Australia's Carbon Policy Predicament

Australia and the U.S. have much in common in terms of energy resources, but Australia’s attempt to mirror the European Union’s climate policies has challenged its power sector.

On the energy front, Australia seemingly has it all. It is endowed with significant reserves of coal, natural gas, uranium, and thorium—as well as resources that excel by world standards for wind, solar, biomass, geothermal, wave, and tidal energy. (See the online version of this article for a sidebar, “Diverse Energy Resources,” on the country’s current and planned generation mix.) It has an adequate transmission and distribution infrastructure plus open markets. Furthermore, it is geographically well-positioned to engage with ravenous energy markets in the Asia Pacific region. In all respects, the country with a sparse population of 23 million should have a solid basis for continued high living standards and a booming economy.

But over the last six years, largely owing to policy or regulatory interventions, and aggravated by needed but costly infrastructure investments, the country’s power and natural gas prices have seen an extraordinary escalation of more than 100% in some states.

The effect has been swift and dramatic: High costs have throttled power demand, leaving a supply glut, and have forced energy-intensive or energy cost-exposed businesses to restructure or move production abroad. As many more citizens are pushed into energy poverty, the government is flailing in its attempts to underpin its environmental ambitions with day-to-day reliability, longer-term security, and affordable energy—all while retaining an efficient and competitive market.

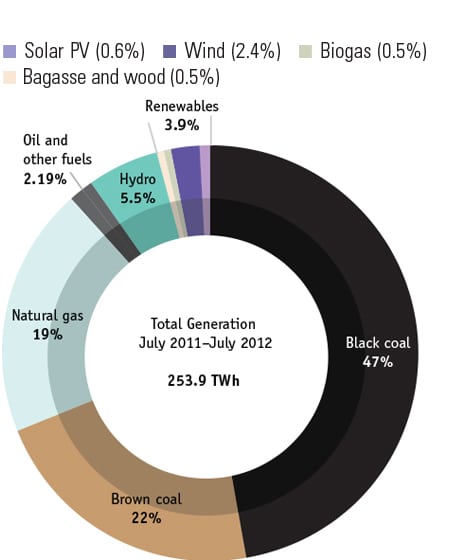

Diverse Energy ResourcesAustralia’s energy mix varies widely across its states and territories, largely reflecting where its major population centers are, its industry structure, geography, and the resource endowments of each region. Western Australia hosts a lucrative mining center as well as abundant natural gas resources, whereas New South Wales accounts for the largest share of total energy consumption and boasts a substantial proportion of electricity generation, transport, and manufacturing activity. Although the overall outlook for investment in new generation until at least 2020 remains subdued, the country has at least 163 projects in the investment pipeline with a combined disclosed value of A$58.5 billion and 43 GW of planned capacity. Coal, around 97% of which is sourced from abundant reserves along the eastern seaboard in New South Wales and Queensland, continues to dominate 69% the country’s total generation profile, which stood at about 254 TWh for the year spanning July 2011 to July 2012. But in 2013, only one 240-MW coal-fired project was commissioned while three new large-scale wind energy projects, a total 643 MW, were completed. Meanwhile, only 7% of planned projects are coal-fired; the majority—42% of total proposed new capacity—consist of new wind projects, followed by proposed gas-fired generation at 35%. About 83% of conventional natural gas production was sourced from three basins in western and central Australia in 2011–12, but production of coal seam gas has since surged, mostly in Queensland, to make up 12% of the nation’s total gas production. Beyond the renewable energy target, the surge in wind projects is expected, owing to Australia’s world-class wind resources along the southern coasts as well as to maturing technologies and falling costs over recent years, says the Bureau of Resources and Energy Economics. Large-scale solar has similar advantages. Australia has the highest average solar radiation per square meter of any continent. Renewables have also benefited from the country’s public funding prowess to boost research and technology development—even though they receive a sparse 7% of research and development funding (55% is dedicated to mining and energy extraction). |

The Carbon Policy Rollercoaster

Long-term security was Australia’s paramount priority after the energy crises of the 1970s and 1980s, when it sought to promote development by investing heavily in power infrastructure—and later, in large coal-fired power plants, which were built in Queensland, New South Wales, and Victoria to attract energy-intensive industries. While the era fostered growth for sectors like aluminum and copper refining, it came at a toll realized only decades later: The National Greenhouse Gas Inventory ballooned to 542.1 million metric tons of CO2 equivalent (Mt CO2-e) in September 2013 from 415.5 Mt CO2-e in the 1990 base year—a stretch that came primarily from the power sector, whose greenhouse gas (GHG) emissions swelled 40%.

