About That Gas-Fired Power Boom...

The U.S. gas market served up an emphatic reminder of its traditional volatility this winter, as unusually severe weather sent regional spot prices spiraling to record highs. Despite the boom in production from shale, the sector remains handicapped by constraints that are unlikely to ease in the near term.

If you were thinking the shale gas boom had permanently changed the natural gas business in the U.S., gas market fundamentals have some news for you.

Natural gas prices have traditionally risen during the winter, when heating demand intensifies the competition with power burn. These price spikes, naturally, tend to be larger during colder-than-normal winters. But a series of mild winters combined with a glut of gas on the market led to a certain degree of complacency about supply constraints over the past few years—a state of affairs largely blown to bits this past winter.

Supply Constraints

Gas market regulators and observers have been warning for several years that the rapid shift toward reliance on natural gas was creating a risk of shortages in the event of unplanned demand shocks. The mild winters in the early 2010s reduced demand for heating, freeing up supplies and pipeline capacity for power generation.

Even last winter’s supply constraints in New England, which led to several episodes of plants being unable to secure fuel to operate, seemed to have little impact elsewhere in the country, even though officials such as Federal Energy Regulatory Commission (FERC) Commissioner Phillip Moeller warned that other areas were at risk of similar disruptions (see “New England Struggles with Gas Supply Bottlenecks” in the June 2013 issue of POWER, online at powermag.com).

Those warnings proved prophetic this winter.

Driven by unusually cold weather and a series of brutal winter storms—dubbed the Polar Vortex—January set a parade of records for natural gas demand. According to Bentek Energy, that month saw seven out of the top 10 demand days on record, reaching an all-time high of 134.3 billion cubic feet (Bcf) on Jan. 7. Demand averaged 102 Bcf per day (Bcf/d), nearly 8 Bcf/d more than the previous high. The January total of 3,162 Bcf was also 241 Bcf higher than any other month on record, according to Bentek data.

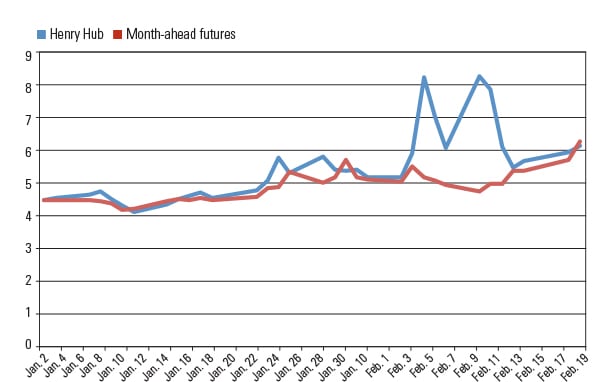

Spot prices for natural gas hit records near $100 per million British thermal units (MMBtu) in several areas. Henry Hub prices topped $5.60/MMBtu the last week of January—a level not seen since early 2010—then spiked over $8 twice in the following month (Figure 1). The February futures contract expired at $5.56/MMBtu, a four-year high. Meanwhile, gas for March delivery briefly traded at $6 levels in mid-February before dropping into the $4 range as temperatures rose.

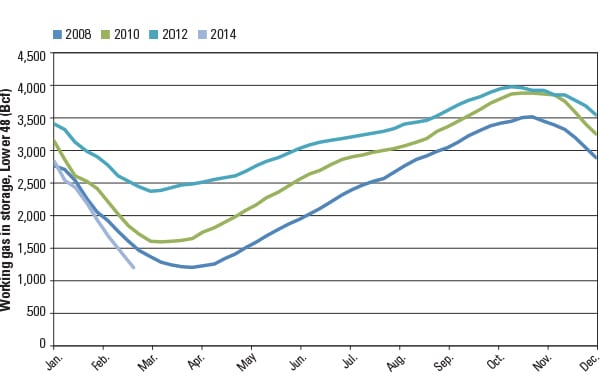

The price run-up was largely a reaction to short-term scarcity. Withdrawals have run well ahead of five-year averages all winter (Figure 2). Storage levels fell almost 1,000 Bcf in January and another 727 Bcf in February, according to the Energy Information Administration (EIA), hitting the lowest level for an end-of-February total since 2004. Cumulative net withdrawals for the 2013–2014 season set an all-time record—on Jan. 17.

|

| 2. Falling stocks. Withdrawals this winter have reduced gas in storage to levels not seen in years. (Trend for missing years folllowed years shown.) Source: Energy Information Administration |

Pulling the Plug

As might be expected, the impact on the power generation sector has been intense.

Numerous pipeline companies had to issue operational flow orders restricting delivery in January, and no interruptible service was available on the worst days of the Polar Vortex. According to estimates by consulting firm ICF International, PJM Interconnection lost 20% of its capacity on Jan. 7—38 GW. The Midwest Independent System Operator (MISO) was also hit hard, losing 28 GW, also around 20% of its total. The New York Independent System Operator (NYISO) lost around 10%, about 4 GW. ISO-New England (ISO-NE), having boosted its dual-fuel capacity after last winter’s debacle, was successfully able to transition to fuel oil, and lost only about 1.5 GW of capacity, around 5%. Even the Electric Reliability Council of Texas (ERCOT) lost about 5% of its capacity. While not all of this lost capacity was due to gas shortages, the lack of fuel was a major factor.

