Global Monitor (September 2007)

Constellation files partial COL

Baltimore-based Constellation Energy Group has dipped its big toe into the nuclear regulatory licensing waters, testing the temperature for a third unit at its 1,165-MW Calvert Cliffs plant in southern Maryland, 50 miles south of Washington, D.C.

Constellation has filed the first part of a request for a combined construction and operating license (COL) for a new, 1,600-MW unit with the U.S. Nuclear Regulatory Commission (NRC). As part of a consortium with France’s Areva and Électricité de France, the utility anticipates licensing an Areva "evolutionary" power reactor (EPR) similar to one Areva is building in Finland.

Areva’s EPR has not yet been blessed by the NRC for use in the U.S. The Finnish project is over budget and behind schedule. Then again, the most advanced American next-generation designs also lack final NRC approval, and none is accumulating the construction experience that Areva’s is.

Constellation’s NRC filing was low-key, coming in mid-July without a formal announcement by either the company or the NRC. The Washington Post headline hyped the submission of initial documents as the "first application to build a new U.S. nuclear power plant in three decades." Not exactly. The Baltimore Sun had a better grip on the story, describing it as a "partial application" for a new nuke.

To his credit, the Post’s reporter, Steven Mufson, described the Constellation filing as "another small step toward a resurgence of the nuclear power industry." Constellation said it expects the new unit to cost $4 billion.

The utility filed a 5,900-page environmental report for the new reactor, but nothing more. An NRC spokesman told the Sun, "They’re the first in the door with some part of a request to actually build a new reactor."

Constellation VP and Calvert Cliffs head honcho George Vanderheyden told the Sun that the company may or may not submit the rest of a COL application by the end of the year, He told the Post, "No entity, including Constellation, has yet made a decision to build a nuclear power plant, but we’re moving as aggressively as we can [through] the first phase, which is the licensing phase."

Constellation CEO Mayo Shattuck III is bullish about new nukes and has long made his fondness for fission known. But Shattuck, formerly of Wall Street, also recognizes that financing a new nuke is a critical-path issue, and one that the industry is far from having in hand.

Many veteran analysts of the nuclear business also find financing a new reactor a core issue. Ed Lyman, who follows nuclear policy issues for the Union of Concerned Scientists, told the Post, "Until we see investors put money down toward the multi-billion-dollar cost of building new plants, we should remain skeptical that there’s any major shift under way."

The two existing units at Calvert Cliffs (Figure 1) are powered by pressurized water reactors from Combustion Engineering that entered service in 1975 and 1977. In 2000 the plant became the first nuclear station to have its license extended for 20 years by the NRC. Since then, more relicensings have become routine.

1. And baby makes three? Constellation Energy’s two-unit Calvert Cliffs plant could someday host a third reactor, if Constellation obtains a license and financing for it. Courtesy: Constellation Energy Group

Elsewhere in Maryland, the state’s Public Service Commission (PSC) held a two-day powwow in July to figure out what to do about high electricity prices. The meeting, called by Governor Martin O’Malley, was triggered by last summer’s 72% retail price hikes by Constellation subsidiary Baltimore Gas & Electric Co (BG&E). One observer described the session as "providing a lot of hot air, but not much in the way of new ideas."

O’Malley has asked the Maryland PSC to examine the implications of a formal divestiture of Constellation and BG&E. Several analysts, however, say that such a move would benefit Constellation and have zero impact on retail rates. Why? BG&E will still have to procure its supplies in a market dominated by Constellation, which isn’t likely to give the utility a break once it’s no longer a subsidiary.

IAEA scrutinizes shaken Japanese nuke

A team of inspectors from the Geneva-based International Atomic Energy Agency (IAEA) arrived in Japan in mid-August for a four-day safety assessment of Tokyo Electric Power Co.’s (Tepco’s) Kashiwazaki-Kariwa nuclear plant, knocked out of service July 16 by a major earthquake.

Japan initially resisted the offer by the IAEA—often called the nuclear watchdog of the United Nations—to inspect the plant, but later changed its position as new information emerged about the size of the earthquake and the extent of the damage it caused.