In spite of declining coal-fired generation (Figure 1), Australia has led the list of the developed world’s largest carbon emitters since 2007, a year in which the nation suffered a crippling drought, water restrictions, and bush fires. Amid climate change panic fanned by the release that year of Al Gore’s An Inconvenient Truth, and the UK’s Stern review, Australia ratified the Kyoto Protocol, and Australia’s former Prime Minister John Howard (1998–2007) and then-leader of the conservative Liberal-National Coalition advocated a carbon emissions trading system (ETS) during his failed bid to win reelection.

Howard is now a self-proclaimed “climate agnostic,” who is skeptical about the climate science consensus and who says his dalliance with an ETS was purely political. But his last-minute ETS proposal sowed the seeds for future carbon reduction plans, including former Labour Party Prime Minister Kevin Rudd’s (2007–2010) three failed attempts to push the proposed “Carbon Pollution Reduction Scheme” through the House of Representatives and the Senate. The carbon tax issue lapsed until the democratic socialist Labour Party administration of Prime Minister Julia Gillard (2010–2013) announced its Clean Energy Future (CEF) plan in July 2011, a complex package of 18 bills that sailed through both houses by November (with amendments) and became law soon after, receiving Royal Assent on Nov. 18, 2011.

That law set the initial level of the carbon tax, which began on July 1, 2012, for about 370 major emitters at A$23 per metric ton (mt) of CO2-e; as designed, it soared to the world’s highest carbon price of A$24.15 in July 2013, and in July 2014, it will rise again to A$25.40. In July 2015, the tax is designed to transition to a flexible price or cap-and-trade scheme; permit prices will fluctuate with market conditions, and Australian firms can buy permits from the European Union.

Or not, because the September 2013 prime ministerial election of Liberal-National Coalition leader Tony Abbott, a Howard protégé, has thrown the country’s plans into limbo. In November, as the first order of the new parliament’s business, he introduced a package of 11 bills to scrap the “punitive” carbon levy and replace it with a so-called “Direct Action Plan” to curb Australia’s carbon emissions by 5%, based on 2000 emissions, by 2020.

The centerpiece of that plan, as described in the government’s Dec. 20–released Green Paper —which “acknowledges the science of climate change”—is the $2.5 billion Emissions Reduction Fund, a pool of capital to support “direct action” by industry to reduce emissions. While more details are forthcoming in a white paper due later this year, it essentially allows entities that reduce their emissions below a baseline to sell CO2 abatement to the government via a market mechanism in order to achieve the lowest cost per mt. It also envisions long-term contracts for abatement, overseen by the Clean Energy Regulator, to help entities to secure financing or undertake projects.

Industry observers note that the package of 11 repeal bills will easily pass the lower house, where the Liberal-National Coalition has a clear majority, but it could face a standoff in the Senate, which is dominantly held by the Labour, Greens, independents, and several smaller parties. Abbott has vowed to call a double dissolution of parliament if the Senate blocks the bills, but even if this occurs, the earliest that the law may be repealed is in September 2014. Irrespective of the date of repeal, CEF rules can only cease to apply on the first June 30 after repeal, industry experts say.

According to consulting firm Energetics, the proposed fund could “reward business for undertaking meaningful action to reduce emissions.” Significantly, if the carbon price is removed, power and gas prices could plunge by about 15%, it says.

Lower Consumption but Higher Prices

Since 2006, against the backdrop of Australia’s climate politics, electricity consumption that had climbed at an average rate of 6% for nearly 40 years before it suddenly slowed, plateaued, and then dropped, surprising even some market specialists, including the Australian Energy Market Operator (AEMO), which releases annual energy forecasts. Yet during the same period, average household power bills soared 85%. The reason lies in the structure and regulation of the electricity market. Generators and retailers both operate in competitive markets, which means if demand deflates, so do profit margins, which are pegged to wholesale power prices.

