berlin, Bremen, North Rhine-Westphalia, Brandenburg, and Rhineland Palatinate—filed a legal complaint with the country’s highest court in Karlsruhe, challenging the federal government’s decision to extend the operating lives of the country’s 17 nuclear reactors by an average of 12 years. The challenge disputes Chancellor Angela Merkel’s decision to bypass the upper house of parliament, or Bundesrat, where the country’s 16 states are represented.

—Sonal Patel is POWER’s senior writer.