[UPDATED] Dynegy Rethinks Illinois Ventures Amid Market Turmoil

As Dynegy moved this week to assume full ownership of two struggling Ohio coal plants it co-owns with AES Corp. subsidiary DPL Inc., the company’s CEO reportedly said it is mulling withdrawing its presence from downstate Illinois owing to the state’s intervention to keep its nuclear plants running.

Dynegy CEO Robert Flexon told Crain’s Chicago Business that the Illinois Future Energy Jobs Act, signed into law last December by Illinois Gov. Bruce Rauner (R), could imperil the economics of the company’s downstate coal-fired power plants serving the Midcontinent Independent System Operator (MISO).

The state measure—designed to help Exelon Corp. keep its financially struggling Clinton and Quad Cities plants open—will take effect on June 1 this year. A trade group and several generators, including Dynegy, NRG Energy, and Calpine Corp., are suing the state, arguing that the law is inconsistent with the federal regulatory approach, which relies on competition to ensure just and reasonable rates.

Flexon told Crains that the downstate plants would remain open over the next year to satisfy bilateral capacity agreements, but unless a court intervenes to freeze the subsidies, closures of the plants may be inevitable. Clarifying Flexon’s comments, Dynegy spokesman David Onufer told POWER on April 27 that the plants are under evaluation and no decisions have been made.

Dynegy has been fairly transparent about its fight to preserve the integrity of the wholesale markets. “Nuclear plant subsidies for inefficient and inflexible plants are wreaking havoc on the competitive markets,” it said in its latest annual report. “Nuclear subsidies are the latest form of corporate welfare. With an influx of renewable energy and low-cost natural gas, nuclear assets are finding it increasingly difficult to compete against the more flexible and cost efficient combined cycle gas plants like those within our portfolio.”

Onufer told POWER on Thursday that Illinois’ zero-emission credits program is “an illegal transfer of $235 million dollars from the pockets of Illinois citizens and businesses into the bank accounts of Exelon’s shareholders. There is a long-term negative impact on Illinois families, businesses, communities and jobs, as well as competitive power generators.” He also noted: “In addition, the downstate Illinois power market is broken and the state must act in the best interest of its citizens and take back the responsibility of resource adequacy.”

In a statement sent to POWER on April 28, Exelon responded: “By implementing a zero-emissions credit program that recognizes nuclear power for its positive environmental attributes, the governor provided the people of Illinois freedom from dependence on fossil fuels and increasing emissions, $1.2 billion in economic activity and 4,200 highly skilled, good-paying jobs—a win for consumers and families alike.”

Full Ownership in Ohio

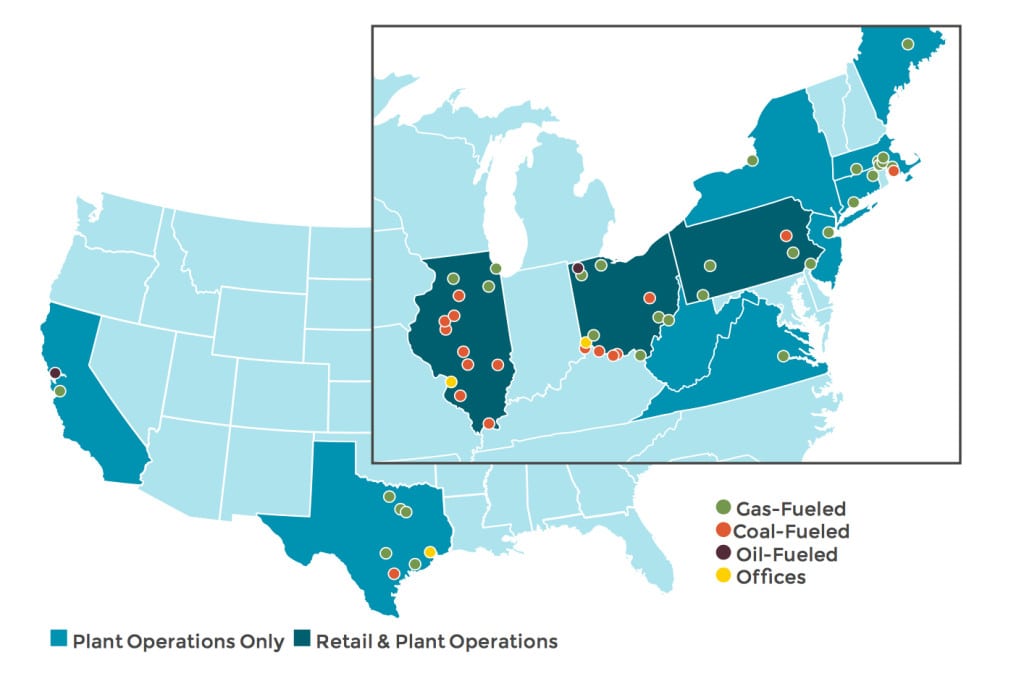

Dynegy owns more than 31 GW of generating capacity scattered across 12 states, the majority of which are “merchant” facilities without long-term power sales agreements. More than 43% of its capacity is in PJM. About 6% (1.9 GW) is in MISO, all of which is coal-fired capacity.

