CHP Update: Policies, Partnerships, and Challenges

Though combined heat and power (CHP) is getting increasing attention as a means of efficiency and reducing carbon emissions, the sector’s traditional challenges remain. But some generators and policymakers are working hard to deploy CHP in new and more economic ways.

Combined heat and power (CHP) is hot again—in more ways than one.

After a surge in capacity during the 1980s, kick-started by the 1978 federal Public Utility Regulatory Policies Act (PURPA) that was designed to combat high oil prices, CHP has since lagged in the U.S., especially after PURPA’s incentive structure was changed in 2005 (see “CHP: A Rocky Path for a Promising Approach” in the February 2015 issue).

But CHP is seeing new interest, driven by a combination of stubbornly low natural gas prices and new policy support driven by environmental and reliability concerns. Both government agencies like the Environmental Protection Agency (EPA) and industry groups like the Electric Power Research Institute (EPRI) have recognized that CHP offers a way for traditional generation technologies to boost efficiency and remain part of the power mix as renewables continue to increase their share.

Rethinking CHP

CHP has long been popular in Europe, where district heating is more common, and among self-generating industrial customers around the world. For industrial CHP, the availability of low-cost “opportunity fuels” is often an added advantage. For example, among several new industrial CHP plants is a project in Turkey built by Outotec for Modern Karton, a major European manufacturer of packaging paper and corrugated cardboard materials from waste paper. The incinerator designed by Outotec uses byproducts such as paper rejects, biological sludge, and paper sludge from Modern Karton. The CHP plant produces electricity for the network and steam that is used in the paper production process.

But in the U.S., largely thanks to PURPA and other problems in the past, utilities remain wary of CHP they don’t control. That’s led think tanks like ICF International to look at ways to bring those utilities in from the figurative cold.

Anne Hampson, a project manager with ICF, who coauthored a 2014 report, “From Threat to Asset: How Combined Heat and Power (CHP) Can Benefit Utilities,” spoke to POWER in December about ways utilities can make CHP work, at least in areas where they’re allowed to own generation.

“Traditionally, you would put power plants out in the middle of nowhere so that people don’t have to see them, but when you do that, you are limiting yourself geographically because you are not located near people who can use the thermal energy,” Hampson said. “And the further away you are, the less likely you are going to have ways to deliver steam to potential customers.”

Hampson pointed to Great River Energy’s Spiritwood Station in North Dakota (a 2015 POWER Top Plant) as an example of strategic colocation. The plant was built to serve adjacent industrial thermal loads as well as supply power to the grid. Doing so enables this coal-fired plant to meet EPA emissions guidelines under the Clean Power Plan because of its high efficiency. Great River also took advantage of a similar arrangement at its Coal Creek plant, partnering with an adjacent ethanol plant to supply process steam. Hampson pointed to district heating systems as another potential use for CHP steam output (see the sidebar “Steel City Steam”).

“Co-siting can be really beneficial,” she said, “if you look at where your existing industrial customers who need steam already are. If they’re having to produce it in a boiler, but they could get it from a power plant, that’s a perfect means to do so. More recently, we’ve seen a lot of focus on how that kind of siting for power plants can take advantage of it.”

The customers get less-expensive steam and lower capital outlays, while the plant owner can substantially boost efficiency and thus reduce average emissions per megawatt.

And there’s a lot of opportunity out there.

According to the ICF report, there’s about 130 GW of technical CHP potential in the U.S. where existing onsite electric loads can be served at facilities conducive to CHP. Another 110 GW of potential exists in sizing CHP systems for industrial thermal loads, leading to exports of electricity to the surrounding grid.

CPP = CHP

Pressure to deploy more CHP is coming, in part because of that route to substantial efficiency gains. The biggest driver—assuming it survives judicial review—will be the EPA’s Clean Power Plan (CPP).

“Whether your state follows a mass-based or rate-based approach to compliance under the CPP, CHP would be able to contribute,” Hampson said. Under a rate-based approach, a CHP plant’s lower emissions per megawatt compared to conventional generation could enable the plant owner to generate emissions rate credits that it could sell to higher-emitting sources. “That could provide another revenue stream to the CHP plant,” she said. “Under a mass-based approach, it would have a very similar type of thing, except instead of selling credits, it would most likely sell into something like an allowance market.”

