Busting Myths

The popular television show Mythbusters uses pseudo-scientific means to examine and often expose as fiction familiar urban myths. After made-for-television lab tests, the myth is then classified as either a fabrication (“busted”), entirely possible (“confirmed”), or somewhere in between (“plausible”).

Since 2003, Jamie Hyneman and Adam Savage have tackled more than 700 popular urban myths on the Discovery Channel’s Mythbusters. Although the duo’s “scientific” testing methods are lacking in many ways, the show has its moments. At times the results are predictable (Is it possible to catch a bullet in your teeth? Busted), actually helpful (Is it dangerous to use a phone in a thunderstorm? Confirmed), or quite useless (Is there a way to beat police speed cameras? Plausible—but you have to drive over 200 mph to beat the camera). This is Hollywood, not Lawrence Berkeley National Laboratory.

Exploring Industry Myths

There are also a number of oft-repeated myths associated with the electric power industry that deserve similar attention, although perhaps with more research and fewer experiments that require high explosives. As your self-appointed mythbuster, I’ve selected an often-cited but seldom-researched myth: Does fossil-fueled generation receive more government subsidies and incentives than renewables? I’ll challenge other myths in future columns.

What types of subsidies are received by the industry? From one perspective, President Obama asserting his support for a 50% increase in federal research spending for alternative energy sources and more investment in carbon capture and sequestration is tantamount to “subsidizing” those technologies. In essence, he is sending a signal to the energy markets of the government’s long-term support. Nuclear benefits from such subsidies as well. In fact, some maintain that the government assuming the risk associated with any nuclear plant accident, no matter how small the probability, is also a subsidy. Even the federal government’s desire for the power industry to move from coal to natural gas as a “bridge fuel” could be viewed as a subsidy of sorts to the natural gas industry. Others even believe the coal industry is subsidized by not penalizing coal-fired plants with a tax on carbon emissions.

Taken to the limit, any government action (or inaction) could be interpreted as manipulating electricity supply markets—even tax credits for electric vehicles. The discussion becomes hopelessly complicated when international policies are added to the puzzle (the U.S. complaint to the World Trade Organization over China’s wind and solar industry subsidies and Brazil’s opposition to U.S. ethanol policy come to mind). Assigning monetary values to these policy and trade issues is hopelessly complicated, and given that it is impossible, I’ll set those factors aside for this analysis.

Good Data Are Available

In April 2008, the Energy Information Administration (EIA) released a report, “Federal Financial Interventions and Subsidies in Energy Markets 2007,” in response to a request from Tennessee Senator Lamar Alexander (R). In his letter to the EIA, Alexander requested an analysis “focus[ed] particularly on subsidies directed to electricity production, including an estimate of electricity subsidies on a per unit basis” for “different fuel types.” The 274-page report, released in April 2008 and described by the EIA as “comprehensive,” includes the effect of all subsidies “through which a government or public body provides a financial benefit with a Federal budget impact.” The report is available on the EIA website.

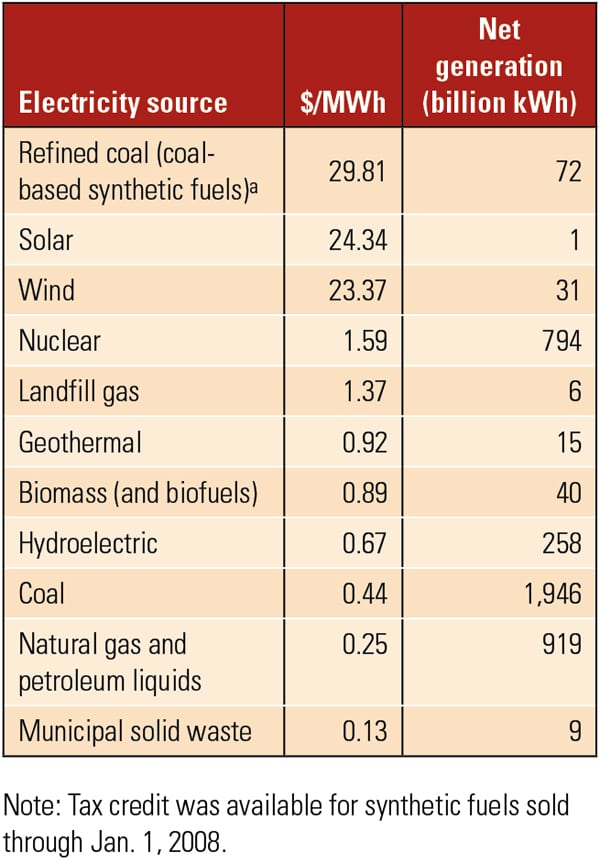

The EIA concluded that “per-unit measure of electricity production subsidies and support may provide a better indicator of its market impact than an absolute measure.” I agree that $/MWh is an appropriate comparative measure because it’s the same basis as is used for the renewable electricity production tax credit (PTC). The public can also relate because this metric is the same one we see when we pay our monthly electricity bills.

|

| Federal energy subsidies and incentives with a federal budget impact and in direct support of electricity production, 2007. The average consumer cost of electricity was $92/MWh in 2007. Source: EIA |

The EIA concluded at the time of the study (data through 2007) that subsidies for wind and solar far exceeded those for any fossil fuel except refined coal, which is defined as coal-based synthetic fuels. The synfuel tax credit or Alternative Fuels Production Tax Credit ended on Jan. 1, 2008 (see table).

The largest subsidy from the federal government is the PTC at $22/MWh (today), ignoring other federal and state financial and indirect incentives (such as a renewable portfolio standard). It’s also reasonable to conclude that federal legislation over the past two years has only increased subsidies for renewable energy resources over those considered by the EIA in 2008, not to mention the hundreds of state subsidy and incentive programs.

The duration and amount of renewal electricity subsidies is a public policy issue. In my opinion, the rationale for maintaining subsidies for technologies that proponents describe as mainstream are nearing an end. Regardless, the data are clear: Federal government subsidies for renewables far exceed those for fossil fuels. That myth is “busted.”

— Dr. Robert Peltier, PE is POWER’s editor-in-chief.