But grid operators, which are regulated monopolies, may actually increase prices to meet regulator-determined revenues they are allowed to collect over a five-year period, transferring the cost of falling consumption to grid users instead. “A bigger problem over the last decade is that some network businesses have spent too much on their network assets,” explains Australian think tank Grattan Institute. The independent Australian public policy organization suggests that regulatory incentives for grid companies have led to excessive investment.

The need for new assets isn’t unfounded, the entity admits. Upgrades have been warranted to address the risk of bush fires being ignited by faulty power lines, to help the rollout of smart meters, and to support the high penetration of rooftop solar systems. However, allowed returns for grid companies “have been higher than they should have been,” it says.

Also underlying the nation’s demand dilemma is a general long-term decline in energy intensity, which the government otherwise attributes to energy efficiency improvements, fuel switching, and structural changes, including the growth of less-energy-intensive sectors over manufacturing. The manufacturing sector’s share of economic output nosedived from 13% in 1990 to just 6% in 2013. This February, for example, aluminum giant Alcoa announced the closure of its Point Henry smelter, making it the second of Australia’s six smelters to be retired after the demise of Kurri Kurri in 2012 and dealing a blow to Australia’s status as one of the world’s biggest aluminum-producing countries.

The overall statistics are alarming: Electricity demand plunged nearly 5% across the National Electricity Market (NEM, see sidebar “A Disconnected Market” in the online version of this article) between 2009 and 2013, according to the AEMO.

Over the next decade, annual electricity demand has been forecast to spurt a paltry 1.3%. Yet, as recent heat waves in Victoria and South Australia showed, “peak demand has not been eroded in the same way as overall consumption,” notes the Energy Supply Association of Australia (ESAA), a coalition of 34 power and downstream gas companies. “Price signals arising from the current market appear unlikely to drive an efficient transition in the near term. Significant financial and commercial barriers to exit for existing generation plants are a likely factor in this regard,” it adds, echoing power firm EnergyAustralia’s recent submission to the government that suggests about 50% of all generators bore losses last year and that many are trying to “hang in there and reduce costs.” Instead, the government should consider the rationale for encouraging any new supply of any type, says the ESAA.

A Disconnected MarketAustralia’s three electricity markets are separated by geographical distance. Reforms in the early 1990s gave rise to the 1998-established National Electricity Market (NEM), which forms an interconnected system that supplies electricity to the eastern states of Queensland, New South Wales, the Australian Capital Territory, Victoria, and South Australia and Tasmania. Western Australia’s electricity isolated market consists of the South West Interconnected System, including Perth and the North West Interconnected System for the mining areas in the north of Western Australia. About 29 non-interconnected distribution systems also operate around towns in rural and remote areas across the states. A smaller market composed of three regulated systems operates in the Northern Territory. NEM operates as a wholesale spot market where electricity is traded through a pool managed by the Australian Energy Market Operator to meet demand at the lowest cost available. The Australian Energy Market Commission oversees sector regulations and the Australian Energy Regulator enforces them. Requirements for investments in electricity generation in these three markets is largely autonomous. |

Operating in a Fog of Policy Uncertainty

An unexpected benefit of the demand decline is that, as the Department of the Environment’s National Greenhouse Accounts shows, annual GHG emissions from the power sector in September 2013 fell 5.5% compared to a year before—though the power sector still accounted for 33% of the nation’s GHG emissions.

Industry group ESAA doesn’t dispute that the government has a key role to play in implementing climate change and energy policy. Its complaint is rooted in the impact of policy uncertainty posed by a potential repeal of the carbon tax. “Investment in generation capacity is not a pertinent issue at present given declining demand, but continued uncertainty over climate change policy could discourage investment in the future, or potentially exacerbate the current oversupply situation even further,” it says.

Researchers from Murdoch University in Perth, meanwhile, posit that even if the carbon tax is repealed in the short term, the generation sector still faces uncertainty. “The effect of the electoral cycles and more stringent global mitigation efforts mean that a carbon price may be reinstated in the future,” said Matt Shahnazari, whose research team has developed a decision framework for long-lived generation facilities caught up in the carbon tax limbo. Their scenario, to be published in the April 2014 issue of the journal Applied Energy, considers three options: whether a coal plant owner should spend money to convert the facility to a lower-emission combined cycle gas turbine plant (CCGT), abandon the plant, or do nothing.