Powered by seven boiling water reactors, Kashiwazaki-Kariwa (Figure 2) has a capacity of 8,200 MW, making it the world’s largest nuclear generating station by that measure. All seven units shut down automatically at the time of the July 16 seismic event. However, the temblor caused a transformer in the switchyard to catch fire and led to not-yet-understood releases of tiny amounts of radioactive Iodine-131 into the Sea of Japan.

2. Shake, rattle, and roll. Last month, IAEA inspectors spent four days at the Kashiwazaki-Kariwa nuclear plant to determine how much damage a July 16 earthquake did to its seven units. Courtesy: Tokyo Electric Power Co.

According to the Reuters news agency, the six-member team was led by IEAE Director Philippe Jamet. After examining the condition of the nuclear station, the inspectors met with Tepco officials and staffers of Japan’s Nuclear and Industrial Safety Agency. Details of the meeting’s discussions were not available at press time.

Tepco said the quake that struck the region was far stronger than any Kashiwazaki-Kariwa was designed to withstand, or than any nuclear plant has ever felt. Because Japan is tectonically active, the country’s rules require nuclear plants to be able to survive a quake of magnitude 6.5 on the logarithmic Richter scale. The July 16 quake measured 6.8, substantially stronger than the worst-case event the plant was designed to withstand. Soon after the quake, Tepco said it was substantially lowering (from $2.6 billion to $57 million) its profit projections for 2007 because it would now need to buy expensive oil- and gas-fueled capacity to replace Kashiwazaki-Kariwa’s low-cost nuclear generation. The company is Asia’s largest utility and posted a profit of $2.5 billion for the prior fiscal year. In a written statement, Tepco estimated that having the plant shut down for several years will cost $2.4 billion.

Japan’s nuclear industry has a spotty safety record. A 1999 criticality accident at the Tokaimura nuclear fuel factory killed two workers and exposed hundreds of villagers to radiation. In 2004 a pipe break at Kansai Electric Power Co.’s Mihama plant in Fukui Prefecture killed five.

In 2002, Tepco’s admission that it had falsified a dozen or more nuclear safety reports over the prior 20 years led to a 2003 shutdown of all 17 of its nuclear units. By this year, all were back in service.

Japan gets about one-third of its electricity from 55 nuclear power plants. Only the U.S. (with 104 plants) and France (with 59) have more.

Wave energy of the future?

A Minneapolis company says it has developed a "revolutionary" way to make ocean wave energy economical. Independent Natural Resources Inc. (INRI) will seek to prove the claim with a three-month demonstration of its patented Seadog wave pumping technology in the Gulf of Mexico, to be monitored by the marine engineering technology department of Texas A&M University at Galveston.

Other wave energy schemes generate power directly from the movement of seawater. According to an INRI press release, each of its Seadog pumps (Figure 3) "captures ocean-wave energy from swells or waves to pump large volumes of seawater to shore-based storage or sea-based platform systems while consuming no fuel." The water then powers turbine-generators before being returned to the ocean. In other words, the technology operates like conventional, land-based pumped storage. The company says a February 2007 test in Texas waters "validated the results of several years of concepts and planning."

3. Salty dogs. Independent Natural Resources envisions configuring hundreds or thousands of its patented Seadog pumps into "wave farms." One square mile of ocean would have to be covered to generate a few hundred megawatts. Unlike other wave power technologies, the conversion of kinetic to electric energy would be done by turbine-generators sited onshore or on a separate offshore platform. Courtesy: Independent Natural Resources Inc.

Frank Warnakulasuriya of Texas A&M at Galveston was quoted in the INRI press release as follows: "As a wave energy collector, [the Seadog system’s] simplicity, apparent efficiency, and effectiveness is commendable and can be placed among the best available wave energy collectors to date." According to IRNI, the electricity produced is inexpensive, renewable, and—because ocean waves never stop, unlike sunlight or wind—dispatchable.

The test off Galveston will vet the performance of nine to 200 Seadog pumps. "If the wave pump continues to perform as well as our sea trials have shown," said INRI CEO Mark Thomas, "we believe it [could represent] a breakthrough in global energy production." Thomas explained that "wave farms" could combine the output of 50 to 80,000 pumps and work in seas with waves as short as 6 inches or as tall as 80 feet.

