IAEA: Pending Reactor Retirements Will Drag Down Global Nuclear Capacity Projections

Cheap natural gas, the impact of subsidized intermittent renewables on power prices, and nuclear policies in several countries in the aftermath of the Fukushima accident will continue to hamper strong growth of new nuclear capacity around the world, the International Atomic Energy Agency (IAEA) said in an October report. However, the world’s central intergovernmental forum for nuclear energy is optimistic that commitments under the Paris agreement may boost long-term prospects.

At the end of 2016, 448 nuclear reactors were operational worldwide with a total net installed capacity of 391 GW, representing about 11% of the world’s total power generation. Another 61 units, a total capacity of 61 GW, were under construction, according to the Vienna-based agency.

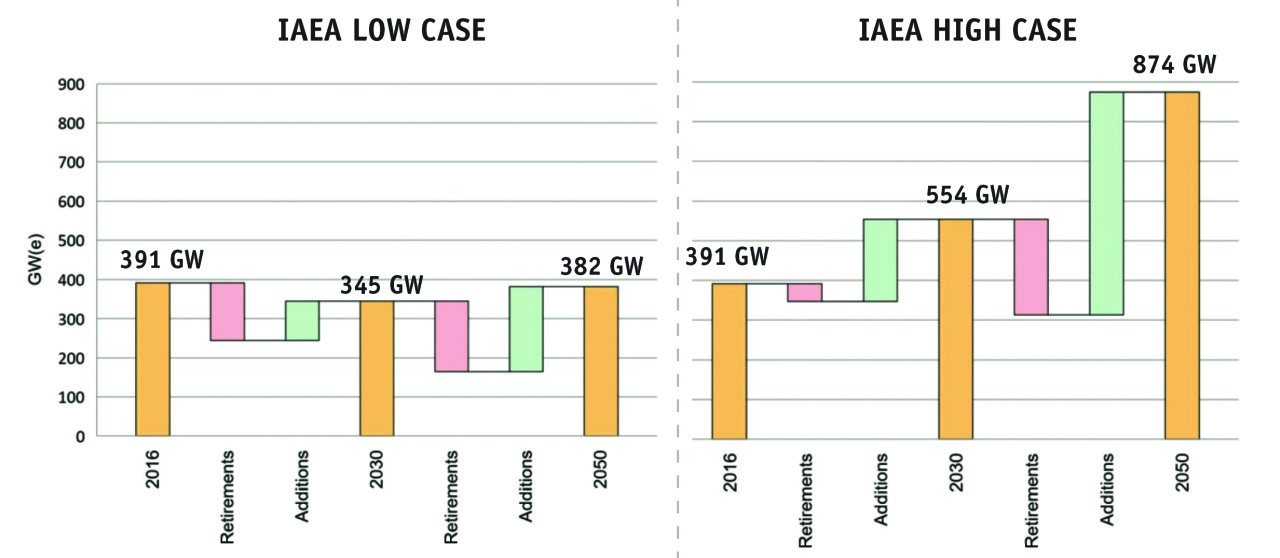

High projections in the IAEA’s newly released 37th annual edition of “Energy, Electricity and Nuclear Power Estimates for the Period up to 2050,” predict an increase in nuclear capacity worldwide, compared to 2016 levels, of 42% in 2030, 83% in 2040, and 123% in 2050. Low projections, however, suggest capacity will decline 12% by 2030 and 15% by 2040, before rebounding to current levels by 2050 (Figure 1).

The report, which is based on statistical data collected by the IAEA’s Power Reactor Information System (PRIS), reflects “contrasting, but not extreme, underlying assumptions on the different driving factors that have an impact on nuclear power deployment,” and vary from country to country. Beyond the impact of gas and renewables, attributes affecting the future of nuclear include “financial uncertainty” and declining electricity consumption in some regions, along with heightened safety requirements, and “challenges in deploying advanced technologies,” which have “increased construction times and costs, contributing to delays.”

The projections also take into account a slew of reactor retirements expected around 2030—especially in North America and Europe. More than 50% of existing nuclear reactors around the world are more than 30 years old and are scheduled to be retired in the coming years. The IAEA’s low case assumes about 147 GW of nuclear capacity will be retired while new reactors will add just 101 GW by 2030. Between 2030 and 2050, an additional 181 GW will be retired and 218 GW of new capacity could be added. The high case, however, assumes the lives of several reactors scheduled for retirement will be extended, so that only 44 GW of nuclear capacity will be retired by 2030 (and another 241 GW retired by 2050). It also projects 206 GW of nuclear capacity could be added by 2030 and about 561 GW of capacity will be added by 2050.

In North America—where all existing reactors are scheduled to be retired by 2050—uncertainty looms for nuclear power, owing to price considerations and soaring new build costs. The IAEA suggests nuclear’s future in the region “is projected to undergo significant changes in both the low and the high case.” In western and southern Europe, where some countries have announced a nuclear phase-out, nuclear’s future is also uncertain. Nuclear power production, however, is projected to continue to grow in eastern Europe, central and eastern Asia, and southern Asia, but it will markedly surge in western Asia, driven by new capacity additions planned in China.

China, which had 38 operating nuclear reactors and 19 under construction (Figure 2) as of October 2017, has increased its number of operating reactors tenfold since 2000. Five new units will enter commercial operation in 2017 alone.

Notably, China is also building several advanced models and looking seriously at plans to export nuclear power reactors. In 2018, the country is expected to put online the first AP1000 reactors in Sanmen and Haiyang along with an EPR reactor in Taishan. The IAEA noted that while China’s drive to increase its nuclear capacity from 38 GW in 2017 to about 120 GW to 150 GW by 2030 is driven mostly by ambitions to increase energy security by tamping down a reliance on coal and oil, nuclear currently makes up only a 3.5% sliver of its total generating capacity. However, because of the scale of expansion, nuclear power will be economically competitive, said Zheng Mingguang, president of the Shanghai Nuclear Engineering Research and Design Institute (SNERDI), in press materials disseminated by the IAEA.

“We have a well-established, complete system in place,” Zheng said. “Not only from the point of view of design, but also manufacturing, quality assurance, safety, construction, and so on. This is why nuclear power in China is economically feasible.” IAEA nuclear engineer Nesimi Kilic said, meanwhile, that China’s expansion is possible mainly because it has localized the technology—including design and manufacturing—and expertise.

While China is the fastest-expanding nuclear power generator in the world, it is followed at a fair distance by Russia, which has seven reactors under construction, then India, with six, and South Korea, with three.

—Sonal Patel is a POWER associate editor.