IEA: World's Power Mix Is Seeing Unprecedented Transformation

A significant transformation of the global power mix is under way, noted the International Energy Agency (IEA) in its newly released World Energy Outlook (WEO-2015). Renewables are getting subsidized boosts from a growing number of countries—and that is posing challenges and requiring changes to electricity markets. Nuclear and coal face wavering support in others, hampered by environmental rules or economics. Natural gas–fired generation, which has been constrained by supply or cost issues, is seeing a resurgence worldwide, surfing on the recent dip in oil-indexed prices.

The annual report notes that an unprecedented number of countries are pursuing integrated policies to meet economic, security, and environmental goals—ambitions driven in part by the United Nations Framework Convention on Climate Change conference in Paris held in December 2015.

In the U.S., three key factors are shaping the power sector: federal rules (including the Clean Power Plan, the Mercury and Air Toxics Standards, and new plant carbon standards); renewable portfolio standards, which are in flux in many states; and the decline in natural gas prices, which has prompted more coal-to-gas switching and even made some nuclear units uneconomic to run.

In the European Union (EU), meanwhile, changes will be determined by the bloc’s newly announced binding target to reduce greenhouse gas emissions by 40% below 1990 levels by 2030. The EU strategy seeks greater coordination of capacity markets so as to facilitate more investment in renewables and low-carbon technologies, the agency said.

Other countries in transition include nuclear-heavy Japan, which has accelerated deployment of renewables in power generation, authorizing 1.7 million mostly solar projects through feed-in tariffs. Meanwhile, 41 of the country’s nuclear reactors remain offline, with 25 waiting for licensing assessments.

Emerging economies, too, are crafting policies to meet energy security and environmental goals in tandem. China has set strict efficiency standards for new coal power plants (equivalent to 43% efficiency), and the nation has ambitious targets for wind (200 GW by 2020), solar (100 GW by 2020), hydropower, and nuclear power. India, determined to significantly expand its generation capacity to provide electricity for all its citizens, also has remarkable renewable targets: 100 GW for solar, 60 GW for wind, 10 GW of bioenergy, and 5 GW of small hydropower by 2022.

Southeast Asian countries, which are leading the charge in new coal plant installations, are also seeking to diversify their energy supply. And Brazil, which is in the midst of a severe, devastating drought, has been forced to curtail the hydropower output on which it has overwhelmingly depended in the past and is relying on auctions to contract new power sources to meet soaring power demand.

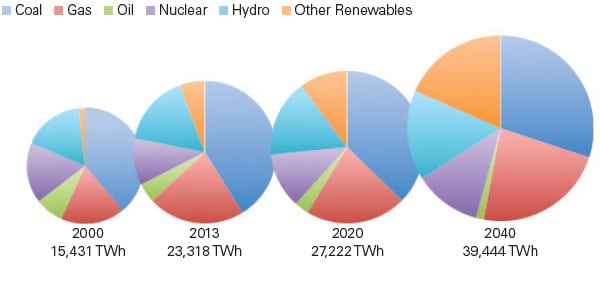

All in all, the share of low-carbon technologies in the global power mix will increase from about 33% in 2013 to 47% in 2040 (Figure 1), the report predicts in its central scenario, which assumes that policies and measures announced as of mid-2015 have been adopted. However, it notes that the nature and speed of this evolution will vary by region.

Cumulatively, the global investments needed to facilitate these transformations are estimated at $19.7 trillion over 2015–2040, averaging $760 billion per year. Almost two-thirds of the total investment is in emerging economies, the report notes. Meanwhile, investment in power plants account for 58% of the total (more than half which will go to renewables, with less than a fifth to coal), while the rest will be dedicated to transmission and distribution networks.

Finally, the report forecasts that the transformation will be moderately expensive. In the central scenario, as the supply of power shoots up by 70%, the average cost of generation will rise from $67/MWh to $71/MWh. That increase factors in power plant efficiency gains and higher fuel costs.

—Sonal Patel, POWER associate editor.