Though the CPP is often thought to offer a substantial boost to gas-fired power, a study from EPRI released in October 2015 suggests that CHP could provide a way for advanced coal-fired plants to meet EPA emissions limits without carbon capture, again because of the efficiency gains that would result. (See “CHP and Other Technologies Could Breathe New Life into U.S. Coal-Fired Power Plants” in this issue for details.) The caveat, however, is that a 750-MW advanced ultrasupercritical plant would require at least a 150-MW thermal load to achieve 12.5% extraction, and the number of potential customers who need that much steam is limited. The study suggests that smaller coal-fired CHP plants—similar to Spiritwood Station—are more likely to be viable under the CPP.

Another report, which ICF helped prepare for the Pew Charitable Trusts, “Industrial Efficiency in the Changing Utility Landscape,” looked at potential growth in the CHP market through 2030. Though CHP in general is poised to expand, growing 12.4 GW by 2030, the combination of the CPP and some improved tax treatment of CHP could result in 30% more capacity: 16.1 GW by 2030. The biggest gains in absolute terms would accrue in California and Texas, both states with substantial industrial bases that are potential customers for CHP output.

State-Level Support

California and Texas also illustrate the possibilities for state-level policy support to affect CHP adoption. Both states have substantial unexploited CHP potential. Another report, by the Brattle Group, estimates the potential in Texas at around 11 GW, and up to 20 GW by 2032 as a result of continued growth in the petrochemicals industry. Texas took a big step in that direction recently by making it easier for CHP plants to sell electricity to adjacent customers without being considered utilities.

California, meanwhile, has a state policy to add at least 4 GW of new CHP capacity by 2020. That’s been a bit controversial because, while CHP is more efficient than conventional generation, it’s still typically powered by natural gas, which means greenhouse gas (GHG) emissions. With the state also under a mandate to reduce those emissions, environmentalists have pushed to cut support for gas-fired CHP. Renewable CHP, meanwhile, is getting some attention (see the sidebar “Bakersfield Biomass”).

|

Bakersfield Biomass California is often thought of as an oasis of environmentalism and renewable energy. Although both are deeply embedded in the Golden State, California also has a robust oil and gas sector, most of it concentrated in the inland areas of the southern half of the state. Kern County and its county seat, the city of Bakersfield, have long been the capital of California’s oil business. Making that sector more environmentally friendly has long been a goal of state regulators and environmental groups. One such project, the 44-MW Mt. Poso Cogeneration Plant—shown in the header photo—came to fruition a few years ago. The Mt. Poso plant has been around for decades, but until recently, it ran on a combination of coal, petroleum coke, and shredded tires—not the most eco-friendly mix. Plant owner MacPherson Energy Corp. uses steam from the plant for operations in its adjacent oil field, while water from the oil field is used for produced steam and plant cooling. Emissions from Mt. Poso put the plant in the sights of state regulators, who slated it for closure in the 2000s. MacPherson Energy opted instead to convert the plant to burn biomass. It formed a partnership with DTE Energy Services to undertake the conversion, which began in November 2010. Limited operations began the following year, and the project was declared complete in February 2012. While plant capacity was reduced from 55 MW to 44 MW, the emissions profile was substantially improved. MacPherson and DTE are equal owners in the new plant, which burns biomass from urban and agricultural wood waste (construction, tree trimmings, and agricultural sources). The $34 million project not only preserved 30 existing jobs in an economically challenged area, but it also created eight new ones at the site and spurred growth for several area companies supplying biomass fuel. The project was also a win for Pacific Gas & Electric (PG&E), which signed a 20-year power purchase agreement for the plant’s electricity. Conversion to biomass qualified the plant as a renewable power generator, helping PG&E meet its obligations under California’s ambitious renewable portfolio standard. |

But CHP-heavy states like California and Texas are not the only places where the technology has a growing future.

New York has promoted CHP for years, in part because of its ability to promote grid resiliency, and the state gets 57% of its total distributed generation (DG) from CHP. The state’s Reforming the Energy Vision (REV) strategy, spearheaded by Governor Andrew Cuomo, is expected to provide an even greater boost to CHP. The plan seeks a 40% reduction in state greenhouse gas emissions, 50% renewable generation, and a 23% decrease in building energy consumption—all goals that CHP can help meet.

