DOE’s First $1B Loan Guarantee in Years Seeks to Bolster Turquoise Hydrogen Process

The Department of Energy’s (DOE’s) first conditional loan guarantee offered to a non-nuclear project since 2016 will finance the expansion of a pioneering commercial-scale “turquoise hydrogen” and carbon black production facility in Nebraska.

The agency’s Loan Programs Office (LPO) on Dec. 23 offered a commitment to guarantee a loan of up to $1.04 billion under the LPO’s Title XVII Innovative Energy Loan Guarantee program to Monolith, a 2012-established firm that has developed a methane pyrolysis process to convert natural gas into hydrogen and high-purity carbon black using renewable energy. Carbon black, a solid carbon material, is a critical raw material in the automotive and industrial sectors.

Assuming Monolith fulfills certain conditions, the DOE intends to issue a final loan to help the company expand its Olive Creek facility (Figure 1) in Hallam, Nebraska, and boost its production capacity to 194,000 metric tons per year. Engineering, construction, and procurement (EPC) giant Kiewit is slated to spearhead construction of the project.

DOE LPO Director Jigar Shah said last week the Monolith project represents “the first-ever commercial-scale project to deploy methane pyrolysis technology, which converts natural gas into carbon black and hydrogen—two products that are frequently used in difficult to decarbonize industrial sectors like tire and ammonia fertilizer production.” The Monolith project “can potentially catalyze a new and cleaner way of producing materials that go into a lot of our everyday products,” he said.

Shah also notably hailed the announcement as a “re-emergence” of LPO as “DOE’s lending authority that can accelerate the development and deployment of clean energy technologies.” While the DOE already has “dozens of active applications under review,” the recently enacted $1 trillion Bipartisan Infrastructure Law expanded LPO’s loan authority and broadened the pool of eligible borrowers for the program, he said, suggesting more announcements should be expected next year.

A Pioneering Methane Pyrolysis Process

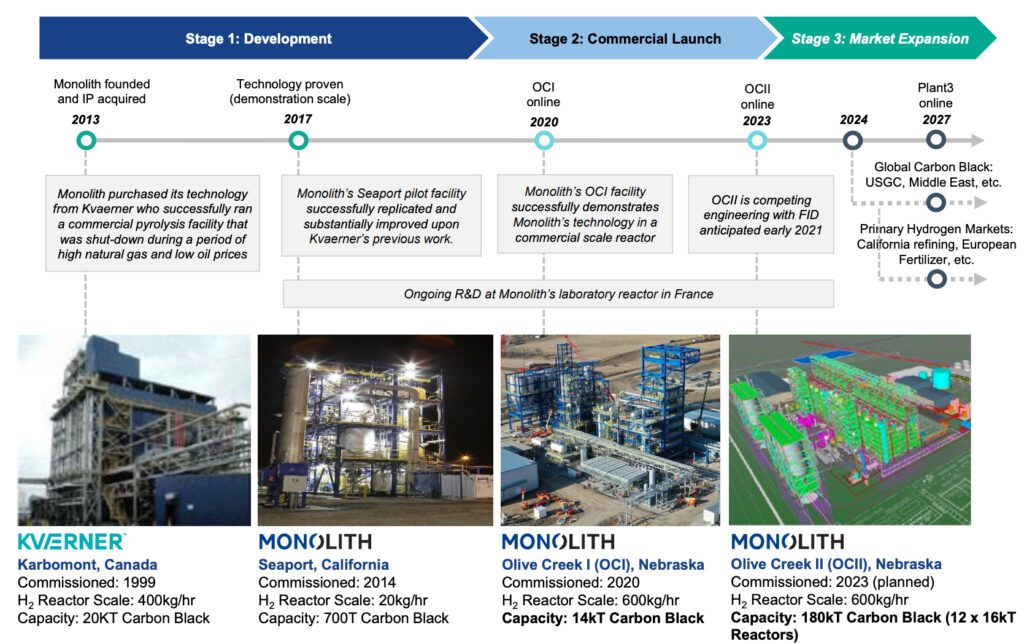

Monolith’s methane pyrolysis process has been much-watched by entities across the world since the company kicked off its efforts in 2013 to scale up a technology it purchased from Norwegian company Kværner (now Aker Solutions). Kværner deployed the first and only commercial-scale methane pyrolysis facility using hot plasma in 1997. Kværner’s facility, however, was decommissioned in 2003 owing to insufficient quality of carbon black product.

Monolith has in recent years gained the capital backing of Japanese technology giant Mitsubishi Heavy Industries (MHI), Azimuth Capital Management, Cornell Capital, Imperative Ventures, Warburg Pincus, Perry Creek Capital, SK Inc., and utility giant NextEra Energy Resources. MHI, which invested in the company to diversify its hydrogen value chain, told POWER that Monolith’s process solves a “century-old” problem of scaling methane pyrolysis to a commercial level.

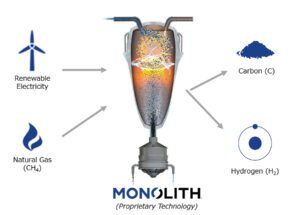

Monolith’s methane pyrolysis process essentially uses natural gas as feedstock, but unlike blue hydrogen, which involves its combustion, Monolith uses thermal plasma (hot plasma) to heat natural gas’s methane molecules in the absence of oxygen using renewable power (acquired through renewable energy certificates). The process uses relatively high temperatures (of more than 800C) to crack the CH4 molecules to cleanly separate them into hydrogen and carbon (Figure 2).

