EPRI: Electrification to Reshape Power Landscape

Even in the absence of climate policy, customer adoption of electric end-use technologies over the next 30 years is expected to spur steady growth in energy consumption, a new report assessing U.S. electrification from the Electric Power Research Institute (EPRI) suggests.

The April 3–released report, “U.S. National Electrification Assessment,” is based on findings by EPRI’s Efficient Electrification Initiative, which is exploring how electrification could affect grid operations and planning. The research entity noted that though “electrification” in the developing world refers to making power available to customers for the first time, in more advanced economies like the U.S., the concept increasingly describes “electric end-uses displacing other commercial energy forms or providing new services such as 3-D printing and indoor agriculture.”

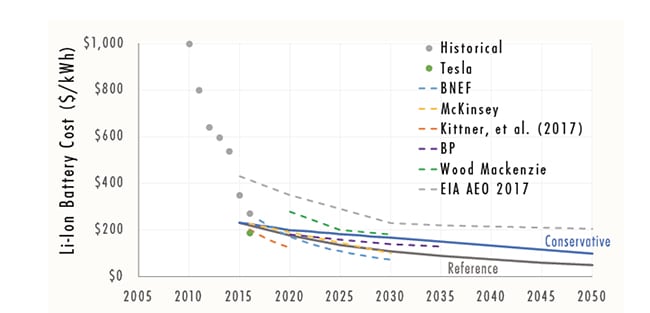

Examples of emerging electric end-use technologies include: electric vehicles (EVs) and plug-in hybrid electric vehicles; heat pumps for space and water heating; and electric technologies in industry and heavy transportation. Falling battery costs, digitalization, advances in materials, and increasing production scale could improve the efficiency and performance of a range of electric technologies, from automobiles to industrial equipment, the report notes. “Transformative shifts on the horizon” also include mobility-as-service models and autonomous vehicles, indoor agriculture, additive manufacturing, and electro-synthesis of chemicals, it says.

Load Growth Projected to Grow

The report is based on an examination of four scenarios under EPRI’s US-REGEN model—which is the entity’s energy-economy model of the U.S. These include a conservative scenario, which considers a slower decline in the relative cost of EVs; a reference scenario, which assumes technology costs and performance improve over time across the economy under existing state-level policies and targets; a progressive scenario, which includes a carbon value of $15/ton of carbon dioxide starting in 2020 in the reference scenario; and a transformation scenario, in which the carbon value starts at $50/ton in 2020.

The report notes, however, that many actions will be necessary to realize the full benefits of efficient electrification. Fundamentally, more research will be required to examine how alternatives may affect the grid and energy system, as well as to inform policy, regulation, and market choices, it says.

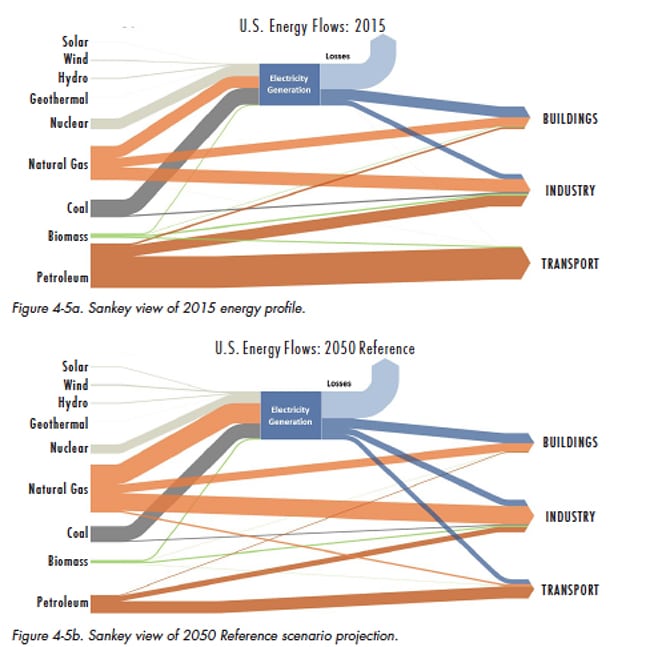

A key finding across all scenarios is that electricity’s role in U.S. final energy will continue its growth trajectory. In 1950, electricity was 3% of final energy, a share that has soared to 21%. Across all four scenarios, that share is expected to range between 32% and 46% of final energy in 2050.

