China Wrestles with Power Shortages

China has gone through three periods of nationwide power shortages since 1978. The previous two shortages were mostly caused by the lack of installed generation capacity. However, the third—which has severely restricted economic development—is a consequence of institutional problems that must be corrected.

China’s Reform and Opening Up policy, introduced in 1978, allowed for private power generation businesses and foreign investment for the first time. China’s economy responded, posting sustained economic growth exceeding 10% for the past three decades, which increased China’s gross domestic product 15-fold. Today, China’s economic growth leads the global community.

China’s white-hot economy requires ever-increasing amounts of reliable electricity. (See “China: A World Powerhouse,” July 2010, for an overview of China’s demand growth and power generating resources.) The central government’s focus for the past decade has been on building new plants of all technologies and improving the power distribution infrastructure. In response, China’s installed power generation has nearly doubled over the past five years, aided by significant private investment (see “China’s 12th Five-Year Plan Pushes Power Industry in New Directions,” January 2012). Additional power sector reforms have been proposed that will encourage continuing private investment (see “China’s Power Generators Face Many Business Barriers,” October 2012).

Since 1978, China has experienced three periods of nationwide power shortages that have severely restricted its economic and social development. Lagging development of generating capacity was the cause of two very disruptive nationwide shortages experienced during 1978–1996 and 2003–2006. Following large-scale investment in new generating capacity, China experienced a period of inefficient overcapacity with many redundant plants. Unfortunately, the oversupply period was short-lived, as nationwide power shortages resumed in 2008 and continue today, although this time for institutional reasons. In China, the first two power shortages are called “hard shortages”; the current shortage is known as a “soft shortage.”

First Power Shortage: 1978–1996

Before 1996, China suffered from nationwide power shortages and interruptions for nearly 20 years. During this period, many industrial facilities were able to maintain normal production only two or three days a week because of power interruptions. Across China, lack of an adequate and reliable power supply seriously suppressed economic and social development. The principal cause was China’s slow and difficult transition from a centrally planned economy to a more market-oriented economy, although government-planning authorities still strictly controlled investment in generating capacity. The lack of an efficient power market and private investment were important reasons why generating capacity was unable to keep up with rapidly rising power demand.

The Chinese government responded to the crisis by allowing local investors to invest in generating capacity. The government imposed a tariff of 0.02 yuan (0.32¢)/kWh on industrial end users to compensate investors.

The tariff approach was very successful in encouraging local investment in power generation resources. This approach eased the strain on the government’s financial resources and also opened further investment opportunities in the power industry, which laid the foundation for power market reforms that would come later. In 1995, the total installed generating capacity was 3.8 times and generated energy was 3.9 times that in 1978. The power shortage problem lasting 18 years was solved.

Second Power Shortage: 2003–2006

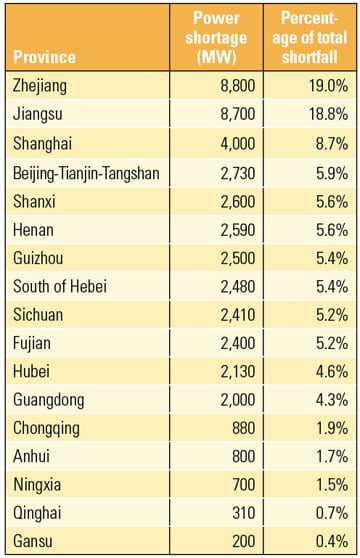

Nationwide power shortages reappeared from 2003 through 2006. During the worst times, 26 of China’s 34 provinces were plagued by the shortfalls. Economically developed provinces in coastal areas, such as Zhejiang, Jiangsu, and Shanghai, suffered the most serious power shortages (Table 1).

|

| Table 1. Power shortage across China in 2004. Source: State Electricity Regulatory Commission (www.serc.gov.cn) and China Electricity Council (www.cec.org.cn) |

Power supply and demand remained in balance during the decade following the first power shortage. However, that balance ended with the onset of the Asian financial crisis in 1997. Power demand declined sharply, resulting in a large excess of generation capacity, which appeared as a large reduction in power plant utilization. In fact, the Chinese government banned the building of new power plants during the period 1997 to 1999 based on its pessimistic forecast of future power demand. New plant construction stagnated.