“The findings show that although the current political uncertainty may delay investment in CCGT conversion, the expectation that carbon pricing will be reinstated reduces the amount of option premium to defer the decision,” Shahnazari told POWER. If stability cannot be achieved, policy makers should consider setting a higher carbon price, he offered. That would “improve the business case for converting to lower emission systems.”

Renewables Wary of Policy Pivots

Meanwhile, uncertainty about the future of the carbon policy has even more implications for Australia’s seemingly healthy renewables sector, because, as the Bureau of Resources and Energy Economics (BREE) notes, the carbon price has directly improved the competitiveness of renewable energy technologies.

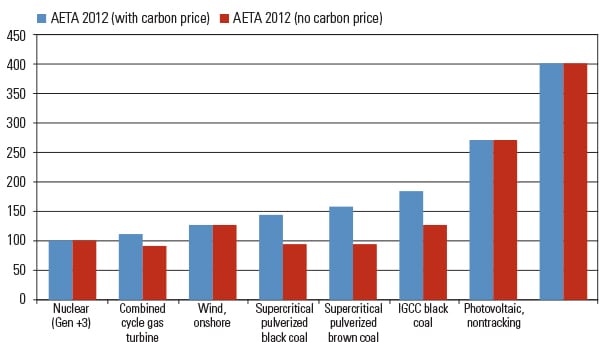

In 2012, the arm of the Department of Resources, Energy, and Tourism published its pivotal Australian Energy Technology Assessment (AETA), including carbon price considerations in assessments of the levelized cost of electricity (LCOE, or the price per megawatt-hour required to cover all costs incurred over the life of the plant) for various technologies, including nuclear. BREE concluded that with the carbon price, a number of renewable technologies already have costs that are comparable to natural gas–based technologies (Figure 2).

Though BREE admits that considerations such as dispatchability and intermittency are not factored into LCOE calculations, it projected that renewables could be more cost competitive with fossil fuels over the next four decades. That means, under current carbon price projections, by 2049–2050, the share of renewable energy sources in the generation mix could rise from 9% to a stunning 51%.

But in a preliminary December 2013 update to the document (more data is expected in 2014), BREE set the carbon price modifier to 0% as the base value, noting that the “outlook for fuel costs for gas, coal, and carbon was claimed to have materially shifted since the AETA 2012. Still, in the new assessment, wind-based generation is estimated to already have a lower LCOE than many new-build, comparable fossil-fueled generation technologies owing to an 18% reduction in onshore wind operation and management costs. And by 2050, even without a carbon price, the LCOE will vary substantially across technologies. For example, the LCOE estimate for photovoltaic (PV) non-tracking technologies in 2050 is A$73/MWh while for an integrated gasification black coal–fired power plant with carbon capture, it is A$247/MWh.

The Renewables Glut

Renewables have already gained a moderate share of the country’s generation portfolio owing to its renewable energy target (RET), which currently mandates that 20% of estimated generated power (in GWh) comes from accredited renewable sources by 2020.

Designed to increase the market share of renewables by funding the difference between the average wholesale price of electricity and the cost of producing renewable power, the program has two components—the large-scale renewable target (LRET) and the small-scale renewable scheme (SRES). The LRET requires electricity retailers to purchase a certain amount of large-scale generation certificates (whose market price is determined by market forces) from renewable sources. In 2014, the LRET stands in absolute terms at 16,950 GWh; in 2020 it will soar to 41,850 GWh.

The SRES incentivizes residents and businesses to install small-scale power sources such as solar water heaters, panels, or small-scale wind or hydro systems, but it also legally obliges energy retailers to purchase a government-set number of small-scale technology certificates (STCs) based on “displaced” megawatt-hours and surrender them on a quarterly basis.

The RET has “forced in,” as ESAA CEO Matthew Warren puts it, 1.8 GW of large-scale renewable generation into the electricity market, such as AGL Energy’s 420-MW Macarthur Wind Farm (a 2013 POWER Top Plant). Over 2011–2012, the nation’s hydro plants generated 14,083 GWh while non-hydro installations—wood bagasse, biogas, wind, and solar PV—generated another 9,945 GWh.