According to INRI, 1 square mile of Seadog pumps could generate from 50 MW to 1,500 MW, depending on wave height. If swells are at least 9 feet high, such a farm would have an average capacity of 775 MW per square mile. Swells of 5 feet would produce about 240 MW/square mile.

New GE plant reigns in Spain

Two General Electric 109FB combined-cycle systems fueled by natural gas have entered commercial service at the Plana del Vent power plant in Vandellos, Spain, 80 miles southwest of Barcelona. The plant (Figure 4), owned by Gas Natural SDG, SA, adds more than 800 MW of badly needed capacity to the Spanish grid. GE Energy was its turnkey supplier.

4. Making its commodity more valuable. Spain’s Gas Natural, now a power producer as well, has fired up two GE combined-cycle units fueled by captive supply at its new Plana del Vent plant southwest of Barcelona. Courtesy: GE Energy

Each of the combined-cycle systems consists of a top-of-the-line Frame 9FB combustion turbine-generator, a 109A High Efficiency Advanced Technology (HEAT) steam turbine, and a heat-recovery steam generator. GE also supplied Plana del Vent’s integrated control system. Under a separate contract with Gas Natural, GE will maintain the turbines and operate the overall plant for at least 12 years.

The two Frame 9FB gas turbines are the largest ever built at GE Energy’s factory in Belfort, France. The first of the 310-ton machines left Belfort in February 2006 for a 30-day journey by land and sea to Vandellos. The second unit was shipped in March 2006. Both required special wide-load trucks for the road legs of the trip and a special railcar for the train leg in Spain.

GE Energy’s Ricardo Cordoba said the project "incorporates GE’s first fully implemented, standardized 109FB plant design. [On each combined-cycle unit,] the generator is located between the gas turbine and the steam turbine, which allows installation of an axial condenser that lowers the shaftline level, [making it possible to reduce] the building height." Cordoba added that the Frame 9Bs are equipped with GE’s latest dry low-NOx combustion system, Version 2.6+.

According to GE, the 9FB is "among the world’s most advanced, air-cooled, 50-Hz gas turbines." Nearly 30 of the turbines have been installed or ordered worldwide, and the GE F-class family that includes them has racked up more 20 million operating hours.

Among the updated features of the 109A HEAT turbine is a reaction turbine section capable of operating at up to 2,400 psi. One such unit at a 400-MW 109FA plant in Ireland has already accumulated 8,000 hours of operation, "a milestone generally considered by the industry as the mark of a proven product," said GE.

Long a player in the natural gas markets of Spain, Italy, France, and Latin America, Gas Natural also has become a major electricity generator in Spain since the restructuring of that nation’s electricity sector. Its production now ranks fourth in the country, according to Spain’s National Energy Commission.

Solar house competition heats up

As fall approaches, teams from 20 colleges and universities are rushing to refine their entries in this year’s U.S. Department of Energy’s (DOE’s) "solar decathlon," a competition to design, build, and operate the most attractive and efficient solar-powered house. The entrants will be showcased on the National Mall in Washington between October 12 and 20, and the winner will be announced on October 19 at 2 p.m. Eastern time.

Teams of college students are designing the houses to be powered entirely by photovoltaic panels. They will also equip the buildings with systems for extracting heat energy from sunlight and storing it.

In a news release, the DOE noted that "the students learn how to raise funds and communicate about team activities. They collect supplies and talk to contractors. They build their solar houses, learning as they go." According to the agency, "Today’s solar houses connect with nature to take advantage of heat and light from the sun and cooling breezes and shading. But [the students] crank this natural advantage way up by using the newest products on the market."

The University of Colorado is a three-time winner of the competition. Its major competitors include MIT, Carnegie Mellon University, Cornell University, and the Georgia Institute of Technology.

Georgia Tech reports that its team is well into construction (Figure 5, p. 10). The school’s College of Architecture is leading the team, with support from the Colleges of Engineering, Management, and Sciences, as well as a number of research centers.