As part of REV, the state announced in September that it is aiming to increase the number of CHP projects in New York by 10% through $258 million in public and private funding of 53 separate projects (totaling about 200 MW) that are already in development. The New York State Energy and Research Development Authority is providing $41 million of the total, with the balance coming from private investors. In part because of experiences during Superstorm Sandy, when CHP helped numerous institutions keep the lights on (for one example, see the story on the New York University [NYU]Cogeneration Plant, a POWER Top Plant, in the September 2014 issue), many of these projects are part of microgrids, including a $37 million, 15-MW system at Columbia University.

Other states are also making concerted drives to boost CHP.

Minnesota in 2013 began an initiative designed to study how CHP could help meet the state’s renewable portfolio, energy conservation, and GHG reduction goals. The process, funded by a U.S. Department of Energy grant and conducted through stakeholder meetings in 2013 and 2014, produced a detailed CHP Action Plan that was released in October 2015. It builds on previous studies that showed, among other things, that the state could easily double its CHP capacity and had technical potential of four times the current 961 MW. Other findings during the process were that most stakeholders felt current rates and utility business models were not favorable for CHP in Minnesota and that existing incentive programs were not sufficient.

In the action plan, the state lays out an ambitious, multifaceted plan to help advance CHP, including policy and rate reform, identifying the best CHP opportunities, and public outreach and education. One concern is how CHP fits into the state’s existing Conservation Improvement Program, and the plan seeks to clarify and revise evaluation criteria to ensure worthwhile CHP projects are eligible. The process of identifying potential projects will start with existing public facilities that could employ CHP, such as universities and wastewater treatment plants, and develop plans for CHP implementation. The plan also makes an aggressive commitment to seeking out and exploiting existing CHP support mechanisms and incentives. Policy and rate reform, naturally, will take longer, but the plan begins a process to formulate a specific list of changes that could be implemented.

New CHP Tech

Microgrids powered by CHP are drawing increasing attention because of their extra resiliency. Typically, though, these have been large, megawatt-scale systems such as the NYU and Columbia projects. Now, advances in software and data processing are enabling owners of smaller CHP systems to aggregate them into a single, flexible, dispatchable resource. While not necessarily a true microgrid, these systems have many of the same properties.

Redwood City, Calif.–based firm Autogrid has begun marketing what it calls Software-Defined Power Plants, aggregated DG that functions as a single system on the grid using its Predictive Controls software. This approach allows large customers to reduce their demand charges, to participate in utility demand response programs, or trade directly in electricity markets in ways that may not be available or feasible for small systems operating separately. The first such virtual plant was rolled out in November in the Netherlands and Belgium in partnership with Eneco Group, and involves 100 MW of resources, including several customer-sited CHP systems. Autogrid has also partnered with Italian firm Electro Power Systems (EPS) to integrate its hydrogen-based energy storage system.

EPS’s technology deserves special mention because, in addition to storing energy as hydrogen via electrolysis, the units can then release the hydrogen for use as fuel for CHP. While still new, the technology holds the promise of integrating storage and renewable CHP into a single system.

Smaller turbines and microturbines have been used for CHP for many years, but these typically require pairing with a separate heat-recovery system. Portsmouth, N.H.–based FlexEnergy, however, is introducing a CHP system that combines a 330-kW microturbine with an integrated onboard hot water heat exchanger. According to Doug Demaret, FlexEnergy’s vice president of sales and marketing, combining the turbine and heat exchanger in a single self-contained module allows for higher efficiency because less heat is lost outside the unit, especially when it is situated outdoors. Demaret said the units will be able to achieve up to 92% efficiency.