Load growth, too, will soar. With efficient electrification—opportunities for electrification that lower cost, lower energy use, and reduce air emissions and water use—the study projects cumulative load growth of 24% to 52% by 2050. “By comparison, annual load growth from 1990–2000 was 2.7%, dropping to 0.82%, on average from 2000–2010,” the report notes. Some of this projected load growth through 2050 will be customer supplied, but in most cases, utilities will supply capacity to ensure reliability. “For electric companies, such slow but steady growth can moderate potential rate impacts of investments for environmental compliance or grid modernization. Moreover, if guided, new flexible loads can improve grid efficiency and performance,” EPRI said.

All four scenarios, however, project falling final energy consumption, despite continued growth in economic activity and energy services across all sectors of the economy. This is in part due to efficiency improvements, which will be led by advances in individual end-uses, such as lighting, variable speed motors, and more efficient internal combustion engine vehicles, as well as a shift from non-electric to more-efficient electric technologies, the report says. In the reference case, the analysis, for example, projects a reduction in economy-wide final energy consumption of 22% by 2050, while electricity use grows by 32%.

Increased Natural Gas and Renewable Use

In all four scenarios, meanwhile, natural gas use is projected to increase based on its operational flexibility and an assumed ongoing cost of around $4/MMBtu. “Direct natural gas use in industry and to fuel electric generation grows, while natural gas use in building heat remains relatively flat over time,” the report says. “Electric heat pumps with natural gas backup become attractive technologies in colder regions, utilizing the best features of both with dual-fuel capability potentially providing additional reliability.”

While the study did not explicitly model that aspect, EPRI said that the addition of flexible loads through efficient electrification could emerge as a “central strategy” to efficient renewable generation integration.

Meanwhile, if the end-use mix ultimately includes more vehicle charging and heating applications, seasonal low temperatures drive heating demand and reduce the efficiency of EVs. That could mean that electricity demand in most U.S. regions will peak in the winter—not during the summer as it does now—if no efforts actively manage loads. These new electric loads could provide significant opportunities for more flexible and responsive demand response as well as storage. “Realizing such benefits is contingent on investment in a flexible, resilient, and integrated grid and clear electricity market signals. Such demand-side changes coupled with more diverse, dynamic electric supply, create an array of challenges and opportunities for system planners and operators,” the report notes.

A Number of Improvements Needed

On the technology front, improvements will be necessary for renewables, natural gas, coal, and nuclear generation technologies. Increased flexibility in dispatch, improvements in storage, an expansion of biofuels, and development and demonstration of CCS will also be needed.

Grid modernization will also be needed. “Grid investment must enable the dynamic matching of variable generation with demand, while supporting new models for customer choice and control. Investments are needed also to maintain reliability and enhance resiliency. Grid capacity planning and operation will need to address the integration of electric transportation networks with the grid through smart charging, fast charging, and storage utilization,” the report says.

A number of new analytical tools will also be needed, such as a new cost-benefit framework for assessing individual electrification projects. New metrics for reliability will also be needed—and perhaps even an overhaul of concepts of reliability that historically focused solely on the electric system and on framing resource adequacy, primarily annual peak demand. “Looking ahead, system reliability may be framed in multiple hours by comprehensively considering system flexibility, natural gas delivery risk, and other factors,” EPRI said.

Other actions needed to reap the benefits of efficient electrification will include updating energy efficiency codes, facilitating market transformation, and electricity market design reforms. “With new electric supply and demand technologies projected to emerge, it becomes increasingly important to value energy, capacity, flexibility, locational value, storage, and other attributes,” EPRI said.

Finally, all four scenarios underscore the value of taking a broad view of energy policy, rather than addressing issues individually. “Uncoordinated approaches for electricity, transportation, and industry or across energy sources create unnecessary costs. Broadly considered policies may enable more effective, less disruptive shifts, with respect both to the energy sector and society,” the report says.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)