5. Work-study program. These Georgia Tech students are working on their entry in this year’s DOE’s "solar decathlon," a competition to see who can design and build the most attractive and efficient solar-powered house. Courtesy: Georgia Institute of Technology

Said Doug Allen, interim dean of the College of Architecture, "No single discipline carries all the knowledge necessary to undertake and successfully complete such a project. The students, with diverse backgrounds, have to work together in ways that cannot be duplicated by any other means."

Judges will grade each house’s construction, marketing, and planning. The DOE gives each of the teams $100,000 to get started and leaves it to them to raise any additional funds needed—a big part of the overall challenge. A typical solar house costs more than $600,000 to design, build, and transport to Washington.

Oxygen-blown IGCC, at micro-scale

Researchers at the UK’s Newcastle University say tiny ceramic tubes developed for another purpose have a key property that may make them suitable for reducing the CO2 emissions of any fossil fuel–fired power plant.

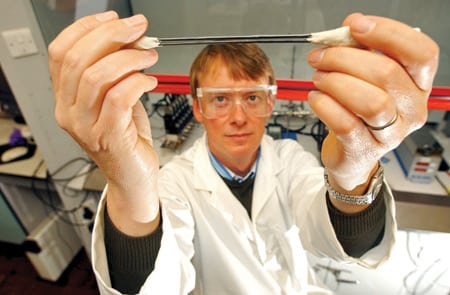

The advanced ceramic—lanthanum-strontium-cobalt ferric oxide (LSCF)—is not a new material, the researchers note. It was originally developed for use as the cathode of a fuel cell. But the LSCF tubes (Figure 6) have a uniquely useful property: They can strip oxygen from a stream of air. Burning a fossil fuel in an environment of nearly pure oxygen would produce a by-product stream that is nearly pure CO2. The ability to do so would have tremendous commercial implications for both power production and chemical processing.

6. Tiny solution to global problem? Ian Metcalfe of Newcastle University shows the composite ceramic tubes, made of lanthanum-strontium-cobalt ferric oxide, that can strip oxygen from a stream of air. Courtesy: Newcastle University

Engineers from Newcastle University, in cooperation with scientists from Imperial College in London, have already adapted the technology for use by natural gas–fired plants. When such plants burn methane in an air stream, the product of combustion is a gaseous mix of oxides of nitrogen and CO2. A news release from Newcastle University states what most power engineers already know: "Separating the gases is not practical because of the high cost and large amount of energy needed to do so."

The LSCF tubes developed by the Brits address that problem by working at the front end of the combustion process. They filter oxygen from the air supply, allowing only O2 to combine with the methane fuel. The products of this reaction are pure CO2 and steam, which are easily separated by condensation. The process also could be applicable to power or chemical plants that convert coal feedstock to synthetic natural gas (syngas).

A research team led by Ian Metcalfe of Newcastle University and Kang Li of Imperial College has tested the new combustion process at laboratory scale. Details of research findings to date were published this August in two technical journals, Materials World and The Chemical Engineer.

The LSCF tubes look like small drinking straws. Oxygen ions can permeate them. When air is blown around the outside of the tubes, oxygen in it is pushed through the tubes’ walls to react with methane pumped through the tubes’ center. According to a Newcastle University news release, "Although it has not yet been attempted, it should be possible to assemble a power station combustion chamber from a large number of the tubes, with space between them for air to circulate."

Team leader Metcalfe added, "The cheapest way to dispose of waste carbon dioxide from combustion is to release it into the atmosphere. We have been doing that since humans first discovered how to make fire. The technology we have developed may provide a viable alternative, although whether it is economical to develop it will depend largely upon the carbon credit system that governments operate in the future."

Turning corncobs into ethanol

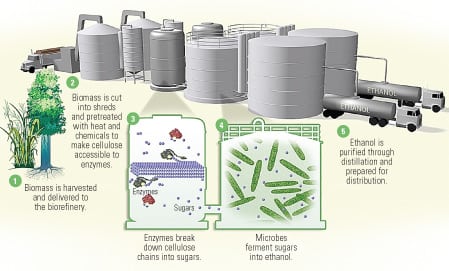

A South Dakota ethanol producer, Poet LLC, says it has successfully produced cellulosic ethanol from corncobs. The ability to turn fibers such as corncobs into a liquid fuel is a key to the future of biological alternatives to fossil fuels.