Last year, the company was embroiled in a similar fight to keep American Electric Power (AEP) and FirstEnergy from continuing operations of uneconomic or aging power plants in Ohio, successfully petitioning the Federal Energy Regulatory Commission (FERC) to block a proposed regulatory agreement that would have guaranteed income for the struggling facilities.

Earlier this week, Dynegy moved to assume full ownership of two struggling Ohio coal plants it co-owns with AES Corp. subsidiary DPL Inc.

Dynegy said in an April 21 filing with the U.S. Securities and Exchange Commission that it entered into purchase agreements with DPL companies Dayton Power and Light Co. (DP&L) and AES Ohio to take on their shares of the coal-fired William H. Zimmer Generating Station in Moscow, Ohio, and Units 7 and 8 at the Miami Fort Station in North Bend, Ohio. Dynegy operates both plants within PJM Interconnection’s competitive wholesale electricity market.

Dynegy co-owns the 1.3-GW Zimmer plant with DP&L, and Miami Fort with DP&L and AEP. The agreement would see Dynegy buy out a 28.1% undivided interest in the Zimmer plant and a 36% undivided interest in the Miami Fort units. If approved by FERC, the deal would add a total of 740 MW to Dynegy’s portfolio.

DP&L is selling its shares in the two plants per a settlement it reached with environmental groups earlier this year. Under terms of that settlement, the company will shutter its Stuart and Killen coal-fired plants in mid-2018 and sell its ownership shares in three other Ohio-based coal plants: Conesville, Miami Fort, and Zimmer.

Deal Swaps

Dynegy in February struck a deal with AEP to buy its 330-MW share of the Zimmer plant. That deal also saw AEP take on Dynegy’s 312-MW share of the Conesville plant.

AEP is looking to shed its plants in competitive markets in an effort to become a fully regulated company. In November, the company reported a $2.3 billion “impairment” largely relating to its ownership share of 2,684 MW of competitive generation in Ohio, including its Cardinal, Conesville, Stuart, and Zimmer plants.

For Dynegy, operations in PJM have proved profitable. The company reported in fourth quarter 2016 earnings documents that its PJM energy margin increased by $11 million compared to 2015 owing to “realized” spark spreads and higher retail volumes that more than offset a small decline in generation volumes.

The Zimmer and the Miami Fort units, Onufer told POWER on Thursday, are “reliable, controlled” coal plants, adding that “the most efficient way to operate them is by owning them 100% outright.”

But Dynegy’s fortunes may be unique. The competitiveness of PJM merchant projects, particularly coal-fired projects, has been negatively impacted by prolonged low energy prices, which stem from cheap natural gas, says an April 21–released Moody’s Investors Service report.

Merchant Coal Generators Encounter Refinancing Risks

The report, “PJM Merchant Generation Facing Refinancing Risk,” suggests that refinancing risks for PJM merchant plants have surged lately. The credit ratings service posited: “Some of the most efficient coal-fired plants, which had capacity factors above 80% four or five years ago, today operate at around 60% or below across the region, as they continue to be displaced by more economic [combined cycle gas turbines (CCGTs)].” Operating at such lower capacity factors may make it more difficult for merchant coal generators to break even at current energy prices, the report says.

It also notes, “The more efficient merchant coal-fired generation plants have, on average, variable costs around $30 per megawatt-hour (MWh) compared to recent on-peak prices in the region in the low to mid $30s/MWh while newer and more efficient CCGTs’ variable costs are in the low to mid $20s.”

Meanwhile, nearly 20 GW of new CCGTs are expected to come online in PJM by 2020.

Compounding those issues is that “merchant coal-fired projects have generated little or no excess cash flow for debt repayment (other than mandatory requirements) since their original financings.” This isn’t likely to change over the next few years, judging from natural gas price projections through 2019 and uncertainty regarding future capacity auction results owing to capacity additions, the report notes.

Merchant coal-fired generators are looking to maintain sufficient liquidity and respond to the low commodity price environment by slashing costs and improving operating efficiency, the report notes. These include layoffs and longer maintenance cycles.

“Larger and more diverse corporate issuers with merchant generation exposure, including Dynegy Inc. … and NRG, have announced plans to sell non-core assets as a means of increasing liquidity and strengthening their balance sheets during this challenging period,” the report says.

Moody’s projected owners of single assets or small portfolios of generation projects will be harder hit, because asset sales may not be an option to raise liquidity for debt reduction. With limited financial flexibility, they may be more dependent on “potential sponsor support” as a means of averting a debt restructuring.

The report also points out that evidence of “sponsor support” has emerged to varying degrees over the past two years, such as to address “covenant violations through equity cures, deferring or subordinating fees paid to the sponsor, making capital contributions towards major maintenance, and the posting of letters of credit to bolster liquidity.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

UPDATED (April 28): Adds Exelon’s response to Mr. Onufer’s comments.