For those looking for completely self-contained CHP, German firm Entrade announced in December that it would begin offering a containerized system that can take raw biomass and waste materials, turn them into syngas in an onboard reformer, and use that to generate power, heat, and cooling (Figure 2). Though relatively small compared to other options discussed in this article—the E3 system generates up to 25 kW of electricity, 60 kW of thermal energy, and 30 kW of cooling—Entrade says the system is completely turnkey and can be installed and commissioned in a single day.

|

|

2. Pocket tri-gen. This containerized solution combines biogas generation, power, and waste heat recovery into a single modular system. Courtesy: Entrade |

An even more unusual CHP system is being marketed by Israeli firm AORA Solar. The Tulip is a modular hybrid concentrating solar power–microturbine system that is able to generate both electricity and hot air. The Tulip’s solar tower, instead of generating steam, heats air to drive the microturbine, which can also run on a variety of fuels, including biogas (Figure 3). Each module can generate up to 100 kW of electricity and 170 kW of heat. Two Tulip systems are currently in operation, one in Israel and the other in Spain. Another is under development in Ethiopia.

|

|

3. Flower power. The Tulip is a hybrid CHP system that combines concentrating solar power with a microturbine to produce electricity and heat around the clock. Courtesy: AORA Solar |

Engines Power Up

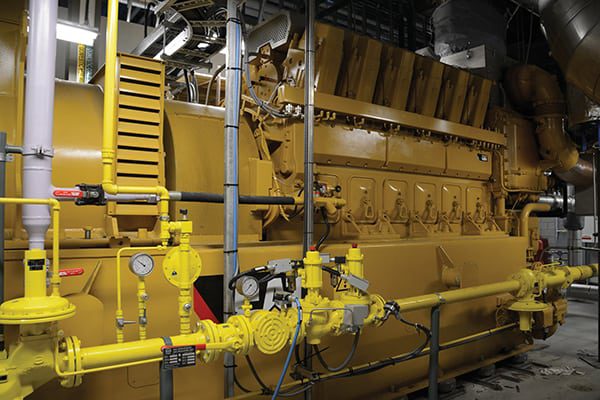

Existing technologies are also being reoriented more and more toward CHP, in particular reciprocating engines, which are seeing increased use as natural gas prices remain low and diesel and fuel oil fall out of favor for environmental reasons. Patrick Barrett, an account manager for Caterpillar, who has worked extensively on CHP deployments, told POWER that his company is seeing substantial growth for reciprocating engine–based CHP in the commercial and institutional fields because the abundance of shale gas has resulted in lower costs and less pricing volatility in the marketplace (Figure 4).

|

|

4. Full steam ahead. This Cat CG260-12 gas-fired generator set was installed at Markham District Energy’s Birchmount Energy Centre in Markham, Ontario. It supplies both power to the local grid and steam for the district heating system. Courtesy: Caterpillar |

“The biggest driver for us is spark spread,” he said, referring to the margin between gas costs and electricity prices. “There is a pretty favorable spark spread in the Northeast, and while universities are always looking to be green and efficient, they are also looking to reduce their operating costs, which makes CHP a win-win for them all around. We are seeing a lot of university and hospital CHP projects right now, and again, it is an economic driver.”

Barrett said that while incentives are nice, the economics of CHP in many cases are such that incentive money is just a bonus. “Financially, the project makes sense even without it.”

Siemens’ Dresser-Rand unit recently installed a CHP-powered microgrid at a Northeastern university, Wesleyan in Connecticut. The campus lost power for nearly a week after a nasty 2011 storm, and in the aftermath, the university opted to upgrade its existing cogeneration system to better prepare for future outages. Powered by a 676-kW Guascor SFGLD 360 gas engine, the new system can supply about 90% of the campus’s electrical load in island mode if necessary. The project was supported by a state program designed to strength the grid through deployment of advanced microgrids.

GE is also pushing its reciprocating engines on the CHP market, having delivered its eighth J920 Flextra gas engine to a 10-MW CHP plant (shown on the cover of this issue) owned by CHP firm HanseWerk in northern Germany in November. The plant will provide grid support while supplying the local district heating system.

Reliability and Efficiency

Cogeneration has come a long way from the days of simple diesel engines and boilers. Between the environmental benefits of greater efficiency and the reliability provided by CHP and advanced microgrid technology, the sector’s future appears bright.

“What we’re concentrating on is reliability,” Connecticut Gov. Dannel Malloy said at the inauguration of the Wesleyan microgrid, “the ability to recover, to keep our citizens warm, to keep their phones charged, the ability to have a hot meal. So if we can build this system out around the entire state, we’re going to be able to respond better to those kinds of emergencies.” ■

—Thomas W. Overton, JD is a POWER associate editor.