To put those figures in perspective, PJM had never lost more than 9% of its capacity due to weather. Even with the lost capacity, PJM, NYISO, MISO, ISO-NE, and ERCOT all set or neared records for peak demand.

Yet even when the severe weather eased, the impact continued to be felt. The enormous demand for gas sent ripples across the country, and California, though spared the blast of cold that hit the rest of the nation, still found itself short of gas. On Feb. 6, the California Independent System Operator was forced to issue a conservation alert because of gas shortages in Southern California.

The chaos in the gas market sent wholesale electricity prices skyrocketing. Day-ahead prices topped $500/MWh on several days. On Jan. 23, 2013, PJM had to seek FERC approval to exceed its electricity price cap of $1,000/MWh in an attempt to boost power supplies. Real-time, hourly prices during Jan. 7–8 climbed into the $800/MWh range, with 15-minute periods topping $2,000/MWh.

Overreliance?

January’s events have renewed concerns about a too-rapid shift toward natural gas. ICF International noted that had planned and projected coal plant retirements in PJM already occurred this winter, the region would likely have suffered rolling blackouts on the worst days.

“Higher-than-bargained-for electricity costs and an unreliable gird are part and parcel of what will happen as coal-fueled power goes offline,” Laura Sheehan, senior vice president of communications for the American Coalition for Clean Coal Electricity told POWER. “This has been predicted for years, and what we are experiencing now is likely to become even more prevalent as more coal is forced offline due to unachievable [Environmental Protection Agency] carbon regulations.”

Switchback

The spike in gas prices has caused a rebound in coal-fired generation, with coal plants producing around 4.5 million MWh per day this winter, the highest levels since 2011. After falling to around a 32% share of total generation during the gas glut in early 2012, coal has returned to around 40% this year.

The EIA projected in its February 2014 Short Term Energy Outlook that coal-fired generation will rise from 4,326 GWh/d last year to 4,519 GWh/d in 2014, while gas-fired generation will fall slightly from 3,050 GWh/d to 3,023 GWh/d this year.

Still, construction of new natural gas plants continues to far outstrip coal, in large part because such decisions are made outside short-term pricing concerns. California, for example, has more than 3 GW of gas-fired capacity under construction or in active development, according to the California Energy Commission, while Texas has around 3.5 GW under construction, according to the Public Utility Commission of Texas. The situation in the U.S. remains far better than in Europe, where gas-fired power is still looking for the light at the end of a very dark tunnel (see sidebar).

| Developments in EuropeGas-fired power in Europe continues to be moribund at best. Construction of new plants has essentially ceased in Western Europe, and around 30 GW of gas-fired capacity is currently mothballed. IHS CERA recently projected that a further 110 GW of currently operating capacity is at risk of being shut down, with around 25 GW likely to be shuttered in 2014. The situation has gotten bad enough that bottom-feeding investors are beginning to buy up idled plants that the majors are ready to unload.

The culprits remain cheap coal, expensive gas, and depressed wholesale electricity prices stemming from renewable subsidies and flat demand. Rising gas prices in the U.S. are unlikely to provide any relief to European generators. Should gas-to-coal switching in 2014 reach meaningful levels, however, this is likely to reduce U.S. coal exports to Europe, which could ease the current glut and create upward pressure on coal prices. (For an overview of recent and projected coal export markets globally, see “THE BIG PICTURE: Coal’s Export Future” in the March issue at powermag.com.) The continuing problem of depressed carbon prices on the European Union Emissions Trading System (ETS), which has largely eliminated any penalty for coal-fired generation, may or may not see improvement this year. The European Commission is proposing reforms of the ETS that are intended to boost carbon prices and clear the current backlog of allowances. Essentially, the new scheme would create an automated “stability reserve” that would withhold allowances from the market until the amount in circulation falls below 400 million, or until the carbon price rises to three times the previous two-year average and remains there for six months. A previous plan to simply delay release of allowances in order to raise the price—a practice known as backloading—was scuttled after objections from the European Parliament and member states. Opinions are mixed on whether the reforms will make a meaningful difference in the near and medium term. Carbon prices have climbed slightly (from about €5 to €7 at this writing) since the announcement, but they are still well below levels that observers see as necessary for gas to begin making a comeback. |

Effects on Production

It’s unclear at the moment whether higher prices on the spot market will lead to an increase in production this summer. Many producers plan their output well in advance, and with significantly lower prices last fall, may not have planned for increased drilling this year. Canadian stocks are also very low, which may limit exports to the U.S.

Analysts expect the U.S. withdrawal season to end with stocks at around 1 Tcf, the lowest in at least 10 years. Levels below that, should they occur, may send summer prices back over $5/MMBtu, a level that could spur substantial gas-to-coal switching. Morgan Stanley analysts projected in February that an average price of $4.35/MMBtu during this summer’s injection season would support adequate refilling of storage because of reduced demand.

Some increase in production seems certain, given the number of shut-in wells that were drilled but not brought into production during the glut in 2012. Higher prices this spring are likely to bring many of those wells online. Bentek Energy estimates a 4.5% increase in production in 2014, though the EIA expects production growth for 2014 to be only 2.2%.

One key fact to keep in mind is that takeaway capacity in the Marcellus region is still constrained. This means that only so much production can be brought online without creating bottlenecks and a regional glut that would cause a rapid price drop—a situation that producers will wish to avoid. ■

— Thomas W. Overton, JD is a POWER associate editor (@thomas_overton, @POWERmagazine).