“Per unit of hydrogen produced, methane pyrolysis uses three to five times less electricity than electrolysis; however, it requires more natural gas than steam methane reforming,” the International Energy Agency (IEA) noted in its October-released Global Hydrogen Review 2021. “The overall energy conversion efficiency of methane and electricity combined into hydrogen is 40–45%.”

Monolith has refined its technology since 2017, when it was proven at a demonstration-scale at Monolith’s Seaport pilot facility in California. In 2020, the company began operations of Olive Creek 1 (OC1), its first commercial-scale emissions-free production facility designed to produce approximately 14,000 metric tons of carbon black annually along with clean hydrogen. The company in 2020 also announced its plans to produce emissions-free ammonia at a second phase production facility known as Olive Creek 2 (OC2) in Hallam, Nebraska. Documents suggest OC2 should be online in 2024 to produce 180,000 metric tons of carbon black. A third plant may also be under development (Figure 3).

“Our expansion in Nebraska will include a clean ammonia production facility, which will produce approximately 275,000 tons of ammonia annually. This helps fill a 1.75 million-ton deficit in the U.S. Corn Belt, a significant player in feeding a growing world population. From there, applications are endless, including transportation fuel, industrial and steel manufacturing applications,” Monolith said.

Interest in Turquoise Hydrogen Is Growing

While Monolith’s process is noteworthy for its regional applications and end-uses for carbon black, hydrogen, and ammonia, several other facilities are also spearheading methane pyrolysis around the world. Australia-based Hazer Group is, for example, planning to convert biogas into hydrogen and graphite at a demonstration plant for its catalytic-assisted fluidized bed reactor technology. In May 2021, German chemical firm BASF and power company RWE announced they would develop a project to convert 7,500 GWh produced by a proposed 2-GW offshore wind farm for methane pyrolysis, electrical cracking for petrochemical production, and power-to-heat at BASF sites in Germany. Russia’s Gazprom is also reportedly developing a cold plasma–based process for methane pyrolysis.

U.S-based startup C-Zero, a company backed by Bill Gates’ clean-energy fund, in July 2021 meanwhile announced plans to launch a pilot project by the end of 2022. C-Zero says it is developing a “drop-in” system that can be placed between the existing natural gas infrastructure and industrial natural gas consumers.

Asked about the economics of “turquoise hydrogen,” Dr. Fadl Saadi, director of Business Development and Operations at C-Zero, in a July 2021 live stream at the Atlantic Council said methane pyrolysis may not be as competitive with steam methane reforming, but it’s “very competitive compared to steam reforming plus carbon capture and sequestration (CCS).” Compared to green hydrogen, methane pyrolysis is “especially interesting” because, from a thermodynamic perspective, it needs seven-and-a-half times less energy to split methane into carbon and hydrogen. “That 7.5-times differential for energy requirements is absolutely massive in an energy and commodity space, especially when we’re talking about producing significant amounts of hydrogen globally,” he said.

Scaling up, however, will require a more nuanced balance, Saadi suggested. “We think finding a way to make sure that as we scale up this technology, maintaining that energy differential benefit will be critical for methane pyrolysis,” he added. “We think if you ended up needing just as much energy as electrolysis but now you also have to buy the natural gas and worry about the upstream emissions, and then you have a solid carbon they need to dispose of, that this technology no longer becomes economically competitive.”

The DOE’s Re-emergence as a Clean Energy Financier

If finalized, the conditional loan guarantee offered to Monolith will be the DOE’s thirtieth under Title XVII of the Energy Policy Act of 2005. Title XVII has generally supported projects under two separate loan guarantee authorities. The 2005 law authorized $23.9 billion for Section 1703 to boost “innovative” clean energy technologies, including nuclear, coal, and renewables—but the program ultimately secured only one project commitment: $12 billion to shareholders to support the Vogtle nuclear expansion in Georgia. Section 1705 was created by the American Recovery and Reinvestment Act of 2009 to support the rapid deployment of renewable energy, transmission, and biofuel projects, but it expired in September 2011 after committing funds to 28 projects.

POWER’s analysis shows more than $14 billion of financial support was provided under Section 1705. The limited utilization of Section 1703 is mainly attributed to its requirements that projects employ new/significantly improved technologies, and that borrowers—due to limited appropriations—pay either a portion or the entire subsidy cost.

However, the DOE last week suggested that LPO has made “substantial changes to improve the program that has now attracted more than 66 loan and loan guarantee applications, valued at more than $53 billion in clean energy and advanced vehicle technology projects.” The Bipartisan Infrastructure Law also expanded the LPO’s authority, it said.

Changes include updates to processes, work to solicit new projects, and due diligence on potential loans in support of the DOE’s work to deploy clean energy, said Shah. “LPO’s rigorous due diligence has resulted in a portfolio loss ratio of just 3.3% to date, to accelerate the advancement of American innovation, a mixture of successful projects and losses is expected,” he noted.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).