More than 3 GW of small-scale solar PV capacity had been installed at the end of 2013, mostly in Queensland, where households rushed to meet a July 2013 installation deadline to remain eligible for a state-set premium feed in tariff of $0.44/kWh. “If 2013 taught us anything, it’s that solar isn’t going anywhere,” says the ESAA in a recent solar PV assessment. “It’s here to stay and it will continue to grow even without significant subsidy.”

“But there’s a problem,” said Warren. The RET was passed in 2001 when it was assumed demand for energy would soar. “With demand falling, the RET target is now approaching 30% [because total generation has fallen but the RET is a fixed amount of generation]. This means we will have to build even more renewable power stations trying to sell electricity into an already over-supplied electricity market.”

Responding to these concerns—and citing compliance with the Renewable Energy Act of 2000, which requires periodic review of the operation, costs, and benefits of the law—the Abbott government on Feb. 17 launched a review of Australia’s 20% RET. To the chagrin of renewables proponents, Dick Warburton, a senior business figure and notable climate change skeptic, is to head the review. The review team will explore whether the RET is still “appropriate,” assess how it affects power prices, and identify risks or transition issues that could arise from policy changes to the RET. Findings will be reported to the prime minister mid-year in 2014.

The renewable sector is lobbying against a radical alteration of the RET, arguing that while it could make investors nervous, it will certainly push the country to rely more on increasingly expensive natural gas. And already one project, Origin Energy’s “ready to go” A$900 million Stockyard Hill wind project planned for western Victoria, has been halted as the company awaits the outcome of the government’s review.

Expensive Gas

But why would Australia, which has proven and probable reserves of coal seam gas and conventional gas of 140,000 petajoules (PJ)—enough to meet more than 70 years of gas demand at current rates of production—suffer a crippling increase in the price of natural gas? The simple answer from the Grattan Institute: “Sellers, attracted by higher prices, will move supply from the cheaper to the more expensive [international] markets until prices converge.” This “export parity price” is setting the benchmark of new gas contract negotiations in Australia.

Australia’s proclivity to export natural gas is rooted in its geography. Exports make sense for Western Australia, which produces the nation’s vast majority of natural gas—far from populated regions around Perth, about 1,500 kilometers to the south. “It has been and remains uneconomic to pipe any of this gas across the empty center of the country to reach population centers in the East,” explains Dr. Ronald Ripple, an energy business and finance professor at the University of Tulsa.

Ripple assessed the geopolitics of Australia’s gas development for a two-year study launched by Harvard University’s Kennedy School and Rice University’s Belfer Center. Eastern Australian gas markets have historically been relatively stable, but the recent exponential increase in the capacity to extract coal seam gas, its existing pipeline infrastructure, and small domestic demand have made exports more lucrative. For the first time this year, gas exports will occur from the Australian east coast, and that will mean demand will increase fourfold by 2017.

On the whole, Ripple notes that BREE forecasts project that the share of natural gas used to produce power will increase from 16% in 2009 to 36% in 2035, indicating a domestic consumption increase to 2,611 PJ by 2035. But during the same period, Australia’s total gas exports are expected to soar to 5,663 PJ, almost doubling domestic use. Today, Australia has 24.2 million tonnes per annum (mtpa) of liquefied natural gas (LNG) production capacity in operation—from three projects that accounted for 64.5% of global capacity under construction in January 2013—and seven new export-oriented LNG projects that could add 61.5 mtpa under construction. If those are completed as expected before 2017, the country’s LNG exports will surpass Qatar’s.

That means, over the next several years, wholesale domestic gas price increases of more than 80% nationally can be expected, suggests the Grattan Institute. And, it adds, it is possible that prices could rise sharply as exports commence on the East Coast and are expanded on the West Coast. “The future of gas-fired generation in Australia is highly uncertain,” it says.