Poet’s biofuel production project (Figure 7) is hosted at its corn dry-mill plant in Emmetsburg, Iowa. The company, America’s largest dry-mill ethanol producer, converts corn to ethanol by grinding the plant’s kernels. At present, Poet can produce 50 million gallons of the biofuel daily.

7. Ethanol on the cob. Poet LLC says it has successfully turned corncobs into fuel-grade ethyl alcohol (ethanol), a major step toward cellulosic ethanol production, using this five-step process. Courtesy: U.S. Department of Energy

The goal of the new project, which will use corn cobs and other corn wastes as feedstock, is to produce 125 million gal/day, with 25% of that coming from cellulosic content. The project has U.S. Department of Energy funding, and Poet expects it will take 30 months to build and commission the new biorefinery.

Jeff Broin, Poet’s CEO, said that 40% of the output of the new plant will come from corn, and 60% from corncobs. "There is no major market for cobs," he said, "so we will be producing cellulosic ethanol from an agricultural residue. And because cobs represent only 18% of the above-ground stover [(the stalks that remain after the corn has been harvested), removing them] will not adversely impact soil quality." The remaining stover will be plowed back into the soil to keep it from becoming exhausted.

Mark Stowers, Poet’s head of R&D, says that corncobs are a top-notch feedstock. "Because the cobs have more carbohydrate content than the rest of the corn plant," he explained, "they’re very suitable for producing cellulosic ethanol. What’s more, the cobs are denser than other parts of the corn stalk, so it’s easier to transport them from the field to the factory."

This February, the DOE announced grants totaling $385 million for cellulosic ethanol R&D projects. It and the U.S. Department of Agriculture are hosting a national meeting on cellulosic ethanol, organized by Infocast Inc., in Washington October 15–17.

Court blocks gas attack on coal project

Last month, the Oklahoma Supreme Court rejected a motion by an in-state natural gas supplier and its supporters to put the brakes on a planned $1.8 billion coal-fired power project. The gist of the complaint was that the coal plant would be less green than a gas-fired combined-cycle plant of similar capacity.

The court order, in one sentence, denied the complaint by Chesapeake Energy Corp. and the Quality of Service Coalition—a group of Oklahoma businesses and cities. The motion asked the Oklahoma Supremes to assume jurisdiction over the case, thus nullifying preconstruction approval of the project this June by the Oklahoma Corporation Commission (OCC).

Chesapeake, the largest oil and gas exploration and production company in Oklahoma (Figure 8), argued that the June OCC hearings at which the Red Rock Power Project was approved violated the state’s constitution. The 950-MW plant would burn Powder River Basin (PRB) coal at ultrasupercritical pressure and temperature.

8. Oklahoma fuel fight. Chesapeake Energy, Oklahoma’s largest natural gas producer, has lost a court battle over the constitutionality of a state agency’s preconstruction approval of a large power project that would burn Powder River Basin coal. Courtesy: Chesapeake Energy

It should come as no surprise that Chesapeake’s biggest supporters in the campaign against Red Rock are the proposed plant’s developers: American Electric Power’s Public Service Co. of Oklahoma (PSO), Oklahoma Gas & Electric Co. (OG&E), and the Oklahoma Municipal Power Authority (OMPA), a state agency that supplies bulk electricity to dozens of munis. Chesapeake et al. argued that a gas-fired, combined-cycle project would be more economical and environmentally sensitive than the coal plant.

Thomas Price Jr., VP for development at Chesapeake, said, "Natural gas is significantly greener and better for the environment, the state, and all of its citizens." The gas company also has the support of state environmental groups, including the Oklahoma chapter of the Sierra Club.

The Red Rock plant would be sited near OG&E’s coal-fired Sooner Power Plant to take advantage of Burlington Northern rail service from the southern Powder River Basin in Wyoming. The Sooner plant burns 4 million tons of PRB coal annually. The Red Rock plant would require delivery of another 3.5 million tons.