Unexpectedly, the economy recovered very quickly. Power demand by heavy industry and many other high-energy-consuming industries quickly rebounded and by 2003 exceeded power demand predictions prior to the Asian financial crisis. The result was immediate: Power reserve margins were quickly consumed and nationwide power shortages returned across China.

The Chinese government responded by allowing local governments to make power generation investment decisions without central government approval. Simultaneously, the central government began a market-oriented restructuring of state-owned power generation assets during which “unbundling” of generation assets took place.

The former State Power Corp. was separated into five separate major power generation corporations and two power grid corporations as part of the central government’s market competition mechanism. The more nimble power generation corporations worked closely with local governments to focus investment in new generation. The result of this more market-oriented approach was resumed investment and construction of new plants capable of tracking the country’s rising power demand. From 2003 to 2006, over 237,500 MW was added to the Chinese grid. The problems that had caused this power shortage were solved, again (Figure 1).

|

| 1. Growth in installed generation capacity, 2002–2007. Source: National Energy Administration (www.nea.gov.cn) and China Electricity Council |

Third Power Shortage: Since 2008

The period when supply met demand was short. By the end of 2008, a new type of nationwide power shortage hit portions of China, becoming severe by 2011 in at least 12 provinces that were each short by 2,000 MW or more. Zhejiang Province experienced the worst shortfall in supply at 8,800 MW, or 19% of demand (Table 2).

|

| Table 2. Installed capacity and power shortages in selected provinces/regions in 2011. Source: State Electricity Regulatory Commission and China Electricity Council |

The market-oriented restructuring of China’s power industry begun a decade ago was very successful in attracting needed private investment, which helped finance China’s power infrastructure growth. Currently, China has excess capacity available to meet current demand. According to China Electricity Council statistics, the average utilization hours for thermal power plants in 2007 was 5,344 hours, but in 2008 it fell to 4,885 hours, a decrease of 459 hours. In contrast, the average utilization hours for hydropower increased by 89 hours during the same period. There is plenty of power capacity available in China, particularly thermal power plant capacity.

Regulation of China’s coal market was further relaxed in 2005. Global coal prices have since risen sharply with the increased domestic demand for coal, as has the global price of crude oil. However, power generators continue to be required to supply power to the grid corporations at a fixed “benchmark price,” a price determined by the central government.

More than 80% of the electricity produced in China is by thermal power stations, so the result was inevitable. The cost to produce electricity at market fuel prices soon exceeded the government’s benchmark price, and power generators are prohibited from passing increased fuel costs to the grid corporations or consumers, so generating electricity became an unprofitable business. Many generators elected to idle units or reduce operating hours to cut their economic losses. The third power nationwide power shortage was sudden, and continues today (Figure 2).

|

| 2. Utilization of generating equipment decreases. Note the large decrease in utilization since 2004. Because 80% of generation in China is by thermal power stations, the average utilization of all power generation sources will generally mirror the thermal power utilization curve. Source: China Electricity Council and State Electricity Regulatory Commission |

Similarities and Differences

Since 1978, China has experienced three separate periods of nationwide power shortages. Each period has two common factors: Each was caused by a shortage of generation (although for different reasons) and each illustrates that government regulation is less efficient than open market mechanisms when balancing power supply and demand with the cost to generate power.

What has changed are the regions where the power shortages occur. Traditionally, power shortages were prone to occur in the southern and eastern parts of China, which are more highly industrialized and have greater power demand. Recently, the impacted provinces are in the central regions, such as Hunan, Jiangxi, and Henan Provinces as well as Fujian, Anhui, and Guangxi Provinces, which did not experience power shortages in the past.

Solving power supply problems in these regions in the short term will be much more difficult than in previous shortage periods. The central provinces have less local natural resources (from fossil fuels to wind and hydroelectric) and limited power grid interconnection with other regions.

China’s power market is more open than at any time in history, but an open power market also allows power demand to set the market price of electricity. The permanent long-term solution may require substantial rate increases to reflect the actual cost of service based on the global price of fuel—a solution that is economically and politically difficult.

— Yu Shunkun, Zhou Lisha ([email protected]) and Li Chen are with North China Electric Power University, Beijing, China.