IEA: Renewables Will Overtake Coal's Share in World Power Mix by 2040

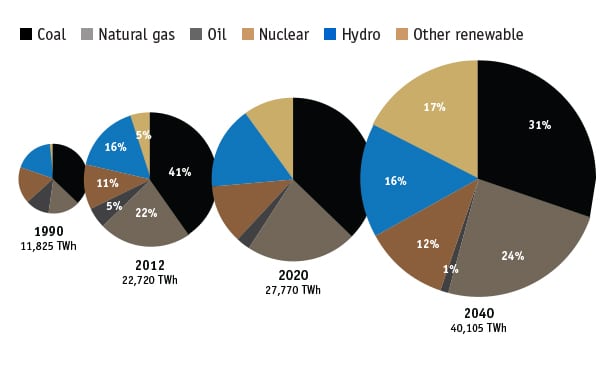

Renewables’ share of the global power mix is slated to overtake coal to become the largest source of electricity by 2040, the International Energy Agency (IEA) projects in its 2014 edition of the World Energy Outlook.

The annual report predicted that electricity will generally remain the fastest-growing final form of energy worldwide (meeting 23% of the world’s final energy needs in 2040, up from 18% in 2012). That conclusion relies on a central scenario in which policies currently proposed (such as the U.S. Environmental Protection Agency’s Clean Power Plan, the European Commission’s 2030 climate and energy policy framework, and China’s State Council air pollution plans) are adopted, under which the IEA estimated that world electricity demand is set to soar by 2.1% per year on average through 2040.

Factors that drive this growth include rising electrification rates—in Africa alone, the population with access to power will soar from 42% to 73%—and increased demand from the residential sector. Notably, electricity’s share of transport energy demand is only expected to reach 2.4%, compared with 1% at present.

Worldwide growth in power demand will require cumulative capacity additions of about 7,200 GW—nearly half of which will be needed to replace retired facilities. Overall, almost 40% of existing capacity—most of which is renewables (885 GW), coal-fired (610 GW), gas-fired (490 GW), and oil-fired (311 GW)—will need to be replaced. Figures vary by region, however. For example, about 60% of the European Union’s (EU’s) capacity is slated to retire during that period, compared to China’s 16%. According to the report, the U.S. may retire about 736 GW between 2014 and 2040—a significant number considering that its existing power fleet had a capacity of 1,032 GW in 2012.

But how power profiles will change through 2040 (Figure 1) also varies tremendously across regions. New regulations in the U.S. are expected to stimulate a 40% increase in the use of gas for power and propel renewables’ growth by 165%. In the EU, renewables’ share will almost double, reaching 46% by 2040. How well the bloc cements reliability will depend on how it secures investments for new thermal plants, the report noted.

In China and India, meanwhile, coal’s share will fall more than anywhere else, though it will plunge further in China than in India as efforts are beefed up to control air pollution. China’s coal-fired generation share could drop from 76% in 2012 to 52% in 2040—while around 45% of new coal plants built during that period will be ultrasupercritical or integrated gasification combined cycle plants. India’s coal share could, meanwhile, fall from 72% to 55%, and new additions will also increase the average efficiency of the country’s coal fleet.

According to the IEA, the future of carbon capture and storage (CCS) appears foggy because “supportive government policies needed to drive its deployment are notably absent.” The agency projected that about 3% (around 70 GW) of coal capacity and a much smaller portion of gas plants will be equipped with CCS by 2040; most will be in the U.S. and China.

Nuclear’s future, too, looks uncertain, the report suggests, noting that a number of factors will determine nuclear’s “retreat, recovery, or renaissance.” The sector is grappling with workforce constraints as well as availability of heavy forging capacity to manufacture reactor vessels. In addition, nearly half of the 434 reactors operating in the world at the end of 2013 will be retired by 2040. The rate of retirements will pick up in the first half of the 2020s, as reactors built during the 1970s are taken offline, and then again in the late 2030s. “This is set to pose challenges for industry and regulators and possibly strain engineering and project management capabilities,” the IEA predicted.

The report also included an interesting revelation about future power costs, which are expected to climb (in 2013 dollars) from $1.6 trillion in 2012 to about $2.9 trillion in 2040 and will be mostly recovered through regulated or competitive wholesale power prices. The IEA projected that the U.S. in particular will have some of the world’s most competitive industrial power prices: In 2040, Chinese industrial electricity prices will be 75% higher than those in the U.S., while EU prices will be almost twice as high, it suggests. And that is despite the agency’s projections that average costs of generation in the U.S. will rise from $55/MWh today to close to $70/MWh in 2040.

From 2014 to 2040, an average of around $770 billion (in 2013 dollars) will be poured into the world’s power sector, 58% to build new capacity and refurbish existing plants, and the remainder to expand transmission and distribution networks. The IEA suggested that at least one-fifth of investment in generation will go to wind, followed by about 16% each for hydro and coal, 13% for solar, and 11% for natural gas. Global subsidies for renewables will also increase, it projected, from $121 billion in 2013 (15% higher than in 2012) to $230 billion in 2030.