In 2005, PSO issued requests for proposals for new baseload generation with an in-service date of 2011. The utility chose the bid by OG&E and OMPA that evolved into the Red Rock project. As the contract is currently structured, PSO would own 50% of the plant, OG&E 42%, and OMPA 8%.

In 2006, the Oklahoma legislature approved a bill to smooth the path for the Red Rock project, including preconstruction regulatory approval of cost recovery, needed to obtain financing. That’s the provision Chesapeake and its supporters argued is unconstitutional.

In ruling that the OCC has jurisdiction to review the plant, the Oklahoma high court made no statement on the merits of the case; it simply affirmed that the state commission has initial jurisdiction. Lee Paden, an attorney for Chesapeake, said the company will continue to pursue the case at the OCC and beyond. "We are disappointed in the decision," he said, "but that doesn’t deter us from moving forward."

New advanced energy initiatives

A rich amalgam of technical papers greeted those who attended the 50th ISA Power Industry Symposium in Pittsburgh June 10–15. Topics included simulation and modeling, plant instrumentation, asset management, advanced control techniques, performance improvement through advanced monitoring, nuclear plant issues and technologies, I&C system security, and installation and commissioning issues.

Jeff Kupfer of the U.S. DOE was the keynote speaker. In his speech, he detailed several advanced energy initiatives, such as:

- Three new bioenergy research, development, and demonstration centers.

- Incentives for biorefineries to achieve the DOE’s goal of reducing U.S. gasoline consumption 20% within 10 years—what Kupfer called the "20 in 10" initiative.

- Identifying sites for new nuclear reactors by 2010, to facilitate permitting and regulatory approval.

- Solar and wind technologies.

- Clean coal.

- Energy efficiency.

Kupfer noted that the production of all initiatives will be delivered to electricity grids, which he said require "critical improvements." Supporting the increased electron traffic, he added, will require improvements in grid reliability. Kupfer conceded that the DOE’s designation of national electric transmission corridors, mandated by the Energy Policy Act of 2005, is "controversial."

—Jason Makansi, Pearl Street Inc.

POWER digest

News items of interest to power industry professionals.

Siemens inks first U.S. gasification supply contract. Siemens Power Generation has received an order from Secure Energy Inc. for two entrained-flow gasifiers. The units will be used by a proposed plant in Decatur, Ill., to convert high-sulfur Illinois coal to pipeline-quality syngas.

Each of the gasifiers has a thermal capacity of 500 MW and is designed to produce 20 billion cubic feet of syngas annually. Siemens says the gasifiers will be delivered in early 2009, for placement in service within six months. The deal also calls for Siemens to do the plant’s process and basic engineering design and to supply other key gasification island components. The financial terms of the agreement were not disclosed.

The deal is the first gasifier order for Siemens from the U.S. Randy Zwirn, CEO of Siemens Power Generation (www.powergeneration.siemens.com), said the order "is further evidence of the market potential for fuel gasification and the important role it can play in meeting our nation’s energy requirements."

In other Siemens news, the company has been awarded an $819 million contract by the Kuwait Ministry of Energy to turn the Az Zour gas turbine plant into a combined-cycle facility. Siemens will be working with Belgium’s Cockerill Maintenance & Ingénierie SA and Kuwait’s Alghanim International on the project. Unit 1 is scheduled to enter service in March 2010, with Unit 2 following three months later. Siemens built the Az Zour plant in 2005 as a 1,000-MW simple-cycle turbine facility capable of burning natural gas or fuel oil.

Alstom lands order for 660-MW Aussie peaker. Alstom has won a turnkey order for a 660-MW simple-cycle gas-fired peaking power plant in Australia worth an estimated $342 million. The French firm will design, supply, install, and commission the Colongra Project, 75 miles north of Sydney, for state-owned Delta Electricity.

At the heart of the peaker will be four of Alstom’s 165-MW GT13E2 gas turbine-generators, which Alstom (www.alstom.com) says offer the "high flexibility" needed for peaking operation. Alstom says the deal is its fifth in Australia since 2005 for turnkey gas turbine plants.

The Colongra plant will be built next to Delta Electricity’s existing coal-fired plant on the New South Wales central coast. Alstom supplied the original four 350-MW steam turbine-generators for the coal-fired plant in the mid-1960s.