Australian gas generators are already feeling the pinch. In February, Stanwell Corp., Queensland’s largest generator took the unprecedented step of mothballing its 385-MW Swanbank E. gas-fired station for up to three years, opting to sell gas directly to the Queensland market to earn more revenue. To compensate for lost power, the state-owned utility opted to return to service two 350-MW units at its 1,400-MW coal-fired Tarong power station, which had been shuttered in October and December 2012 when wholesale prices dropped.

Noting this, a number of domestic natural gas purchasing entities—including power companies—have taken issue with the Australian government’s spurning, unless as a “matter of last resort,” of market interventions such as a national domestic reservation policy.

The 11-member DomGasAlliance, Western Australia’s peak energy user group, continually points out that Australia is the only country in the world that allows natural gas to be exported without first considering domestic needs. “It is also the only gas exporting country to experience serious gas shortages and sharply rising prices,” the group says.

As other industry observers point out, Australia is also the only LNG-exporting country that has a national carbon abatement program.

The Coal Conundrum

Whereas the global market for natural gas has made domestic availability of that fuel problematic (see the online version of this article for details), supply issues aren’t as apparent for coal. In fact, coal is one of Australia’s largest and most reliable commodity exports that earned the country A$48 billion in 2011-12—and with which the country generates about 70% of its power. Australia accounts for around 6% of world coal production but 27% of world coal trade (18% of thermal coal exports), mostly to China, where imports from Australia have increased sevenfold over the past seven years. Over the medium term, coal production is likely to increase significantly as a result of investment in new mining and export capacity.

Even so, some observers note that rising global supplies—and particularly exports from the U.S., which have surged as domestic consumption shifts to natural gas—could hamper Australian coal exports, which have the world’s highest marginal costs. Last August, Australian thermal coal prices dipped to about $82/mt—below the $87/mt bottom line set by some analysts before profits and mining capital expenditures are threatened—forcing a freeze in new mining developments and greenfield projects until spot prices improved.

For generators, the issue is not so much fuel insecurity as it is the widespread surplus of capacity, the emissions constraints, and the so-called “merit order” effect, which ranks generation capacity by price that it is bid into the market and is exacerbated by increased renewables. Along with the mothballing of Stanwell’s two 350-MW Tarong units, last year saw the closure of the 600-MW Munmorah power station, Stanwell’s 125-MW Swanbank B power station and 240-MW Playford B, and the 520-MW Northern brown coal generators in South Australia.

Balancing Carbon and Costs

So what is Australia’s most promising short-term solution to lowering carbon emissions while keeping electricity affordable? It isn’t renewables or distributed generation for the Abbott administration.

Australia’s government blatantly acknowledges that “policies to encourage uptake of low-emissions energy technologies have potential to distort the market or impact on reliability at very high levels of penetration,” and it cautions that the transition “must have parameters that minimise costs and market distortions.” Notwithstanding the range of issues posed by a rapid expansion of distributed generation to grid operators, the scale-up of renewable energy generation also poses “scientific and engineering challenges” that could “require investment in skills, expertise, infrastructure, research and development,” it says.

Curiously, the government’s December 2013–released “Issues Paper,” drafted to prepare for its energy policy–setting “Energy White Paper” due this September, hints that the use of small modular reactors could offer myriad benefits for the country. But, though Australia has one of the world’s largest deposits of uranium and thorium, it has no nuclear plants, and the ban on nuclear power introduced by the Howard government has longstanding bipartisan backing. The Industry Ministry confirms that the Coalition “has no plans to pursue nuclear energy.”

However, Australia does champion carbon capture and storage (CCS) and advanced coal technologies as means of “high efficiency low-emissions intensity” generation. It has been pivotal in the establishment of the Global CCS Institute, and through its CCS Flagships Program, it fostered five CCS projects that are in various stages (Figure 3). But even here there is turmoil. Industry observers point out that while there is a general lack of industry advocacy for CCS, likely due to costs, the government’s own position on CCS has flip-flopped with political leadership.

One possible solution with multi-pronged benefits that has industry patronage is to increase the uptake of electric vehicles. As well as increasing electricity demand, electric vehicles could deliver energy efficiency across the power sector, indirectly improve energy security, mitigate the intermittency of renewables, and reduce carbon emissions from the transport sector, which spews about 15% of the country’s carbon emissions. ■

— Sonal Patel is a POWER associate editor (@POWERmagazine, @sonalcpatel).